Philips sees some improvement in Q4 2022 and takes firm actions to

address operational challenges in an uncertain environment

January 30, 2023

Fourth-quarter highlights

- Group sales amounted to EUR 5.4 billion, with 3% comparable

sales growth driven by component supply improvements, while

Philips’ supply chain conditions remain challenging

- Comparable order intake decreased 8%, due to lower demand for

COVID-19-related products compared to 2021 and company actions to

improve the order book margin profile

- Income from operations amounted to EUR 171 million, compared to

EUR 162 million in Q4 2021

- Adjusted EBITA of EUR 651 million, or 12.0% of sales, compared

to EUR 647 million, or 13.1% of sales, in Q4 2021

- Operating cash flow was EUR 540 million, compared to EUR 720

million in Q4 2021

Full-year highlights

- Group sales amounted to EUR 17.8 billion, with a 3% comparable

sales decline due to operational and supply challenges, lower sales

in China, the consequences of the Respironics field action, and the

Russia-Ukraine war

- Comparable order intake decreased 3% compared to 4% growth in

2021

- Income from operations amounted to a loss of EUR 1,529 million,

largely due to the previously disclosed EUR 1.5 billion non-cash

goodwill and R&D impairment charges, compared to income of EUR

553 million in 2021

- Adjusted EBITA of EUR 1,318 million, or 7.4% of sales, compared

to EUR 2,054 million, or 12.0% of sales, in 2021

- Operating cash outflow of EUR 173 million, compared to an

inflow of EUR 1,629 million in 2021

- Proposed dividend maintained at EUR 0.85 per share, to be

distributed in shares

Roy Jakobs, CEO of Royal Philips:“2022 has been a very

difficult year for Philips and our stakeholders, and we are taking

firm actions to improve our execution and step up performance with

urgency. When I took over as CEO in October 2022, I said that our

priorities are first to further strengthen our patient safety and

quality management and address the Philips Respironics recall;

second, to improve our supply chain reliability to convert our

order book to sales and improve performance; and third, to simplify

how we work to increase agility and productivity. This is a

step-by-step improvement journey supported by our leading market

positions, extended customer base, meaningful innovations,

ecosystem partnerships, strong brand, and talented employees.

As we are working through the operational challenges, we

progressed on our execution priorities in the fourth quarter. We

provided an important and encouraging update on the complete set of

test results for the first-generation DreamStation sleep therapy

devices and have completed around 90% of the production for the

remediation. We were able to secure more components to convert our

order book into sales, although the supply chain situation remains

challenging. Our order book remains strong, despite the comparable

order intake decline in the quarter. The previously announced

workforce reduction by 4,000 roles globally and other actions are

being implemented as planned.

Today, we will present Philips’ plan to create value with

sustainable impact, which is based on focused organic growth to

deliver patient- and people-driven innovation at scale with

improved execution as key value driver, prioritizing patient safety

and quality, supply chain reliability and a simplified operating

model. We are confident that these measures will enable us to

deliver on our purpose to improve people’s health and well-being

through meaningful innovation and create value for all our

stakeholders.”

Group and business segment performanceSales for the Group

in the quarter were EUR 5.4 billion, with 3% comparable sales

growth, which was driven by improved component supplies, for

example in hospital patient monitoring, image-guided therapy, and

ultrasound. However, Philips’ supply chain situation remains

challenging, and the company anticipates further improvements to be

gradual. The combined Diagnosis & Treatment and Connected Care

businesses grew 5% on a comparable basis. Adjusted EBITA for the

Group was EUR 651 million, or 12% of sales, due to cost inflation,

partly offset by pricing and productivity measures. Philips’

comparable order intake declined 8% due to lower demand for

COVID-19-related acute care products compared to 2021 and company

actions to improve the order book margin profile. For the full year

2022, Philips’ performance was impacted by operational and supply

challenges, inflationary pressures, the COVID situation in China,

the consequences of the Respironics field action, and the

Russia-Ukraine war. As a result, comparable sales declined 3%, and

the Adjusted EBITA margin decreased to 7.4%.

The Diagnosis & Treatment businesses’ comparable sales

increased 5% in the quarter, driven by high-single-digit growth in

Ultrasound and Image-Guided Therapy. Comparable order intake

decreased 7% due to company actions to improve the order book

margin profile, and on the back of 10% growth in Q4 2021. The

Adjusted EBITA margin was 11.3%, which was mainly due to cost

inflation, partly offset by increased sales. For the full year, the

Diagnosis & Treatment businesses recorded a 1% comparable sales

decline and an Adjusted EBITA margin of 8.4%.

The Connected Care businesses’ comparable sales increased 5% in

the quarter, driven by strong double-digit growth in Hospital

Patient Monitoring. Comparable order intake decreased by 10%,

mainly due to lower demand for COVID-19-related acute care products

compared to 2021. The Adjusted EBITA margin increased to 12.6%,

mainly due to increased sales and productivity measures, partly

offset by cost inflation. For the full year, the Connected Care

businesses recorded an 11% comparable sales decline, mainly due to

a strong double-digit decline in Sleep & Respiratory Care, and

an Adjusted EBITA margin of 2.2%.

The Personal Health businesses’ comparable sales decreased by 4%

in the quarter, with double-digit growth in North America more than

offset by a strong double-digit decline in China. The Adjusted

EBITA margin amounted to 17.0%. For the full year, comparable sales

growth for the Personal Health businesses was flat, including a 2

percentage-point impact from the Russia-Ukraine war, and the

Adjusted EBITA margin amounted to 14.8%.

Highlights of Philips’ ongoing focus on innovation and customer

partnerships in the quarter:

- Demonstrating the trust hospital leaders have in Philips’

strategy and solutions to help them improve health outcomes and

productivity, and deliver care that is more convenient and

sustainable, Philips signed around 100 new long-term strategic

partnerships with hospitals and health systems across the world in

2022.

- Philips ranked as the number 1 brand in the personal health

category on E-commerce platforms JD and Ali during the ‘Double 11’

shopping festival in China. Philips was the highest-ranked male

grooming and oral healthcare brand on the key online shopping

channels.

- In 2022, Philips’ products and solutions improved the lives of

1.8 billion people, including 200 million people in underserved

communities. In addition, Philips was again recognized with the

prestigious ‘A’ score for its climate action leadership by global

environmental non-profit CDP (Carbon Disclosure Project).

- Philips launched the Ultrasound Compact 5000, which is designed

for portability and versatility with premium image quality and

performance, to facilitate first-time-right ultrasound exams for

more patients.

- In 2022, Philips’ Image-Guided Therapy business reached sales

of over EUR 3 billion and further expanded its market leadership

position leveraging the unique strengths of its successful

interventional imaging systems, such as Philips Azurion, and rich

portfolio of diagnostic and therapeutic devices, such as its IVUS

(intravascular ultrasound) catheters. To further drive the use of

these systems and devices based on clinical evidence, more than 110

clinical studies are ongoing, including the research studies

conducted by the Smith Center for Outcomes Research at Beth Israel

Deaconess Medical Center with recent results that further

underpinned the outcome benefits of Philips’ IVUS devices.

- At RSNA 2022, one of the largest radiology meetings globally,

Philips featured its latest AI-powered diagnostic systems and

multi-vendor workflow solutions that help reduce clinical

complexity and enhance operational efficiency. This included the MR

5300 with its unique BlueSeal magnet for helium-free operations and

sustainable imaging with premium image quality and lower site

costs. Philips also featured its vendor-neutral, multi-modality

Radiology Operations Command Center, which is a multi-site

telepresence solution that provides advanced tele-acquisition

capabilities and seamlessly connects imaging experts at a command

center with technologists at scanning locations across an

organization.

Philips Respironics field action for specific sleep therapy

and ventilator devicesIn December 2022, Philips provided an

update on the completed set of test results for first-generation

DreamStation sleep therapy devices. Around 90% of the production

required for the delivery of replacement devices to patients has

been completed. In order to expedite the completion of the recall,

Philips Respironics will increase the proportion of new replacement

devices, resulting in an increase in the field action provision by

EUR 85 million.

As previously disclosed, Philips Respironics is subject to an

investigation by the US Department of Justice, is a defendant in

several class-action lawsuits and individual personal injury

claims, and is in ongoing discussions with the FDA regarding the

proposed consent decree. Given the uncertain nature of the relevant

events, and of their potential financial and operational impact and

associated obligations, if any, the company has not made any

provisions in the accounts for these matters.

OutlookLooking ahead, Philips expects to deliver

low-single-digit comparable sales growth and high-single-digit

Adjusted EBITA margin in 2023. Considering the slowing of consumer

demand and a gradual improvement of the order book conversion

during 2023, Philips anticipates a slow start to the year, with

improvements throughout the year supported by the ongoing

productivity, pricing and other actions.

This guidance excludes the impact of the ongoing discussion on

the proposed consent decree beyond current assumptions (Sleep &

Respiratory Care/Respironics CSGR 2023-2025 of 10%), as well as

ongoing litigation and the investigation by the US Department of

Justice related to the Respironics field action.

DividendPhilips intends to submit to the 2023 Annual

General Meeting of Shareholders a proposal to declare a dividend of

EUR 0.85 per common share, and to distribute such dividend in

shares.

Click here to view the release online

For further information, please contact: Ben Zwirs

Philips Global Press Office Tel.: +31 6 1521 3446 E-mail:

ben.zwirs@philips.com Derya Guzel Philips Investor Relations

Tel.: +31 20 59 77055 E-mail: derya.guzel@philips.com About

Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health

technology company focused on improving people's health and

well-being, and enabling better outcomes across the health

continuum – from healthy living and prevention, to diagnosis,

treatment and home care. Philips leverages advanced technology and

deep clinical and consumer insights to deliver integrated

solutions. Headquartered in the Netherlands, the company is a

leader in diagnostic imaging, image-guided therapy, patient

monitoring and health informatics, as well as in consumer health

and home care. Philips generated 2022 sales of EUR 17.8 billion and

employs approximately 77,000 employees with sales and services in

more than 100 countries. News about Philips can be found at

www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements This document and the related oral

presentation, including responses to questions following the

presentation, contain certain forward-looking statements with

respect to the financial condition, results of operations and

business of Philips and certain of the plans and objectives of

Philips with respect to these items. Examples of forward-looking

statements include statements made about our strategy, estimates of

sales growth, future Adjusted EBITA*), future restructuring and

acquisition- related charges and other costs, future developments

in Philips’ organic business and the completion of acquisitions and

divestments. Forward-looking statements can be identified generally

as those containing words such as “anticipates”, “assumes”,

“believes”, “estimates”, “expects”, “should”, “will”, “will likely

result”, “forecast”, “outlook”, “projects”, “may” or similar

expressions. By their nature, these statements involve risk and

uncertainty because they relate to future events and circumstances

and there are many factors that could cause actual results and

developments to differ materially from those expressed or implied

by these statements. These factors include but are not limited to:

Philips’ ability to gain leadership in health informatics in

response to developments in the health technology industry;

Philips’ ability to transform its business model to health

technology solutions and services; macroeconomic and geopolitical

changes; integration of acquisitions and their delivery on business

plans and value creation expectations; securing and maintaining

Philips’ intellectual property rights, and unauthorized use of

third-party intellectual property rights; Philips’ ability to meet

expectations with respect to ESG-related matters; failure of

products and services to meet quality or security standards,

adversely affecting patient safety and customer operations;

breaches of cybersecurity; Philips’ ability to execute and deliver

on programs on business transformation and IT system changes and

continuity; the effectiveness of our supply chain; attracting and

retaining personnel; COVID and other pandemics; challenges to drive

operational excellence and speed in bringing innovations to market;

compliance with regulations and standards including quality,

product safety and (cyber) security; compliance with business

conduct rules and regulations; treasury and financing risks; tax

risks; reliability of internal controls, financial reporting and

management process. For a discussion of factors that could cause

future results to differ from such forward-looking statements, see

also the Risk management chapter included in the Annual Report

2021. Reference is also made to Risk management in the Philips

semi-annual report 2022. Philips has recognized a provision related

to the voluntary recall notification in the US/field safety notice

outside the US for certain sleep and respiratory care products,

based on Philips’ best estimate for the expected field actions.

Future developments are subject to significant uncertainties, which

require management to make estimates and assumptions about items

such as quantities and the portion to be replaced or repaired.

Actual outcomes in future periods may differ from these estimates

and affect the company’s results of operations, financial position

and cash flows. In Q3 2022 there was a goodwill impairment charge

of EUR 1.3 billion related to the Sleep & Respiratory Care

cash-generating unit (CGU). As a result of this impairment and

related uncertainties, the valuation of the CGU remains sensitive

to changes in key assumptions.

Adverse changes to these assumptions would cause a material

impairment loss to be recognized. Furthermore, Philips Respironics

is subject to an investigation by the US Department of Justice, is

a defendant in several class-action lawsuits and individual

personal injury claims, and is in ongoing discussions with the FDA

regarding a proposed consent decree. Given the uncertain nature of

the relevant events, and of their potential financial and

operational impact and associated obligations, if any, the company

has not made any provisions in the accounts for these matters.

Third-party market share data Statements regarding market

share, contained in this document, including those regarding

Philips’ competitive position, are based on outside sources such as

specialized research institutes, industry and dealer panels in

combination with management estimates. Where information is not yet

available to Philips, market share statements may also be based on

estimates and projections prepared by management and/or based on

outside sources of information. Management’s estimates of rankings

are based on order intake or sales, depending on the business.

Market Abuse Regulation This press release contains inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation. This press release was distributed at 07:00 am

CET on January 30, 2023. Use of non-IFRS information In

presenting and discussing the Philips Group’s financial position,

operating results and cash flows, management uses certain non-IFRS

financial measures. These non-IFRS financial measures should not be

viewed in isolation as alternatives to the equivalent IFRS measure

and should be used in conjunction with the most directly comparable

IFRS measures. Non-IFRS financial measures do not have standardized

meaning under IFRS and therefore may not be comparable to similar

measures presented by other issuers. A reconciliation of these

non-IFRS measures to the most directly comparable IFRS measures is

contained in this document. Further information on non-IFRS

measures can be found in the Annual Report 2021. Use of fair

value information In presenting the Philips Group’s financial

position, fair values are used for the measurement of various items

in accordance with the applicable accounting standards. These fair

values are based on market prices, where available, and are

obtained from sources that are deemed to be reliable. Readers are

cautioned that these values are subject to changes over time and

are only valid at the balance sheet date. When quoted prices or

observable market data are not readily available, fair values are

estimated using appropriate valuation models and unobservable

inputs. Such fair value estimates require management to make

significant assumptions with respect to future developments, which

are inherently uncertain and may therefore deviate from actual

developments. Critical assumptions used are disclosed in the Annual

Report 2021. In certain cases independent valuations are obtained

to support management’s determination of fair values.

Presentation All amounts are in millions of euros unless

otherwise stated. Due to rounding, amounts may not add up precisely

to the totals provided. All reported data is unaudited. Financial

reporting is in accordance with the accounting policies as stated

in the Annual Report 2021 except for the adoption of new standards

and amendments to standards which are also expected to be reflected

in the company’s consolidated financial statements for the year

ending December 31, 2022. Prior-period amounts have been

reclassified to conform to the current-period presentation due to

immaterial organizational changes. *) Non-IFRS financial measure.

Refer to the Reconciliation of non-IFRS information

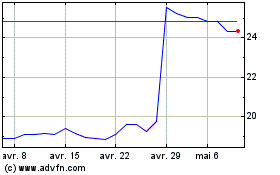

Koninklijke Philips NV (EU:PHIA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Koninklijke Philips NV (EU:PHIA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024