RIBER: 2022 first-half earnings

Press release

2022

first-half earnings

- Robust development

of activities with strong order intake for

systems

- Difficulties in supplying

electronic components leading to a possible postponement of certain

deliveries

- Order book at

end-June 2022:

€30.6m, up +76%

Bezons, October 7, 2022 – 5:45pm – RIBER, a

global market leader for semiconductor industry equipment, is

releasing its earnings for the first half of 2022.

|

(€m) |

H1 2022 |

H1 2021 |

Change |

|

RevenuesSystems revenuesServices and accessories

revenues |

9.22.96.3 |

9.32.86.5 |

-1%+5%-3% |

|

Gross margin% of revenues |

2.830.9% |

2.527.5% |

+11% |

|

Income from ordinary operations% of revenues |

(2.1)(23.0%) |

(1.9)(21.0%) |

-9% |

|

Operating income% of revenues |

(2.1)(23.1%) |

(1.9)(21.0%) |

-9% |

|

Net income% of revenues |

(1.6)(17.0%) |

(1.8)(19.3%) |

+12% |

Key developments

During the first half of 2022, customer demand

remained very strong, as evidenced by the large number of orders

recorded since the start of the financial year, with 13 systems

ordered in nine months and an option for four additional systems.

However, the constraints in the electronic component supply chain

led to system assembly delays and prevented further deliveries over

the period.

Revenues

In this context, revenues for the first half of

2022 came to €9.2m, stable compared with the first half of 2021.

Systems revenues increased by +5% to €2.9m, while revenues for

services and accessories are down -3% to €6.3m.

Earnings

First-half earnings cannot be extrapolated over

the full year due to the lower seasonality of revenues in the first

half of the year.

The first-half gross margin came to €2.8m,

representing 30.9% of revenues, up from the first half of 2021

considering the change in the product mix.

Operating expenditure increased (+€0.5m) due to

sustained R&D investments (€1.8m; +14%) and the increase in

sales and marketing costs in a context of rising order intake

(+15%), while administrative costs are stable overall.

Income from ordinary operations totaled €(2.1)m,

down €0.2m from the first half of 2021.

Net income came to €(1.6)m, compared with

€(1.8)m for the first half of 2021. It includes €0.6m of financial

income and expenses, linked primarily to the evolution of the euro

/ US dollar parity.

Cash flow and balance sheet

The cash position at end-June 2022 was positive

at €7.7m, up €1.8m from December 31, 2021.

Shareholders’ equity at June 30, 2022 totaled

€17.0m, compared with €19.8m at December 31, 2021. This change is

mainly linked to first-half earnings and the distribution of

amounts drawn against the issue premium to shareholders for the

2021 financial year.

Order book at

June 30, 2022

During the first half of 2022, new order intake

improved significantly. The company recorded four production

systems orders and five research systems orders, while maintaining

its growth in services and accessories.

This recovery further strengthened the order

book at June 30, 2022, which totaled €30.6m, up +76% compared with

June 30, 2021. System orders (€23.0m; +119%) include 11 machines

and orders for services and accessories (€7.6m) are up +10%.

This order book does not include the orders

announced in July and August 2022 for two Compact 21 research

systems, one MBE6000 production system and one MBE49 production

system, as well as the option to buy announced on June 8 covering

four MBE6000 production machines for which the firm orders will be

confirmed when the export license is obtained in 2023.

Outlook

In a still buoyant market context, with strong

demand for the company's systems, RIBER is expected to continue

taking orders by the end of the 2022 financial year.

Faced with supply chain constraints, the company

has diversified its sourcing capacity with its supplier partners to

reduce the shortage of electronic boxes, which are crucial

components for the company’s MBE machines to operate. Supply chain

delays will likely cause system deliveries to be postponed to

2023.

The significant increase in energy costs will

have a very limited impact on the company's activity due to the low

energy consumption in the company's production processes.

Over the longer term, RIBER is moving forward

with a project for profitable growth based on its technological and

industrial know-how, as well as its capacity for innovation. Driven

by new information technologies, the company is rolling out a

strategy focused on further strengthening its leading position for

MBE, achieving regular growth in its service activities, and

maintaining a robust level of R&D investment to expand its

portfolio of technologies and applications.

Next date: 2022 third-quarter

revenues on October 31, 2022, after close of trading

The condensed consolidated half-year accounts

have not been subject to an audit or a limited review by the

statutory auditors. They were approved by the Executive and

Supervisory Boards on October 6, 2022. The half-year financial

report is available in French on the company website

(www.riber.com).

About RIBERRIBER is the global

market leader for MBE - molecular beam epitaxy - equipment. It

designs and produces MBE systems and evaporators for the

semiconductor industry. It also provides technical and scientific

support for its clients, maintaining their equipment and optimizing

their performance and output levels. Through its high-tech

equipment, RIBER performs an essential role in the development of

advanced semiconductor systems that are used in numerous consumer

applications, from information technologies to 5G

telecommunications networks, OLED screens and next-generation solar

cells.RIBER is a BPI France-approved innovative company and is

listed on the Euronext Growth Paris market

(ISIN: FR0000075954).www.riber.com

Contacts

RIBER: Michel Picault | tel:

+33 (0)1 39 96 65 00 | invest@riber.com CALYPTUS:

Cyril Combe | tel: +33 (0)1 53 65 68 68 |

cyril.combe@calyptus.net

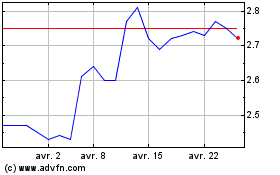

Riber (EU:ALRIB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Riber (EU:ALRIB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024