SBM Offshore Full Year 2024 Earnings

Amsterdam, February 20, 2025

Record-level results, increasing total shareholder

returns

Highlights

- Record

Directional1 Revenue of US$6.1 billion (+35%), in line

with guidance

- Record Directional

EBITDA of US$1.9 billion (+44%), in line with guidance

- Record US$35.1

billion Directional backlog; US$9.5 billion or

EUR51.6/share2 Directional net cash

backlog3

- 30% increase in

cash return to US$1.59 per share4: US$155 million

dividend5; US$150 million share

repurchase6

- US$1.7 billion

cash return to shareholders over the coming 6 years

- 2025 Directional

Revenue guidance of above US$4.9 billion

- 2025 Directional

EBITDA guidance of around US$1.55 billion

- Completion of FPSO

Prosperity and Liza Destiny sales in Q4 2024

- FPSO Almirante

Tamandaré achieved first oil on February 15, 2025

SBM Offshore’s 2024 Annual Report can be found

on its website under: Annual Reports - SBM Offshore

Øivind Tangen, CEO of SBM Offshore,

commented:

“SBM Offshore has delivered excellent results in 2024 with a

record-level directional revenue of US$6.1 billion and record-level

directional EBITDA of US$1.9 billion, reflecting three new awards

and the purchases of FPSOs Prosperity and Liza

Destiny by ExxonMobil Guyana. Thanks to the addition of three

new awards, we ended the year with a record US$35.1 billion

backlog. From this we expect to generate US$9.5 billion net cash,

equivalent to almost 52 euro per share2. Based on this

strong performance, we are increasing our fixed cash return by 30%

to US$1.59 per share4 through a proposed US$155 million

dividend5 and US$150 million share

repurchase6 program. At this level we will deliver a

minimum US$1.7 billion cash return to shareholders over the next 6

years.

Our Fast4Ward® program is setting the

pace for deepwater developments. FPSO Almirante Tamandaré

achieved first oil on February 15, 2025. This vessel, which

benefits from emission reduction technologies, is the largest

operating unit in Brazil. Two additional units are on track to

achieve first oil in 2025. First, FPSO Alexandre de Gusmão

which sailed-away at the end of 2024, followed by FPSO ONE

GUYANA. These three units have a combined capacity of 655,000

barrels of oil per day. With these achievements, we are further

de-risking our construction portfolio.

We strive for excellence both in terms of

project execution and asset management. Our lifecycle approach in

the FPSO market is unique and the focus on continuous improvement

is setting a strong foundation for success. The outlook for new

deepwater projects is strong given their low break-even prices and

low emission intensity. In the next three years, we see 16 projects

in the

Company’s core market of large and complex FPSOs, driven by the

promising prospects in Brazil, Guyana, Suriname and Namibia. We

have ordered our 10th MPF hull giving us two hulls to

support tendering activities. We will remain disciplined in

selecting the highest quality projects.

As the world’s ocean-infrastructure expert we

are using our experience to further diversify and decarbonize the

solutions we offer. In 2024, we created a joint venture, Ekwil,

with Technip Energies to enhance our floating offshore wind product

offering, and in early 2025 we completed a minority equity

investment in Ocean-Power to offer lower-emission power solutions.

We are now able to offer a market ready near-zero emission FPSO and

were recently awarded a contract by Petrobras to qualify SBM’s

Carbon Capture Module technology for FPSOs.”

Financial

Overview7

|

|

Directional |

|

IFRS |

|

|

|

|

|

|

|

|

|

|

in US$ million |

|

FY 2024 |

FY 2023 |

% Change |

|

FY 2024 |

FY 2023 |

% Change |

|

Revenue |

|

6,111 |

4,532 |

35% |

|

4,784 |

4,963 |

-4% |

|

Lease and Operate |

|

2,369 |

1,954 |

21% |

|

2,074 |

1,563 |

33% |

|

Turnkey |

|

3,743 |

2,578 |

45% |

|

2,710 |

3,400 |

-20% |

|

EBITDA |

|

1,896 |

1,319 |

44% |

|

1,041 |

1,239 |

-16% |

|

Lease and Operate |

|

1,261 |

1,124 |

12% |

|

842 |

695 |

21% |

|

Turnkey |

|

724 |

296 |

145% |

|

287 |

646 |

-56% |

|

Other |

|

(89) |

(101) |

-12% |

|

(88) |

(101) |

-13% |

| Profit

attributable to Shareholders |

|

907 |

524 |

73% |

|

150 |

491 |

-69% |

|

Earnings per share (US$ per share) |

|

5.08 |

2.92 |

74% |

|

0.84 |

2.74 |

-69% |

|

|

|

|

|

|

|

|

|

|

in US$ billion |

|

FY 2024 |

FY 2023 |

% Change |

|

FY 2024 |

FY 2023 |

% Change |

| Pro-forma

Backlog |

|

35.1 |

30.3 |

16% |

|

- |

- |

- |

| Net Debt |

|

5.7 |

6.7 |

-15% |

|

8.1 |

8.7 |

-7% |

Directional revenue increased by 35% to US$6,111

million compared with US$4,532 million in 2023. This increase is

driven by the Directional Turnkey revenue which rose to US$3,743

million in 2024 compared with US$2,578 million in 2023. This 45%

increase stems from (i) the sale of FPSOs Prosperity and

Liza Destiny completed respectively in November and

December 2024, (ii) the progress on awarded contracts for the FPSOs

Jaguar and GranMorgu, (iii) the 13.5% divestment

to CMFL completed in October 2024, and (iv) the increased support

to the fleet through brownfield projects. This increase was partly

offset by a reduction in charter revenues following (i) the sale of

FPSO Liza Unity in November 2023, (ii) the completion of

FPSO Prosperity during the last quarter of 2023 as well as

a delay in the start-up of FPSO Sepetiba early 2024, and

(iii) a comparatively lower level of progress on both FPSOs

Almirante Tamandaré and Alexandre de Gusmão as

those projects approached completion in 2024.

Directional Lease and Operate revenue stood at

US$2,369 million compared with US$1,954 million in the year-ago

period. This 21% increase mainly reflects (i) FPSO

Prosperity joining the fleet during the last quarter of

2023 and Sepetiba joining the fleet in January 2024, (ii)

a higher contribution of FPSOs N’Goma, Saxi

Batuque and Mondo following the acquisition of

interests held by Sonangol mid-2024, and (iii) an increase in

reimbursable scope. This was partly offset by FPSO Liza

Unity only contributing in 2024 as an operating contract

following the purchase of the unit by ExxonMobil Guyana at the end

of 2023.

Directional EBITDA amounted to US$1,896 million,

which is a 44% year-on-year increase compared with US$1,319 million

in 2023. This was mostly attributable to the Turnkey segment which

increased by over US$400 million to US$724 million in 2024.

Directional Turnkey EBITDA was mainly impacted by (i) the same

drivers as for Directional Turnkey revenue (except that being at

relative early stages of completion, FPSO Jaguar only

contributed marginally to Turnkey EBITDA and FPSO

GranMorgu not at all), and (ii) a reduced investment on

Floating Offshore Wind projects following the implementation of

Ekwil Joint Venture in partnership with Technip Energies.

Directional Lease and Operate EBITDA stood at

US$1,261 million for the year-ended 2024 compared with US$1,124

million in the previous year. The 12% increase reflects (i) the

same key factors as for Directional Lease and Operate revenue, (ii)

the net gain on the acquisition of interests held by Sonangol in 3

FPSOs and the divestment in the parent company of the Paenal

shipyard in Angola, and (iii) the dividends related to FPSO

N’Goma partially offset by (iv) additional non-recurring

maintenance costs for the fleet under operation.

The other non-allocated costs charged to EBITDA

amounted to US$(89) million in 2024, a US$(12) million improvement

compared with the previous period mainly due to the one-off impact

of US$11 million of restructuring costs in 2023.

During the last quarter of 2024, the Company

performed a review of revised estimates of cash flow, maintenance

and repair costs. Based on this analysis, actual values and future

cash flows related to FPSO Cidade de Anchieta were

re-estimated leading to an impairment charge of US$(39) million,

accounted for in the 2024 results.

Directional net profit increased by over 70%

standing at US$907 million in 2024, or US$5.08 per share, mainly

reflecting the increase in Directional EBITDA.

Liquidity, Funding and Directional Net

Debt

The Company’s financial position has remained

strong as a result of the cash flow generated by the fleet, as well

as the positive contribution of the Turnkey activities.

Directional Net debt decreased by US$(936)

million to US$5,719 million at year-end 2024. This was driven by

the repayment of the FPSOs Prosperity and Liza

Destiny financings, the proceeds from the sale of the vessels

and the Lease and Operate segment’s strong operating cash flow.

This was partially offset by drawings on project financing

facilities to fund the construction portfolio. The Company drew on

the project finance facilities for FPSO ONE GUYANA, FPSO

Almirante Tamandaré and FPSO Alexandre de Gusmão;

additionally, the US$1.5 billion construction financing for FPSO

Jaguar was signed and partly drawn in November 2024.

More than a third of the Company’s Directional

debt for the year-ended 2024 consisted of non-recourse project

financing (US$2.2 billion) in special purpose investees. The

remainder (US$4 billion) consisted mainly of borrowings to support

the ongoing construction of 3 FPSOs which will become non-recourse

following achievement of first oil. The project loan for FPSO

Jaguar will be repaid following completion of

construction. The Company’s RCF was drawn for US$500 million as at

December 31, 2024 and the Revolving Credit Facility for MPF hull

financing was drawn for US$89 million.

Directional cash and cash equivalents amounted

to US$606 million and lease liabilities totaled US$93 million at

December 31, 2024.

Cash and undrawn committed credit facilities

amount to US$2,639 million at December 31, 2024.

Directional Pro-Forma

Backlog

Change in ownership scenarios and lease contract

duration have the potential to significantly impact the Company's

future cash flows, net debt balance as well as the profit and loss

statement. The Company therefore provides a pro-forma Directional

backlog based on the best available information regarding ownership

scenarios and lease contract duration for the various projects.

The pro-forma Directional backlog at the end of

December 2024 increased by US$4.8 billion to a total of US$35.1

billion. This was mainly the result of (i) the FPSO Jaguar

contract awarded in April 2024, (ii) the FSO Trion contract awarded

in August 2024, and (iii) the FPSO GranMorgu contract

awarded in November 2024, partially offset by (iv) turnover for the

period which consumed approximately US$6.1 billion of backlog

(including the sale of FPSO Prosperity completed in

November 2024 and the sale of FPSO Liza Destiny completed

in December 2024, in advance of the initial lease terms which were

respectively in November 2025 and in December 2029), and (v) the

13.5% divestment to CMFL completed in October 2024, which was not

reflected in the pro-forma Directional backlog end of 2023. The

Company's backlog provides cash flow visibility up to 2050.

|

in US$ billion |

|

Turnkey |

Lease & Operate |

Total |

| 2025 |

|

2.6 |

2.3 |

4.9 |

| 2026 |

|

1.6 |

2.6 |

4.2 |

| 2027 |

|

3.3 |

2.1 |

5.4 |

|

Beyond 2028 |

|

0.2 |

20.3 |

20.5 |

|

Total pro-forma Directional backlog |

|

7.7 |

27.3 |

35.1 |

The pro-forma Directional backlog at the end of

2024 reflects the following key assumptions:

- The FPSO ONE GUYANA

contract covers a maximum lease period of 2 years, within which the

ownership of the FPSO will transfer to the client. The impact of

the subsequent sale is reflected in the Turnkey backlog.

- The FPSO Jaguar contract

awarded to the Company in April 2024 covers the construction period

within which the FPSO ownership will transfer to the client and is

reported in the Turnkey backlog.

- 10 years of operations and

maintenance are considered for FPSOs Liza Destiny,

Liza Unity, Prosperity and ONE GUYANA

following signature of the Operations & Maintenance Enabling

Agreement in 2023. Regarding FPSO Jaguar, the pro-forma

Directional backlog includes the operating and maintenance scope

for 10 years as it has been agreed in principle, pending a final

work order. This is consistent with prior years.

- The FPSO GranMorgu

contract awarded to the Company in November 2024 covers the

construction period within which the FPSO ownership will transfer

to the client and is reported in the Turnkey backlog.

- The FSO Trion contract awarded to

the Company in August 2024 is considered for 20 years in lease and

operate contracts at the Company ownership share at year-end

(100%).

- The transaction with MISC Berhad

related to the FPSO Espírito Santo and FPSO Kikeh

announced on September 6, 2024, and completed on January 31, 2025,

has been reflected in the pro-forma Directional backlog.

Project Review and Fleet Operational

Update

|

Project |

Client/Country |

Contract |

SBM Share |

Capacity, Size |

Percentage of Completion |

Project delivery |

|

FPSO Alexandre de

Gusmão |

Petrobras

Brazil |

22.5-year L&O |

55% |

180,000 bpd |

>75% |

2025 |

|

FPSO ONE GUYANA |

ExxonMobil

Guyana |

2-year BOT |

100% |

250,000 bpd |

>75% |

2025 |

|

FPSO Jaguar |

ExxonMobil

Guyana |

Sale & Operate |

100% |

250,000 bpd |

>25% <50% |

2027 |

| FSO

Trion |

Woodside |

20-year Lease |

100% |

n/a |

<25% |

n/a8 |

|

FPSO GranMorgu |

TotalEnergies |

Sale & Operate |

52% |

220,000 bpd |

<25% |

2028 |

Projects are on track with one major delivery

achieved in early 2025. After successful completion of the offshore

commissioning activities, FPSO Almirante Tamandaré

achieved first oil on February 15, 2025. An update on the

individual ongoing projects is provided below considering the

latest known circumstances.

FPSO Alexandre de Gusmão – In December

2024, the vessel safely departed from the yard in China after

successful completion of the onshore topsides’ integration and

commissioning phase. The FPSO is on its way to Brazil. First oil is

expected mid-2025.

FPSO ONE GUYANA – Integration

activities are completed and project teams are finalizing

commissioning activities. First oil is expected in the second half

of 2025.

FPSO Jaguar – The

Fast4Ward® MPF hull has been

safely delivered and arrived in Singapore in preparation for the

remaining vessel activities. The topside modules fabrication in

Singapore continues as planned. First oil is expected in 2027.

FSO Trion – Engineering and procurement

are progressing in line with project schedule.

FPSO GranMorgu – The

Fast4Ward® MPF hull has been

safely delivered. Engineering and procurement are progressing in

line with project schedule.

Fast4Ward® MPF

hulls – Under the Company’s successful

Fast4Ward® program, the

10th MPF hull has been ordered. 4

Fast4Ward® MPF hulls are in

operation, another 4 allocated to projects and 2 reserved as part

of tendering activities driven by the strong FPSO market

outlook.

Contract extension – The Company has

agreed a contract extension related to the lease and operation of

FPSO Saxi Batuque up to June 2026.

Fleet Uptime – The fleet’s uptime was

95.9% in 2024.

Safety and Sustainability

Safety – The Total Recordable Injury

Frequency Rate (“TRIFR”) year-to-date was 0.10, 17% below the

yearly target of below 0.129, notwithstanding the high

level of activity.

Fleet emissions – For 2024, the Company

set a target to further optimize operational excellence on the

FPSOs for which it provides operations and maintenance services

amounting to a maximum absolute volume of gas flared below 1.57

mmscft/d as an overall FPSO fleet average during the year. As of

December 31, 2024, SBM Offshore outperformed this target with the

actual being 1.33 mmscft/d, a 15% improvement compared with 2024

target and mainly driven by a continued focus on reducing the

number of unplanned events in its operated fleet.

Sustain-2 Notation – FPSO Liza

Unity is the 1st FPSO which has

received a Sustain-2 Notation by American Bureau of Shipping. This

sustainability certificate recognizes the Company’s efforts in

minimizing environmental impacts over the lifecycle of the FPSO

including the use of low carbon technologies as well as the focus

on workers’ wellbeing.

ESG ratings – In recognition of the

Company’s continued focus on sustainability, MSCI has improved SBM

Offshore’s rating from AA in 2023 to AAA in 2024 and Sustainalytics

included the Company in its 2024 ESG Industry Top Rated, with the

Company ranking 2nd out of 106 industry

peers.

Sustainable recycling – The Deep Panuke

Production Field Center recycling project reached completion in

Nova Scotia, Canada, in early 2024 with 97% of the waste materials

were sold, recycled or reused and the remainder 3% was safely

disposed of. As for the FPSO Capixaba project, following

the handover to M.A.R.S., the Company continues to monitor the safe

execution of the decommissioning which is expected to reach

completion in 2026.

Blue Economy

SBM Offshore is a blue economy company aiming to

manage ocean resources for economic growth while preserving

ecosystems. Using its deepwater expertise, the Company is advancing

technologies focusing on decarbonizing and diversifying its ocean

infrastructure solutions. Ranging from floating offshore wind to

offshore hydrogen and ammonia, SBM Offshore remains selective and

disciplined in developing innovative solutions and investing in new

ocean infrastructure solutions.

Provence Grand Large – The three

floating offshore wind turbines that were installed by SBM Offshore

at the end of 2023 for the Provence Grand Large project, jointly

owned by EDF Renewables and Maple Power, were fully commissioned

and started production in 2024.

Floventis Energy Ltd – In December

2024, SBM Offshore reached an agreement with Cierco Energy to sell

its shares in the joint venture company Floventis Energy Ltd, thus

transferring the ownership of both Cademo and Llŷr Floating Wind

projects to Cierco Energy. As planned, following the advancement of

these pioneering projects and acquiring valuable knowledge in the

offshore wind market, the Company will continue to concentrate its

efforts on the remaining two larger scale projects in its

portfolio.

emissionZERO®

program – SBM Offshore continues to address FPSO emissions

reduction through its emissionZERO®

program and is offering a market-ready near zero emission FPSO for

2025, featuring advanced technologies such as carbon capture,

combined cycle gas turbines and deepwater intake risers.

Carbon Capture Module – SBM Offshore

has been awarded a contract by Petrobras to qualify SBM’s Carbon

Capture Module technology for FPSOs. The Carbon Capture Module for

post combustion removal of CO2 from gas

turbine exhaust gasses on FPSO’s has been developed in partnership

with Mitsubishi Heavy Industries, Ltd.

Blue Power Hub – With the aim to

decarbonize the offshore power generation sector, SBM Offshore

signed in December 2024 an investment agreement with the Norwegian

company Ocean-Power AS to develop and commercialize offshore power

generation units with CO2 capture and

storage. This investment has been completed in early 2025.

Capital allocation and Shareholder

Returns

The Company’s shareholder returns policy is to

maintain a stable annual cash return to shareholders which grows

over time, with flexibility for the Company to make such cash

return in the form of a cash dividend and the repurchase of shares.

Determination of the annual cash return is based on the Company’s

assessment of its underlying cash flow position. The Company

prioritizes a stable cash distribution to shareholders and funding

of growth projects, with the option to apply surplus capital

towards incremental cash returns to shareholders.

As a result, following review of its cash flow

position and forecast, the Company intends to pay US$1.59 per share

through a proposed US$155m dividend5 (EUR150 million

equivalent or US$0.88 per share4) and US$150 million

(EUR141 million equivalent) share repurchase program6.

This represents an increase of 30% compared with 2024. The

objective of the share buyback program would be to reduce share

capital and provide shares for regular management and employee

share programs (maximum US$25 million). Shares repurchased as part

of the cash return will be cancelled.

The share repurchase program will be launched

after the current share repurchase program has ended. The dividend

will be proposed at the Annual General Meeting on April 9,

2025.

Guidance

The Company’s 2025 Directional revenue guidance

is above US$4.9 billion of which above US$2.2 billion is expected

from the Lease and Operate segment and around US$2.7 billion from

the Turnkey segment.

2025 Directional EBITDA guidance is around

US$1.55 billion for the Company.

Conference Call

SBM Offshore has scheduled a conference call

together with a webcast, which will be followed by a Q&A

session, to discuss the Full Year 2024 Earnings release.

The event is scheduled for Thursday February 20,

2025, at 10.00 AM (CET) and will be hosted by Øivind Tangen (CEO)

and Douglas Wood (CFO).

Interested parties are invited to register prior

the call using the link: Full Year 2024 Earnings Conference

Call

Please note that the conference call can

only be accessed with a personal identification code, which is sent

to you by email after completion of the registration.

The live webcast will be available

at: Full Year 2024 Earnings

Webcast

A replay of the webcast, which is

available shortly after the call, can be accessed using the same

link.

Corporate Profile

SBM Offshore is the world’s deepwater

ocean-infrastructure expert. Through the design, construction,

installation, and operation of offshore floating facilities, we

play a pivotal role in a just transition. By advancing our core, we

deliver cleaner, more efficient energy production. By pioneering

more, we unlock new markets within the blue economy.

More than 7,800 SBMers collaborate worldwide to

deliver innovative solutions as a responsible partner towards a

sustainable future, balancing ocean protection with progress.

For further information, please visit our

website at www.sbmoffshore.com.

|

Financial Calendar |

|

Date |

Year |

| Annual General

Meeting |

|

April 9 |

2025 |

| First Quarter

2025 Trading Update |

|

May 15 |

2025 |

| Half Year 2025

Earnings |

|

August 7 |

2025 |

| Third Quarter

2025 Trading Update |

|

November 13 |

2025 |

| Full Year 2025

Earnings |

|

February 26 |

2026 |

For further information, please contact:

Investor Relations

Wouter Holties

Corporate Finance & Investor Relations Manager

|

Phone: |

+31 (0)20 236 32 36 |

|

E-mail: |

wouter.holties@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Media Relations

Giampaolo Arghittu

Head of External Relations

|

Phone: |

+31 (0)6 212 62 333 / +39 33 494 79 584 |

|

E-mail: |

giampaolo.arghittu@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Market Abuse Regulation

This press release may contain inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

Disclaimer

Some of the statements contained in this release

that are not historical facts are statements of future expectations

and other forward-looking statements based on management’s current

views and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance, or

events to differ materially from those in such statements. These

statements may be identified by words such as ‘expect’, ‘should’,

‘could’, ‘shall’ and / or similar expressions. Such forward-looking

statements are subject to various risks and uncertainties. The

principal risks which could affect the future operations of SBM

Offshore N.V. are described in the ‘Impacts, Risks and

Opportunities’ section of the 2024 Annual Report.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results and performance of the Company’s business

may vary materially and adversely from the forward-looking

statements described in this release. SBM Offshore does not intend

and does not assume any obligation to update any industry

information or forward-looking statements set forth in this release

to reflect new information, subsequent events or otherwise.

This release contains certain alternative

performance measures (APMs) as defined by the ESMA guidelines which

are not defined under IFRS. Further information on these APMs is

included in the 2024 Annual Report, available on our website Annual

Reports - SBM Offshore.

Nothing in this release shall be deemed an offer

to sell, or a solicitation of an offer to buy, any securities. The

companies in which SBM Offshore N.V. directly and indirectly owns

investments are separate legal entities. In this release “SBM

Offshore” and “SBM” are sometimes used for convenience where

references are made to SBM Offshore N.V. and its subsidiaries in

general. These expressions are also used where no useful purpose is

served by identifying the particular company or companies.

"SBM Offshore®", the SBM logomark,

“Fast4Ward®”, “emissionZERO®” and

“F4W®” are proprietary marks owned by SBM Offshore.

1 Directional reporting, presented in

the Financial Statements under section 4.3.2 Operating Segments and

Directional Reporting, represents a pro-forma accounting policy,

which treats all lease contracts as operating leases and

consolidates all co-owned investees related to lease contracts on a

proportional basis based on percentage of ownership. This

explanatory note relates to all Directional reporting in this

document.

2 Based on the number of shares outstanding and exchange

rate EUR/US$ of 1.039 at December 31, 2024.

3 Reflects a pro-forma view of the

Company’s Directional backlog and expected net cash from Turnkey,

Lease and Operate and Build Operate Transfer sales after tax and

debt service.

4 Based on the number of shares outstanding at December

31, 2024. Dividend amount per share depends on number of shares

entitled to dividend.

5 Equivalent of EUR150 million based on the EUR/US$

exchange rate on February 11, 2025. Dividends will be paid in Euro

provided that the minimum Euro dividend shall amount to EUR150

million.

6 Including maximum US$25 million for management and

employee share plans.

7 Numbers may not add up due to

rounding.

8 Project delivery not disclosed by the client.

9 Measured per 200,000 work

hours.

- SBM Offshore Full Year 2024 Earnings

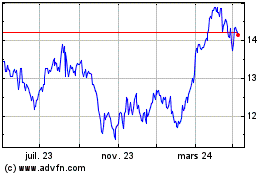

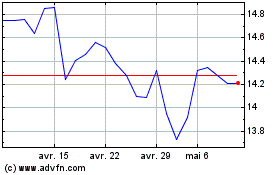

SBM Offshore NV (EU:SBMO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

SBM Offshore NV (EU:SBMO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025