Regulatory News:

Rallye (Paris:RAL) has launched today a global tender offer at a

fixed purchase price for its unsecured debt (including the bonds

and commercial paper) (the "Tender Offer").

Tender Offer

The purpose of the Tender Offer is to (i) provide holders of

unsecured debt with the opportunity of having all or part of their

claims repurchased at a fixed purchase price and to (ii) improve

Rallye’s debt profile, in the context of the implementation of its

safeguard plan approved on February 28, 2020 by the Paris

commercial court, as amended.

On October 26, 2021, the Paris commercial court has extended the

duration of the safeguard plan of Rallye approved on February 28,

2020 for two additional years and has consequently deferred the

payment dates under the safeguard plan which is now providing for

the repayment of its liabilities to be rescheduled between 2023 and

20321.

Rallye proposes to purchase unsecured claims at a price equal to

15% of the amount of the outstanding claim under each unsecured

debt instrument the relevant holder of unsecured debt is willing to

offer.

It is recalled that on January 22, 2021, Rallye launched a

global tender offer on its unsecured debt, as part of a modified

Dutch auction procedure (the "Previous Tender

Offer")2. On May 18, 2021, Rallye acquired a total amount of

unsecured debt of approximately EUR 195,4 million, for a total

purchase price of approximately EUR 39,1 million, reducing the

total amount of its debt by approximately EUR 156,3 million.

As a reminder, on December 31, 2021, the gross financial debt of

Rallye was as follows:

(in millions of euros)

December 31, 2021

Claims secured by pledges over Casino

shares

1,228

Unsecured claim

1,518

Claims secured by pledges overs shares of

Rallye subsidiaries other than Casino

137

Total – claims from safeguard

plans

2,883

Financings issued after the enforcement of

the safeguard plan

295

Total – gross financial debt

3,178

The Tender Offer, the maximum amount of which is 37 million

euros, starts today and will expire on April 5, 2022, at 5 p.m

(Paris time). Rallye will keep the markets informed of the results

of the Tender Offer, its outcome and its impact on the repayment

profile of Rallye.

Completion of the Tender Offer is, inter alia, subject to the

approval by the Paris Commercial Court of the amendment to the

Rallye’s safeguard plan in order to authorize the effective

completion of the Tender Offer. Rallye will seek such approval in

the days after announcing, subject to the results of the Tender

Offer.

To obtain a copy of the tender offer memorandum relating to the

Tender Offer or for any questions about the Tender Offer and the

procedures required to participate in it, holders of unsecured debt

(including bonds and commercial paper issued by Rallye) are invited

to contact Lucid Issuer Services Limited, in its capacity as tender

agent, at the contact details set out below:

Lucid Issuer Services Limited The Shard

32 London Bridge Street London SE9 1SG United Kingdom Attn: Thomas

Choquet and Arlind Bytyqi Telephone: +44 20 7704 0880 Email:

rallye@lucid-is.com Website: https://deals.lucid-is.com/rallye

Tender Offer Financing

The Tender Offer will be financed by the amount available under

the financing made available to Rallye for the purpose of the

Previous Tender Offer.

Presentation

An investor presentation describing the terms and conditions of

the Tender Offer is available on Rallye’s website.

This press release does not represent an invitation to

participate in the Tender Offer in any country in which, or to any

person to whom, it is prohibited to make such an invitation in

accordance with applicable laws and regulations. Offers to sell

made in connection with the Tender Offer by eligible investors will

not be accepted in all cases where such an offer or request would

be unlawful. Rallye makes no recommendation to eligible investors

as to whether or not they should take part in the Tender Offer.

Distribution of this document in some jurisdictions may be

restricted by law. Those in possession of this document are

required to obtain information themselves and to comply with all

legal and regulatory restrictions.

United States

The Tender Offer is not being made and will not be made,

directly or indirectly, in or into, or by use of the mails of, or

by any means or instrumentality (including, without limitation,

facsimile transmission, telex, telephone, email and other forms of

electronic transmission) of interstate or foreign commerce of, or

any facility of a national securities exchange of, or to owners of

debt instruments who are located or resident in, the United States

or to any U.S. Persons as defined in Regulation S under the

Securities Act (each, a “U.S. Person”). The debt instruments

may not be tendered in the Tender Offer by any such use, means,

instrumentality or facility from or within the United States or by

persons located or resident in the United States or by, or by any

person acting for the account or benefit of, a U.S. Person.

Accordingly, copies of this press release and any other documents

or materials relating to the Tender Offer are not being, and must

not be, directly or indirectly, mailed or otherwise transmitted,

distributed or forwarded (including, without limitation, by

custodians, nominees or trustees) in or into the United States, or

to U.S. Persons or to persons located or resident in the United

States. Any purported tender of debt instruments in the Tender

Offer resulting directly or indirectly from a violation of these

restrictions will be invalid and any purported tender of debt

instruments made by, or on behalf of, a U.S. Person or a person

located or resident in the United States or from any agent,

fiduciary or other intermediary acting on a non-discretionary basis

located in or acting for a principal located or resident in the

United States or a U.S. Person will not be acknowledged or

accepted. For the purposes of this paragraph, United States means

the United States of America, its territories and possessions, any

state of the United States of America and the District of

Columbia.

EEA and United Kingdom

This press release and the Tender Offer Memorandum are not a

prospectus within the meaning of the Regulation EU 2017/1129, as

amended or supplemented from time to time, and including underlying

legislation (the “Prospectus Regulation”), or the Prospectus

Regulation as it forms part of United Kingdom domestic law by

virtue of the European Union (Withdrawal) Act 2018 and has not been

approved, filed or reviewed by any regulatory authority of a Member

State of the EEA or of the United Kingdom.

1 See Rallye’s press releases dated March 2, 2020 and October

27, 2021. 2 See Rallye’s press release dated January 22, 2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220322006090/en/

Press contact: PLEAD Étienne Dubanchet +33 6 62 70 09 43

etienne.dubanchet@plead.fr

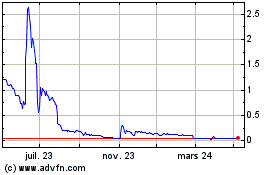

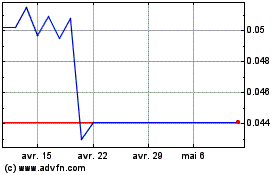

Rallye (EU:RAL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Rallye (EU:RAL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024