Pershing Square Holdings Tells Shareholders It Sold Netflix Stake

21 Avril 2022 - 1:19AM

Dow Jones News

By Stephen Nakrosis

Pershing Square Holdings, Ltd., in a letter to shareholders,

said Wednesday it sold its investment in Netflix Inc.

The company said it had high regard for Netflix's management,

but added "in light of the enormous operating leverage inherent in

the company's business model, changes in the company's future

subscriber growth can have an outsized impact on our estimate of

intrinsic value."

Pershing Square said planned changes by Netflix, including

incorporating advertising and being more aggressive in going after

non-paying customers, while sensible, make it difficult to predict

their impact on the company.

"We require a high degree of predictability in the businesses in

which we invest due to the highly concentrated nature of our

portfolio," Pershing Square said. It also said "While Netflix's

business is fundamentally simple to understand, in light of recent

events, we have lost confidence in our ability to predict the

company's future prospects with a sufficient degree of

certainty."

The company said the loss on its investment reduced year-to-date

returns by four percentage points. "Reflecting this loss, as of

today's close, the Pershing Square Funds are down approximately 2%

year-to-date," the company said.

Netflix shares touched a 52-week low on Wednesday, after the

company said it lost subscribers in the first quarter. The stock

ended the day with a 35.12% loss, closing at $226.19 a share.

Earlier in the session, it touched a 52-week low of $212.51 per

share.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

April 20, 2022 19:04 ET (23:04 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

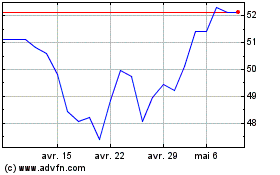

Pershing Square (EU:PSH)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pershing Square (EU:PSH)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024