Confirmed strong business in main regions

Significant increase in operating profitability Doubling in net

income Reinforced financial robustness

Roadmap through to 2025 Organic growth:

contributed revenue close to €1,000m Profitability: EBITDA between

24% and 25% of revenue Flexibility: leverage < 3x EBITDA

mid-cycle if acquisitions

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220307005582/en/

APPENDIX 5 - NEW BREAKDOWN OF BUSINESS

ACTIVITIES

FORMER PRESENTATION (Photo: Séché Environnement)

Séché Environnement (Paris:SCHP):

Main objectives met or exceeded one year ahead of

schedule

Commercial performance:

Contributed revenue: €736m, +15%

Operational performance:

EBITDA: €170m or 23.1% of revenue, +24% COI: €71m or 9.7%

of revenue, +50%

Profit performance:

Net Income €28m or 3.9% of revenue, +106%

Financial performance:

Free operational cash flow: €77m, +25% Financial leverage

ratio: 2.7x, -0.4x

Dividend proposed: €1.00 per share (vs. €0.95 for

the year 2020)

Outlook for 2022

Growth in contributed revenue:

- Scope effect stemming from the integration of Séché

Assainissement on January 1, 2022 and 12-month contribution from

Spill Tech

- Organic growth based on H2 2021 trends, with market effects

remaining positive in France and a continued improvement

internationally

EBITDA margin (EBITDA / contributed revenue) confirmed

for at least the level reached in 2021

CAPEX: similar to 2021 given development investments

Financial leverage ratio stable at 2.7x EBITDA ex.

acquisitions

At the Board of Directors meeting held on March 4, 2022 to

approve the financial statements drawn up on December 31, 2021, the

Chairman, Joël Séché, stated:

“Séché Environnement’s excellent commercial, operational,

financial and non-financial performances in fiscal 2021 once again

demonstrate the quality of its positioning and the relevance of its

growth strategy in the circular economy and decarbonized economy

sectors.

These performances were generated by its internal and external

growth strategy, policy on industrial efficiency and cost

reduction, controlled investments and financial agility.

They are also a result of the constant commitment of the women

and men that make up this Company. I would like to thank each of

them on behalf of our Board.

Séché Environnement moved ahead with its external growth

transactions in 2021. It did so internationally, with the

acquisition of Spill Tech, a South African environmental emergency

specialist, and in France, with the acquisition of Osis-IDF

centers, a major player in sanitation, which in early 2022 has

enriched the range of our environmental services businesses under

the name Séché Assainissement.

Séché Environnement is benefiting from the lasting effects of

its profitable growth strategy and in 2021 posted strong increase

across all its business activities in its main scopes and an even

stronger increase in operational margins.

Net income was twice as high as in 2020.

Our Group continued to improve its cash flow and financial

flexibility through sold cash management. It also shored up its

balance sheet by substantially lengthening the maturity of its

financial debt for an improved cost, thanks to the successful issue

of its first environmental impact bond.

A year ahead of schedule, it has met or even exceeded most of

the objectives set in 2019 for 2022.

These performances are sustainable.

Working in sustainably buoyant and opportunity-rich markets and

harnessing financial flexibility and strong cash flow, our Group is

confident about its short- and long-term outlook.

For 2025, it is targeting contributed revenue, at constant

scope, of nearly €1bn, while continuing to improve its operational

margins and maintaining strict objectives on cash-flow generation

and financial flexibility.

Also for 2025, fully in line with the Paris Agreement on the

climate and consistent with its ambitious Climate for 2030

strategy, Séché Environnement will reduce its greenhouse gas

emissions by 10% and increased by 40% the avoided greenhouse gas

emissions by its clients; illustrating its commitment to the fight

against climate change and in favor of a circular and decarbonized

economy.”

Selected financial data

Consolidated data in €m

As of December

2019 restated*

2020 restated*

2021

Gross change

Contributed Revenue

687.8

641.7

735.8

+14.7%

EBITDA

135.4

137.0

170.3

+24.3%

% of contributed revenue

19.7%

21.3%

23.1%

Current Operating Income

47.8

47.5

71.5

+50.5%

% of contributed revenue

6.9%

7.4%

9.7%

Net financial Income

(17.5)

(20.4)

(24.1)

+18.1%

Income tax

(10.4)

(8.4)

(14.1)

+67.9%

Share of Income of Associates

ns

(1.5)

(0.9)

Share of non-controlling interests

(1.0)

(0.1)

(1.2)

Group net income

17.8

13.8

28.4

+105.8%

% du CA

2,6%

2,2%

3,9%

Earnings per share

2.27

1.77

3.64

+105.7%

Dividend per share (€ per

share)

0.95

0.95

1.00

+5.3%

Recurrent operating cashflow1

113.2

110.9

139.9

+26.1%

Net Capex paid

69.0

64.2

87.4

+36.1%

Free operating cashflow2

48.7

61.6

77.4

+25.6%

Cash and cash equivalents

92.3

105.3

172.2

+63.5%

Net financial debt (IFRS)

456.2

450.3

474.9

+5.5%

Financial leverage ratio

3.1x

3.1x

2.7x

-0.4x

* Contributed revenue has been calculated ex. TGAP since 2021.

Contributed revenue in 2019 and 2020 was recalculated to enable the

comparison of data.

Summary of activity, income, and financial situation at

December 31, 2021

In fiscal 2021, Séché Environnement pursued its profitable

growth momentum in buoyant markets while maintaining an

opportunistic external growth strategy both internationally and in

France.

In France, the Group benefited from strong volumes and positive

price trends on industrial and local-authority markets, bolstering

its business activities relating to the circular economy and hazard

management. The Services businesses also returned to strong growth

compared with the previous year.

This solid commercial momentum was driven by the implementation

of an industrial efficiency policy that promotes the full

availability of recovery and treatment tools and, with the effects

of the savings plan, improves the organization's performance. Séché

acquired Osis-IDF’s centers, a sanitation company in Ile-de-France,

integrating it in the consolidation scope on January 1, 2022 under

the name Séché Assainissement.

The International business confirmed its return to growth in the

main regions in which the Group operates, particularly in Europe

(Mecomer) and South Africa (Interwaste). In South Africa, Séché

Environnement acquired Spill Tech, a leading operator in the

environmental emergency sector, thus supplementing its network in

this promising region.

The Group posted a significant increase in operating margins,

and net income attributable to company shareholders more than

doubled in relation to 2020.

Over the period, the Group controlled its net debt while

maintaining an active growth investment policy, particularly in

international markets.

The Group seized opportunities having emerged at the end of the

year on debt markets to refinance its senior banking debt through

2023 as well as a number of bonds with the same maturity through a

seven-year bond issue featuring ESG impact criteria and with a

substantially reduced rate.

Underpinned by solid cash generation and improved financial

flexibility, and with a considerably strengthened liquidity

position and extended debt maturity, Séché Environnement is

confirming its ability to actively pursue its development strategy

in France and internationally.

Solid organic growth in main scopes

At December 31, 2021, Séché Environnement posted contributed

revenue3 of €735.8m, up 14.7% compared with December 31, 2020. The

figure includes a €34.0m contribution from Spill Tech, consolidated

on March 1, 2021.

At constant scope, contributed revenue stood at €701.8m, up 9.4%

compared with December 31, 2020 (€641.7m) and 9.3% at constant

exchange rates. The figure also compares favorably with contributed

revenue at December 31, 2019 (€687.8m).

In 2021, Séché Environnement confirmed strong business growth in

France and returned to growth in its main international scopes:

- In France (72% of contributed revenue), business activity rose

substantially, by 9.3% to €531.7m. The Group benefited from high

volumes and good price trends in its circular economy and hazard

management businesses, while the Services activities confirmed

their return to dynamic growth after a 2020 year hampered by the

impacts of the health crisis;

- Internationally (28% of contributed revenue), revenue came out

at €204.1m, up 31.6% as reported, including a 10-month contribution

of Spill Tech amounting to €34.0m. At constant scope and exchange

rates, growth in this scope was +8.8%. Europe (Mecomer), South

Africa (Interwaste) and the rest of the World (Solarca) confirmed

dynamic growth, while Latin America reached a level after the

deterioration in 2020.

Operating income improved considerably relative to 2020 and 2019

alike:

- EBITDA was €170.3m, or 23.1% of contributed revenue. It

increased 24.3% compared with 2020 and 25.8% compared with 2019. It

includes a scope effect related to the integration of Spill Tech on

March 1, 2021, for €10.2m or 30.0% of the subsidiary’s revenue. At

constant scope, EBITDA increased 16.9% versus June 30, 2020. It

came to 22.8% of contributed revenue (versus 21.3% in 2020 and

19.7% in 2019).

- In France, the Group benefited from the strong availability of

its facilities, strengthened by the effects of its industrial

efficiency policy, which enabled it to process increased volumes

and take advantage of favorable price effects and mix effects.

- Internationally, the Group benefited from an improved trend in

its businesses relative to last year, along with a particularly low

cost base in regions where business remained less brisk, such as

Latin America.

- Current operating income (COI) amounted to €71.5m, or 9.7% of

contributed revenue. COI increased 50.5% compared with 2020. It

includes Spill Tech's contribution of €8.6m (25.3% of the

subsidiary’s revenue). At constant scope, COI rose strongly

compared with 2020, by 32.4%, and compared with 2019 (+31.6%).

Current operating profitability was 9.0% of contributed revenue

(7.3% in 2020 and 6.9% in 2019). This major improvement mainly

reflects the favorable trend in gross operating profitability in a

context of controlled depreciation expenses in line with the

selective investment policy;

- Operating income came out at €68.7m, or 9.3% of contributed

revenue, for a 55.2% increase compared with 2020. At constant

scope, operating income totaled €60.1m, up 36.0% relative to 2020

and 28.7% to 2019. The trend in 2021 was driven mainly by the

increase in COI.

Financial income stood at -€24.1m, compared with -€20.4m a year

earlier.

The trend reflects the slight decrease in the cost of gross debt

(2.76% vs. 2.79% in 2020) and the increased weight of the balance

of financial income and expenses, notably owing to early repayments

of various borrowings, including senior banking debt and Euro PP

bonds for €4.4m.

After recognition of income tax for -€14.1m compared with -€8.4m

in 2020, the share of income of associates at -€0.9m versus -€1.5m

and results from minority interests at -€1.2m versus -€0.1m, net

income attributable to company shareholders came out at €28.4m, or

3.9% of contributed revenue, compared with €13.8m in 2020 (2.2% of

contributed revenue) and €17.8m in 2019 (2.6%).

Industrial investments (ex. IFRIC 12) reached €92.4m, or 12.6%

of contributed revenue (vs. €63.0m or 9.4% in 2020). With

maintenance investments having held steady over the period, the

increase reflects the recovery in development investments suspended

in the previous year owing to the pandemic, particularly outside

France.

Free operating cash flow stood at €77.4m (versus €61.6m in

2020), for an increase of 22.7%. EBITDA cash conversion ratio stood

at 45% well above the target of 35% set by the Group4.

Cash and cash equivalents totaled €172.2m (vs. €105.3m a year

earlier) and served to further boost the already solid liquidity

position5, from €275.3m at end-2020 to €342.2m at end-2021.

Net financial debt (IFRS) was under control at €479.9m (versus

€450.3m at December 31, 2020) and the financial leverage ratio was

down substantially to 2.7x EBITDA (vs. 3.3x a year earlier),

illustrating a vast improvement in the Group's financial

flexibility.

The dividend was €1.00 per share based on income per share of

€3.64 (vs. €1.77 in 2020).

Recent events and outlook

Integration of Séché Assainissement (formerly Osis-IDF

centers)

The eight Osis-IDF centers, the acquisition of which was

announced in the third quarter of 20216 and which are now

wholly-owned by Séché Environnement, were included in the

consolidation scope from January 1, 2022, under the name Séché

Assainissement.

The scope of the acquired activities generated revenue of

approximately €27m in 2021, for EBITDA of around €4m and EBIT of a

similar amount.

Roadmap through to 2025

Drawing on its sustained growth momentum at the heart of the

growing markets of the circular economy and the fight against

climate change, Séché Environnement is benefiting from the lasting

effects of its industrial efficiency policy.

The Group is confident in its commercial, operational and

financial outlook in the short and medium term.

Outlook for 2022

Séché Environnement is basing its assumptions on a return to

normal in the health situation in France and the regions in which

the Group operates. The outlook does not take into account any

adverse macroeconomic consequences resulting from current

geopolitical tensions.

In 2022, the Group will benefit from the consolidation of Séché

Assainissement from January 1, 2022 and the contribution of Spill

Tech over the full year (12 months instead of 10 in 2021).

After delivering a strong performance in 2021 partly due the

favorable comparison basis of H1 2021, Séché Environnement expects

to continue its organic growth on trends comparable to H2 2021:

- In France, in its industrial and local-authority markets alike,

the Group should benefit from the momentum of its activities

relating to the circular economy and decarbonization. These markets

are boosted by the implementation of favorable regulations and the

strong level of industrial production, which is contributing to

positive trends in volumes and prices.

- Internationally, Séché Environnement is expected to continue to

grow in buoyant markets. In Italy, Mecomer should benefit from the

gradual start-up of its new capacity, while Interwaste and Spill

Tech in South Africa should maintain a solid growth rate. Solarca

has a very large order book (around €20m), bolstering the positive

outlook for this subsidiary in 2022. Latin American business is

expected to trend more positively.

From an operational standpoint, Séché Environnement will

continue its industrial efficiency policy, based on heightened

selectivity in its investments, improving the use conditions of its

facilities and optimizing its logistics structure. In addition, it

will maintain its productivity efforts through its cost-cutting

plan.

Gross and current operating margin should therefore at least

remain at the levels seen in 2021 (excluding acquisitions).

Industrial investments are expected to remain robust, close to

2021 levels, due to planned international development investments,

particularly in South Africa.

The financial leverage ratio is expected to remain at the level

recorded in 2021.

Roadmap to 2025

For 2025, Séché Environnement aims to achieve contributed

revenue of close to €1bn (at constant 2022 scope) with a gross

operating margin7 of between 24% and 25% (excluding

acquisitions).

After making sustained development investments in 2022, the

Group expects to return to its standard capex of around 10% of

contributed revenue between 2023 and 2025.

The Group is maintaining its target of free operating cash flow

generation of more than 35% of EBITDA, which will allow significant

cash generation and a further improvement in its financial

flexibility between 2023 and 2025 (excluding acquisitions). In the

event of acquisitions, Séché Environnement reaffirms its ability to

maintain its standard mid-cycle financial leverage ratio below 3x

EBITDA.

In terms of its non-financial performance and under its 2030

climate strategy, which is aligned with the objectives of the 2017

Paris Agreement, the Group will reduce its own greenhouse gas

emissions by 10% by 2025 and increase the greenhouse gases avoided

by its clients by 40% thanks to its recycling activities and

low-carbon energy production.

Results Presentation Webcast March 8, 2022 at 8:30 am

Connection to the home page of Séché Environnement's website In

French: https://www.groupe-seche.com/fr In English:

https://www.groupe-seche.com/en

Upcoming Events

Q1 2022 Revenue: April 26, 2022 after market

Annual General Meeting of Shareholders: April 29, 2022

About Séché Environnement

Séché Environnement is the leader in the treatment and recovery

of all types of waste including the most complex and hazardous

waste, and decontamination, protecting the environment and health.

Séché Environnement is a family-owned French industrial group that

has supported industrial and regional ecology for over 35 years

with innovative technology developed by its R&D team. It

delivers its unique expertise on the ground in local regions, with

more than 100 sites around the world, including around 40

industrial sites in France. With 4,600 employees, of which 2,000 in

France, Séché Environnement has revenue of about €750 million, of

which 28% is earned internationally, driven on the medium term by

internal and external growth momentum via its many acquisitions.

Thanks to its expertise in creating circular economy loops, the

treatment of pollutants and greenhouse gases, and hazard

containment, the Group directly contributes to the protection of

the living world and biodiversity – an area it has actively

supported since its creation.

Séché Environnement has been listed on Eurolist by Euronext

(Compartment B) since November 27, 1997. It is eligible for equity

savings funds dedicated to investing in SMEs and is included in the

CAC Mid&Small, EnterNext Tech 40 and EnterNext PEA-PME 150

indexes. ISIN: FR 0000039139 – Bloomberg: SCHP.FP – Reuters:

CCHE.PA

FINANCIAL NFORMATIONS FINANCIERES AT

DECEMBER 31, 2021

(Extracts from the Report of the

Board)

Comments on activity and results at December 31, 2021

At December 31, 2021, Séché Environnement reported consolidated

revenue of €790.1m, compared with €673.1m a year earlier.

Reported consolidated revenue includes non-contributed revenue

of €54.3m (versus €31.4 million at December 31, 2020) broken down

as follows:

As at December 31

2020

2021

IFRIC 12 investments

0.6

8.7

TGAP8

30.8

45.6

Non contributed Revenue

31.4

54.3

Reported data in €m

Net of non-contributed revenue, contributed revenue totaled

€735.8m at December 31, 2021, amounting to a 14.7% increase

relative to December 31, 2020 (€641.7m). It includes the

contribution of Spill Tech, consolidated as of March 1, 2021, for

€34.0m.

At constant scope, contributed revenue amounted to €701.8m, up

sharply by 9.4% on December 31, 2020, as reported, and +9.2% at

constant exchange rates.

Breakdown by geographical scope

As at December 31

2020

2021

Gross change

In €m

%

In €m

%

%

Subsidiaries in France

486.6

75.8%

531.7

72.3%

+9.3%

o/w scope effect

-

-

-

-

International subsidiaries

155.1

24.2%

204.1

27.7%

+31.6%

o/w scope effect

13.6

-

34.0

-

Total contributed revenue

641.7

100.0%

735.8

100.0%

+14.7%

Consolidated data at current exchange

rates. At constant exchange rates, contributed revenue at December

31, 2020 was €642.9m, illustrating a positive foreign exchange

effect of €1.2m.

The first half of 2021 confirmed a high level of activity in

France and abroad in the main geographical regions:

- In France, contributed revenue rose a considerable 9.3% to

€531.7m, versus €486.6m at December 31, 2020. Séché Environnement

benefited from industrial markets supported by the high level of

industrial production and local authorities contracts driven by the

implementation of regulations related to the circular economy.

These bullish markets and strong sales momentum enabled the Group

to report favorable volume and price effects, while Services

activities also performed well (Large Account services,

Environmental Services). Activities related to the circular economy

and hazard containment drove growth. Revenue earned in France

accounted for 72.3% of contributed revenue at Friday, December 31,

2021 (versus 75.8% one year earlier);

- Internationally, revenue totaled €204.1m versus €155.1 million

at December 31, 2020, for a 31.6% increase as reported.

International revenue includes a scope effect of €34.0m, resulting

from the contribution of Spill Tech, integrated on March 1, 2021.

It also recorded foreign exchange gains of +€1.2m, mainly due to an

appreciation of the South African rand against the euro. At

constant scope and exchange rates, international revenue growth was

+8.8% over the period, illustrating the return to growth in most

geographical regions:

- Europe (revenue: €70.4m, up 7.5%) recorded a significant upturn

in Mecomer’s activities (hazardous waste treatment in Italy) and a

good performance by Valls Quimica (chemicals recovery in Spain) and

UTM (industrial gas recovery in Germany);

- South Africa (revenue: €67.2m, up 14.5% at current exchange

rates and +9.3% at constant exchange rates): Interwaste confirmed

its return to normative activity levels in markets driven by the

needs of major industrial clients in terms of environmental

solutions at the highest international standards;

- Latin America (revenue: €14.3m, -9.3% at current exchange rates

and -1.6% at constant exchange rates) stabilized in 2021 and showed

some signs of recovery at the end of the year;

- Solarca in the Rest of the World (revenue: €18.2m, up 20.8%)

recorded stronger levels of activity, but the subsidiary is still

being affected by restrictions on international travel in some

parts of the world.

Revenue earned by international subsidiaries accounted for 27.7%

of contributed revenue at December 31, 2021 (versus 24.2% one year

earlier).

Breakdown by activity

As at December 31

2020

2021

Gross change

In €m

%

In €m

%

Services

248.8

38.8%

301.4

41.0%

+21.1%

o/w scope effect

0.1

-

34.0

-

-

Circular economy, decarbonization

218.9

34.1%

243.1

33.0%

+11.1%

o/w scope effect

13.4

-

-

-

-

Hazard management

174.0

27.1%

191.3

26.0%

+10.0%

o/w scope effect

0.1

-

-

-

-

Total contributed revenue

641.7

100.0%

735.8

100.0%

+14.7%

Consolidated data at current exchange

rates.

All activities contributed in a balanced manner to growth, with

services also benefiting from the contribution of the newly

consolidated Spill Tech.

Service activities recorded contributed revenue of €301.4m at

December 31, 2021 (versus €248.8m one year earlier, i.e. an

increase of +21.1% in reported data). This strong increase includes

Spill Tech's contribution of €34.0m.

At constant scope and exchange rates, Services business rose a

considerable 6.4% year on year. They benefited from:

- In France (revenue: €174.0m, up 3.8%), the contribution of Key

Accounts Services, and notably "all-inclusive offers" that meet the

growing needs of clients in terms of outsourcing their sustainable

development issues, and the good performance of Environmental

Services (decontamination, emergency interventions);

- Internationally (revenue: €93.4m, +14.9%), renewed growth for

Solarca and the strong performance of Interwaste in South

Africa.

Service activities accounted for 41.0% of contributed revenue at

December 31, 2021 (versus 38.8% one year earlier).

Circular economy and decarbonization activities generated

revenue of €243.1m at December 31, 2021 (vs. €218.9m a year

earlier), a significant increase of +11.1% in reported data and of

+11.2% at constant exchange rates. This increase reflects:

- In France (revenue: €176.3m, up 13.2%), the good trend in

material recovery and recycling businesses driven by the

implementation of regulations related to the circular economy, and

energy recovery activities supported, among other aspects, by the

ramp up of the Osiris contract.

- Internationally (revenue: €66.8m, up 5.8% as reported and +6.2%

at constant exchange rates), strong trends in the solvent

regeneration business in Spain (Valls Quimica)

Activities related to the circular economy and decarbonization

accounted for 33.0% of contributed revenue at December 31, 2021

(vs. 34.1% one year earlier).

Hazard management activities generated revenue of €191.3m, up

+10.0% year on year in reported data and +10.6% at constant

exchange rates:

- In France, hazard management activities increased

significantly, +11.1% to €181.4m. They benefited from positive

volume and price effects in line with strong trends in HW

activities; with revenue of €9.9m, these activities posted a

decline of -7.2% compared with 2020 as reported, but an increase of

+2.6% at constant exchange rates.

- Internationally, with revenue of €9.9m, these activities posted

a decline of -7.2% compared with 2020 as reported, but an increase

of +2.6% at constant exchange rates. This change reflects the

modest performance of final waste management activities in Latin

America.

Hazard management activities accounted for 26.0% of contributed

revenue at December 31, 2021 (versus 27.1% one year earlier).

Breakdown by division

As at December 31

2020

2021

Gross change

In €m

%

In €m

%

Hazardous waste division

405.2

63.1%

483.9

65.8%

+19.4%

o/w scope effect

13,6

-

34,0

-

-

Non Hazardous waste division

236.5

36.9%

251.9

34.2%

+6.5%

o/w scope effect

-

-

-

-

-

Total contributed revenue

641.7

100.0%

735.8

100.0%

+14.7%

Consolidated data at current exchange

rates.

The Hazardous waste division, which accounts for 65.8% of

consolidated contributed revenue (versus 63.1% in 2020), generated

revenue of €483.9m, up 19.4% from December 31, 2020. The figures

include a scope effect of €34.0m related to the integration of

Spill Tech.

At constant scope and exchange rates, the HW division’s revenue

was up 11.4%, driven by renewed growth in industrial production in

most of the regions in which the Group operates:

- In France, the division brought in €333.3m in revenue, up 11.7%

from €298.4m in 2020. Over the period, this division’s circular

economy activities were underpinned by the good level of activity

in the recycling and low-carbon energy generation businesses, with

the launch of the Osiris contract. In addition, its hazard

containment activities were driven by positive trends on industrial

markets, both in terms of volumes and prices. Services activities,

in particular environmental services, returned to strong growth

after being disrupted by the pandemic in 2020;

- Internationally, the division's revenue totaled €150.6m at

December 31, 2021 (versus €106.8m a year earlier), for an increase

of 41.0%. At constant scope and exchange rates, growth came out at

+10.4% year on year, illustrating the good performance of most

markets over the period, with the exception of Latin America, which

remained more sluggish.

The Non-Hazardous waste division, which accounted for 34.2% of

contributed revenue (versus 36.9% a year earlier), generated

contributed revenue of €251.9m, up 6.5% year on year in reported

data and +5.4% at current exchange rates:

- In France, the division brought in €198.4m in revenue, up 5.4%

compared with 2020 This division was driven by its activities in

the circular economy, boosted by the implementation of

incentivizing regulations and ever tougher restrictions on waste

exports, which are facilitating the sector’s good performance in

terms of volumes and prices;

- Internationally, this division’s revenue totaled €53.6m, an

increase of 10.9% as reported and +5.5% at constant exchange rates.

This growth reflects contrasting trends between Interwaste’s

buoyant sales momentum in South Africa and the weaker performance

in Latin America.

EBITDA

At December 31, 2021, EBITDA rose sharply, by 24.3% year on

year, to €170.3m, or 23.1% of contributed revenue (vs. €137.0m,

i.e. 21.3% of contributed revenue at December 31, 2020).

This increase includes a scope effect linked to the

consolidation of Spill Tech over ten months, representing +€10.2m,

or 30.0% of the subsidiary’s revenue. The exchange rate effect is

negligible.

At constant scope, EBITDA totaled €160.1m, or 22.8% of

contributed revenue.

The increase in EBITDA at constant scope (+€23.1m) mainly

reflects:

- Volume effects and positive mix effects for +€42.7m, mainly

benefiting from treatment activities related to commercial momentum

and the effects of the industrial efficiency policy;

- Price effects of +€22.6m, in line with the high level of

treatment facilities in France;

Partially offset by trends in:

- Variable operating expenses (+€31.2m), in line with the

increase in activity;

- Fixed operating expenses (+€8.2m) of which staff expenses

partly related to the strong recovery in Services activities

(particularly Environmental Services - Decontamination);

- Various expenses (insurance premiums, communication expenses

…), for +€2.8m, the period benefiting however from the decrease of

certain expenses such as taxes of production.

Breakdown of EBITDA by geographical area

As at December 31

2020

2021

In €m

Consolidated

France

Internnal

Consolidated

France

Internnal

Revenue

641.7

486.6

155.1

735.8

531.7

204.1

EBITDA

137.0

111.3

25.7

170.3

132.4

37.9

% revenue

21.3%

22.9%

16.6%

23,1%

24,9%

18,6%

Consolidated data at current exchange

rates

For each geographic scope, the main changes were:

- In France, EBITDA totaled €132.4m, or 24.9% of contributed

revenue (versus €111.4m, i.e. 22.9% of contributed revenue a year

earlier). This increase is mainly attributable to:

- Favorable commercial effects in terms of volumes, waste mix and

prices, in line with the good market trends in France and the

improvement in the utilization rate of facilities resulting from

the industrial efficiency policy;

- Controlled operating expenses, linked in particular to

optimization of the logistics organization and the cost-cutting

plan;

- A €1.5m increase in various expenses such as insurance premiums

or communication expenses.

- Internationally, EBITDA totaled €37.9m, or 18.6% of contributed

revenue. The figures include a scope effect of €10.2m related to

the integration of Spill Tech. At constant scope, EBITDA reached

€27.7m, or 16.4% of contributed revenue (versus €25.6m, i.e. 16.5%

of revenue in 2020). This change is mainly attributable to:

- The improvement in activity levels compared to 2020 (volume and

mix effects), particularly in South Africa and at Solarca;

- Offset in part by the increase in certain operating costs in

Europe and decreased business in Latin America (particularly Peru)

despite measures taken to reduce operating expenses.

Current operating income

At December 31, 2021, current operating income was €71.5m, or

9.7% of contributed revenue, representing a sharp increase of

+50.5% on the previous year (€47.5m, or 7.4% of contributed

revenue).

It includes a scope effect related to the integration of Spill

Tech for €8.6m or 25.3% of the subsidiary’s revenue. The exchange

rate effect is negligible.

At constant scope, COI rose sharply (+32.4%) to €62.9m, or 9.0%

of contributed revenue. This sharp improvement mainly reflects the

increase in EBITDA (+€23.1m).

Breakdown of COI by geographical perimeter

As at December 31

2020

2021

In €m

Consolidated

France

Internnal

Consolidated

France

Internnal

Revenue

641.7

486.6

155.1

735.8

531.7

204.1

COI

47.5

41.0

6.5

71.5

54.7

16.8

% Revenue

7.4%

8.4%

4.2%

9.7%

10.3%

8.2%

Consolidated data at current exchange

rates

For each geographic scope, the main changes were:

- In France, current operating income totaled €54.7m, or 10.3% of

contributed revenue (versus €41.0m, or 8.4% of contributed revenue

one year earlier). This good performance reflects the increase in

the contribution of EBITDA in France (+€21.1m) minus, in

particular, the increase in depreciation charges related to the

final waste storage business lines and the start of new

facilities.

- Internationally, COI totaled €16.8m, or 8.2% of revenue.

Restated for the scope effect of €8.6m related to the consolidation

of Spill Tech, COI at constant scope and exchange rates amounted to

€8.2m or 4.8% of revenue (vs. €6.5m, or 4.2% of contributed revenue

in 2020). This performance essentially reflects the improvement in

international EBITDA at constant scope (+€2.0m).

Operating income

Operating income reached €68.7m, or 9.3% of contributed revenue,

recording a +55.4% increase compared with June 30, 2020.

This positive trend mainly reflects the increase in COI.

This figure also included goodwill impairment totaling -€1.6m

recorded on Kanay in Peru (for - €0.9m) and Moz Environmental in

Mozambique (for -€0.8m) following damage to its facilities.

Net financial income

At December 31, 2021, financial income was -€24.1m compared with

-€20.4m in 2020. This improvement reflects in particular:

- An increase in the cost of net debt, to -€18.2m versus -€17.1m

a year ago, following the increase in gross financial debt, with a

slightly lower cost of borrowing than in the previous year, of

2.76% (vs. 2.79% in 2020);

- The recognition in “Other financial income and expenses” of

-€4.4 million representing early repayment penalties on the senior

bank debt maturing in 2023 and certain euro-PPs with the same

maturity.

Income tax

At December 31, 2021, the corporate tax expense was -€14.1m

versus -€8.4m a year ago. It is broken down as follows:

- France, -€9.7m, vs. -€7.5m a year earlier.

- Internationally, -€4.4m, vs. -€0.9m a year earlier, of which

-€2.3m related to the Spill Tech scope.

The effective tax rate was 31.5% versus 35.3% at December 31,

2020.

Share of income of associates

The share of net income of affiliates primarily comprised the

Group’s share of the income of Gerep and Sogad and amounted to

-€0.9m at December 31, 2021 versus -€1.5m a year earlier.

Consolidated net income

At December 31, 2021, consolidated net income was €29.6m versus

€13.9m one year earlier.

After booking the minority interest share in that income,

comprising a loss of -€1.2m versus -€0.1m in 2019, primarily

representing the minority interest shares in Solarca and Mecomer,

net income attributable to company shareholders at December 31,

2021 was €28.4m, i.e. 3.9% of contributed revenue (vs. €13.8m a

year earlier).

Net earnings per share amounted to €3.64 versus €1.77 at

December 31, 2020.

Comments on cash flow and the financial situation as at

December 31, 2021

Cash flows

Summary of the consolidated statement of cash flows

In €m as at December 31

2020

2021

Cashflows from operating activities

121.4

142.3

Cashflows from investing activities

(73.2)

(117.6)

Cashflows from financing activities

(30.0)

41.6

Change in cashflows of continuing

operations

18.1

66.2

Change in cashflows from discontinued

operations

ns

-

Change in cashflows

18.1

66.2

During the period, the change in cash and cash equivalents rose

from +€18.1m to +€66.2m.

The change of +€48.1m reflects:

- The increase in flows generated by operating activities:

+20.9m

- Changes in flows related to investment transactions:

-€44.4m

- An increase in flows related to financing transactions:

€71.6m

Cash flows from operating activities

In fiscal 2021, the Group generated €142.3m in cash flows from

operating activities (versus €121.4m a year earlier), up

€20.9m.

This trend reflects the combined effect of:

- The €31.8m increase in cash flows before tax and financial

expenses to €153.1m (vs. €121.3m a year earlier);

- The -€0.6m decline in the working capital requirement, which

stood at +€11.3m at the end of 2020. This item includes a scope

effect related to the consolidation of Spill Tech, for €4.3m. It

also incorporates a transfer of receivables of €23.8m vs. €24.2m in

2020;

- Net taxes paid in the amount of -€10.1m versus -€11.2m in

2020.

Cashflows from investing activities

In €m as at December

2020

2021

Net industrial capex recorded

63.0

92.4

Net financial capex recorded

0.0

1.2

Total net capex recorded

63.0

93.8

Net industrial capex paid

64.2

87.4

Net financial capex paid

(0.0)

0.8

Acquisition of subsidiaries – Net

cashflows

9.0

29,4

Total net capex paid

73.2

117.6

In fiscal 2021, recorded industrial investments amounted to

€92.4m (versus €63.0m in 2020), breaking down as follows:

- Recurrent investments totaling €50.4m, representing 6.8% of

contributed revenue (versus €43.2m in 2020, i.e. 6.7% of

contributed revenue).

- Development investments totaling €42.0m, or 5.7% of contributed

revenue (versus €19.8m in 2020, i.e. 3.1% of contributed revenue).

These mainly concern growth investments in Italy (Mecomer) and the

ERP project.

Industrial investments can be broken down as follows:

- €14.0m in category 2 “public service delegation” expenses

(versus €9.8m in 2020;

- €18.7m for energy storage and production facilities (versus

€13.9m in 2020;

- €7.6m for thermal treatment systems, platforms and other

treatments (versus €6.7m in 2020;

- €3.9m for materials recovery tools (versus €0.9m in 2020;

- €20.0m for eco-services tools, including the vehicle fleet

(versus €11.4m in 2020;

- €16.9m for holding activities relating to information systems,

regulatory investments and development investments in subsidiaries

(versus €10.7m in 2020.

- €11.3m in miscellaneous recurring investments (versus €9.8m in

2020).

Cash flows from financing activities

Total net cash relating to financing activities amounted to

+€41.6m in 2021, essentially reflecting:

- Flows from new borrowings: €380.3m vs. €64.4m a year earlier.

This line includes a €80m Euro PP issue in March 2021 and a €300m

senior bond issue in November 2021

- Flows from loan repayments: -€293.8m vs. -€51.0m in 2020. These

flows mainly include the early repayment of the senior bank loan

maturing in 2023 and of certain euro-PP bonds

- Interest expense: -€15.3m vs. -€15.1m in 2020

- Flows from dividends paid to minority interests: -€1.1m vs.

-€0.9m in 2020

- Cash flows without gain of control: -€2.1m vs. -€4.1m in 2020,

partially representing the impact of the acquisition of an

additional 5% interest in Solarca

- Change in shareholder’s equity: €0.2m

- Repayment of lease liabilities for -€19.2m, including interest

on leases for €2.0 million, vs. -€16.2m including interest for

€1.9m a year earlier.

Debt and funding structure

Change in financial debt

In €m as at December

2020

2021

Bank loans

241.5

139.1

Non recourse bank loans

29.6

27.0

Bonds

229.3

425.3

Lease liabilities

45.0

45.7

Miscellaneous debt

3.1

2.3

Short-term banks borrowings

7.1

7.7

Gross financial debt

555.5

647.1

Cash balance

(105.3)

(172.2)

Net financial debt

450.2

474.9

o/w due in less than one year (1)

(37.5)

(108.1)

o/w due in more than one year

487.7

583.0

(1) Cash and cash equivalents are

considered as less than one year

Gross financial debt stood at €647.1m at December 31, 2021,

compared with €555.5m a year earlier. This €91.6m increase mainly

reflects changes in:

- Bank debt, excluding non-recourse debt, which fell €102.4m

following the early repayment of the senior bank loan;

- Bond debt: +€196.0m, reflecting the balance of new issues (made

in March and November) and early repayments on certain Euro PP

bonds at the end of the year;

At December 31, 2021, the cash balance stood at €172.2m, up

€66.9m year on year.

Net financial debt (IFRS) is under control at €474.9m versus

€450.2m a year earlier.

Over the period, it changed as follows:

In €m

12/31/2020

12/31/2021

Net financial debt at opening

456.2

450.3

Scope effect

-

3.1

Cashflows from operating

activities

(121.3)

(142.3)

Net industrial capex paid

64.2

87.4

Net financial capex paid

9.0

30.2

Dividends

8.3

8.5

Net interests paid (o/w interests on

leases)

17.0

17.3

Cash and cash equivalent without gain of

control

4.0

2.0

Others

0.2

(0.2)

Non cash change

12.7

18.7

Net financial debt at closing

450.3

474.9

Net financial investments paid include:

- €23.9m: the fair value of the consideration transferred from

Spill Tech Group including transaction fees), as the acquired

financial debt amounts to a non-cash change in net debt – scope

effect – for €3.1m (excluding lease liabilities);

- For the balance: mainly the payment of the last earnout on the

acquisition of Mecomer group.

The financial leverage ratio came out at 2.7x EBITDA (versus

3.3x a year earlier), illustrating significantly improved financial

flexibility.

APPENDIX 1

CONSOLIDATED CASHFLOW STATEMENT

(In thousands of euros)

31/12/2020

31/12/2021

Goodwill

309,079

324,156

Intangible fixed assets from under

concession arrangements

41,419

36,846

Other intangible fixed assets

39,156

41,901

Property, plant, equipment

313,768

344,847

Investments in associates

180

50

Non-current financial assets

7,209

11,054

Non-current derivatives - assets

-

-

Non-current operating financial assets

35,930

29,516

Deferred tax – assets

23,438

21,447

Non-currents assets

770,179

809,816

Inventories

15,009

17,321

Trade and other receivables

171,023

186,035

Current financial assets

974

3,218

Current derivatives - assets

-

-

Current operating financial assets

32,103

36,220

Cash and cash equivalents

105,265

172,201

Current assets

324,374

414,996

Assets held for sale

-

-

TOTAL ASSETS

1,094,554

1,224,812

(in thousands of euros)

31/12/2020

31/12/2021

Share capital

1,572

1,572

Additional paid capital

74,061

74,061

Reserves

163,479

165,452

Net income

13,815

28,384

Shareholder’s equity (share of the

Group)

252,927

269,469

Minority interests

4,302

5,426

Total shareholder’s

equity

257,230

274,895

Non-current financial debt

457,847

552,173

Non-current rental debt

29,882

30,833

Non-current derivatives - liabilities

0

0

Employee benefit

16,497

17,178

Non-current provisions

22,185

24,314

Non-current operating financial

liabilities

2,377

4,722

Deferred tax – liabilities

6,076

5,383

Non-current liabilities

534,865

634,603

Current financial debt

52,647

49,102

Current rental debt

15,161

14,977

Current derivatives - liabilities

75

-

Current provisions

1,756

1,810

Trade payables

115,150

137,343

Other current liabilities

116,229

111,161

Tax liabilities

1,440

922

Current liabilities

302,459

315,314

Liabilities held for sale

-

-

TOTAL LIABILITIES AND

SHAREHOLDER’S EQUITY

1,094,554

1,224812

APPENDIX 2

CONSOLIDATED INCOME STATEMENT

(in thousands of euros)

12/31/2020

12/31/2021

Revenue

673,076

790,117

Oher business income

780

1,207

Income from ordinary activities

673,856

791,324

Purchases used for operational

purposes

(85,007)

(97,760)

External expenses

(240,026)

(280,042)

Taxes and duties

(47,663)

(59,021)

Employee expenses

(164,154)

(184,218)

EBITDA

137,007

170,282

Expenses for rehabilitation and/or

maintenance of sites under concession arrangements

(12,488)

(10,692)

Depreciation & amortization,

impairment and provisions

(76,840)

(86,624)

Other operating items

(144)

(1,469)

Current operating income

47,535

71,496

Other non-current items

(3,292)

(2,813)

Operating income

44,243

68,684

Cost of net financial debt

(17,020)

(18,184)

Other financial income and expenses

(3,419)

(5,941)

Financial income

(20,439)

(24,126)

Share of income in associates

(1,477)

(908)

Income tax

(8,404)

(14,051)

Net income

13,923

29,599

o/w attribuable to minority interest

(107)

(1,215)

o/w Group share

13,815

28,384

Non-diluted per share (in euros)

1,77

3,64

Diluted per share (in euros)

1,77

3,64

APPENDIX 3

CONSOLIDATED CASHFLOW STATEMENT

(in thousand of euros)

12/31/2020

12/31/2021

Net Income

13,923

29,599

Share of income of associates

1,477

908

Dividends from joint venture and

associates

-

-

Depreciation & amortization,

impairment and provisions

76,210

87,181

Income from disposals

829

676

Deferred tax

201

2,235

Other income and expenses

3,904

4,018

Cashflows

96,544

124,616

Income tax

8,204

11,816

Cost of gross financial debt

16,532

16,626

Cashflows before taxes and financial

expenses

121,279

153,058

Change in WCR

11,310

(645)

Tax paid

(11,233)

(10,147)

Net cashflows from operating

activities

121,356

142,266

Investments in property, plant, equipment

and intangible assets

(66,392)

(89,565)

Disposals of property, plant, equipment

and intangible assets

2,171

2,119

Increase in loans and financial

receivables

(543)

(1,207)

Decrease in loans and financial

receivables

473

380

Takeover of subsidiaries net of cash and

cash equivalents

(9,003)

(29,335)

Loss of control of subsidiaries net of

cash and cash equivalents

52

1

Net cashflows from investing

activities

(73,242)

(117,608)

(in thousands of euros)

31/12/2020

31/12/2021

Dividends paid to equity holders of the

parent

(7,412)

(7,410)

Dividends paid to holders of minority

interests

(861)

(1,078)

Capital increase or decrease by

controlling company

407

-

Cash and cash equivalents without

loss/gain of control

(4,066)

(2,077)

Change in shareholder’s equity

(168)

202

New loans and financial debt

64,431

380,261

Repayment of loans and financial debt

(51,013)

(293,842)

Interest paid

(15,115)

(15,296)

Repayment of lease liabilities and

associated expenses

(16,245)

(19,185)

Net cashflows from financing

activities

(30,043)

41,575

Total cashflow of the period for

continuing activities

18,072

66,233

Net cashflow from discontinued

activities

(1)

-

TOTAL CASHFLOWS FOR THE

PERIOD

18,071

66,233

Cash and cash equivalents at the beginning

of the year

80,741

98,184

Cash and cash equivalents at the end of

the year

98,184

164,520

Effects of changes in foreign exchange

rates

631

(103)

(1) o/w:

Cash and cash equivalents

105,265

172,201

Short term banks borrowings

(current financial debt)

(7,081)

(7,682)

APPENDIX 4

DEFINITION OF CONTRIBUTES REVENUE

New presentation of contributed revenue

In €m

As at December 31

2019

2020

2021

Reported Revenue

704.4

673.1

790.1

IFRIC 12 Revenue

-

0.6

8.7

Compensation

16.6

-

-

TGAP

30.9

30.8

45.6

Contributed Revenue

656.9

641.7

735.8

Definitions

IFRIC 12 revenue: investments made for disposed assets,

recognized as revenue and intangible assets or in financial assets

in accordance with the IFRIC 12 interpretation.

Compensation: diversion compensation paid to Sénerval (net of

variable cost savings on non incinerated tonnage) in 2019 to cover

the costs incurred to ensure the continuity of services to local

authorities during asbestos removal at the Eurométropole Strasbourg

incinerator.

TGAP: General Tax on Polluting Activities paid by the waste

producer and collected by waste management operators on behalf of

the State. This tax is paid to the government with no impact on

operating margins.

It is slated to change between 2021 and 2025, in both very

significant and very differentiated manners, leading to the

recognition of:

- Non-economic revenue resulting from a significant increase in

the amount of tax collected, particularly within the NHW

division;

- Widely varying changes across operations, not representative of

their economic developments, in particular in the treatment

businesses (incineration and storage of final waste).

APPENDIX 6

APPLICATION OF REGULATION EU

2020/852

(“GREEN TAXONOMY”)

The European Taxonomy classifies economic activities with a

favorable impact on the environment. The aim is to direct

investment towards “green” businesses.

Business activities classified as sustainable meet at least one

of the following six objectives:

- No. 1: climate change reduction

- No. 2: climate change adaptation

- No. 3: sustainable use and protection of water and sea

resources

- No. 4: transition to a circular economy

- No. 6: protection and restoration of biodiversity and

ecosystems

The business activity must make a substantial contribution to

one or more of the six objectives without doing no significant harm

to the other objectives (the “DNSH” principle).

An initial delegated act (Act 1) on the climate (first two

objectives) of the European Taxonomy was adopted on June 4,

2021.

The Platform for Sustainable Finance proposed criteria for a

second delegated act (Act 2) in August 2021. These criteria

proposals concern the alignment of economic activities with

objectives 3 to 6. It is on the basis of this proposal that the

European Commission will draft a proposal of Act 2 in 2022.

The entities concerned by this new obligation publish the share

of their revenue, the share of their CAPEX and the share of their

OPEX relating to activities eligible for the Taxonomy.

Séché Environnement has classified its activities according to

their eligibility for Act 1 and the criteria proposed for Act

2.

The sole obligation is the publication of information on the

eligibility of economic activities for Act 1.

In a spirit of transparency, the Group is thus preparing ahead

of time for the classification of all its activities according to

their eligibility for the two delegated acts.

Eligible share

2021

Act 1

Act 2

Total

Contributed revenue

16%

58%

74%

OPEX

17%

65%

82%

CAPEX

16%

44%

61%

Based on Act 1 of the Taxonomy, the following Group activities

are eligible:

- The collection and transport of non-hazardous waste sorted at

source

- The recovery of from non-hazardous waste

- Other low-carbon manufacturing technologies (mainly the

production of basic organic chemical products)

- The generation of photovoltaic electricity

Based on the proposed criteria for Act 2 of the Taxonomy, the

following Group activities are eligible:

- The collection and transport of hazardous waste

- The treatment of hazardous waste for material recovery

- The treatment of hazardous waste for pollution prevention and

control

- Decontamination to prevent and control pollution

- Environmental emergency services

- Urban wastewater treatment

- Other renewable and recovered energies, notably from hazardous

waste

It should be noted that service activities (41% of turnover and

91% considered eligible for taxonomy) consume less CAPEX than

circular economy and decarbonization activities, as well as those

of hazard management.

This considerable share of business activities, operating

expenses and industrial investments eligible for the Taxonomy

illustrates the Group’s strong positioning in businesses related to

the ecological transition.

1 Earnings before interest, tax, depreciation and amortization

plus dividends received from subsidiaries and the balance of other

operating income and expenses and cash, less site maintenance and

restoration expenses, major maintenance expenses under concession

arrangements ("public service delegations") and investments in

concessions (IFRIC 12). 2 Free cash before non-recurring industrial

investments, financial investments, dividend and debt repayments. 3

Contributed revenue is reported revenue, less IFRIC 12 revenue

(amount of investments in concessions, recognized as revenue and

activated in intangible assets or in financial assets in accordance

with the recommendations of the IFRIC 12 interpretation) and less

the General Tax on Polluting Activities (TGAP). 4 See press release

of December 17, 2019 5 Cash and cash equivalents + facilities + RCF

6 See press release of August 2, 2021 7 EBITDA / contributed

revenue 8 General Tax on Polluting Activities, paid by the waste

producer and then transferred to the government by Séché

Environnement in respect of some of its activities in France

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220307005582/en/

SÉCHÉ ENVIRONNEMENT

Analyst / Investor Relations Manuel Andersen Head of

Investor Relations m.andersen@groupe-seche.com +33 (0)1 53 21 53

60

Media Relations Constance Descotes Head of Communications

c.descotes@groupe-seche.com +33 (0)1 53 21 53 53

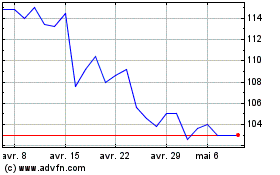

Seche Environnement (EU:SCHP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Seche Environnement (EU:SCHP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024