LECTRA: Q1 2022: strong growth in orders, revenues and earnings

Q1 2022:

strong growth in

orders, revenues and earnings

- Revenues: 122.0 million euros

(+83%)

- EBITDA before non-recurring items:

21.6 million euros (+90%)

- Net income: 9.3 million euros

(+55%)

- Free cash flow before non-recurring

items: 7.1 million euros

|

in millions of euros |

January 1 – March 31 |

|

|

2022 |

2021 |

|

Revenues |

122.0 |

66.7 |

|

Change (%) |

+83% |

|

|

EBITDA before non-recurring items(1) |

21.6 |

11.4 |

|

Change (%) |

+90% |

|

|

EBITDA margin before non-recurring items (in % of revenues) |

17.7% |

17.0% |

|

Net income |

9.3 |

6.0 |

|

Change (%) |

+55% |

|

|

Free cash flow before non-recurring items(1) |

7.1 |

9.8 |

|

|

|

|

|

|

(1) The definition of the performance indicators is

illustrated in the Financial Report at March 31, 2022

Paris, April

28, 2022. Today,

Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the

unaudited consolidated financial statements for the first quarter

of 2022.

To facilitate analysis of the Group’s results,

the financial statements are compared to those published in 2021

and to the Q1 2021 pro forma figures ("2021 Pro forma"), prepared

by integrating the three acquisitions made in 2021 – Gerber

Technology (“Gerber”), Neteven, and Gemini CAD Systems (“Gemini”) –

as if they had been consolidated from January 1, 2021, whereas they

have been consolidated since June 1, July 28 and September 27, 2021

respectively.

(Detailed comparisons between 2022 and 2021 are

at actual exchange rates).

-

SUMMARY FOR Q1

2022

From February 24 onwards, the first quarter of

2022 was marked by the war in Ukraine.

As soon as the war began, the Company decided to

cease its operations in Russia, by suspending the activity of its

subsidiary Lectra Russia (which has a workforce of five) and

stopping all deliveries of products or services.

The Group's direct exposure to Ukraine and

Russia is low; the contribution of these two countries in 2021

accounted for less than 1 percent of revenues.

The climate of uncertainty surrounding this

conflict caused some of the Group's customers to postpone

investment decisions, starting in late February, especially in

Europe. This war has also accelerated price increases, energy

shortfalls, and shortages in some raw materials. The impact of

these inflationary factors on the Group's financial statements

should remain limited, due to low exposure to energy costs and to

the prices of those raw materials affected the most.

At the same time, lockdown measures implemented

by the Chinese government, which became even stricter in late

March, had a negative impact on orders in China. Those measures

also prevented shipment of 3.5 million euros' worth of orders

for CAD/CAM equipment, which had a negative impact of the same

amount on Q1 revenue.

In this peculiar environment, Q1 2022 revenues

amounted to 122.0 million euros, up 83% compared to

Q1 2021.

EBITDA before non-recurring items totaled 21.6

million euros, up 90%, and the EBITDA margin

before non-recurring items was 17.7%.

Income from operations before non-recurring

items amounted to 14.4 million euros (8.5 million euros in

Q1 2021), up 71%. This includes a 2.7-million-euro charge for

amortization of intangible assets arising from the acquisitions of

Gerber, Neteven and Gemini.

Net income totaled 9.3 million euros (+55%

compared to Q1 2021).

Free cash flow before non-recurring items came

to 7.1 million euros (9.8 million euros in Q1 2021).

Comparison to the 2021 Pro forma

Orders for perpetual software licenses,

equipment and accompanying software, and non-recurring services

(51.9 million euros) were up 14% compared to the amount of 2021 Pro

forma orders. As for the annual value of new software subscription

orders (2.3 million euros), it increased by a factor of 2.4.

Despite the negative impact of the war in

Ukraine and the lockdown measures in China, revenues

(122.0 million euros) increased by 10%.

Revenues from perpetual software licenses,

equipment and accompanying software, and non-recurring services

(48.6 million euros) were up 9%, those from recurring contracts

(39.2 million euros) by 10% and those from consumables and

parts (34.2 million euros) by 11%.

EBITDA before non-recurring items (21.6 million

euros) increased by 37% and EBITDA margin before non-recurring

items was 17,7%, up 3.5 percentage points.

Income from operations before non-recurring

items (14.4 million euros) increased by 62% and the operating

margin before non-recurring items (11.8%) by 3.7 percentage

points.

Balance sheet at March 31, 2022

At March 31, 2022, the Group’s consolidated

shareholders’ equity amounted to 416.9 million euros

(400.8 million euros at December 31, 2021) and the net

financial debt stood at 3.2 million euros, consisting in financial

debt of 139.4 million euros and available cash of 136.3 million

euros.

The working capital requirement at March 31,

2022 was a negative 24.5 million euros.

- BUSINESS

TRENDS AND OUTLOOK

At the beginning of 2020, Lectra had developed

its long-term vision and its new strategic roadmap for the

2020-2022 period.

In its 2021 Financial Report, published February

9, 2022, the Group indicated that the acquisitions made in 2021,

and particularly the acquisition of Gerber, give the Group a new

dimension and open new perspectives.

It further explained that uncertainties persist

regarding the evolution of the pandemic and its impacts on the

macroeconomic environment (e.g., inflation, difficulties in the

automotive industry, and transportation costs), and could continue

to weigh on investment decisions by the Group’s customers. To those

uncertainties have been added the consequences of the war in

Ukraine and of the strict lockdown measures implemented in

China.

Financial objectives for 2022

The Group has set itself objectives of

achieving, in 2022, revenues in the range of 508 to 556 million

euros (+31% to +43%) and EBITDA before non-recurring items in the

range of 92 to 104 million euros (+41% to +60%). These objectives

were prepared on the basis of the closing exchange rates on

December 31, 2021, and particularly $1.13 to the euro.

While revenues through March 31, 2022, were

affected by the war in Ukraine and the strict lockdown measures in

China, business activity and the other parameters of the income

statement for Q1 2022 are in line with the roadmap. Together with

the particularly strong order backlog on March 31, these elements

reinforce Lectra's confidence in the ability to achieve its

objectives.

However, the consequences of the war in Ukraine

and the strict lockdown measures in China remain uncertain and

could adversely affect the Group's business and results for the

remainder of 2022.

The 2021 Financial Report, as well as the

Management Discussion and analysis of financial conditions and

results of operations and the financial statements for Q1 2022 are

available on lectra.com. The Shareholders' Meeting will be held on

April 29, 2022, in the Company’s offices. Q2 and H1 2022 earnings

will be published on July 28, 2022, after the close of trading on

Euronext Paris.

As a major player in

the fashion, automotive and furniture markets, Lectra contributes

to the Industry 4.0 revolution with boldness and passion by

providing best-in-class technologies.The Group offers industrial

intelligence solutions - software, equipment, data and services -

that facilitate the digital transformation of the companies it

serves. In doing so, Lectra helps its customers push boundaries and

unlock their potential. The Group is proud to state that its 2,400

employees are driven by three core values: being open-minded

thinkers, trusted partners and passionate innovators.Founded in

1973, Lectra reported revenues of 388 million euros in 2021 and is

listed on Euronext Paris (LSS).

For more information,

please visit www.lectra.com.

Lectra – World Headquarters: 16–18, rue Chalgrin • 75016 Paris •

FranceTel. +33 (0)1 53 64 42 00 – www.lectra.comA French Société

Anonyme with capital of €37,742,959 • RCS Paris B 300

702 305

- Lectra_PressRelease_Q12022

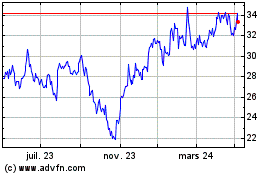

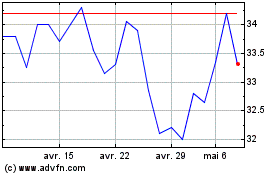

Lectra (EU:LSS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lectra (EU:LSS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024