Regulatory News:

The consolidated financial statements for the first half of

2022, established by the Board of Directors on 28 July 2022, were

reviewed by the statutory auditors. They were drawn up in

accordance with the going concern principle given estimates

prepared for the next twelve months for Rallye (Paris:RAL). Cash

position forecasts are consistent with future commitments taken

within the safeguard plan 1 and operating expenses taking into

account Rallye’s cash position (€25m2 at 30 June 2022).

(in €m)

H1 2022

H1 2021 (restated)

Net sales

15,905

14,482

EBITDA 3

1,064

1,087

EBITDA margin

6.7%

7.5%

Trading profit

375

434

Trading profit margin

2.4%

3.0%

Net income from continuing operations,

Group share

(48)

18

Net underlying income from continuing

operations, Group share

(132)

(116)

Net income, Group share

(54)

(72)

Rallye’s consolidated net sales amounted to €15.9bn and trading

profit reached €375m as at 30 June 2022. Net underlying income from

continuing operations, Group share, amounted to - €132m as at 30

June 2022.

1. Holding perimeter 4

Global tender offer launched by Rallye on its unsecured

debt

On 9 May 2022, the Paris Commercial Court approved the amendment

to Rallye safeguard plan allowing the effective completion of the

global tender offer on its unsecured debt launched on 23 March

2022. Rallye acquired a total amount of unsecured debt of €242.3m

for a total repurchase price of €36.6m reducing the amount of its

debt by €234.8m (including accrued interest). The tender offer was

settled on 16 May 2022.

Net financial debt of Rallye’s holding perimeter

The bridge between Rallye’s holding perimeter gross financial

debt and net financial debt is detailed below:

(in €m)

30 June 2022

31 Dec. 2021

Claims secured by pledges over Casino

shares

1,247

1,228

Unsecured claims

1,270

1,518

Claims secured by pledges over shares of

Rallye subsidiaries (other than Casino)

139

137

Total - claims under the safeguard

plan

2,656

2,883

Financings issued after the enforcement of

the safeguard plan

373

295

Total - gross financial debt

3,029

3,178

Cash and other financial assets (1)

(25)

(17)

Total - net financial debt (before IFRS

restatements)

3,004

3,161

IFRS restatements (including the impact of

the approval of the safeguard plan) (2)

(271)

(343)

Total – net financial debt

2,733

2,818

- Of which 25 M€ at Rallye company level at 30 June 2022,

including the drawing on the €15m financing subscribed to Fimalac,

vs. 16 M€ at 31 December 2021.

- In 2020, Rallye analysed the accounting treatment for the

modifications resulting from the liability repayment plan and the

other modifications made to financial liabilities and, more

particularly, the existence of a substantial modification within

the meaning of IFRS 9 – Financial Instruments.

Given the specific characteristics of the safeguard proceedings,

the application of IFRS 9 led to the restatement of financial

liabilities in an amount of €334m at 31 December 2020, then

increased to €343m at 31 December 2021, following on the one hand,

the global tender offer, and on the other hand, the deferment for

two years of the payment dates under the safeguard plan and finally

reduced to €271m at 30 June 2022, mainly as a result of the second

global tender offer carried out in the first half of 2022. This

amount, recognized as a reduction in the consolidated financial

debt, will be amortised on an actuarial basis (based on the

applicable effective interest rate) via an increase in the cost of

net debt in accordance with the repayment terms defined in the

safeguard plan.

The accounting treatment comprising a reduction of the financial

liability and as counterpart the future increase of the interest

expenses is the translation of the IFRS 9 standard and does not

amend the repayments undertakings or the financial liability to be

reimbursed.

Rallye’s holding perimeter gross financial debt stood at €3,029m

as of 30 June 2022, down €149m over the first semester, mainly as a

result of:

- Financial interests (excluding IFRS) of €63m over the first

semester of 2022, which will be repaid in accordance with the

repayments undertakings approved by the Paris Commercial Court on

28 February 2020 and 26 October 2021 and its contractual

documentation;

- Unsecured debt tendered for a total amount of €242.3m for a

total repurchase price of €36.6m reducing the total amount of its

debt by €234.8m (including accrued interest).

Rallye’s holding perimeter net financial debt, before IFRS

restatements, amounted to €3,004m as of 30 June 2022, compared to

€3,161m as of 31 December 2021.

The change in Rallye’s holding perimeter net financial debt over

H1 2022 breaks down as follows:

(in €m)

H1 2022

2021

Net financial debt (opening)

2,818

2,839

Financial interests (excluding IFRS)

63

123

Holding costs

9

19

Net impact of the global tender offers

(1)

(166)

(113)

Other

6

1

Variation of IFRS restatements (including

the impact of the approval of the safeguard plan)

3

(52)

Net financial debt (closing)

2,733

2,818

- Excluding IFRS restatements (i.e. the accelerated amortization

of liabilities under the IFRS 9 standard for the acquired debt),

the net impacts of the global tender offers carried out in the

first half 2021 and 2022 would respectively amount to €156m and

€235m.

After taking into account the change in IFRS restatements for

-€271m, Rallye’s holding perimeter net financial debt amounted to

€2,733m as of 30 June 2022.

Rallye is exposed to the risk and risk factors inherent in the

proper execution of the safeguard plan over time, which are

described in detail in its 2021 Universal Registration Document

available on its website, and filed with the Autorité des marchés

financiers on 20 April 2022 under number D.22-0314.

The execution of the safeguards plans of Rallye and its parent

companies depends mainly on Casino’s distributive capacity as well

as various refinancing options. The distributive capacity of Casino

is framed by its financial documentation which authorises the

distribution of dividends1 when the ratio of gross financial debt

to EBITDA including leases (France Retail + E-commerce) is below

3.5x. As at 30 June 2022, the gross financial debt to EBITDA

including leases ratio was 7.12x versus 6.47x at 31 December 2021

and 5.50x at 30 June 2021 (see table in Appendices).

2. Casino’s activity 2

Casino consolidated net sales amounted to €15.9bn in H1

2022, up +5.7% on a same-store basis 3, up +3.0% on an organic

basis 3 and up +9.8% as reported after taking into account the

effects of exchange rates and hyperinflation in Argentina (+6.6%),

changes in scope (-0.1%), fuel (+0.7%), and the calendar effect

(-0.4%):

- On the France Retail scope, net sales were up +1.0% on a

same-store basis.

- E-commerce (Cdiscount) gross merchandise volume (GMV) came to

€1.8bn, down -9.9 % 4 (+2.3 % 4 compared to H1 2019) in a difficult

market environment and against a high H1 2021 basis for comparison

due to the pandemic.

- Sales in Latin America were up by +13.2% on a same-store basis

3, mainly driven by the very good performance in the Cash &

Carry segment (Assaí) and Grupo Éxito.

Casino trading profit totalled €380m, down -13.7 % (-21.8

% at constant exchange rates).

- France Retail trading profit was €141m (€163m in H1 2021), of

which €86m was attributable to the retail banners (excluding

GreenYellow and property development). Trading profit came to €27m

for GreenYellow and to €28m 5 for property development operations.

The trading margin for the France Retail segment came out at 2.0

%.

- E-commerce posted a trading profit of -€32m compared to a

trading profit of €6m in H1 2021 and a trading loss of -€17m in H1

2019. The change compared to H1 2019 is attributable to Octopia

development costs.

- In Latin America, trading profit was stable year-on-year at

€271m (-9.7% excluding tax credits and currency effects), driven by

continued strong sales momentum at Assaí and Grupo Éxito, with a

decline at GPA Brazil due to hypermarket closures (inventory

drawdowns before disposals) and a ramp-up in promotional

initiatives.

Casino net debt excluding the impact of IFRS 5 was

€7.5bn, of which €5.1bn in France and €2.4bn in Latin America,

higher than the level at end of 2021 due to the seasonality of the

activity. Including the impact of IFRS 5, consolidated net debt

came to €6.6bn, of which €4.3bn in France and €2.3bn in Latin

America.

At 30 June 2022, Casino's liquidity in France (including

Cdiscount) was €2.2bn, with €405m in cash and cash equivalents 1

and €1.8bn in confirmed undrawn lines of credit, available at any

time 2. Casino also has €111m in a secured segregated

account for the repayment of secured gross debt at 30 June 2022

(€95m at 11 July 2022 following buybacks of secured bonds maturing

in January 2024).

Casino met the covenants 2 contained in its revolving

credit facility, with headroom of €227m on gross debt for the

secured gross debt/ EBITDA after lease payments covenant, and

headroom of €215m on EBITDA for the EBITDA after lease payments/net

finance costs covenant.

On 28 July 2022, Casino has signed with Ardian an agreement in

view of a disposal of GeenYellow at an enterprise value of

€1.4bn and an equity value of €1.1bn. The disposal proceeds for

Casino, net of a reinvestment of €165m, would amount to €600m3.

Further to the agreement for the disposal of GreenYellow, the

asset disposal plan represents €4.0bn to date.

3. Outlook

Casino’s outlook in France for the second half of the year

2022:

Amid rising inflation, Casino’s priority remains growth and

maintaining a good level of profitability to ensure the increase of

cash flow generation.

Casino returned to growth in H1 2022, despite an unstable

economic environment.

In H2 2022, amid rising inflation, Casino intends to maintain

its growth momentum:

- Continuation of the expansion plan, with 800 convenience store

openings (Monop', Franprix, Naturalia, Spar, Vival, etc.), mainly

under franchise (376 openings in H1)

- Development of the most buoyant retail and E-commerce

activities (Casino Hyper Frais, partnerships with Gorillas, Amazon

and Ocado)

For FY 2022, Casino confirms its targets:

- Maintain a high level of profitability and improve cash flow

generation

- Continue the €4.5bn disposal plan in France,

which is expected to be completed by the end of 2023

Disclaimer

This press release was prepared solely for information purposes

and should not be construed as a solicitation or an offer to buy or

sell securities or related financial instruments. Similarly, it

does not give and should not be treated as giving investment

advice. It has no connection with the investment objectives,

financial situation or specific needs of any recipient. No

representation or warranty, either express or implicit, is provided

in relation to the accuracy, completeness or reliability of the

information contained herein. It should not be regarded by

recipients as a substitute for exercise of their own judgement. All

opinions expressed herein are subject to change without notice.

Appendices

H1 2022 Results

(consolidated data)

(in €m)

H1 2022

H1 2021 (restated)

Net Sales

15,905

14,482

EBITDA

1,064

1,087

Trading profit

375

434

Other operational income and expenses

(286)

8

Cost of net financial debt

(292)

(280)

Other financial income and expenses

(95)

(63)

Profit (loss) before tax

(298)

99

Income taxes

112

(44)

Income from associated companies

5

29

Net profit (loss) from continuing

operation, Group share

(48)

18

Net profit (loss) underlying income

from continuing operations, Group share

(132)

(116)

Net profit (loss), Group share

(54)

(72)

Reconciliation of reported profit to underlying

profit

Underlying net profit corresponds to net profit from continuing

operations, adjusted for (i) the impact of other operating income

and expenses, as defined in the "Significant accounting policies"

section in the notes to the consolidated financial statements, (ii)

the impact of non-recurring financial items, as well as (iii)

income tax expense/benefits related to these adjustments and (iv)

the application of IFRIC 23.

Non-recurring financial items include fair value adjustments to

equity derivative instruments, the effects of discounting Brazilian

tax liabilities, the restatements and impacts of the implementation

of IFRS 9 following Rallye’s safeguard plan approval, the deferment

for two years of the payment dates and the net results of the

global tender offers carried out by Rallye in 2021 and 2022.

(in €m)

H1 2022

Adjusted items

H1 2022 underlying

H1 2021 restated

Adjusted items

H1 2021 restated underlying

Trading profit

375

375

434

434

Other operating income and expenses

(286)

286

8

(8)

Operating profit

89

286

375

442

(8)

434

Cost of net financial debt (1)

(292)

(24)

(316)

(280)

(4)

(284)

Other financial income and expenses

(2)

(95)

(137)

(232)

(63)

(113)

(176)

Income taxes (3)

112

(86)

26

(44)

(9)

(53)

Share of net income of equity-accounted

investees

5

5

29

29

Net profit (loss) from continuing

operations

(181)

39

(142)

84

(134)

(50)

o/w attributable to non-controlling

interests (4)

(133)

123

(10)

66

66

o/w Group share

(48)

(84)

(132)

18

(134)

(116)

1. Cost of net financial debt restatements

mainly relates to the implementation of IFRS 9 - Financial

Instruments following Rallye’s safeguard plan approval in 2020 and

amended in 2021, as well as the cancellation of the interest

calculated, since the start of the safeguard procedure, on Rallye’s

unsecured debt repurchased during the tender offer made in the 1st

half of 2022.

2. Other financial and expenses have been

restated for the positive net impacts of Rallye’s global tender

offers carried out in the first half 2021 and 2022.

3. Income tax have been restated in

accordance with items restated above.

4. Non-controlling interests have been

restated for amounts associated with the restated items listed

above.

Estimated repayment profile of Rallye’s

liabilities

(in €m)

The estimated repayment profile of Rallye’s liabilities

incorporates the impact of the tender offer on the unsecured debt

(see "1. Holding perimeter" of this press release) and the impact

of the forward yield curve.

It is detailed in the press release attached to this article and

available on the company' website:

http://www.rallye.fr/en/press/press-releases.

Additional Information

Gross debt to EBITDA ratio governing the

distribution of dividends in Casino’s financial documentation

Financial information 12-months France Retail + E-commerce

scope

(in €m)

30 June 2022

31 Dec. 2021

30 June 2021

Net sales (1)

16,021

16,101

16,319

EBITDA (1)

1,393

1,464

1,599

(-) impact of leases (2)

(601)

(622)

(640)

(i) Adjusted consolidated EBITDA incl.

leases (1)(3)

792

842

959

(ii) Gross debt (1)(4)

5,639

5,450

5,279

(iii) Gross cash and cash equivalents

(1)

413

569

538

Gross debt to EBITDA ratio (ii/i)

(1)

7.12x

6.47x

5.50x

The H1 2021 financial statements have been restated to allow

their comparability with H1 2022 accounts. Restatements mainly

refer to the retrospective application of IFRIC IC decision with

regard to the costs of implementing, configuring and customizing

software in SaaS mode and related to IAS 19. 1 As a reminder, no

payment is due under the safeguard plan in 2022 and 2023 2 After

drawing on the €15m financing subscribed to Fimalac 3 EBITDA =

trading profit + current depreciation and amortization expense 4

Rallye’s holding perimeter is defined as Rallye and its

subsidiaries holding the investment portfolio

1 Beyond ordinary dividend representing 50% of net profit

attributable to owners to the parent, with a minimum of €100m per

year from 2021 and an additional €100m that may be used for one or

several distributions during the life of the debt instruments. 2

More detailed information about Casino activity is communicated

directly by the subsidiary 3 Excluding fuel and calendar effects 4

Data published by the subsidiary 5 Linked to the deneutralisation

of real estate development carried out with Mercialys (the real

estate development operations carried out with Mercialys are

neutralized in the EBITDA to the extent of the Group’s

participation in Mercialys; a decrease in Casino’s stake in

Mercialys or a sale by Mercialys of these assets therefore results

in recognition of EBITDA previously neutralized)

1 Amount excluding GreenYellow, classified in IFRS 5 2 Covenants

tested on the last day of each quarter – outside of these dates,

there is no limit on the amount that can be drawn down 3 Including

€30m paid at closing in an escrow account subject to compliance

with certain operational indicators

1 Unaudited data, scope as defined in the refinancing

documentation dated November 2019 with mainly Segisor accounted for

within the France Retail + E-commerce scope 2 Interest paid on

lease liabilities and repayment of lease labilities as defined in

the documentation 3 EBITDA after lease payments (i.e. repayments of

principal and interest on lease liabilities) 4 Loans and other

borrowings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220728005889/en/

Press contact: PLEAD Étienne Dubanchet +33 6 62 70 09 43

etienne.dubanchet@plead.fr

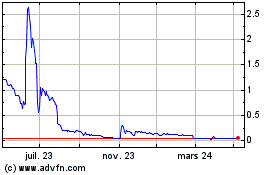

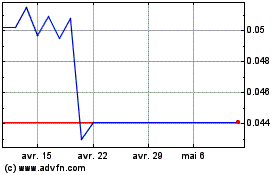

Rallye (EU:RAL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Rallye (EU:RAL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024