Regulatory News:

Teleperformance SE’s (Paris:TEP) Combined General Meeting was

held on April 14, 2022 in Paris under the chairmanship of Daniel

Julien, Chairman and CEO of the group.

Shareholders adopted all the resolutions submitted to their

vote.

They notably approved:

- the 2021 parent company and consolidated financial

statements;

- the proposed dividend of €3.30 per share, representing an

increase compared with the previous year: the ex-dividend date is

April 26, 2022 and the payment date is April 28, 2022;

- the renewal of the terms of office of four directors: Bernard

Canetti, Pauline Ginestié, Wai Ping Leung and Patrick Thomas;

- the appointment of Shelly Gupta and Carole Toniutti as

directors. These appointments will increase the percentage of women

on the Board to 50% (compared to 43% previously) and strengthen the

Board’s diversity in terms of experience, expertise, and

nationalities;

- the information on the remuneration of directors and corporate

officers as well as their remuneration policy, described in the

corporate governance report included in the 2021 Universal

Registration Document.

The resolutions submitted to the shareholders were all approved

with strong majorities*. They reflect the Group’s ongoing

commitment to meet the expectations of its shareholders and adopt

best practices in corporate governance.

* Voting results provided in the appendix to this press release

and available on Teleperformance’s corporate website

(www.teleperformance.com – Investors / General Meetings

section).

ABOUT TELEPERFORMANCE GROUP

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), the global leader in outsourced customer and

citizen experience management and advanced related services,

serves as a strategic partner to the world’s largest companies in

many industries. It offers a One Office support services model

including end-to-end digital solutions, which guarantee successful

customer interaction and optimized business processes, anchored in

a unique, comprehensive high touch, high tech approach. Nearly

420,000 employees, based in 88 countries, support billions of

connections every year in over 265 languages and around 170

markets, in a shared commitment to excellence as part of the

“Simpler, Faster, Safer” process. This mission is supported by the

use of reliable, flexible, intelligent technological solutions and

compliance with the industry’s highest security and quality

standards, based on Corporate Social Responsibility excellence. In

2021, Teleperformance reported consolidated revenue of €7,115

million (US$8.4 billion, based on €1 = $1.18) and net profit of

€557 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350 and MSCI Global Standard. In the area of

corporate social responsibility, Teleperformance shares are

included in the Euronext Vigeo Euro 120 index since 2015, the EURO

STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index

since 2019 and the FTSE4Good index since 2018.

For more information: www.teleperformance.com Follow us

on Twitter: @teleperformance

APPENDIX:

VOTING RESULTS OF THE COMBINED SHAREHOLDERS’ MEETING OF APRIL

14, 2022

Ordinary

Extraordinary

Number of shares composing the share

capital

58,737,600

58,737,600

Number of shares with voting rights:

58,645,175

58,645,175

Number of shareholders represented or

voting by post:

4,945

4,945

Number of shares owned by shareholders

represented or voting by post

40 993 750

40 993 750

Number of voting rights owned by

shareholders represented or voting by post:

42 143 536

42 143 536

Quorum

69.90%

69.90%

FOR

AGAINST

ABSTENTIONS

RESULTS

Number

%

Number

%

Number

As an Ordinary Shareholders’

Meeting

1. Approval of the statutory financial statements for the year

ended December 31, 2021

42,112,090

99.994%

2,414

0.006%

28,894

Adopted

2. Approval of the consolidated financial statements for the

year ended December 31, 2021

42,112,083

99.994%

2,414

0.006%

28,894

Adopted

3. Appropriation of 2021 results - Determination of dividend

amount and payment date

41,954,965

99.562%

184,380

0.438%

4,063

Adopted

4. Special report of the statutory auditors on regulated

agreements and commitments – Acknowledgement of the absence of new

agreements

42,138,883

99.999%

305

0.001%

4,220

Adopted

5. Approval of the information referred to in paragraph I of

Article L. 22-10-9 of the French Commercial Code for all of the

Company’s corporate officers

40,646,204

96.461%

1,491,049

3.539%

6,150

Adopted

6. Approval of the fixed, variable and exceptional elements

comprising the total remuneration and the benefits of all kind paid

in the 2021 financial year or granted in respect of the 2021

financial year to Mr. Daniel Julien, Chairman and Chief Executive

Officer

35,758,011

85.564%

6,032,841

14.436%

352,391

Adopted

7. Approval of the fixed, variable and exceptional elements

comprising the total remuneration and the benefits of all kind paid

in the 2021 financial year or granted in respect of the 2021

financial year to Mr. Olivier Rigaudy, Deputy Chief Executive

Officer

36,783,861

88.020%

5,006,504

11.980%

352,796

Adopted

8. Approval of the remuneration policy for directors

41,767,354

99.887%

47,309

0.113%

328,675

Adopted

9. Approval of the remuneration policy for the Chairman and

Chief Executive Officer

38,181,951

90.738%

3,897,293

9.262%

64,129

Adopted

10. Approval of the remuneration policy for the Deputy Chief

Executive Officer

38,616,617

91.769%

3,463,703

8.231%

63,063

Adopted

11. Appointment of Ms. Shelly GUPTA as a director

42,117,101

99.950%

21,099

0.050%

5,038

Adopted

12. Appointment of Ms. Carole TONIUTTI as a director

42,115,707

99.949%

21,647

0.051%

5,766

Adopted

13. Renewal of the term of office of Ms. Pauline GINESTIE as a

director

42,115,555

99.948%

21,842

0.052%

5,914

Adopted

14. Renewal of the term of office of Ms. Wai Ping LEUNG as a

director

42,112,552

99.939%

25,498

0.061%

5,053

Adopted

15. Renewal of the term of office of Mr. Patrick THOMAS as a

director

40,697,260

96.581%

1,440,763

3.419%

5,224

Adopted

16. Renewal of the term of office of Mr. Bernard CANETTI as a

director

34,373,967

83.829%

6,630,792

16.171%

1,138,386

Adopted

17. Determination of the annual amount of directors’

remuneration

42,001,877

99.676%

136,658

0.324%

4,693

Adopted

18. Authorization to be given to the Board of Directors to allow

the Company to repurchase its own shares pursuant to the provisions

of Article L.22-10-62 of the French Commercial Code, duration of

the authorization, purposes, conditions, cap, non-exercise during

public offerings

41,695,925

98.970%

433,860

1.030%

13,493

Adopted

As an Extraordinary

Shareholders’ Meeting

19. Delegation of authority to be given to the Board of

Directors for the issue of ordinary shares and/or securities giving

access to the capital (of the Company or of a subsidiary) and/or to

debt instruments, with application of the preferential subscription

rights for shareholders, duration of the delegation, maximum

nominal amount of capital increases, option to offer the

unsubscribed securities to the public, non-exercise during public

offerings

39,371,148

93.426%

2,770,295

6.574%

1,776

Adopted

20. Delegation of authority to be given to the Board of

Directors for the issue of ordinary shares and/or securities giving

access to the capital (of the Company or of a subsidiary) and/or to

debt instruments, without preferential subscription rights for

shareholders, with the option to confer a priority right, by public

offering (except offers referred to in paragraph 1 of Article

L.411-2 of the French Monetary and Financial Code) and/or as

consideration for securities transferred under a public exchange

offer, duration of the delegation, maximum nominal amount of

capital increases, issue price, option to limit the issue to the

amount of subscriptions or to distribute unsubscribed securities,

non-exercise during public offerings

39,520,717

93.782%

2,620,498

6.218%

2,012

Adopted

21. Delegation of authority to be given to the Board of

Directors for the issue of ordinary shares and/or securities giving

access to the capital (of the Company or of a subsidiary) and/or to

debt instruments, without preferential subscription rights for

shareholders by an offer referred to in paragraph 1 of Article

L.411-2 of the French Monetary and Financial Code, duration of the

delegation, maximum nominal amount of capital increases, issue

price, option to limit the issue to the amount of subscriptions or

to distribute unsubscribed securities, non-exercise during public

offerings

38,371,343

91.053%

3,770,368

8.947%

1,473

Adopted

22. Authorization to increase the amount of capital increases

under the 19th, 20th and 21st resolutions within the limit of their

thresholds and within the limit of 15% of the initial issuance,

non-exercise during public offerings

36,614,546

86.894%

5,522,701

13.106%

5,900

Adopted

23. Delegation of authority to be given to the Board of

Directors to increase the share capital by issuing ordinary shares

and/or securities giving access to the equity, without preferential

subscription rights for shareholders, in favor of members of a

company savings plan pursuant to the provisions of Articles

L.3332-18 et seq. of the French Labor Code, duration of the

delegation, maximum nominal amount of capital increases, issue

price, possibility to allocate free shares in accordance with

Article L.3332-21 of the French Labor Code

41,017,701

97.334%

1,123,390

2.666%

2,054

Adopted

24. Authorization to be granted to the Board of Directors to

grant, under no consideration, existing shares and/or shares to be

issued to employees and/or certain corporate officers of the

Company or of affiliated companies or economic interest groups,

waiver by the shareholders of their preferential subscription

rights, duration of the authorization, cap, term of vesting period

in particular in the event of disability

38,450,023

92.004%

3,341,556

7.996%

351,578

Adopted

25. Powers for formalities

42,137,667

99.999%

340

0.001%

4,187

Adopted

Teleperformance SE (Societas Europaea). Share

capital of 146,844,000. 301 292 702 RCS Paris. 21-25 rue Balzac,

75406 Paris Cedex 08 France. Siret 301 292 702 00059. Code APE

6420Z.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220414005809/en/

FINANCIAL ANALYSTS AND INVESTORS Investor relations and

financial communication department TELEPERFORMANCE +33 1 53 83 59

15 investor@teleperformance.com

PRESS RELATIONS Europe Karine Allouis – Leslie

Jung-Isenwater – Laurent Poinsot IMAGE7 +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS Americas and Asia-Pacific Mark

Pfeiffer TELEPERFORMANCE +1 801-257-5811

mark.pfeiffer@teleperformance.com

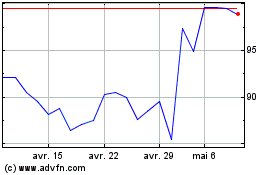

Teleperformance (EU:TEP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

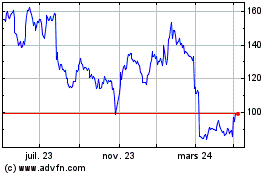

Teleperformance (EU:TEP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024