Pernod Ricard Capital Markets Day

08 Juin 2022 - 7:30AM

Business Wire

PERNOD RICARD PRESENTS

ITS CONVIVIALITY PLATFORM

Regulatory News:

Press release - Paris, 8 June 2022

Today, Pernod Ricard is hosting its Capital Markets Day in

Paris. Alexandre Ricard, Chairman and CEO along with members of

both the executive committee and leadership teams in key markets

will demonstrate how Pernod Ricard is implementing its Conviviality

Platform, as the next step in its Transform and Accelerate FY23 to

FY25 strategic plan.

Alexandre Ricard stated:

“In today's world and for many companies, the end goal is to

leverage data. For us, at Pernod Ricard, the end goal is to spread

convivialité… by leveraging data.”

The Conviviality Platform is about leveraging the power of data,

our portfolio of brands and our distribution network to further

stretch Pernod Ricard’s profitable and sustainable growth, with the

following mid-term ambition:

- +4 to +7% annual topline growth framework aiming for the

upper end of the range

- Stretching our topline growth with the Conviviality

Platform

- Building on our key competitive advantages, leveraging

our broad-based portfolio and balanced geographical footprint

- Focus on pricing, further enhanced by our proprietary

predictive digital tools

- Continuous improvement in operational efficiency, building

on our culture of excellence

- Significant A&P investment, maintained at c.16%

of Sales, with higher return on investments leveraging Key

Digital Programs

- Discipline on Structure costs, investing in priorities

while maintaining an agile organisation, aiming at increase below

topline growth

- Operating leverage of c.50-60 bps pa, provided topline

within +4 to +7% range

- Confirmed financial policy priorities

The event will be live-streamed and the webcast will be

accessible here:

https://edge.media-server.com/mmc/p/fchhrvg5

All growth data specified in this press release refers to

organic growth, unless otherwise stated. Data may be subject to

rounding.

Definitions and reconciliation of non-IFRS measures to IFRS

measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

- Organic growth is calculated after

excluding the impacts of exchange rate movements, acquisitions and

disposals and changes in applicable accounting principles. -

Exchange rates impact is calculated by translating the current year

results at the prior year’s exchange rates. - For acquisitions in

the current year, the post-acquisition results are excluded from

the organic movement calculations. For acquisitions in the prior

year, post-acquisition results are included in the prior year but

are included in the organic movement calculation from the

anniversary of the acquisition date in the current year. - Where a

business, brand, brand distribution right or agency agreement was

disposed of, or terminated, in the prior year, the Group, in the

organic movement calculations, excludes the results for that

business from the prior year. For disposals or terminations in the

current year, the Group excludes the results for that business from

the prior year from the date of the disposal or termination. - This

measure enables to focus on the performance of the business which

is common to both years and which represents those measures that

local managers are most directly able to influence.

Profit from recurring

operations

Profit from recurring operations corresponds to the operating

profit excluding other non-current operating income and

expenses.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and

spirits with consolidated sales amounting to €8,824 million in

fiscal year FY21. The Group, which owns 16 of the Top 100 Spirits

Brands, holds one of the most prestigious and comprehensive

portfolios in the industry with over 240 premium brands distributed

across more than 160 markets. Pernod Ricard’s portfolio includes

Absolut vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal

Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey,

Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur,

Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek, New

Zealand wines, Campo Viejo, Mumm sparkling and Kenwood wines.

Pernod Ricard’s strategy focuses on investing in long-term and

sustainable growth for all its stakeholders, remaining true to its

founding values: entrepreneurial spirit, mutual trust, and strong

sense of ethics. The Group’s decentralised organisation empowers

its 18,500 employees to be on-the-ground ambassadors of its vision

of “Créateurs de Convivialité”. Pernod Ricard 2030 Sustainability

and Responsibility roadmap “Good Times from a Good Place” is

integrated into all its activities from grain to glass, and Pernod

Ricard is recognised as a UN Global Compact LEAD participant for

its contribution to the United Nations Sustainable Development

Goals (SDGs). Pernod Ricard is listed on Euronext (Ticker: RI; ISIN

Code: FR0000120693) and is part of the CAC 40 and Eurostoxx 50

indices.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220607006419/en/

Florence Tresarrieu / Global SVP Investors Relations and

Treasury +33 (0) 1 70 93 17 03 Edward Mayle / Investor Relations

Director +33 (0) 1 70 93 17 13 Charly Montet / Investor Relations

Manager +33 (0) 1 70 93 17 13 Emmanuel Vouin / Head of External

Engagement +33 (0) 1 70 93 16 34

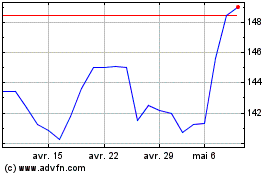

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pernod Ricard (EU:RI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024