Rémy Cointreau: Very good start to the year

26 Juillet 2022 - 7:25AM

Business Wire

Sales: +27.0% in organic growth

Full-year guidance confirmed

Regulatory News:

Rémy Cointreau (Paris:RCO) posted sales of

409.9 million euros in the first quarter of 2022-23, up

+27.0% in organic terms1 (compared to an exceptionally high

base of comparison of +105.0% in Q1 2021-22). This demonstrates a

very positive price/mix effect (+14.5%), in line with the

Group’s value strategy, and a significant increase in volumes

(+12.5%), including a favourable phasing effect for shipments

to the United States. Reported sales were up +39.9%,

including a very positive currency effect (+12.9%), mainly due to

the movement of the US dollar and Chinese renminbi.

During the quarter, the Group has benefited from an excellent

dynamic in the United States and the continued recovery in the EMEA

region. Activity in China rebounded strongly in June having

suffered due to lockdown measures in April-May.

All the brands contributed to the Group's excellent performance.

The Cognac division had an excellent start to the year

(+31.5% organic growth). The Liqueurs & Spirits division

also posted strong growth of +19.4% in organic terms.

Breakdown of sales by division:

€m (April-June 2022)

Q1 2022-23

Q1 2021-22

Reported change

Organic change

Cognac

292.3

199.6

+46.4%

+31.5%

Liqueurs & Spirits

109.7

85.3

+28.7%

+19.4%

Subtotal: Group Brands

402.0

284.9

+41.1%

+27.9%

Partner Brands

7.9

8.2

-3.1%

-3.8%

Total

409.9

293.1

+39.9%

+27.0%

Cognac

The Cognac division had an excellent start to the year.

Sales increased by +31.5% in organic growth, buoyed by the Americas

and the EMEA region. In the United States, Rémy Cointreau

has continued to enjoy sustained demand for its high-end and

mid-range products (Louis XIII, Rémy Martin XO and 1738 Accord

Royal). The performance also reflects the phasing effects of

shipments, the fourth quarter of 2021-22 having been marked by the

Group's decision to manage its strategic inventories. Most regions

in the EMEA zone have seen strong growth, boosted by the

overperformance of high-end products such as Louis XIII and Rémy

Martin XO. Sales in China were temporarily affected by

strict lockdown measures up until May. However, business was

boosted by a strong resumption in sales in June and excellent

growth in e-commerce (particularly on T-Mall and JD.com and for the

18th June shopping festival). The pandemic in China has had limited

impact on the division’s overall performance as sales are

traditionally low during this period. Overall, the global inventory

level remains extremely healthy.

More recently, building on the success of the Team Up For

Excellence campaign in 2021, Rémy Martin 1738 Accord Royal and the

artist Usher have teamed up once more for a new campaign: A Taste

of Passion. This will present the limited-edition first-ever

bottle/NFT using artificial intelligence to give an immersive

multisensory experience. Usher’s own musical vocabulary, used to

describe his olfactory experience when tasting a 1738 Accord Royal,

is transformed into an avant-garde representation (making the

invisible visible). This limited edition will be available as an

NFT on BlockBar.com from 29 July.

Liqueurs & Spirits

First-quarter sales in the Liqueurs & Spirits

division saw +19.4% in organic growth. In the United States,

Maison Cointreau and Bruichladdich Whiskies continue to show good

momentum, while The Botanist gin is reaping the benefits of its

recent campaign during the Super Bowl as it wins new listings.

In Europe, Maison Cointreau has seen exceptional growth. The

brand has just had a major overhaul of its iconic bottle (l’Unique)

which has been unveiled in France. It is due to be deployed in

Europe this summer and then in the United Kingdom, the United

States and Asia. This quarter has also been notable for the very

successful launch of the new ‘Taste the unexpected’ Metaxa campaign

which aimed to increase brand awareness and target a new moment for

consumption: the aperitif. Finally, St-Rémy brandy has recorded

remarkable growth, buoyed by the success of the new St-Rémy

Signature which is capitalising on its versatility and perfect

suitability for the world of the bar. The brand is also benefiting

from the many initiatives undertaken in recent months to initiate

consumers to the specific qualities of French brandy.

Partner Brands

First-quarter sales of Partner Brands fell by -3.8% in

organic terms having been impacted by a high comparative basis in

Europe.

2022-23 outlook: full-year guidance confirmed

Ideally positioned to take advantage of new consumption trends

and encouraged by progress against its strategic plan, Rémy

Cointreau is approaching the financial year 2022-23 with

confidence.

The Group intends to continue implementing its strategy focused

on medium-term brand development and underpinned by a policy of

sustained investment in marketing and communications. The Group

reaffirms its desire to continue to win market share in the

exceptional spirits sector and anticipates another year of

strong growth.

Helped by excellent pricing power, the improvement in the

current operating margin will be driven by the resilience of

the Group’s gross margin despite the inflationary environment

and by strict control over overhead costs.

This year the Group is forecasting a positive currency

effect on:

- Sales: between €90M and €100M (compared with €70-80M

previously)

- Current Operating Profit: between €50M and €60M

(compared with €30-40M previously)

Appendices

First quarter 2022-23 sales (April-June 2022)

€m

Reported 22-23

Forex 22-23

Scope 22-23

Organic 22-23

Reported 21-22

Reported change

Organic Change

A

B

C

A/C-1

B/C-1

Cognac

292.3

+29.8

-

262.5

199.6

+46.4%

+31.5%

Liqueurs & Spirits

109.7

+7.9

-

101.8

85.3

+28.7%

+19.4%

Group Brands

402.0

+37.7

-

364.3

284.9

+41.1%

+27.9%

Partner Brands

7.9

+0.1

-

7.9

8.2

-3.1%

-3.8%

Total

409.9

+37.8

-

372.2

293.1

+39.9%

+27.0%

Definitions of alternative performance

indicators

Rémy Cointreau’s management process is based on the following

alternative performance indicators, selected for planning and

reporting purposes. The Group’s management considers that these

indicators provide users of the financial statements with useful

additional information to help them understand the Group’s

performance. These alternative performance indicators should be

considered as supplementing those included in the consolidated

financial statements and the resulting movements.

Organic sales growth:

Organic growth is calculated excluding the impact of exchange

rate fluctuations, acquisitions and disposals.

The impact of exchange rates is calculated by converting sales

for the current financial year using average exchange rates from

the previous financial year.

For acquisitions in the current financial year, sales of

acquired entities are not included in organic growth calculations.

For acquisitions in the previous financial year, sales of acquired

entities are included in the previous financial year but are only

included in organic growth calculations for the current year with

effect from the anniversary date of the acquisition.

For significant disposals, data is post-application of IFRS 5

(under which sales of entities disposed of are systematically

reclassified under “Net earnings from discontinued operations” for

the current and previous financial year). This indicator serves to

focus on Group performance common to both financial years, which

local management is more directly capable of measuring.

Regulated information in connection with this press release can

be found at www.remy-cointreau.com.

1 All references to “organic growth” in this press

release correspond to sales growth at constant currency and

scope.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220725005752/en/

Investor Relations: Célia d’Everlange / +33 6 03 65 46 78

Media relations: Carina Alfonso Martin /

press@remy-cointreau.com

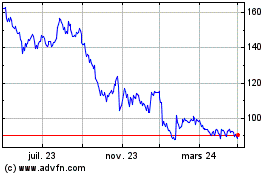

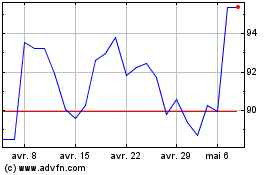

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Remy Cointreau (EU:RCO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024