- Total revenue growth of 8.8% and organic growth1 of

6.5%

- Workforce grew by 4.3% relative to Q1 2021, including 12.2%

growth in India

Regulatory News:

Sopra Steria (Paris:SOP) generated revenue of €1,267.7

million in the first quarter of 2022, representing growth of 8.8%.

At constant scope and exchange rates, revenue grew 6.5%.

Sopra Steria: Consolidated revenue – Q1 2022 €m / %

Q1 2022

Q1 2021

Organic growth

Total growth

Revenue

1,267.7

1,165.2

6.5%

8.8%

Cyril Malargé, Chief Executive Officer of Sopra Steria Group,

commented:

“We turned in a strong first quarter, slightly exceeding our

initial expectations. Market conditions were buoyant, still driven

by our clients’ digital transformation projects. Growth was

particularly strong in the defence and aeronautics vertical

markets, which made up around 20% of our revenue. In the current

context in which major investments are being made in digital, we

expanded our resources and the added value delivered to our

clients, reflected in particular in an increase in our sales

prices. As such, we began the year in step with our short- and

medium-term targets. The invasion of Ukraine has made the European

economic environment more uncertain. I’d like to reiterate that the

Group does not have any direct exposure to Russia or Ukraine, and

our presence in the manufacturing sector is very limited. At this

stage, we have not observed any changes in purchasing decisions

among our major clients. Our core strengths in this context are the

close relationships we have with our clients and our large share of

revenue from recurring activities (more than 40%).”

Comments on Q1 2022 business activity

Revenue came to €1,267.7 million, a total increase of 8.8%

relative to Q1 2021. Changes in scope had a positive impact of

€11.8 million, and currency fluctuations had a positive impact of

€13.4 million. At constant scope and exchange rates, revenue grew

6.5%.

In France (40% of the Group total), revenue came to

€513.2 million, equating to organic growth of 9.6%.

Consulting activities performed well, achieving growth of more than

10%. The defence and aeronautics sectors were particularly robust,

both showing double-digit growth. The banking sector was also very

active, with growth of around 10%, while the energy, telecoms,

transport and social services vertical markets grew less

quickly.

In the United Kingdom (17% of Group total), revenue was

virtually stable (up 0.3%) at constant scope and exchange rates,

amounting to €219.0 million. The basis for comparison in Q1 2021

was very high, with revenue having grown by 16.8% in that quarter.

The joint ventures specialising in business process services for

the public sector (NHS SBS and SSCL) saw slightly negative growth

on average, while the rest of the public sector posted slightly

positive growth. The defence & aeronautics vertical market

posted growth of more than 10%. The private sector saw negative

growth, but to a lesser extent than in 2021. This sector is

expected to return to positive growth in the second half of the

year, in particular thanks to the implementation of the new debt

collection service.

The Other Europe reporting unit posted €365.0 million in

revenue (29% of the Group total). Organic revenue growth for the

reporting unit was 8.1%. This performance was driven by Scandinavia

and Bénélux, with these two geographic regions seeing double-digit

growth.

Revenue for Sopra Banking Software (8% of Group revenue)

came to €103.2 million, equating to slight growth with

respect to Q1 2021 (up 0.8%). As in previous quarters, the

reporting unit continued to invest in product development, focusing

in particular on digital layers. The gradual transformation of

R&D continued according to plan.

The Other Solutions reporting unit (5% of Group revenue)

posted revenue of €67.3 million, representing organic growth of

5.9%. Human resources solutions posted growth of 9.1%. Revenue from

property management solutions was relatively stable.

Workforce

3,585 new employees joined the Group in the first quarter

of 2022, representing around a third of the annual recruitment

target.

At end-March 2022, the Group’s net workforce was up 4.3%

compared with Q1 2021, with 12.2% of this increase in India. The

Group had a total workforce of 48,114 people, compared with 47,437

people at 31 December 2021 and 45,959 people at 31 March 2021.

Staff employed at international service centres (India, Poland,

Spain, etc.) represented 18.3% of the total workforce (17.5% at 31

March 2021).

The number of subcontractors was up 738 people at

end-March 2022 compared with end-December 2021.

The workforce attrition rate came to 20%, a level similar

to Q1 2019.

Outlook

The macroeconomic environment has deteriorated since the

invasion of Ukraine on 24 February 2022. However, the first quarter

was dynamic and slightly exceeded the Group’s initial expectations.

Given this situation and based on the information currently

available, the targets previously reported on 24 February 2022

remain valid.

Recap of targets for 2022 reported on 24 February

2022

- Organic revenue growth of between 5% and 6%

- Operating margin on business activity of between 8.5% and

9.0%

- Free cash flow of around €250 million

Q1 2022 revenue presentation meeting

Revenue for the first quarter of 2022 will be presented to

financial analysts and investors via a bilingual (French and

English) conference call to be held on 29 April 2022 at 8:00 a.m.

CET:

- French-language phone number: +33 (0)1 70 71 01 59 – PIN:

66479034#

- English-language phone number: +44 (0)207 194 37 59 – PIN:

86559732#

Practical information about this conference call can be found in

the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial publications

Wednesday, 1 June 2022 (2:30 p.m.): General Meeting of

Shareholders

Thursday, 28 July 2022 (before market open): Publication of H1

2022 results

Friday, 28 October 2022 (before market open): Publication of Q3

2022 revenue

Glossary

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating income and expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Basic recurring earnings per

share: This measure is equal to basic earnings per share

before other operating income and expenses net of tax.

- Free cash flow: Free cash

flow is defined as the net cash from operating activities; less

investments (net of disposals) in property, plant and equipment,

and intangible assets; less lease payments; less net interest paid;

and less additional contributions to address any deficits in

defined-benefit pension plans.

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sale) divided by the total number of business days.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2021 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 17 March 2022 (see

pages 38 to 44 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a European leader in the field of technology,

renowned for its consulting, digital services and software

development, helps its clients drive their digital transformation

and obtain tangible and sustainable benefits. It provides

end-to-end solutions to make large companies and organisations more

competitive by combining in-depth knowledge of a wide range of

business sectors and innovative technologies with a fully

collaborative approach. Sopra Steria places people at the heart of

everything it does and is committed to putting digital to work for

its clients in order to build a positive future for all. With

47,000 employees in nearly 30 countries, the Group generated

revenue of €4.7 billion in 2021. The world is how we shape

it. Sopra Steria (SOP) is listed on Euronext Paris (Compartment

A) – ISIN: FR0000050809 For more information, visit us at

www.soprasteria.com

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – Q1 2022 €m

Q1 2022

Q1 2021

Growth

Revenue

1,267.7

1,165.2

+8.8% Changes in exchange rates

13.4

Revenue at constant exchange rates

1,267.7

1,178.6

+7.6% Changes in scope

11.8

Revenue at constant scope and exchange rates

1,267.7

1,190.4

+6.5% Sopra Steria: Changes in exchange rates – Q1

2022 For €1 / %

Average rate Q1 2022

Average rate Q1 2021

Change

Pound sterling

0.8364

0.8739

+4.5% Norwegian krone

9.9247

10.2584

+3.4% Swedish krona

10.4807

10.1202

-3.4%

Danish krone

7.4407

7.4372

-0.0%

Swiss franc

1.0364

1.0913

+5.3%

Sopra Steria: Revenue by reporting unit – Q1 2022

€m / %

Q1 2022

Q1 2021 Restated*

Q1 2021

Organic growth

Total growth

France

513.2

468.5

460.2

+9.6% +11.5% United Kingdom

219.0

218.3

208.9

+0.3% +4.9% Other Europe

365.0

337.6

331.2

+8.1% +10.2% Sopra Banking Software

103.2

102.4

101.4

+0.8% +1.8% Other Solutions

67.3

63.5

63.5

+5.9% +6.0%

Sopra Steria Group

1,267.7

1,190.4

1,165.2

+6.5% +8.8% * Revenue at 2022 scope and exchange

rates

Sopra Steria: Workforce breakdown – 31/03/2022

31/03/2022

31/03/2021

France

20,067

19,861

United Kingdom

7,045

6,654

Other Europe

11,726

10,886

Rest of the World

470

508

X-Shore

8,806

8,050

Total

48,114

45,959

1 Alternative performance measures are defined in the glossary

at the end of this document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220428005797/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

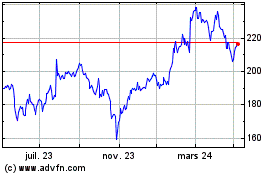

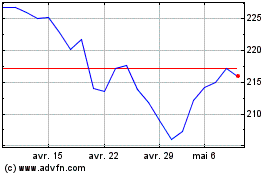

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Sopra Steria (EU:SOP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024