RIBER: 2022 full-year earnings positive

Press release

2022 full-year earnings

positive

- Business impacted by difficulties sourcing

electronic components

- Income from ordinary operations stable at

€1.3m

- Positive net income of €0.2m

- 2023 objectives: revenues of around €40m and

improvement in profitability

- Proposed payout of €0.05 per share for FY

2022

- Christian Dupont appointed

as Chairman of the Executive

Board

Bezons, April 14, 2023

- 8:00am - RIBER, the global leader for molecular beam epitaxy

(MBE) equipment serving the semiconductor industry, is releasing

its full-year earnings for 2022.

|

(€M - at December 31) |

2022 |

2021 |

Change |

|

Revenues |

27.8 |

31.2 |

- €3.4m |

| MBE systems

revenues |

14.8 |

17.4 |

- €2.6m |

|

Services and accessories revenues |

13.0 |

13.8 |

- €0.8m |

|

Gross margin% of revenues |

9.835.2% |

11.135.4% |

- €1.3m |

|

Income from ordinary operations% of revenues |

1.34.7% |

1.34.1% |

- €0.0m |

|

Operating income% of revenues |

0.00.0% |

1.34.1% |

- €1.3m |

|

Pre-tax income from ordinary operations% of

revenues |

0.41.5% |

1.75.5% |

- €1.3m |

|

Net income% of revenues |

0.20.6% |

1.54.7% |

- €1.3m |

Key developments

During FY 2022, RIBER recorded a strong level of

commercial development, as shown by its high order intake,

including 14 systems and an option for an additional four systems.

Nevertheless, the supply chain disruption affecting electronic

components resulted in the deferral of the delivery of two research

systems to 2023, representing a total of €2.9m, despite the

Company’s efforts to diversify its sourcing capacity.In addition,

RIBER has stopped marketing a range of evaporators for the OLED

market.

Revenues

In this context, 2022 full-year revenues came to

€27.8m, down -11% from 2021. Sales of MBE systems contracted -15%

to €14.8m, for six machines delivered, compared with eight in 2021.

Sales of services and accessories are down -6% from a high basis

for comparison to €13.0m, representing 46.8% of 2022 revenues.

Earnings

The gross margin came to €9.8m, representing

35.2% of revenues, stable versus 2021(35.4%).

Operating expenditure is stable (€9.8m). R&D

investments totaled €3.2m, representing 12% of revenues, stable

compared with 2021. Sales and marketing costs are up (+18% in line

with the strong growth in order intake), while administrative costs

are stable overall.

Income from ordinary operations amounted to

€1.3m, comparable to 2021.

Operating income broke even, compared with a

€1.3m profit in 2021. It is impacted by non-current charges for

€1.3m, in particular due to the decision to discontinue the OLED

evaporator product line, which led to the depreciation of

inventories.

Net income totaled €0.2m, compared with €1.5m in

2021. In 2022, it included +€0.4m of financial income and expenses,

linked primarily to the revaluation in euros of receivables

denominated in US dollars and Yuan.

Cash flow and balance sheet

The cash position at end-2022 was positive at

€6.1m, up +€0.2m from the end of 2021. This change reflects the

good level of cash flow from operations and the improvement in

working capital requirements.

Net financial debt decreased to €1.3m at

December 31, 2022, compared with €2.4m one year earlier.

Shareholders’ equity totaled €18.8m, down -€1.0m

from end-2021. This change is linked to earnings for the year and

the distribution of amounts drawn against the issue premium for

2021 to shareholders.Order book

During FY 2022, new order intake improved

significantly, with 14 systems ordered over the period and a good

level of orders recorded for services and accessories.

This robust development helped significantly

strengthen the order book at December 31, 2022, up +102% to €29.9m

and including 11 MBE systems (€24.6m), as well as orders for

services and accessories (€5.3m).

This order book does not include the additional

order for a production system announced on February 20, 2023, or

the option to buy announced on June 8, 2022 covering four

production machines for which the firm orders will be confirmed in

2023 when the export license is obtained.

Outlook

In view of these elements, RIBER is confident

that it will be able to achieve revenues of around €40m, driven by

40% growth compared with 2022. This growth in business is expected

to be combined with a significant improvement in profitability.

In a still buoyant market context, with robust

demand for the Company’s systems, RIBER is expected to continue

taking orders in 2023, capitalizing on a strong pipeline of

prospects.

Distribution of amounts drawn against

the “issue premium” account

Illustrating its confidence in the Company’s

outlook, the Executive Board will submit a proposal to shareholders

at the General Meeting on June 20, 2023 to approve a cash payout

based on reimbursing part of the issue premium for €0.05 per share.

It will be released for payment on July 5, 2023.

Governance

During its meeting today, chaired by Ms Annie

Geoffroy, RIBER’s Supervisory Board appointed Mr Christian Dupont

as Chairman of the Company’s Executive Board from April 13, 2023,

replacing Mr Michel Picault, who is still a member of the Company’s

Executive Board.

This appointment will make it possible to ramp

up RIBER's robust growth and expansion in a buoyant market

environment.

Biography

Mr Christian Dupont, Chairman of RIBER’s

Executive Board

After graduating as an engineer from EPFL (École

Polytechnique Fédérale de Lausanne), Mr Christian Dupont, 59, began

his career in 1988 with Texas Instruments, where in 1992 he helped

create its Wireless business unit, which became the wireless

semiconductor market leader for 15 years. He was a Marketing

Manager before being appointed to head up the business unit

wireless USA in Dallas and Nice, where he was in charge of the

wireless business unit in Europe. From 2007 to 2010, he was CEO of

the startup Varioptic (electro-optics), which was sold to Parrot,

before serving until 2015 as CEO of PoLight in Norway (MEMS

Auto-Focus), which listed on Oslo’s stock market. From 2015 to

2021, he was Chairman and CEO of CEO-CF, the leading collaboration

platform for executives from high-growth European technology

companies. In 2018, as CEO, he helped restructure and

refinance Dolphin Integration (semiconductors), taken over by

Soitec and MBDA. From 2019, he was CEO of Digitsole (digital

health).

Next dates

- April 28, 2023 - 8:00am: 2023

first-quarter revenues and 2022 annual financial report

- June 20, 2023 - 10:00am: General

Meeting

The annual financial statements were approved by

the Executive Board and, on April 13, 2023, were also approved by

the Supervisory Board. The statutory auditors have completed the

audit procedures on the corporate and consolidated accounts. The

certification report will be issued once the necessary procedures

have been finalized for publishing the full-year financial

report.

About RIBER

RIBER is the global market leader for MBE -

molecular beam epitaxy - equipment. It designs and produces

equipment for the semiconductor industry, and provides scientific

and technical support for its clients (hardware and software),

maintaining their equipment and optimizing their performance and

output levels.

Accelerating the performance of electronics,

RIBER’s equipment performs an essential role in the development of

advanced semiconductor systems that are used in numerous

applications, from information technologies to photonics (lasers,

sensors, etc.), 5G telecommunications networks and research in the

field of quantum computing.

RIBER is a BPI France-approved innovative

company and is listed on the Euronext Growth Paris market

(ISIN: FR0000075954).

www.riber.com

Contacts

RIBER: Michel

Picault | tel: +33 (0)1 39 96 65 00 | invest@riber.com

CALYPTUS Cyril Combe | tel: +33

(0)1 53 65 68 68 | cyril.combe@calyptus.net

- CP_Riber_Résultats 2022_EN_Vdef

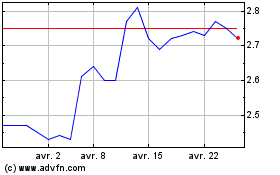

Riber (EU:ALRIB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Riber (EU:ALRIB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024