- Sales growth 14%

- EBITDA improves 15%

- Cash runway through mid-2024

Regulatory News:

SpineGuard (FR0011464452 – ALSGD) (Paris:ALSGD), an innovative

company that deploys its DSG® (Dynamic Surgical Guidance) sensing

technology to secure and streamline the placement of bone implants,

announced today financial results for the half year ending June 30,

2022, as approved by the Board of Directors on September 15,

2022.

Pierre JEROME, cofounder, Chairman & CEO of SpineGuard,

said: “These half year results are in line with our financial

objectives. They reflect our strategy to invest selectively in both

the strengthening of our US commercial structure and the further

deployment of our DSG technology while remaining close to

break-even and minimizing dilution for our shareholders. Our cash

runway and growth prospects, in particular those related to the two

new strategic partnerships initiated this year, enable us to be

confident and enthusiastic about SpineGuard’s future.”

€ thousands – IFRS

H1 2022

H1 2021

Revenue

2,546

2,227

Gross margin

2,161

1,814

Gross margin (% of revenue)

84.9%

81.5%

Sales, distribution, marketing

- 1,827

- 1,253

Administrative costs

- 835

- 779

Research & Development

- 463

- 474

Recurring operating profit /

(loss)

- 964

- 692

Non-recurring operating costs

- 40

- 90

Operating profit / (loss)

- 1,004

- 782

Financial result

- 147

- 50

Income tax

- 26

-

Net profit / (loss)

- 1,175

- 832

EBITDA

- 561

- 661

NB: unaudited

EBITDA improves by 15%

2,848 DSG units were sold in the first half of 2021 compared

with 2,731 in the first half of 2021, including 1,340 in the United

States, representing 47% of total units sold.

Revenue was still impacted by the COVID-19 pandemic early 2022.

For H1 2022, the Company reported revenues of € 2,546 K, up 14% as

reported in H1 2021 and +6.5% in constant currency compared with H1

2021.

Gross margin of 84.9% at June 30, 2022 improved by 3.9%. ASP’s

remained globally stable and while the company faced some higher

costs of manufacturing, they remained limited overall. The return

to growth also reduced the impact of the scraps of obsolete

inventory in the USA incurred in 2021.

Operating expenses were € 3,131 K for H1 2022, compared with €

2,506 K, an increase of € 625 K compared with June 30, 2021 driven

by the momentum of sales & marketing initiatives in the US.

The net operating loss stands at € -964 K vs. € -692 K at June

30, 2021.

EBITDA improved 15% at € -561 K compared to € -661 K at June 30,

2021.

Working capital requirements were € 247 K compared with € -133 K

at December 31, 2021 mainly due to the increase of account

receivables (+€ 271 K) and inventory (+€ 141 K).

At June 30, 2022, cash and cash equivalents were € 4,450 K

compared with € 5,207 K at December 31, 2021, and is explained as

follows:

- Operating cash flow of € -921 K compared with the same period

last year of € -620 K.

- Equity funding using the equity lines for a gross amount of €

1,006 K throughout the period.

- The payment of interests to Norgine Ventures and Harbert

European Growth of € 157 K.

- Reimbursement of the principal of the venture loans for € 336 K

over the half-year.

The cash position as of August 31, 2022 of € 3.7 M plus the

secured equity line facility for € 4.0 M means that the total cash

available to the Company is € 7.7 M. Considering the current cash

position, the secured convertible bond facility and the recurring

expected business, the Company estimates that it can fund its needs

through mid-2024.

Post-closing events

SpineGuard and Omnia Medical, a medical device company focused

on innovative solutions utilizing proven techniques, announced the

signature of a co-development and exclusive distribution agreement

for adult spine surgery in the United States. This partnership

spans two novel devices: a smart single-step pedicle screw system

and a smart drilling tool for sacroiliac joint fusion both

embedding the DSG (Dynamic Surgical Guidance) technology.

SpineGuard’s Priorities

SpineGuard is focusing on the following priorities while

investing selectively to remain close to breakeven:

- Boost commercial activities with the launch of the DSG-Connect

visual interface and the partnership with WishBone Medical

- Deploy the DSG digital technology in the surgical robotic

field

- Develop a Smart Universal Drill (SUD) embedding the DSG

artificial intelligence

- Support ConfiDent with the design and scale-up of the DSG

dental applications

- Implement the agreement recently signed with Omnia Medical

- Sign other strategic partnerships

The company’s half-year financial report is available in the

Investors > Exchange filings section of the www.spineguard.com

website in French only.

Next financial press release: Third quarter 2022 revenue

on October 12, 2022, after market closing.

About SpineGuard®

Founded in 2009 in France and the USA by Pierre Jérôme and

Stéphane Bette, SpineGuard is an innovative company deploying its

proprietary radiation-free real time sensing technology DSG®

(Dynamic Surgical Guidance) to secure and streamline the placement

of implants in the skeleton. SpineGuard designs, develops and

markets medical devices that have been used in over 90,000 surgical

procedures worldwide. Nineteen studies published in peer-reviewed

scientific journals have demonstrated the multiple benefits DSG®

offers to patients, surgeons, surgical staff and hospitals.

Building on these strong fundamentals and several strategic

partnerships, SpineGuard has expanded the scope of its DSG®

technology in innovative applications such as the « smart » pedicle

screw, the DSG Connect visualization and registration interface,

dental implantology and surgical robotics. DSG® was co-invented by

Maurice Bourlion, Ph.D., Ciaran Bolger, M.D., Ph.D., and Alain

Vanquaethem, Biomedical Engineer. SpineGuard has engaged in

multiple ESG initiatives.

For further information, visit www.spineguard.com

Disclaimer

The SpineGuard securities may not be offered or sold in the

United States as they have not been and will not be registered

under the Securities Act or any United States state securities

laws, and SpineGuard does not intend to make a public offer of its

securities in the United States. This is an announcement and not a

prospectus, and the information contained herein does and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of the securities referred to herein in

the United States in which such offer, solicitation or sale would

be unlawful prior to registration or exemption from

registration.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220915005753/en/

SpineGuard Pierre Jérôme CEO & Chairman Tel: +33 1 45

18 45 19 p.jerome@spineguard.com

SpineGuard Manuel Lanfossi CFO Tel: +33 1 45 18 45 19

m.lanfossi@spineguard.com

NewCap Investor Relations & Financial Communication

Mathilde Bohin / Aurélie Manavarere Tel: +33 1 44 71 94 94

spineguard@newcap.eu

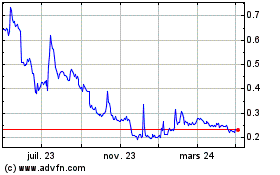

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024