Heineken Holding N.V. reports 2021 half year results

02 Août 2021 - 7:01AM

Heineken Holding N.V. reports 2021 half year results

Amsterdam, 2 August 2021 – Heineken Holding N.V.

(EURONEXT: HEIO; OTCQX: HKHHY) announces:

KEY HIGHLIGHTS

- The net result of Heineken Holding N.V.'s participating

interest in Heineken N.V. for the first half year of 2021 amounts

to €517 million

- Net revenue (beia) €9,971 million, +14.1% organic growth

- Net revenue (beia) organic growth per hectolitre +5.5%

- Consolidated beer volume organic growth +9.6%

- Heineken® volume +19.6%

- Operating profit (beia) organic growth +109.3%

- Net profit (beia) €896 million, +320.3% organic growth

- EverGreen strategy deployment at HEINEKEN has started

- Full year expectations unchanged: financial results to remain

below 2019.

FINANCIAL SUMMARY1

|

IFRS Measures |

€ million |

Total growth |

|

BEIA Measures |

€ million |

Organic growth2 |

|

Revenue |

11,970 |

|

7.3 |

% |

|

Revenue (beia) |

11,970 |

13.1 |

% |

| Net revenue |

10,010 |

|

8.3 |

% |

|

Net

revenue (beia) |

9,971 |

14.1 |

% |

| Operating profit |

1,717 |

|

1,920.0 |

% |

|

Operating

profit (beia) |

1,628 |

109.3 |

% |

| |

|

|

|

Operating

profit (beia) margin |

16.3% |

|

| Net profit of Heineken Holding

N.V. |

517 |

|

448.1 |

% |

|

Net

profit (beia) |

896 |

320.3 |

% |

| Diluted EPS (in €) |

1.80 |

|

446.2 |

% |

|

Diluted

EPS (beia) (in €) |

1.56 |

295.5 |

% |

| |

|

|

|

Free

operating cash flow |

650 |

|

| |

|

|

|

Net debt

/ EBITDA (beia)3 |

3.0x |

|

1 Consolidated figures are used throughout this report unless

otherwise stated; please refer to the Glossary for an explanation

of non-GAAP measures and other terms used throughout this

report.

2 Organic growth shown, except for Diluted EPS (beia) which is

total growth.

3 Includes acquisitions and excludes disposals on a 12 month

pro-forma basis.

Heineken Holding N.V. engages in no activities other than its

participating interest in Heineken N.V. and the management or

supervision of and provision of services to that company.

INTERIM DIVIDEND

According to the Articles of Association of Heineken Holding

N.V. both Heineken Holding N.V. and Heineken N.V. pay an identical

dividend per share. In accordance with its dividend policy,

HEINEKEN fixes the interim dividend at 40% of the total dividend of

the previous year. In 2020, HEINEKEN by exception deviated from

this policy, as no interim dividend was paid in August 2020.

For 2021, HEINEKEN will apply its regular policy and pay an

interim dividend of €0.28 per share (2020: nil) on 11 August 2021.

Both the Heineken Holding N.V. shares and the Heineken N.V. shares

will trade ex-dividend on 4 August 2021.

OUTLOOK STATEMENTS

The COVID-19 pandemic continues to present challenges for the

world with the biggest impact for HEINEKEN's business currently in

Asia. HEINEKEN expects the rest of the year will continue to be

volatile, with some markets gradually recovering while others

continue to implement restrictions until vaccinations are more

broadly rolled out.

Furthermore, HEINEKEN expects headwinds in input costs in the

second half of 2021 and a material impact from commodity costs in

2022. HEINEKEN will be assertive on pricing and drive revenue and

cost management to face this challenge; however HEINEKEN expects

margin pressure to intensify in the second half. In addition,

HEINEKEN will increase its marketing and sales expenses investment

behind growth initiatives versus last year, fully in line with

HEINEKEN's original full year brand plans.

As a consequence, HEINEKEN expects operating profit margin

(beia) to be lower in the second half compared with the second half

of last year, and as indicated before, full year financial results

are expected to remain below 2019.

HEINEKEN also anticipates:

- An average effective interest rate (beia) of around 2.7% (2020:

3.0%)

- Capital expenditure related to property, plant and equipment

and intangible assets of around €1.8 billion (2020: €1.6

billion)

- The effective tax rate (beia) to stay above 2019 level due to

the effect of fixed cost components in the tax line.

TRANSLATIONAL CURRENCY CALCULATED IMPACT

Based on the impact to date, and applying spot rates of 28 July

2021 to the 2020 financial results as a baseline for the remainder

of the year, the calculated negative currency translational impact

would be approximately €450 million in net revenue (beia), €90

million at consolidated operating profit (beia), and €40 million at

net profit (beia).

ENQUIRIES

| Media Heineken

Holding N.V. |

|

| Kees

Jongsma |

|

| Tel.

+31-6-54798253 |

|

| E-mail:

cjongsma@spj.nl |

|

| |

|

| Media |

Investors |

| Sarah

Backhouse |

José

Federico Castillo Martinez |

| Director of

Global Communication |

Investor

Relations Director |

| Michael

Fuchs |

Janine

Ackermann / Robin Achten |

| Global Corporate and

Financial Communications Manager |

Investor Relations

Manager / Senior Analyst |

| E-mail:

pressoffice@heineken.com |

E-mail:

investors@heineken.com |

| Tel:

+31-20-5239355 |

Tel:

+31-20-5239590 |

INVESTOR CALENDAR HEINEKEN N.V.

(events also accessible for Heineken Holding N.V.

shareholders)

| Trading Update

for Q3 2021 |

27 October

2021 |

| Full Year 2021

Results |

16 February

2022 |

CONFERENCE CALL DETAILS

HEINEKEN will host an analyst and investor conference call in

relation to its 2021 HY results today at 14:00 CET/ 13:00 GMT. This

call will also be accessible for Heineken Holding N.V.

shareholders. The call will be audio cast live via the website:

www.theheinekencompany.com. An audio replay service will also be

made available after the conference call at the above web address.

Analysts and investors can dial-in using the following telephone

numbers:

United Kingdom (Local): 020 3936 2999Netherlands (Local): 085

888 7233USA: 1 646 664 1960All other locations: +44 203 936

2999Participation password for all countries: 241538

Editorial information:Heineken Holding N.V. engages in no

activities other than its participating interest in Heineken N.V.

and the management or supervision of and provision of services to

that company.

HEINEKEN is the world's most international brewer. It is the

leading developer and marketer of premium beer and cider brands.

Led by the Heineken® brand, the Group has a portfolio of more than

300 international, regional, local and specialty beers and ciders.

HEINEKEN is committed to innovation, long-term brand investment,

disciplined sales execution and focused cost management. Through

"Brewing a Better World", sustainability is embedded in the

business. HEINEKEN has a well-balanced geographic footprint with

leadership positions in both developed and developing markets.

HEINEKEN employs over 80,000 employees and operates breweries,

malteries, cider plants and other production facilities in more

than 70 countries. Heineken Holding N.V. and Heineken N.V. shares

trade on the Euronext in Amsterdam. Prices for the ordinary shares

may be accessed on Bloomberg under the symbols HEIO NA and HEIA NA

and on Reuters under HEIO.AS and HEIN.AS . HEINEKEN has two

sponsored level 1 American Depositary Receipt (ADR) programmes:

Heineken Holding N.V. (OTCQX: HKHHY) and Heineken N.V. (OTCQX:

HEINY). Most recent information is available on the websites:

www.heinekenholding.com and www.theHEINEKENcompany.com and follow

HEINEKEN on Twitter via @HEINEKENCorp.

Market Abuse Regulation:This press release contains

price-sensitive information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Disclaimer:This press release contains forward-looking

statements with regard to the financial position and results of

HEINEKEN’s activities. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed in the forward-looking

statements. Many of these risks and uncertainties relate to factors

that are beyond HEINEKEN’s ability to control or estimate

precisely, such as future market and economic conditions,

developments in the ongoing COVID-19 pandemic and related

government measures, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

costs of raw materials, interest-rate and exchange-rate

fluctuations, changes in tax rates, changes in law, change in

pension costs, the actions of government regulators and weather

conditions. These and other risk factors are detailed in HEINEKEN’s

publicly filed annual reports. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only of

the date of this press release. HEINEKEN does not undertake any

obligation to update these forward-looking statements contained in

this press release. Market share estimates contained in this press

release are based on outside sources, such as specialised research

institutes, in combination with management estimates.

- Heineken Holding NV 2021 Half Year results

(02_08_2021).pdf

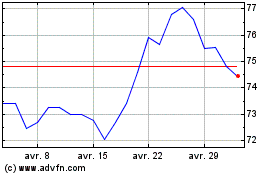

Heineken (EU:HEIO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Heineken (EU:HEIO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024