- A cash position of nearly €22M (excluding potential additional

revenue) at the end of December 2021, securing the execution of the

strategic roadmap through to the first half of 2024;

- 2021: new steps taken on the roadmap;

- 2022: a decisive year with the completion of several clinical

trials in the portfolio's major indications that should pave the

way for future commercialization.

Regulatory News:

Valbiotis (FR0013254851 – ALVAL, PEA/SME eligible), a Research

and Development company committed to scientific innovation for

preventing and combating metabolic diseases, announces its results

for the 2021 fiscal year and provides an update on recent

advances.

Key events in 2021: new advances ahead of a decisive fiscal year

2022

TOTUM•63, prediabetes

- Continuation of the last phase of clinical development

This latest Phase II/III clinical study (REVERSE-IT) was

designed with Nestlé Health Science teams and financed by the

partnership. The main objective of this study is to confirm the

positive Phase II results on fasting blood glucose, a

well-established risk factor for type 2 diabetes. REVERSE-IT

continued throughout FY2021. The study is being conducted in more

than 50 clinical centers worldwide. In January 2022, Valbiotis

announced that it expects to complete recruitment in the second

quarter of 2022 with results expected in the fourth quarter of

2022.

- Exploratory clinical mode of action study conducted by the

Institute of Nutrition and Functional Foods (INAF) at Laval

University, Quebec City

This study will be conducted on 20 volunteers and will explore

many mechanistic parameters of the pathophysiology of prediabetes

and type 2 diabetes. It is intended to strengthen the scientific

and commercial value of TOTUM•63.

Announced in May 2021, this patent grants broad protections on

the composition and use of TOTUM•63. It also grants exclusive

commercial rights in this strategic country as one of the most

affected by metabolic diseases, where the prevalence of prediabetes

in the adult population is estimated at 35%, or 390 million people,

and that of overweight and obesity at 50%. This patent, which has

now been acquired in nearly 50 countries including Europe, the

United States and China, is a concrete expression of the Company's

global protection strategy.

Finally, news on TOTUM•63 was also marked by publications in

three international scientific journals (American Journal of

Physiology - Endocrinology and metabolism, International Journal of

Obesity and Nutrients journal), describing its multi-target

mechanism of action. These publications have validated the work

done in the R&D program for the active substance since its

discovery in 2015.

TOTUM•854, blood pressure reduction For TOTUM•854, the positive

preclinical results obtained in hypertension were selected and

presented by the European Society of Hypertension (ESH) and the

International Society of Hypertension (ISH). In vivo results in

predictive models of hypertension in humans have shown that

TOTUM•854 effectively prevents hypertension. This proof of concept

was obtained in partnership with the Cardiovascular Pharm-Ecology

Laboratory (LaPEC) of the University of Avignon as well as within

the Valbiotis R&D platform. Buoyed by these positive

preclinical results, the Company announced in December 2021 that it

had submitted three clinical protocols for TOTUM•854 in blood

pressure reduction to the relevant authorities (the studies have

since been launched):

- The INSIGHT and INSIGHT 2 clinical trials,

international Phase II/III studies with recruitment expected to end

in the first half of 2023; - A clinical bioavailability and mode of

action study to characterize its metabolites and identify their

effects on human cell lines. Results are expected in the fourth

quarter of 2022.

This strategy will allow Valbiotis to build a complete claim

file. This acceleration would allow for commercialization by a

major healthcare player as soon as Phase II/III results are

available, up to 3 years ahead of the initial plan.

As a reminder, the market for mild to moderate hypertension in

the United States and in the primary European countries is

estimated at 1.15 billion euros (study conducted in 2020 by the

firm AEC).

TOTUM•070, reduction of LDL-cholesterol concentration in the

blood For TOTUM•070, 2021 began with the launch of a multicenter,

randomized, placebo-controlled, double-blind, Phase II HEART

clinical trial including 120 people with untreated mild to moderate

high LDL-cholesterol. Its primary endpoint is the reduction of

blood LDL-cholesterol levels, a cardiovascular risk factor.

Recruitment of the final, randomized volunteer was announced in

early September 2021, with results to be reported in the second

quarter of 2022, similar to the results of the clinical

bioavailability and mode of action study.

Meanwhile, in November 2021, TOTUM•070's positive preclinical

results on high cholesterol were selected and presented at the

American Heart Association (AHA) annual meeting. They demonstrated

a 38-47% reduction in "bad" cholesterol (including LDL-cholesterol)

by TOTUM•070, as well as a reduction in total cholesterol and blood

triglycerides, in two in vivo models predictive of human

physiology. These initial data suggest that TOTUM•070 has a

multi-targeted mode of action, with effects revealed on the gut and

liver, involving lipid metabolism and inflammation. All these data

pave the way for promising clinical developments.

TOTUM•448, reduction of hepatic steatosis TOTUM•448 is the

fourth active substance in the Valbiotis portfolio and is being

developed to address unmet needs in the management of metabolic

liver diseases: non-alcoholic fatty liver and non-alcoholic

steatohepatitis (NAFL and NASH).

The development plan has been updated to meet the challenges

imposed by these emerging pathologies, for which effective

preventive and therapeutic strategies have yet to be developed.

This plan will be based on an innovative study design, in ‘real

life’, in healthcare centers and in direct connection with patient

care. Combined with clinical mode of action studies, this work on

the ground positions TOTUM•448 very well on the management of NAFL

and NASH.

New R&D area: microalgae Finally, the latest advances in

Research and Development, Valbiotis has integrated the exploration

of microalgae produced in New Caledonia into its portfolio, through

an exclusive agreement with ADECAL-Technopole and IFREMER. This

program should make it possible to develop a bank of high-potential

strains selected by ADECAL-Technopole and IFREMER in New Caledonia

since 2013 as part of the joint research project "AMICAL".

In addition to the progress made in the field of Research and

Development, this year, Valbiotis obtained ISO 9001 certification

awarded by AFNOR. This certification guarantees all of the

Company's partners control over all Discovery, Preclinical

Research, Clinical Research, Production, as well as product quality

management.

Valbiotis has also strengthened its management structure by

appointing Sébastien Bessy, international expert in Consumer

Healthcare, as Director of Marketing and Sales Operations.

Previously Vice President of Global Strategic Operations Consumer

Healthcare at Ipsen, Sébastien Bessy has more than 20 years of

experience in international marketing strategy, sales strategy,

portfolio strategy and business development. This appointment comes

at a key time in the acceleration of the Company's growth, with

four active substances now in clinical phase.

On the financial front, Valbiotis successfully completed a €15

million private placement capital increase in April 2021 with the

issuance of 1,930,000 new shares at a unit price of €7.80.

Financing needs are assured until the first half of 2024. The

financial situation is therefore secure in the long term. In

addition, Valbiotis has received €1.25M in innovation support from

Bpifrance (€750,000 Research and Development Innovation Loan and

€500,000 Investment Seed Loan).

As at December 31, 2021, Valbiotis had a cash position of

€21,819,000, up nearly 50% compared to December 31, 2020. At this

time, the cash flow horizon is estimated to be the first half of

2024 and does not take into account additional milestone payments

and potential royalties that could be received from Nestlé Health

Science or additional revenue that could be generated from new

strategic partnerships on other products in the portfolio.

2021 annual results: a perfectly controlled financial situation

that is well positioned for future developments The Company’s 2021

financial statements prepared in accordance with IFRS standards

were approved by the Executive Board on March 9, 2022. They have

been audited by the Statutory Auditor and are available on the

Valbiotis website: www.valbiotis.com/investors.

Income statement - IFRS in €K, as at

December 31

2021

2020

Operating income including

2,693

5,099

Turnover

298

3,092

Grants

645

750

Research Tax Credit

1,750

1,258

R&D expenditure

-7,028

-5,411

Sales & Marketing expenditure

-1,509

-1,031

Overhead expenditure

-1,115

-1,387

Operating profit for the period

-8,475

-3,407

Operating profit

-8,475

-3,407

Earnings before tax

-8,681

-3,829

Net income

-8,681

-3,829

IFRS in €K

2021

2020

Cash flow from operating activities

-7,156

2,693

Cash flow from investing activities

-7

-332

Cash flow from financing activities

14,398

4,191

Change in cash position

7,235

6,552

Closing cash position

21,819

14,585

In 2021, Valbiotis generated a turnover of €298,000, in light of

the 5 million Swiss franc (€4,679,000) upfront payment spread over

the duration of the licensing agreement under the partnership with

Nestlé Health Science.

In addition to turnover, operating income (€2,693,000) consists

mainly of the Research Tax Credit acquired during the period

(€1,750,000) and grants (€645,000), which remained stable during

the year.

Research and Development expenses increased by 30% to €7,028,000

(compared to €5,411,000 in 2020). This anticipated increase

includes the continuation of the Phase II/III clinical trial,

REVERSE-IT, on TOTUM•63, the launch of the Phase II clinical trial

on TOTUM•070 and the continuation of preclinical research work on

the Riom technical platform.

Sales and marketing expenses were up 46% to €1,509,000 (compared

to €1,031,000 in 2020). This increase, again expected, reflects the

intensification of marketing and sales efforts to prepare for

future opportunities. The increase in personnel costs illustrates

the need to strengthen the Group’s management structure in order to

secure the execution of the business plan for the various

indications in the portfolio.

Cash flow from operating activities amounted to (€7,156,000) in

2021, reflecting the intensification of research and development

work. Cash flows from investing activities were negative by €7,000.

Cash flows from financing activities were positive by €14,398,000,

mainly due to the private placement capital increase in April 2021,

for a gross amount of €15M, as well as to two loans obtained from

Bpifrance for an amount of €1.3M.

As at December 31, 2021, Valbiotis had a cash position of

€21,819,000, up 49% compared to the available liquid assets at the

end of December 2020 (€14,595,000).

To date, taking into account in particular:

- its €21,819,000 in available liquid assets

on December 31, 2021, - its operating expenses related to its

current development plan, - the maturity of its current financial

debt.

Valbiotis considers that it does not face a liquidity risk with

an estimated cash flow horizon of the first half of 2024. This cash

flow horizon does not take into account additional milestone

payments that may be made to Nestlé Health Science, nor additional

revenue that may be generated from new strategic partnerships.

2022: a decisive year with the completion of several clinical

trials on the portfolio's major indications

After 2021, a year of background work, which enabled us to reach

new milestones in the clinical plans of the portfolio's main active

substances, 2022 will be a pivotal year with major clinical results

expected in three key indications: prediabetes, high cholesterol

and blood pressure:

- TOTUM•63 (prediabetes): end of recruitment

planned for the second quarter with results expected in the fourth

quarter of 2022 for the pivotal Phase II/III REVERSE-IT study and

completion of the mode of action clinical study by INAF; -

TOTUM•070 (high cholesterol): results of the Phase II HEART

clinical efficacy study and the clinical bioavailability and mode

of action study (second quarter 2022); - TOTUM•854 (blood

pressure): results of the bioavailability and mode of action

clinical study (fourth quarter 2022) and launch of the two Phase

II/III clinical studies INSIGHT and INSIGHT 2. In February 2022,

these two randomized, placebo-controlled studies were authorized,

paving the way for the recruitment of 800 volunteers, which should

be completed in the first half of 2023. Their results are essential

for a health claim application and will follow the protocols

validated by the competent authorities.

Sébastien Peltier, CEO, Chairman of the Board of Valbiotis,

states: "We closed 2021 with a strong financial position that will

allow us to continue to execute our business plan across our entire

product portfolio with confidence. 2022 thus promises to be a key

year with major clinical results expected on our primary active

substances. Thanks to these results, we intend to demonstrate the

efficacy of our innovations for patients and impose our innovative

model in the prevention of metabolic and cardiovascular diseases.

They should also enable us to prepare for future commercialization,

particularly in prediabetes, alongside our partner Nestlé Health

Science. We are therefore looking forward to the coming months with

even greater mobilization and enthusiasm to achieve our position as

an innovative player in health nutrition."

Valbiotis' annual financial report on December 31, 2021, has

been made available to the public and filed with the AMF. This

document is available on the website:

www.valbiotis.com/investors.

Valbiotis confirms that it complies with the PEA-SME eligibility

criteria specified in Article D.221-113-5 of the regulatory decree

no. 2014-283 of March 4, 2014, namely:

- A total workforce of fewer than 5,000

employees; - A total turnover of less than 1.5 billion euros or

total assets of less than 2 billion euros.

As a result, Valbiotis shares continue to be included in PEA-SME

accounts, which benefit from the same tax advantages as the

traditional equity savings plan (PEA).

About Valbiotis

Valbiotis is a Research & Development company committed to

scientific innovation for preventing and combating metabolic

diseases in response to unmet medical needs. Valbiotis has adopted

an innovative approach, aiming to revolutionize healthcare by

developing a new class of health nutrition products designed to

reduce the risk of major metabolic diseases, relying on a

multi-target strategy enabled by the use of plant-based terrestrial

and marine resources. Its products are intended to be licensed to

players in the health sector. Created at the beginning of 2014 in

La Rochelle, the Company has forged numerous partnerships with

leading academic centers. The Company has established three sites

in France – Périgny, La Rochelle (17) and Riom (63) – and a

subsidiary in Quebec City (Canada). Valbiotis is a member of the

"BPI Excellence" network and has been recognized as an "Innovative

Company" by the BPI label. Valbiotis has also been awarded "Young

Innovative Company" status and has received major financial support

from the European Union for its research programs via the European

Regional Development Fund (ERDF). Valbiotis is a PEA-SME eligible

company. For more information about Valbiotis, please visit

www.valbiotis.com

Name: Valbiotis ISIN Code: FR0013254851

Mnemonic code: ALVAL EnterNext© PEA-PME 150

This press release contains forward-looking statements about

Valbiotis’ objectives. Valbiotis considers that these projections

are based on rational hypotheses and the information available to

Valbiotis at the present time. However, in no way does this

constitute a guarantee of future performance, and these projections

may be affected by changes in economic conditions and financial

markets, as well as certain risks and uncertainties, including

those described in the Valbiotis Universal Registration Document

approved by the French Financial Markets Regulator (AMF) on July

27, 2021 (application number R 21-039). This document is available

on the Company’s website (www.valbiotis.com). This press release

and the information it contains do not constitute an offer to sell

or subscribe, or a solicitation to purchase or subscribe to

Valbiotis’ shares or financial securities in any country.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220315005696/en/

Corporate communication / Valbiotis Carole ROCHER / Marc

DELAUNAY +33 5 46 28 62 58 media@valbiotis.com

Medias relations / PrPa Damien MAILLARD +33 6 80 28 47 70

damien.maillard@prpa.fr

Financial communication / Actifin Stéphane RUIZ +33 1 56 88 11

14 sruiz@actifin.fr

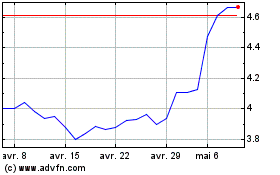

Valbiotis (EU:ALVAL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Valbiotis (EU:ALVAL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024