2021 Results in Line with Theraclion's Development Strategy for 2022

31 Mars 2022 - 7:00PM

Business Wire

Regulatory News:

THERACLION (Paris:ALTHE) (ISIN: FR0010120402; Mnemo: ALTHE),

an innovative company developing a scalable robotic platform for

non-invasive ultrasound therapy, today released its 2021

results. Theraclion continues its new growth momentum for 2022,

focusing on the development of its technology to launch the next

generation SONOVEIN®.

The development teams are working on the next generation of the

SONOVEIN® robotic platform. It will integrate the collection and

analysis of technical and intraoperative data. Ultimately,

SONOVEIN® will become a universal non-invasive AI-assisted

treatment, with no learning curve for the physician and optimal

quality of care for all patients.

The recent appointment of Yann Duchesne as Executive Chairman of

the Board marks a new chapter in governance, setting the company up

for success in its major strategic shift to focus on technology

performance and clinical benefits to access the USA veins markets.

In Europe, the focus will be on standardize treatment protocols

among the current KOLs to pave the way for dynamic growth.

Yann Duchesne’s vision is to grow Theraclion in 3 major

therapeutical areas in 3 geographies: Varicose veins, in the USA

(seeking FDA clearance) and in Europe; Thyroid, in Europe and in

China; Breast cancer, mostly in the USA. In order to achieve these

ambitious goals, Theraclion is identifying global strategic

partners. The company will focus mostly on critical technical and

clinical milestones, talent motivation and retention. Yann

Duchesne’s ambition is to bring Theraclion amongst the world

leaders treatment device with robotics & artificial

intelligence.

Despite a clear upturn in activity, results are still

impacted by the Covid-19

In K€

2021/12/31

2020/12/31

Var.

Sales

1 481

744

99%

Subsidies

203

(3)

n.a.

Other revenues

27

n.a.

Total revenues

1 711

741

+ 131%

Costs of goods sold

(459)

(291)

+ 58%

Purchases

(2 417)

(1 956)

+ 24%

Employees compensation

(3 145)

(2 304)

+ 37%

Other operating costs

(224)

(479)

- 53%

Total operating costs

(6 244)

(5 029)

+24%

Operating profit

(4 535)

(4 288)

+ 6%

Financial results

(136)

(330)

- 59%

Non Current results

28

(10)

n.a.

Research tax credit

883

722

+ 22%

Net Results

(3 760)

(3 905)

- 4%

Average headcount (FTE)

29

24

+21%

Theraclion SA has achieved a turnover of €1,481K in 2021, an

increase of 99% compared to 2020. 5 systems were sold in 2021

versus 1 in 2020. It is adopting a sustained investment policy

while keeping its expenses under strict control to execute its

development strategy. Cash needs are covered for the next 12

months

Theraclion continues to develop its technology while keeping its

expenses under tight control, resulting in an increase in operating

expenses of €1 million compared to a particularly lean 2020. In

2020, total operating costs had decreased by 37% compared to 2019,

mainly due to the abandonment of variable compensation and the

implementation of furlough during the first covid containment when

premises were closed.

In total, the company maintains its sustained investment policy

with total R&D costs standing at €3.8m (compared to €2.1m in

2020); this aggregate is strongly impacted by the increase in

payroll due to the non-renewal of Covid measures such as furlough,

with more than 80% of the workforce dedicated to it.

The financial result is a loss of 136 K€ for the year, mainly

due to currency exchange losses and interest on the government back

loans (PGEs) concluded to face the consequences of Covid19.

The research tax credit amounted to 883 K€ at the end of

December 2021 compared to 722 K€ due to the increase in research

expenses.

The control of operating costs, which varies in line with the

increase in revenues, results in a net loss of €3,760K, down 4%

compared to 2020.

In K€

2021/12/31

2020/12/31

Var.

Cash

2 462

2 314

+148

Medium term cash position

31

31

0

Total Cash & Cash

Equivalent

2 493

2 345

+148

Bank Loans

-2 750

-1 400

-1 350

Convertible debt

- 184

- 2 684

+2 500

Total debt

- 2 934

- 4 084

+1 150

Net Cash position

- 441

- 1 739

+1 298

Theraclion received cash advances from Oseo for an amount of €6

290K including capitalized interests. Its payback is based on

milestones which should not be achieved in the next five years.

Consequently the advance is not accounted for as a financial

debt.

Theraclion's cash position is €2.5 million at December 31, 2021.

Investors converted the whole €2.7 million of convertible debts

recorded end of 2020, they exercised warrants attached to the 3rd

tranche for €0.5 million and subscribed to convertible bonds for

€2.7 million, out of which the converted €2.5 million. In addition,

Theraclion received two additional PGEs during the first half of

2021 for a total of €1.5 million.

On March 1st, 2022, Theraclion completed a capital increase of

€6.5 million, including issue premium, which should allow

Theraclion to meet its cash flow needs for the next 12 months.

About Theraclion

At Theraclion we believe that surgery, as we know it, is

outdated. It converts optimistic patients into anxious individuals,

brilliant doctors into exhausted system executors and stretches

healthcare systems to the limit. We have disrupted this convention

by creating extracorporeal treatment platforms. We replace surgery

with a robotic treatment from outside the body using High Intensity

Focussed Ultrasound (HIFU). Our leading edge echotherapy platforms

are currently CE marked in non-invasive treatment of varicose veins

with SONOVEIN® and of breast fibroadenomas and thyroid nodules with

Echopulse®.

Located in Malakoff, near Paris, our employees live and breath

innovation by extensive clinical research and harness artificial

intelligence. The market of varicose veins treatment alone requires

around 5 million procedures annually. It is a dynamic market in

which we change paradigms by making non-invasive echotherapy the

new standard.

For more information, please visit www.theraclion.com and our

patient website https://echotherapie.com/echotherapy/

Theraclion is listed on Euronext Growth Paris Eligible for the

PEA-PME scheme Mnemonic: ALTHE - ISIN code: FR0010120402 LEI:

9695007X7HA7A1GCYD29

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220331005842/en/

Contacts Theraclion David Auregan Chief Operating Officer

david.auregan@theraclion.com Anja Kleber VP Marketing, Market

Access & Sales Francophonia anja.kleber@theraclion.com

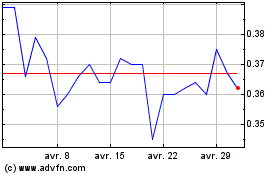

Theraclion (EU:ALTHE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Theraclion (EU:ALTHE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024