- Conclusion of an exclusive negotiation agreement with the

Alcentra - Fidera - Atream group of investors as part of the equity

strengthening process

- Planned injection of €200M in equity and important debt

reduction in particular with the equitization of more than €550M of

debt

- Agreement in principle with major financial

creditors

Regulatory News:

As part of its equity strengthening process, Pierre et Vacances

S.A (Paris:VAC) (the "Company"), the listed holding company

of Pierre & Vacances - Center Parcs group, entered into an

exclusivity agreement on December 17, 2021 until January 31, 2022

with a group of investors consisting of (i) Alcentra Limited

(also a financial creditor of the Group), (ii) Fidera

Limited (also a financial creditor of the Group), and (iii)

Atream (also an institutional landlord of the Group) (together the

"Investors").

This exclusivity agreement follows the receipt of a binding

offer by the Investors on November 8, 2021, as amended on November

23, 2021, which was extended to January 31, 2022 in connection with

the execution of the exclusivity agreement (the "Binding

Offer").

This Binding Offer meets the Company's expectations by

preserving the Group's integrity and opening up the perspective of

a global restructuring plan. It reinforces the orientations of the

Reinvention strategic business plan.

As of the date hereof, discussions with the financial creditors

concerned have resulted in an agreement in principle reached by all

the banks and Euro PP creditors of the Company on the main elements

of the Transaction, which shall be submitted with a favourable

opinion to the formal validation of the respective committees of

the relevant parties. The Binding Offer has also already received

the agreement in principle of a number of Ornane holders

representing to date approximately 55% of the receivables held by

this category of creditors (including claims held by Alcentra and

Fidera).

The implementation of the proposed restructuring transactions

(the "Transaction") remains subject to the signature of a

final binding contractual documentation on terms acceptable to all

relevant parties, including the various creditors mentioned

above.

The Binding Offer is supported by the Company and its

management, as well as by the Group's majority shareholder,

S.I.T.I, and its founder Mr. Gérard Brémond, subject to

finalization of an agreement between the latter, S.I.T.I and the

Investors, on terms satisfactory to all relevant parties.

The completion of the Transaction would principally allow :

- the injection of €200m of equity, to strengthen the Group's

balance sheet in view of the implementation of its the Reinvention

strategic business plan (see section 7 below in this respect);

- the important reduction of the Group’s debt, with the

conversion into equity of more than €551 million of unsecured debt,

enabling the Group to return to a sustainable level of debt that is

equivalent to the one which prevailed before the health Covid

crisis;

- the implementation of a new governance structure with

shareholders ready to support the General Management in the

execution of its Reinvention strategic plan; and

- the outsourcing of the real estate business through the

creation of a dedicated real estate company to ensure the

development of new sites.

As a reminder, the Covid-19 pandemic and its restrictive

measures have severely impacted the Group's activities since the

beginning of the crisis in March 2020. In 18 months, the Group has

thus recorded a loss of nearly €800 million in revenues, €380

million in current operating income, and consumed nearly €600

million in operating cash.

In this context, and in the absence of visibility on the end of

the Covid crisis, the Group's priority was to preserve its cash

flow. As part of an amicable conciliation procedure, opened from

February 2 to November 24, 2021 (for the Company) and December 2,

2021 (for the other Group companies concerned), the Group was able

to obtain from its various financial creditors a new bridge

financing in debt for a principal amount of around 300 million

euros and to reach an agreement on the treatment of rents with

almost all of its institutional landlords and with approximately

80% of its individual landlords. As an extension of the

conciliation, the Company requested the opening of a mandat ad hoc

procedure, which was opened by order of the President of the

Commercial Court on December 14, 2021 for a period of 4 months.

The completion of the Transaction would thus constitute the

successful conclusion of the efforts made by the Group since the

beginning of this Covid crisis to ensure its sustainability and its

development.

Key elements of the Transaction

1. Transactions on the Company's share capital

Following the agreement in principle reached with the relevant

parties, the envisaged transactions on the Company's share capital

would be as follows:

(i)

after reduction of the nominal

value of the shares from €10 to €0.01 by way of a capital

reduction, a free allocation of warrants to subscribe for

shares in the Company (the "Shareholder Warrants") to

all shareholders (including S.I.T.I but excluding treasury

shares) at an exercise price of €2.75 per new share and with a

validity period of 5 years. The exercise of all the Shareholder

Warrants would enable their holders to hold approximately 7.5% of

the fully diluted share capital of the Company at the end of the

Transaction (before taking into account the dilution linked to the

allocation and conversion of the preference shares detailed below

for the benefit of the directeur général of the Group and top

management);

(ii)

a capital increase with

preferential subscription rights ("DPS") for a total gross amount

of €50,085,656, at a price of € 0.75 per new share (i.e. a

total issue of 66,780,875 new shares envisaged to date), to

be subscribed and paid up in cash, fully guaranteed by Alcentra

and Fidera. In the context of the capital increase with

preferential subscription rights, 1 preferential subscription right

would be allocated per existing share and 4 preferential

subscription rights would allow the subscription of 27 new shares

at a price of €0.75 per new share;

(iii)

a capital increase with

cancellation of the preferential subscription right for a total

gross amount of € 149,914,344 at a price of € 0.75 per new

share (i.e. a total planned issue of 199,885,792 new shares)

reserved for (a) Alcentra and Fidera for €44,957,172

each (i.e. at least 59,942,896 new shares each), (b) Atream

for €30,000,000 (i.e. 40,000.000 new shares), (c) to the Ornane

holders who wish to participate in this reserved capital

increase (in proportion to their holding of Ornane), up to a

maximum of €12,750,000 (i.e. 17,000,000 new shares), and (d) to

the holders of non-elevated Euro PP Bonds who wish to

participate in this reserved capital increase (in proportion to

their holding of Euro PP Bonds), up to €17,250,000 maximum (i.e.

23,000,000 new shares maximum). This allocation may be adjusted in

the event that a new investor approved by the Investors and by the

Group wishes to participate in the Transaction, in which case, a

portion of up to €10,000,000 may be reserved for such investor, the

total amount of the reserved capital increase remaining unchanged

in this event. The proceeds of the capital increase with

preferential subscription rights and of the reserved capital

increase would be used to repay part of the €300 million bridge

financing granted during 2021;

(iv)

a conversion of debt into

equity in an amount of approximately €551,495,311 (which should

be increased by the interest accrued at the date of conversion),

via an issuance of shares with warrants to subscribe for

shares (the "Creditors' Warrants" and, together with the

shares issued to the creditors, the "ABSA") reserved for

the creditors, and paid up by offsetting the amount of their claims

at a price of €4 per new share (i.e. a total issue envisaged to

date of approximately 137,873,828 new shares). The Creditors’

Warrants would have an exercise price of €2.25 per new share and a

validity period of 5 years. An offer to monetize the claims

held by the interested creditors could be made by certain

Investors, according to terms and conditions to be defined with the

creditors concerned, depending in particular on the total amount

whose monetization would be requested, the claims thus acquired by

the Investors being converted within the framework of the reserved

capital increase, according to the same terms and conditions as the

other creditors. The exercise of all of the Creditors’ Warrants

would enable their holders to hold approximately 7.5% of the

Group's fully diluted share capital at the end of the Transaction

(before taking into account the dilution linked to the allocation

and conversion of the preference shares detailed below for the

benefit of the directeur général of the Group and top

management);

(v)

a liquidity offer proposed by

Alcentra and Fidera under which the latter would undertake to

acquire, from all shareholders who so wish, the outstanding

preferential subscription rights in respect of the capital increase

with preferential subscription rights, for an economic value

determined on the day prior to obtaining the approval of the

Autorité des marchés financiers ("AMF") on the prospectus

relating to the Transaction. It is specified that the unit price of

the DPS offered in the context of this liquidity offer may not

exceed in any case €0.22 per DPS, corresponding to the

economic value of the DPS calculated on the basis of a closing

price of €9.16 per share on 5 November 2021. Subject to the

agreement between S. I. T. I, and Alcentra and Fidera on the one

hand, and S.I.T.I's creditors on the other hand, it is envisaged

that S. I. T. I will transfer to Alcentra and Fidera (and to them

only), in the context of this liquidity offer, all the unexercised

preferential subscription rights that it would hold in respect of

the capital increase with preferential subscription rights;

(vi)

a free allocation of warrants

to subscribe for shares in the Company (the "Guarantor

Warrants") to Alcentra and Fidera at an exercise price of

€0.01 per new share, in consideration for their undertaking to

backstop the capital increase with preferential subscription rights

and their liquidity undertaking regarding the preferential

subscription rights provided for above. The exercise of all of the

Guarantor Warrants would enable their holders to obtain a total of

approximately 7% of the Group's fully diluted share capital at the

end of the Transaction (before taking into account the dilution

linked to the allocation and conversion of the preference shares

detailed below for the benefit of the directeur général of the

Group and top management);

(vii)

a fee for structuring and

coordinating the Transaction for a total amount of €3 million,

payable by the Company and divided equally among the Investors;

(viii)

a consent fee for the benefit of

the Ornane holders and the holders of non-elevated Euro PP bonds

who would accept the Transaction and the bank creditors accepting

the Transaction who did not participate in the 2021 bridge

financing, for an amount of 1% of the relevant debt; and

(ix)

an early cash repayment of 2% of

the debt of the bondholders (i.e. the Ornane and non-elevated Euro

PP bonds holders) and bank creditors who did not participate in the

2021 bridge financing.

In connection with the Transaction, the Investors would not act

in concert.

As the Binding Offer stands, and depending on the subscription

rate of the existing shareholders to the capital increase with

preferential subscription right, the Investors, acting in this

capacity (excluding the holding of the share capital in respect of

their existing or acquired claims under their monetization offer

and to be converted in the context of the reserved capital

increase) would hold between approximately 42,6% and 56.8% 1 of the

share capital, after (i) the completion of the capital

increases (a) with preferential subscription rights and

(b) reserved for the Investors, (ii) the issuance of

the ABSA, (iii) the exercise of the Guarantor BSA and

(iv) the allocation and conversion of the first two tranches

of free shares to the benefit of Mr. Gérard Brémond (but prior to

the exercise of the Shareholder Warrants and the Creditors’

Warrants, and before taking into account the dilution related to

the allocation and conversion of the preference shares to the

benefit of the directeur général and the top management of the

Group and the third tranche of preference shares to the benefit of

Mr. Gérard Brémond).

On this same basis, and depending on their subscription rate to

the capital increase with preferential subscription rights, the

existing shareholders would hold between approximately 2.1% and

16.4% of the share capital at the end of the Transaction.

The dilution percentages will be more fully detailed at a later

date in the context of the implementation of the Transaction and

are subject to change depending on any adjustments to the terms of

the Transaction.

In this respect, the Investors will have the possibility to

request, within the framework of a good faith discussion,

adjustments to the terms of the Binding Offer (including

modifications to the subscription price of the aforementioned

capital transactions that they consider appropriate), in the event

that, in the Investors' reasonable opinion, the Group's activities

or liquidity situation would be affected by a significantly

unfavourable event or the Group's pro forma liquidity situation

would be below their assumption of a minimum liquidity level.

2. New funding reinstated

The Binding Offer, as adjusted for the elements agreed in

principle with the main financial creditors of the Company, also

provides for the implementation of the following new rescheduled

financing:

(i)

the partial reinstatement of

the bridge financing obtained in 2021 by the setting up of a senior

term loan of 174 million euros at the date of completion of the

Transaction to the benefit of the Dutch subsidiary Center Parcs

Europe N.V., as borrower. The senior term loan will have a maturity

of 5 years and will bear interest at the same rate as the bridge

financing, i.e. 3.75% per annum;

(ii)

the continuation of the

existing debt that was elevated upon implementation of the new

bridge financing in 2021 for an amount in principal of 103.5

million, which would be converted into a 5-year term loan

bearing interest at the same rate as the existing senior debt;

and

(iii)

an additional elevation for

€50 million of additional principal amount of unsecured debt

from the existing revolving credit facility and the existing

consolidated facility.

These financing facilities would be secured until their full

repayment, (a) in first rank for the term loan and

(b) in second rank for the existing and additional elevated

debt, by the establishment of a fiducie-sûreté similar to the one

set up for the 2021 bridge financing, covering all the shares of

Center Parcs Holding, a subsidiary of the Company and holding

company of the Center Parcs division, and by granting pledges on

the share of Center Parcs Holding that has not been transferred in

the fiducie-sûreté, and on the shares of the sub-subsidiaries

Center Parcs Europe NV, Center Parcs NL Holding BV, Center Parcs

Germany Holding, Center Parcs Holding Belgique and other

subsidiaries of Center Parcs Europe NV, as well as pledges on the

Center Parcs trademarks.

As the Binding Offer stands, the remaining amount of the

financial debt of the Company, i.e. around €551 million would be

converted into capital in the context of the issue of the ABSA to

the benefit of the creditors under the reserved capital increase,

in accordance with the terms and conditions specified above, which

would result, subject to the evolution of the activity, notably

linked to the Covid crisis, in the Group's net financial debt

pro forma of the Transaction being reduced to approximately 132

million euros as at 30 June 2022.

3. Preference shares

The Binding Offer provides for the implementation of a free

allocation of preference shares convertible into ordinary shares,

subject to the achievement of performance conditions for the

benefit of the General Manager (directeur général) and the top

management of the Group (excluding the Group's founder). In the

event of the achievement of all the performance conditions, and

subject, in certain cases, to customary vesting conditions, the

free preference shares could be converted into a number of ordinary

shares of the Company representing up to 3.94% of the fully diluted

share capital of the Company (after any dilution pursuant to the

Transaction).

Upon completion of the Transaction, the founder of the Group,

Mr. Gérard Brémond would enter into an employment contract with one

of the Group's entities, in addition to taking up a position in a

new real estate company, as described in section 5 below. In this

capacity, Mr. Brémond would be responsible for assisting the Group

in its transition and would therefore benefit from a separate plan

for the free allocation of preference shares convertible into

ordinary shares in three tranches, subject to performance

conditions for the last two tranches. If all applicable performance

conditions are met, the free preference shares could be converted

into a number of shares of the Company representing up to 3.7% of

the fully diluted share capital of the Company (at the end of the

Transaction but before taking into account the dilution related to

the allocation and conversion of the preference shares to the

benefit of directeur général and of the top management of the Group

as described in the previous paragraph), subject to finalization of

an agreement between Mr. Gérard Brémond, S.I.T.I and the Investors

on terms satisfactory terms for all relevant parties.

The terms and conditions of the various free shares plans for

the benefit of the directeur général and top management of the

Group and Mr. Gerard Brémond and the performance conditions, if

any, associated with them, would be further detailed at the

dedicated shareholders' meeting that would be called to vote on the

transactions on the share capital of the Company contemplated in

the context of the Transaction.

4. Governance

Following the Transaction, it is envisaged that the Company's

board of directors will be composed of 8 to 9 members (excluding

members representing employees), including (i) the Chairman

of the board of directors, (ii) Franck Gervais, the

Company's directeur général, (iii) 1 member for Alcentra

(iv) 1 member for Fidera, (v) 1 member for Atream

(who, in view of his sectoral expertise, will have the particular

objective of supervising the implementation of the Group's

industrial project), and (vi) 3 to 4 other members to be

appointed by the general meeting of shareholders.

Certain standard strategic decisions would be included in the

rules of procedure of the Board of Directors and would require

prior authorisation of the Board of Directors by an enhanced

majority of 3/4 of the members of the Board of Directors. Other

decisions would be taken by a simple majority of the members

present or represented.

Following the completion of the Transaction, four committees

would be created or maintained (Audit Committee, Appointments and

Remuneration Committee, Finance Committee and Strategic Committee).

The Group would also continue to refer to the recommendations of

the AFEP MEDEF Code in its corporate governance practices.

5. New real estate company

As part of the Transaction, a framework agreement would be

entered into relating to the development of the Group's new sites

by a real estate company dedicated to the Group, to be formed by

Atream with other institutional partners, the main purpose of which

will be to acquire and lease to the Group residences in the form of

a sale before completion (VEFA) or a lease before completion

(BEFA), as the case may be.

The provision of certain services to the above-mentioned real

estate company would be entrusted to a company to be formed in

which Mr. Gérard Brémond (or a company controlled by him) would

hold 70% of the share capital. Atream and the Group would each hold

15% of the share capital of this company.

This new company would have an asset management role on behalf

of the real estate company and its purpose would be to select and

propose to the real estate company the acquisition of tourism

assets to be leased by the Group by sourcing, arranging and

monitoring the project owners from design to delivery, and then

managing and, where applicable, selling the assets on behalf of the

real estate company. The relationship between the Group and the new

company will be governed by contracts with the Group, which would

be entered into under market conditions, on terms acceptable to

each of the relevant parties and to the Group, determined on a

transaction-by-transaction basis.

6. Conditions precedent

The Binding Offer is subject to the following conditions

precedent:

(i)

agreement between the Investors,

the Company, its financial creditors by the contractually required

majority, and S.I.T.I on the final terms of the Transaction and

conclusion of definitive contractual documentation acceptable to

all relevant parties;

(ii)

agreement between the Investors,

S.I.T.I. and S.I.T.I's own financial creditors on the terms of the

restructuring of S.I.T.I and the conclusion of definitive

contractual documentation acceptable to all relevant parties;

(iii)

obtaining (a) a decision

from the AMF to waive or not to file a mandatory public offer in

connection with the Transaction, which decision shall be free of

any appeal, and (b) a decision from the AMF approving the

Company's prospectus, including in particular the note relating to

the capital transactions contemplated in connection with the

Transaction;

(iv)

obtaining a report from an

independent expert judging the proposed price to be fair in the

context of the capital increases planned under the Transaction. In

this respect, the board of directors of the Company has already

decided to appoint Finexsi, represented by Mr. Olivier Peronnet,

upon the proposal of an ad hoc committee of four members, the

majority of whom are independent, to prepare a fairness opinion in

the context of the capital increases planned in connection with the

Transaction, in accordance with the provisions of the AMF's general

regulations; and

(v)

obtaining, if necessary, the

required authorizations under the applicable merger control

regulations.

It is specified that the acceptance of the Binding Offer by the

Group and the conclusion of the definitive and binding contractual

documentation can only occur after the information-consultation

procedures with the competent employee representative bodies within

the Group will have been finalised.

The various transactions involving the Company's share capital

will then be submitted to the vote of the Company's shareholders at

a dedicated general meeting to be held after the Group's

annual general meeting scheduled for 10 February 2022.

7. Other terms of the Binding Offer

In their Binding Offer, the Investors confirmed that they shared

the strategy set out in the Reinvention business plan presented by

the Group's management, specifying that an additional period of up

to 12 to 24 months in the achievement of the envisaged financial

objectives (€1.838m in turnover and €275m in EBITDA initially

planned for 2025) could not be ruled out in view of the current

health context. Prior to the implementation of the Transaction, an

update of the financial targets agreed between the Group and the

Investors will be communicated.

*

Subject to the finalisation of discussions and the completion of

certain conditions precedent applicable prior to or concurrently

with the signing of the contractual documentation, the objective is

to reach a definitive contractual agreement on the terms of the

Transaction by the end of January 2022. In this case, the final

completion of the Transaction would then take place several months

after the signature of the final agreement, depending on legal and

regulatory constraints. The timetable of the main steps envisaged

for the implementation of the Transaction following the signature

of a binding agreement will be communicated at a later date.

Warning

This press release and the information it contains do not

constitute an offer to sell or subscribe, or a solicitation of an

order to buy or subscribe, Pierre et Vacances S.A. securities in

Australia, Canada, Japan or the United States of America or in any

other country in which such an offer or solicitation would be

prohibited.

The dissemination, publication or distribution of this press

release in certain countries may constitute a violation of the

legal and regulatory provisions in force. Accordingly, persons

physically present in such countries and in which this press

release is disseminated, distributed or published should inform

themselves of and observe any such local restrictions. This press

release must not be disseminated, published or distributed,

directly or indirectly, in Australia, Canada, Japan or the United

States of America.

This press release is a promotional communication and does not

constitute a prospectus within the meaning of Regulation 2017/1129

of the European Parliament and of the Council of 14 June 2017 on

the prospectus to be published when securities are offered to the

public or admitted to trading on a regulated market and repealing

the Prospectus Directive 2003/71/EC (the "Prospectus

Regulation").

No communication or information relating to this transaction may

be disseminated to the public in any jurisdiction in which

registration or approval is required. No action has been taken (or

will be taken) in any jurisdiction (other than France) in which

such action would be required. The subscription to or purchase of

Pierre et Vacances S.A. shares or preferential subscription rights

may be subject to specific legal or regulatory restrictions in

certain countries. Pierre et Vacances S.A. assumes no liability for

any violation by any person of these restrictions.

With regard to the Member States of the European Economic Area

other than France, no action has been or will be taken to allow a

public offering of securities requiring the publication of a

prospectus in any of the Member States concerned. Consequently, any

offer of securities of Pierre et Vacances S.A. may only be made in

one or other of the Member States (i) to qualified investors within

the meaning of the Prospectus Regulation; or (ii) in any other case

exempting Pierre et Vacances S.A. from publishing a prospectus in

accordance with Article 1(4) of the Prospectus Regulation.

Disclaimer: Forward-Looking Statements

This press release contains certain statements that constitute

"forward-looking statements", including, without limitation,

statements that are predictions of or indicate future events,

trends, plans or objectives, based on certain assumptions and all

statements that do not directly relate to a historical fact. These

forward-looking statements are based on the management team's

current expectations and beliefs and are subject to a number of

risks and uncertainties, as a result of which actual results could

differ materially from the forecast results explicitly or

implicitly mentioned in the forward-looking statements; for more

information on these risks and uncertainties, please refer to the

documents filed by Pierre et Vacances S.A. with the Autorité des

marchés financiers.

1 Based on a subscription by the Investors of approximately

160,000,000 new shares to the reserved capital increase (i.e.

approximately €120 million) out of a total amount of

€149,914,344.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211219005091/en/

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 6 07 36 65 10

valerie.lauthier@groupepvcp.com

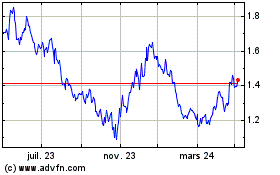

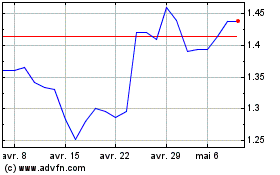

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pierre & Vacances (EU:VAC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024