Thunderbird Resorts Inc. ("Thunderbird") (FSE: 4TR; and

Euronext: TBIRD) is pleased to announce that its 2021

Half-year report has been filed with the Euronext ("Euronext

Amsterdam") and the Netherlands Authority for Financial Markets

("AFM"). As a Designated Foreign Issuer with respect to

Canadian securities regulations, the Half-year report is intended

to comply with the rules and regulations set forth by the AFM and

the Euronext Amsterdam.

Copies of the 2021 Half-year report and Unaudited Consolidated

Financial Statements Report in the English language will be

available at no cost at the Group's website at

www.thunderbirdresorts.com. Copies in the English language are

available at no cost at the Group's operational office in Panama

and at the offices of our local paying agent ING Commercial

Banking, Paying Agency Services, Location Code TRC 01.013,

Foppingadreef 7, 1102 BD Amsterdam, the Netherlands (tel: +31 20

563 6619, fax: +31 20 563 6959, email: iss.pas@ing.nl). Copies

are also available on SEDAR at www.SEDAR.com.

Below are certain material excerpts from the full 2021 Half-year

report, the entirety of which can be found on our website at

www.thunderbirdresorts.com.

Dear Shareholders and Investors:

The below summarizes the Group's performance through June 30,

2021.

A. EBITDA: Peru property EBITDA decreased by

$268 thousand for the six months ending on June 30, 2021, as

compared to the same period in 2020. During the same period,

Nicaragua property EBITDA experienced an improvement of $1.4

million. Corporate expense reduced by $118 thousand. After netting

out corporate expense and expenses from our proportional ownership

in a Costa Rican real estate holding company, adjusted EBITDA

increased by $1.2 million and $687 thousand as compared to through

half-year 2020 and 2019, respectively.

B. Profit / (Loss): Based on continuing

operations, the Group experienced a profit of $210 thousand, an

improvement of $1.4 million and $1.7 million as compared to the

same period in 2020 and 2019, respectively. The improvement was

primarily due to higher revenue and to other corporate gains.

C. Net Debt: Due to a change in accounting

policy as required by IFRS 16, the Group is now required to account

for the net present value of real estate operating lease contracts

as Obligations under leases and hire purchase contracts.

Approximately $4.1 million of our net debt is comprised of

Obligations under leases and hire purchase contracts. Our Net

Debt reduced between 2020 and 2021 by $926 thousand.

1. IMPACT OF COVID-19 ON 2021 AND BEYOND

Covid-19 continues to impact our markets harder than in much of

the world. Having said that, Management has stabilized its

operations and its cash management. To be prudent, however, we

maintain unchanged our Management Statement on Going Concern, as

last updated in our 2020 Annual Report.

2. SHAREHOLDER MANDATE AND OUR ASSETS

We continue to pursue decisions that support the best interest

of shareholders according to the shareholder mandate set forth in

the Sept. 21, 2016, Special Resolutions. Please read the

following carefully.

A. Peru Real Estate Assets: As of the

publication of this 2021 Half-year Report, the Group continued to

operate and wholly own a mixed-use tower containing a 66-suite

hotel, approximately 6,703 m2 of rentable-sellable office space,

and 158 underground parking spaces. Please note the

following:

- The Group has begun a conversion of the 66-suite hotel into

condominiums. Of the 66 suites, 60 suites have a small

kitchen, living room, one bedroom and one-and-a-half

bathrooms. The remaining six penthouse suites have a full

kitchen, living-dining room, two bedrooms, two-and-a-half bathrooms

and a large balcony with views of the city and the ocean at a

distance. The Group is waiting for two final regulatory

approvals of the conversion. The suites, with 5,878 sellable

meters and public areas, will require approximately $600

thousand in upgrades. The Group is pleased that, as of the

date of this publication, it has signed pre-sale contracts (subject

to regulatory approvals) for 53 apartments containing approximately

4,509 m2. It has also signed pre-sale contracts, as part of

those apartment pre-sales, for 32 parking spaces. It is

important to understand that Peru is facing some political

uncertainty based on recent elections. The Group believes the

regulatory approvals will be achieved by the end of 2021 but has

absolutely no confirmation that this will be the case. Should

this be the case, the Group would expect a liquidity event from

this transaction in the first half of 2022.

- The Group is evaluating the conversion of its 6,703 m2 of

offices to apartments: Given the pre-sale performance of the

hotel conversion into condominium apartments, the Group has begun

an analysis of the conversion of its office complex (located in the

same building). We have contracted for construction plans and

are in the budgeting mode. We have active tenants; the

construction budget would likely be in excess of $3 million, and

the timing of such a project could take one to two years. The

Group will keep shareholders apprised.

- Nicaragua Gaming and Real Estate

Assets: As of the publication date of this 2021

Half-year Report, continued to own a 56% interest in a Nicaraguan

holding company that owns the following assets: i) Gaming: Five

full casinos and two slot parlors with a combined approximately 858

gaming positions; and ii) Real Estate: Approximately 4,562 m2 of

land divided among five parcels, and some with tenant

improvements, as more fully detailed on page 10.

- Costa Rica Real Estate Asset: As of the

publication of this 2021 Half Year Report, the Group continues to

own a 50% interest in a Costa Rican entity that owns the

11.6-hectare real estate property known as "Tres Rios". Tres

Rios, with its own, dedicated off-ramp, is located close to the

country's second-largest mall on the highway between the capital

city of San Jose and the commuter city of Cartago.

- Evaluation of change in business

model: While the Group continues to perform on the

shareholder mandate and is actively working on ways to liquidate

assets, it is also evaluating a change to its business

model. That change, if it were to occur, would likely involve

bringing blockchain-based, decentralized finance tools and/or

platforms to the finance of real estate funds and/or to the capital

stack of professionally managed real estate developments in

emerging markets. The Group has been actively investigating

the space through conversations with industry players,

conversations with counsel in various jurisdictions, participation

in conferences and the like. The Group's current position is

one of increasingly visible investigation, which visibility is

requiring it to notify the market at this time. Regardless,

the Group has no material announcements and has made no decisions

while in active learning and engagement mode, but the Group does

note that decentralized finance will over years likely change how

real estate is acquired, collateralized, developed and monetized

and believes there is a possible role for it in emerging markets of

which the Group has developed substantial expertise over 25 years

of real estate development in Latin America and Asia.

GROUP OVERVIEW: The Group's consolidated

profit/ (loss) summary for the six months ended June 30, 2021,

as compared with the same period of 2020, is contained in the

Group's 2021 Half-year Report, located at

www.thunderbirdresorts.com. In summary, Group revenue increased by

$1.0 million or 18.0%, while adjusted EBITDA increased by $1.2

million or 143.7%.

During the half-year ended June 30, 2021, the Group engaged in

the following listed material events:

- The Group has begun a conversion of the 66-suite hotel into

condominiums: Of the 66 suites, 60 suites have a small kitchen,

living room, one bedroom and one-and-a-half bathrooms. The

remaining six penthouse suites have a full kitchen,

living-dining room, two bedrooms, two-and-a-half bathrooms and a

large balcony with views of the city and the ocean at a

distance. The Group is waiting for two final regulatory

approvals of the conversion. The suites, with 5,878 sellable

meters, and public areas will require approximately $600 thousand

in upgrades. The Group is pleased that, as of the date of this

publication, it has signed pre-sale contracts (subject to

regulatory approvals) for 53 apartments containing approximately

4,509 m2. It has also signed pre-sale contracts, as part of

those apartment pre-sales, for 32 parking spaces. It is

important to understand that Peru is facing some political

uncertainty based on recent elections. The Group believes the

regulatory approvals will be achieved by the end of 2021, but has

absolutely no confirmation that this will be the case. Should

this be the case, the Group would expect a liquidity event from

this transaction in the first half of 2022.

- The Group is evaluating the conversion of its 6,703 m2 of

offices to apartments: Given the pre-sale performance of the hotel

conversion into condominium apartments, the Group has begun an

analysis of the conversion of its office complex (located in the

same building). We have contracted for construction plans and are

in the budgeting mode. We have active tenants, the construction

budget would likely be in excess of $3 million, and the timing of

such a project could take one to two years. The Group will

keep shareholders apprised.

- On June 15, 2021, George Gruenberg, a member of Thunderbird

Resorts Inc. Board of Directors, passed away. Mr. Gruenberg had

been a director of the Company since December 2013. The Group

further announced that Reto Stadelmann was elected to the board

pursuant to the Company's charter. Mr. Stadelmann previously joined

the Group as a Director in June 2012 and resigned that position in

February 2016 to pursue other business interests. Mr. Stadelmann

joined the Company's audit committee with a world of business and

financial experience.

- Evaluation of change in change in business model: While

the Group continues to perform on the shareholder mandate and is

actively working on ways to liquidate assets, it is also evaluating

a change to its business model. That change, if it were to

occur, would likely involve bringing blockchain-based,

decentralized finance tools and/or platforms to the finance of real

estate funds and/or to the capital stack of professionally managed

real estate developments in emerging markets. The Group has

been actively investigating the space through conversations with

industry players, conversations with counsel in various

jurisdictions, participation in conferences and the like. The

Group's current position is one of active and increasingly visible

investigation, which visibility is requiring it to notify the

market at this time. Regardless, the Group has no material

announcements and has made no decisions while in active learning

and engagement mode, but the Group does note that decentralized

finance will over years likely change how real estate is acquired,

collateralized, developed and monetized and believes there is a

possible role for it in emerging markets of which the Group has

developed substantial expertise over 25 years of real estate

development in Latin America and Asia.

RISK MANAGEMENT: For more detail on Risk

Factors, see Chapter 5 of the Group's 2021 Half-year Report.

MANAGEMENT STATEMENT ON "GOING CONCERN": This

statement is made taking into account the global health crisis and

economic fallout caused by the pandemic Covid-19. There is

instability in our markets and globally that could impact on Group

activities in ways that are currently unpredictable. To

account for the unpredictable conditions, in forecasting future

cash flows in our assessment of Going Concern, Management has made

certain extraordinary assumptions. Specifically, we have:

- Forecast a materially negative impact on revenue for the

years 2020 and 2021, with revenues returning to 2019 levels only as

of 2022.

- Forecast expenses to remain approximately at the levels

they are as on date of publication of our 2020 Annual Report,

meaning we are assuming (for Going Concern assessment only) that

the Group has no more flexibility to drive down expenses

further.

- Assumed that: a) A portion of our secured debt will be

restructured as an interest-only loan through 2021; and b) Our

remaining unsecured debt will be deferred and repaid against

liquidity events.

- Assumed no development nor material construction, but do

assume some repurposing of existing real estate to accommodate for

changes in demand.

- Forecast no extraordinary one-time events that may impact

positively or negatively on the Group's cash flows, though such

events are possible particularly given the environment.

- Assumed a stable regulatory environment in all countries with

existing operations, and have forecasted receiving no governmental

support apart from what has already been received as described in

Other Group Events on pages 11 and 12.

Management has reviewed their plan with the Directors and has

collectively formed a judgment that the Group has adequate

resources to continue as a going concern for the foreseeable

future, which Management and the Directors have defined as being at

least the next 12 months from the filing of this 2021 Half-year

Report. In arriving at this judgment, Management has prepared the

cash flow projections of the Group.

Directors have reviewed this information provided by Management

and have considered the information in relation to the financing

uncertainties in the current economic climate, the Group's existing

commitments and the financial resources available to the

Group. Specifically, Directors have considered: (i) there are

probably no sources of new financing available to the Group; (ii)

the Group has limited trading exposures to our local suppliers and

retail customers; (iii) other risks to which the Group is exposed,

the most significant of which is considered to be regulatory risk;

(iv) sources of Group income, including management fees charged to

and income distributed from its various operations; (v) cash

generation and debt amortization levels; (vi) fundamental trends of

the Group's businesses; (vii) ability to re-amortize and unsecured

lenders; and (vii) level of interest of third parties in the

acquisition of certain operating assets, and status of genuine

progress and probability of closing within the Going Concern

period. The Directors have also considered certain critical

factors that might affect continuing operations, as follows:

- Special Resolution: On September 21, 2016, the Group's

shareholders approved a special resolution that, among other items,

authorized the Board of Directors of the Corporate to sell "any or

all remaining assets of the Corporation in such amounts and at such

times as determined by the Board of Directors." This

resolution facilitates the sale of any one or any combination of

assets required to support maintaining of a going concern by the

Group.

- Corporate Expense and Cash Flow: Corporate expense has

decreased materially in recent years, but still must accommodate

for compliance as a public company.

- Liquidity and Working Capital: As of the date of publication of

this 2021 Half-year Report, the Group forecasts operating with low

levels of reserves and working capital. Selling assets will

be critical to creating a healthy level of working capital reserves

for periods beyond the Going Concern period, which ability to

liquidate assets is currently unknown.

Considering the above, Management and Directors are satisfied

that the consolidated Group has adequate resources to continue as a

going concern for at least the 12 months following the filing date

of this report. For these reasons, Management and Directors

continue to adopt the going concern basis in preparing the

consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (Expressed in

thousands of United States dollars) for the half-year ended June

30, 2021, were approved by the Board of Directors on Sept. 30,

2021, and are contained in the Half-year Report for 2021 posted at

www.thunderbirdresorts.com. The consolidated financial statements

and the accompanying notes are an integral part of these

consolidated financial statements.

ABOUT THE COMPANY

We are an international provider of branded casino and

hospitality services, focused on markets in Latin America. Our

mission is to "create extraordinary experiences for our guests."

Additional information about the Group is available at

www.thunderbirdresorts.com. Contact: Peter LeSar, Chief Financial

Officer ∙ Email: plesar@thunderbirdresorts.com

Cautionary Notice: The Half-year Report

referred to in this release contains certain forward-looking

statements within the meaning of the securities laws and

regulations of various international, federal, and state

jurisdictions. All statements, other than statements of historical

fact, included in the Half-year Report, including without

limitation, statements regarding potential revenue and future plans

and objectives of Thunderbird are forward-looking statements that

involve risk and uncertainties. There can be no assurances that

such statements will prove to be accurate and actual results could

differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from Thunderbird's forward-looking statements include

competitive pressures, unfavorable changes in regulatory

structures, and general risks associated with business, all of

which are disclosed under the heading "Risk Factors" and elsewhere

in Thunderbird's documents filed from time to time with the

Euronext Amsterdam and other regulatory authorities. Included in

the Half-year Report are certain "non-IFRS financial measures,"

which are measures of Thunderbird's historical or estimated future

performance that are different from measures calculated and

presented in accordance with IFRS, within the meaning of applicable

Euronext Amsterdam rules, that are useful to investors. These

measures include (i) Property EBITDA consists of income from

operations before depreciation and amortization, write-downs,

reserves and recoveries, project development costs, corporate

expenses, corporate management fees, merger and integration costs,

income/(losses) on interests in non-consolidated affiliates and

amortization of intangible assets. Property EBITDA is a

supplemental financial measure we use to evaluate our country-level

operations. (ii) Adjusted EBITDA represents net earnings before

interest expense, income taxes, depreciation and amortization,

equity in earnings of affiliates, minority interests, development

costs, and gain on refinancing and discontinued operations.

Adjusted EBITDA is a supplemental financial measure we use to

evaluate our overall operations. Property EBITDA and Adjusted

EBITDA are supplemental financial measures used by management, as

well as industry analysts, to evaluate our operations. However,

Property and Adjusted EBITDA should not be construed as an

alternative to income from operations (as an indicator of our

operating performance) or to cash flows from operating activities

(as a measure of liquidity) as determined in accordance with

generally accepted accounting principles. Thunderbird's documents

are filed from time-to-time with the Euronext Amsterdam and other

regulatory authorities.

This content was issued through the press release distribution

service at Newswire.com.

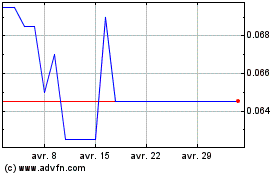

Thunderbird Resorts (EU:TBIRD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Thunderbird Resorts (EU:TBIRD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024