Vallourec reports

fourth quarter and full

year

2021

results

Meudon

(France), February

24th

2022 –

Vallourec, a world leader in premium tubular solutions, announces

today its results for the fourth quarter and full year 2021. The

Board of Directors of Vallourec SA, meeting on February 23rd 2022,

approved the Group's fourth-quarter and full-year 2021

accounts.

FY 2021:

Strong EBITDA

growth with margin up

over 600 bps

- €3,442 million

revenue, up 6.1% YoY

- €492 million

EBITDA, up 91% YoY, EBITDA margin increasing to 14.3% vs. 8% in

2020

- Positive net

income at €40 million

- Free cash flow

at €(284) million mainly reflecting working capital rebuild of

€172million and one-time charges, which include financial

restructuring costs

- Strong liquidity

position at €1,081 million as of December 31st, 2021

|

Q4 2021: solid

year-on-year revenue and EBITDA growth

- €1,064 million

revenue, up 28.1% YoY

- €136 million

EBITDA, up 79% YoY, margin increasing to 12.8% vs. 9.2% in Q4

2020

- Positive free

cash flow at €17 million

|

Operational

efficiency

- Focus on value

vs. volume to be implemented across the business enterprise

- Transformational

footprint actions announced in Q3 2021 are well on track, both for

the disposal process of German assets and for the preparation of

the transfer of their Oil & Gas activity to low-cost operations

in Brazil

- Good momentum on

savings in 2022, and evaluating potential additional cost savings

initiatives

- Reinforcing

Group priority of cash discipline, with focus on inventory

management

|

2022 Outlook

- In North

America, favourable market conditions leading to strong improvement

in financial performance

- In other

markets, overall increase in volumes and prices somewhat offset by

inflation headwinds

- Iron ore prices

as per consensus1

- Gradual restart

of iron ore mine is targeted for Q2 subject to finalization of

conditions precedent with the Brazilian mining authorities

- Based on these

assumptions, the Group is expecting a further improvement of its

full-year 2022 EBITDA relative to 2021

|

Edouard Guinotte,

Chairman of the Board of

Directors and Chief Executive

Officer,

declared:

“Vallourec has delivered a very robust Q4 with

strong revenue and profitability growth, leveraging the

fundamentals of a positive Oil & Gas market. In this context,

our Oil & Gas business improved significantly in North America,

while recovery in EA-MEA markets is progressing more slowly. Across

the Group, Vallourec has benefited from an increased order book at

year end 2021, to be delivered in 2022. Iron ore prices softened in

Q4, but our business remains solidly profitable given our low-cost

and flexible production model.

The transformational footprint action which the

Group announced last quarter continues. It will significantly

simplify the operations of the Group, lowering Vallourec’s

break-even point and allowing the Group to remain solidly

profitable through cycle.

Looking forward, the Oil & Gas market should

continue to develop positively, with high prices creating favorable

conditions for E&P operators. We expect such positive momentum

in most of our markets and particularly in North America, despite

the consequences of the incident at the mine. Inflation is starting

to affect some of our costs in every region, which will create some

offset to positive price movements but will ultimately support

higher finished product prices in the future.

Finally, we are proud that the Group has added

high-level ESG audited ratings to its track record. It

differentiates us from our peers and paves the way for future

growth opportunities.”

Key figures

|

Full year 2021 |

Full year 2020 |

Change |

In € million |

Q4 2021 |

Q4 2020 |

Change |

|

1,640 |

1,599 |

2.6% |

Production shipped (k tons) |

510 |

408 |

24.9% |

|

3,442 |

3,242 |

6.1% |

Revenue |

1,064 |

830 |

28.1% |

|

492 |

258 |

+€234m |

EBITDA |

136 |

76 |

+€60m |

|

14.3% |

8.0% |

+6.3p.p. |

(as a % of revenue) |

12.8% |

9.2% |

+3.6p.p. |

|

374 |

(1,002) |

na |

Operating income (loss) |

75 |

(495) |

na |

|

40 |

(1,206) |

na |

Net income, Group share |

89 |

(570) |

na |

|

(284) |

(111) |

-€173m |

Free cash-flow |

17 |

112 |

-€95m |

|

958 |

2,214 |

-€1,256m |

Net debt |

958 |

2,214 |

-€1,256m |

I - CONSOLIDATED

REVENUE BY MARKET

|

Full year 2021 |

Full year

2020 |

Change |

At constant exchange rates |

In € million |

Q4 2021 |

Q4 2020 |

Change |

At constant exchange rates |

|

2,056 |

2,207 |

-6.8% |

-4.8% |

Oil & Gas, Petrochemicals |

709 |

566 |

25.4% |

21.0% |

|

1,241 |

826 |

50.2% |

59.9% |

Industry & Other |

306 |

225 |

36.0% |

38.8% |

|

145 |

210 |

-30.7% |

-31.7% |

Power Generation |

48 |

39 |

22.4% |

14.8% |

|

3,442 |

3,242 |

6.1% |

10.0% |

Total |

1,064 |

830 |

28.1% |

25.5% |

In the

fourth quarter of

2021,

Vallourec had revenues of

€1,064

million, up

approximately

28%

compared with

the fourth quarter

of

2020

(+25.5%

at constant exchange

rates)

with:

- 25% volume increase mainly driven

by Oil & Gas in North America and Industry & Other

- 1% price/mix effect

- 3% currency conversion effect

mainly related to EUR/BRL.

Over the full

year of

2021,

revenue totaled

€3,442

million, increasing by

6% versus the

full year of

2020 (+10% at constant exchange

rate) with:

- 3% volume effect mainly driven by

higher deliveries in Industry and Other more than offsetting lower

Oil & Gas shipments in EA-MEA.

- 7% price/mix effect mainly driven

by higher iron ore prices and improved Oil &Gas prices in North

America.

- (4)% currency conversion effect

mainly related to EUR/BRL.

Oil & Gas, Petrochemicals

(66.7%

of Q4

2021

consolidated

revenue)

In Q4

2021, Oil & Gas

revenue reached

€647

million, increasing by

23% year-on-year

(+18.5%

at constant exchange

rates).

- In North

America, Oil & Gas revenue more than doubled thanks to

higher prices and volumes.

- In EA-MEA, Oil

& Gas revenue decreased; the higher deliveries were more than

offset by an unfavorable price/mix (Q4 2020 was positively impacted

by high alloy products deliveries).

- In South

America, revenue increased, driven by higher activity in

Oil & Gas and project line pipes.

Over the

full year of

2021,

Oil & Gas revenue

totaled

€1,859

million, decreasing by

7%

year-on-year

((5.3)%

at constant exchange

rates), the lower activity in

EA-MEA following the reduced order intake in 2020, was not offset

by higher revenue and deliveries in North America which picked up

in the second half the year, and in South America.

In Q4

2021, Petrochemicals

revenue was

€63

million, up 61% year-on-year (up

54.4% at constant exchange rates) notably due to a better price/mix

and to an increase in deliveries in South America and North

America.Over the full

year of

2021,

Petrochemicals revenue totaled €197

million, down 1.7% year-on-year (up 0.4% at

constant exchange rates).

In Q4

2021,

revenue for Oil & Gas and Petrochemicals

amounted to €709

million, up

25% compared with Q4 2020 (up 21%

at constant exchange rates).

Over the

full year of

2021,

revenue for Oil & Gas and Petrochemicals

totaled

€2,056

million, down

6.8% compared with the full year

of 2020 (down (4.8)% at constant exchange rates).

Industry & Other

(28.8%

of Q4

2021

consolidated

revenue)

In Q4 2021, Industry

& Other revenue amounted to

€306

million,

increasing by

36% year-on-year

(+39%

at constant exchange rates):

- In Europe, Industry revenue was up,

reflecting higher volumes.

- In South America, Industry &

Other revenue was stable. The lower iron ore contribution resulting

from price decrease and lower volume (1.7Mt versus 2.3Mt) was

offset by higher sales recorded in Industry markets mainly driven

by Mechanical Engineering and Automotive.

Over the

full year of

2021, Industry &

Other revenue totaled €1,241

million, up

50% year-on-year (up 60% at

constant exchange rates) as a result of a higher contribution from

the mine (reflecting higher iron ore prices and volumes at 8.1Mt

versus 7.9Mt in 2020) and of higher deliveries in Industry markets

in Europe and South America, despite an unfavorable currency

conversion effect.

Power Generation

(4.5%

of Q4

2021 consolidated

revenue)

In Q4 2021, Power

Generation revenue amounted to

€48

million, increasing

by 22%

year-on-year (+15% at constant exchange

rates).

For the

full year of

2021,

revenue totaled €145

million, down

31%

year-on-year ((32)% at constant

exchange rates), reflecting notably the disposal of Valinox

Nucléaire SAS on May 31, 2021.

II

– CONSOLIDATED RESULTS

ANALYSIS

Q4

2021

consolidated results analysis

In Q4

2021,

EBITDA reached

€136 million

(compared with €76 million in Q4 2020), and

EBITDA margin

increased to

12.8%

of revenue (versus 9.2% in Q4

2020), as a result of:

- An industrial margin of €219

million, or 20.6% of revenue, versus €157 million and 18.9% of

revenue in Q4 2020. Higher deliveries and prices in the Oil &

Gas market in North America as well as to a lesser extent in the

Oil & Gas and Industry markets in Brazil did largely more than

offset the lower contribution of the mine, the lower activity of

the Oil & Gas market in EA-MEA, and the increase in raw

material and energy costs.

- Sales, general and administrative

costs (SG&A) at €83 million or 7.8% of revenue (versus 9.0% in

Q4 2020) increasing by 11%, in line with the activity

recovery.

Operating

income was

positive at €75

million, compared to €(495)

million in Q4 2020 (which was negatively impacted by impairment

charges and restructuring provisions), resulting mainly from the

EBITDA improvement, lower restructuring costs and lower

depreciation of industrial assets.

Financial

income was negative at

€(25)

million, compared with €(48) million

in Q4 2020, reflecting the new balance sheet structure.

Income tax amounted

to a positive

€40 million

mainly related to the partial reversal of deferred tax asset

provisions and a positive one-off recovery of tax credit, compared

to €(45) million in Q4 2020.

This resulted in

a positive net

income, Group

share, of

€89

million, compared to €(570)

million in Q4 2020.

FY

2021

consolidated results analysis

Over the full

year 2021, EBITDA

reached €492

million, a

€234 million

increase

year-on-year,

at

14.3%

of revenue, including:

- An industrial margin of €837

million, or 24.3% of revenue, increasing by 38% year-on-year,

reflecting a higher contribution of the mine in prices and volumes,

a higher activity in the Oil & Gas market in North America and

in Industry markets along with savings more than offsetting lower

activity in the Oil & Gas market in EA-MEA and the raw

materials and energy costs increase.

- Sales, general and administrative

costs (SG&A) down 3% at €316 million representing 9.2% of

revenue versus 10% in 2020.

Operating

income was positive at

€374

million compared

to a loss of

€(1,002) million

in full year

2020 (which was negatively impacted by impairment

charges for €850 million and by restructuring charges), resulting

from the improvement in EBITDA, lower depreciation of industrial

assets and the positive effects from the sale of Reisholz buildings

and land as well as from the favorable Brazilian Supreme Court

decision on PIS/COFINS tax claim.

Financial

income was negative

at

€(236)

million, compared to €(227) million

in full year 2020. Net interest expenses amounted to €147 million

versus €196 million in full year 2020. Other financial income was a

negative €(40) million, compared with €28 million in full year

2020, due largely to one-offs such as the €(70) million cost of

exercising the option of DBOT repurchase, partially offset by the

positive effects of the PIS/COFINS tax litigation in Brazil for €28

million. In addition, the financial restructuring had a negative

impact on financial income of €(42) million.

Income tax amounted to

€(101)

million mainly related to Brazil, including the partial

reversal of deferred tax asset provisions and a positive one-off

recovery of tax credit.

As a result, net

income,

Group share, amounted to

€40

million, compared to €(1,206)

million in full year 2020.

III

– CASH FLOW & FINANCIAL

POSITION

Cash flow from operating

activitiesIn

Q4

2021,

cash flow from operating activities

was positive at

€10

million, compared to €(18)

million in Q4 2020, reflecting mainly the improved EBITDA and

lower financial interests paid, partly offset by higher

tax.For the full year

2021,

cash flow from operating activities was

positive at €26

million compared to €(146) million in full year

2020, mainly due to higher EBITDA and lower interest expense, more

than offsetting an increase in tax expense. 2021 cash flow results

included one-offs such as debt restructuring fees €(56 million),

the repurchase cost of the DBOT in Brazil (€72 million) partially

offset by a positive tax litigation settlement receipt in Brazil

(€28 million).

Operating working capital

requirementIn Q4 2021,

operating working

capital requirement

decreased by

€61

million, versus a decrease of €178 million in

Q4 2020. Net working capital requirement, excluding the impact

of the IFRS 5, stood at 85 days of sales, compared to 78 days in Q4

2020. Quarterly average net working capital requirement decreased

at 100 days of sales compared to 108 days in 2020.For the

full year of

2021, operating working

capital increased by

€(172)

million versus a decrease of €173 million in full

year 2020, mainly as a result of recovering activity.

CapexCapital

expenditure was

€54

million in Q4

2021, compared with €48 million

in Q4 2020, and was

€138

million in full

year

2021,

in line with 2020.

Free cash flowAs a result,

in Q4

2021,

free cash flow was

positive at

€17

million versus €112 million in Q4

2020. Free cash flow for

the full year

2021 was

negative at

€(284)

million, compared with €(111) million in full-year

2020, impacted notably by the working capital rebuild along with

the activity recovery and one-off charges, which include financial

restructuring costs.

Asset disposals &

other itemsIn Q4 2021, asset

disposals & other items amounted to

€19

million. For the full

year of

2021,

asset disposals & other items

amounted to

€1,540

million mainly as a result of the financial

restructuring.

Net debt and

liquidityAs of December 31, 2021, net debt stood at €958

million, compared with €993 million on September 30, 2021. As of

December 31, 2021, gross debt amounted to €1,577 million including

€91 million of fair value adjustment under IFRS 9 (which will be

reversed over the life of the debt). Long-term debt amounted to

€1,387 million, and short-term debt totaled €190 million.

As of December 31, 2021, lease debt stood at €48

million, compared with €71 million on September 30, 2021 following

the application of IFRS 5 standards.

Liquidity position was strong at €1,081 million,

with cash amounting to €619 million and undrawn committed Revolving

Credit Facility equal to €462 million.

IV – UPDATE ON

MINE

On January 8, 2022, following the exceptionally

heavy rainfall in Minas Gerais State (Brazil), some material from a

waste pile associated with the operations of Vallourec’s Pau Branco

mine slid into a rainwater dam (“the Lisa Dam”) causing it to

overflow, and resulting in the interruption of traffic on the

nearby highway. The structure of the dam was not affected, and

there were no casualties.

As a result of this incident, the operations of

the mine have been temporarily suspended. Vallourec plans to

restart them in the coming weeks subject to receiving the necessary

consents, at first without using the waste pile. In the meantime,

Vallourec is preparing the report on the waste pile stability to be

validated by the mining authorities. The mine could therefore reach

its full capacity during Q2.

In addition, on January 21, 2022, Vallourec

signed an agreement with the Public Prosecutor's Office regarding

the consequences of the overflow of the Lisa Dam. The agreement

includes the implementation of emergency measures, many of which

have already been completed, and a commitment to the environmental

restoration of the affected area. It also includes the provision of

BRL200 million (approximatively €35 million) as a guarantee in a

bank account held by Vallourec. As previously disclosed, Vallourec

confirms that the BRL288 million (approximately €50 million) fine

announced in January is currently being challenged. These one-time

costs will be registered below EBITDA in Vallourec’s 2022

consolidated results.

The Group has not experienced any interruption

in supply to its Jeceaba blast furnace.

V –

STRENGHTENING

VALLOUREC’S

COMPETITIVENESS

The Group expects good momentum on savings in

2022. Vallourec is evaluating potential additional cost-savings

initiatives in 2022 and will deliver further bottom-line net

savings to continue to lower its break-even point. The Group has

also launched a project aiming to reduce its inventory across its

plant system and introduce sustainable and repeatable business

practices to continue to manage working capital going forward.

As a reminder, the Group announced a significant

rationalization of its footprint last November with the planned

disposal of its German operations. This project advances according

to plan, and the preparation for the transfer of the Oil & Gas

related sales to low-cost to Brazil is well on track. Once this

project is fully implemented, the Group will benefit from a €130

million run-rate improvement in EBITDA and a €20 million reduction

in capex.

VI –

2022 OUTLOOK

Oil & Gas

In North America, the very

favorable market conditions observed at the end of 2021 should

continue and even improve during the first half of 2022, both in

terms of prices and capacity utilization. Although visibility is

less certain for the second half of the year, a strong increase in

the region’s contribution is expected over the full year.

In EA-MEA, following the

resumption of the tendering activity in 2021, volumes to be

delivered in 2022 are expected to significantly recover. Costs

inflation, notably on energy and logistics, should weigh on margin,

notably at the start of the year.

In South America, Oil & Gas

volumes delivered in 2022 are expected to increase slightly.

Industry & Other

In Europe, both volumes and

prices are expected to increase.

In Brazil, after a very

positive year in 2021, volumes for Industry are expected to

decrease slightly due to distributor stock normalization and

election uncertainties. While the iron ore operations profitability

for the year will be affected by the January incident, Vallourec

targets a gradual restart of the mine in the second quarter as

described above in section IV. Consensus2 estimates for iron ore

average prices for 2022 are approximately $110/MT compared to the

average of $161/MT in 20213 and current spot price of approximately

$140/MT.

Based on these

market trends and

assumptions, Vallourec

targets a further improvement of its full-year

2022 EBITDA relative to

2021. Q1

will be impacted by the

incident at the iron ore

mine and some

inflationary

headwinds, and

Vallourec expects a rebound in

Q2.

OtherCapex is expected to be

slightly above €200 million, including approximately €50 million

for the preparation of the transfer of operations from Germany to

Brazil.

Information and Forward-Looking

Statements

This press release may include forward-looking

statements. These forward-looking statements can be identified by

the use of forward-looking terminology, including the terms as

“believe”, “expect”, “anticipate”, “may”, “assume”, “plan”,

“intend”, “will”, “should”, “estimate”, “risk” and or, in each

case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts and include statements regarding the

Company’s intentions, beliefs or current expectations concerning,

among other things, Vallourec’s results of operations, financial

condition, liquidity, prospects, growth, strategies and the

industries in which they operate. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These risks include those developed or identified in the

public documents filed by Vallourec with the French Financial

Markets Authority (Autorité des marches financiers, or “AMF”),

including those listed in the “Risk Factors” section of the

Registration Document filed with the AMF on March 29, 2021, under

filing number n° D.21-0226 and the amendment to the Universal

Registration Document filed with the AMF on June 2, 2021 under

filing number n° D.21-0226-A01. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that Vallourec’s or any of its affiliates’ actual results of

operations, financial condition and liquidity, and the development

of the industries in which they operate may differ materially from

those made in or suggested by the forward-looking statements

contained in this press release. In addition, even if Vallourec’s

or any of its affiliates’ results of operations, financial

condition and liquidity, and the development of the industries in

which they operate are consistent with the forward-looking

statements contained in this press release, those results or

developments may not be indicative of results or developments in

subsequent periods.

Presentation of

Q4 &

FY 2021

results

Analyst conference call / audio webcast at 6:30

pm (Paris time) to be held in English.

- To listen to the audio

webcast:

https://channel.royalcast.com/landingpage/vallourec-en/20220224_1/

- To participate in the conference

call, please dial (password to use is “Vallourec”):

-

+44 (0) 33 0551

0200 (UK)

-

+33 (0) 1 70 37 71 66 (France)

- +1 212 999

6659 (USA)

- Audio webcast replay and slides

will be available on the website at:

https://www.vallourec.com/en/investors

About Vallourec

Vallourec is a world leader in premium tubular

solutions for the energy markets and for demanding industrial

applications such as oil & gas wells in harsh environments, new

generation power plants, challenging architectural projects, and

high-performance mechanical equipment. Vallourec’s pioneering

spirit and cutting edge R&D open new technological frontiers.

With close to 17,000 dedicated and passionate employees in more

than 20 countries, Vallourec works hand-in-hand with its customers

to offer more than just tubes: Vallourec delivers innovative, safe,

competitive and smart tubular solutions, to make every project

possible.

Listed on Euronext in Paris (ISIN code:

FR0013506730, Ticker VK), Vallourec is part of the CAC Mid 60, SBF

120 and Next 150 indices and is eligible for Deferred Settlement

Service.

In the United States, Vallourec has established

a sponsored Level 1 American Depositary Receipt (ADR) program (ISIN

code: US92023R4074, Ticker: VLOWY). Parity between ADR and a

Vallourec ordinary share has been set at 5:1.

Calendar

|

May

18th

2022May

24th 2022 |

Release of first quarter 2022 resultsShareholders’ Annual

Meeting |

For further information, please

contact:

| Investor

relations Jérôme FribouletTel : +33 (0)1 49 09 39

77Investor.relations@vallourec.com |

Press

relations Héloïse Rothenbühler Tel: +33 (0)1 41 03 77

50 eloise.rothenbuhler@vallourec.com |

| Individual

shareholdersToll Free Number (from France): 0 800 505 110

actionnaires@vallourec.com |

|

Appendices

Due to rounding, numbers presented throughout this and other

documents may not add up precisely to the totals provided and

percentages may not precisely reflect the absolute figures.

Documents accompanying this release:

- Sales volume

- Forex

- Revenue by geographic region

- Revenue by market

- Summary consolidated income

statement

- Summary consolidated balance

sheet

- Free cash flow

- Cash flow statement

- Definitions of non-GAAP financial

data

Sales volume

|

In thousands of tons |

2021 |

2020 |

Change |

|

Q1 |

358 |

450 |

-20.4% |

|

Q2 |

381 |

422 |

-9.7% |

|

Q3 |

391 |

319 |

+22.6% |

|

Q4 |

510 |

408 |

+24.9% |

|

Total |

1,640 |

1,599 |

+3.0% |

Forex

|

Average exchange rate |

|

Full year 2021 |

Full year 2020 |

|

EUR / USD |

|

1.18 |

1.14 |

|

EUR / BRL |

|

6.38 |

5.90 |

|

USD / BRL |

|

5.39 |

5.16 |

Revenue by geographic

region

|

In € million |

Full year 2021 |

As % of revenue |

Full year 2020 |

As % of revenue |

Change |

Q4 2021 |

As % of revenue |

Q4 2020 |

As % of revenue |

Change |

|

Europe |

529 |

15.4% |

533 |

16.4% |

-0.8% |

143 |

13.4% |

126 |

15.2% |

13.5% |

|

North America (Nafta) |

836 |

24.3% |

719 |

22.2% |

16.4% |

312 |

29.3% |

138 |

16.6% |

125.8% |

|

South America |

1,077 |

31.3% |

756 |

23.3% |

42.3% |

266 |

25.0% |

225 |

27.1% |

18.6% |

|

Asia and Middle East |

766 |

22.2% |

900 |

27.8% |

-14.9% |

253 |

23.8% |

236 |

28.4% |

7.4% |

|

Rest of the world |

234 |

6.8% |

334 |

10.3% |

-30.0% |

89 |

8.4% |

106 |

12.8% |

-15.7% |

|

Total |

3,442 |

100% |

3,242 |

100% |

6.1% |

1,064 |

100% |

830 |

100% |

28.1% |

Revenue by market

|

Full year 2021 |

As % of revenue |

Full year 2020 |

As % of revenue |

Change |

In € million |

Q4 2021 |

As % of revenue |

Q4 2020 |

As % of revenue |

Variation |

|

1,859 |

54.0% |

2,007 |

61.9% |

-7.4% |

Oil & Gas |

647 |

60.8% |

527 |

63.5% |

22.8% |

|

197 |

5.7% |

200 |

6.2% |

-1.7% |

Petrochemicals |

63 |

5.9% |

39 |

4.7% |

61.0% |

|

2,056 |

59.7% |

2,207 |

68.1% |

-6.8% |

Oil & Gas, Petrochemicals |

709 |

66.7% |

566 |

68.2% |

25.4% |

|

477 |

13.9% |

296 |

9.1% |

61.1% |

Mechanicals |

141 |

13.2% |

77 |

9.3% |

83.5% |

|

87 |

2.5% |

59 |

1.8% |

46.3% |

Automotive |

23 |

2.2% |

19 |

2.3% |

26.7% |

|

677 |

19.7% |

471 |

14.5% |

43.8% |

Construction & Other |

142 |

13.4% |

130 |

15.7% |

9.3% |

|

1,241 |

36.1% |

826 |

25.5% |

50.2% |

Industry & Other |

306 |

28.8% |

225 |

27.1% |

36.0% |

|

145 |

4.2% |

210 |

6.5% |

-30.7% |

Power Generation |

48 |

4.5% |

39 |

4.7% |

22.4% |

|

3,442 |

100% |

3,242 |

100% |

6.1% |

Total |

1,064 |

100% |

830 |

100% |

28.1% |

Summary consolidated income statement

|

Full year 2021 |

Full year 2020 |

Change |

In € million |

Q4 2021 |

Q4 2020 |

Change |

|

3,442 |

3,242 |

6.1% |

Revenue |

1,064 |

830 |

28.2% |

|

(2,605) |

(2,634) |

-1.1% |

Cost of sales |

(845) |

(674) |

25.4% |

|

837 |

608 |

37.7% |

Industrial Margin |

219 |

157 |

39.5% |

|

24.3% |

18.8% |

+5.5p.p. |

(as a % of revenue) |

20.6% |

18.9% |

+1.7p.p. |

|

(316) |

(325) |

-2.8% |

Sales, general and administrative costs |

(83) |

(75) |

10.7% |

|

(29) |

(25) |

-€4m |

Other |

(0) |

(6) |

-€6m |

|

492 |

258 |

+€234m |

EBITDA |

136 |

76 |

+€60m |

|

14.3% |

8.0% |

+6.3p.p. |

(as a % of revenue) |

12.8% |

9.2% |

+3.6p.p. |

|

(160) |

(213) |

-24.9% |

Depreciation of industrial assets |

(39) |

(55) |

-29.1% |

|

(42) |

(54) |

-22.2% |

Amortization and other depreciation |

(10) |

(17) |

-41.2% |

|

(5) |

(850) |

na |

Impairment of assets |

(5) |

(409) |

na |

|

89 |

(143) |

na |

Asset disposals, restructuring costs and non-recurring items |

(7) |

(90) |

na |

|

374 |

(1,002) |

+€1,376m |

Operating income (loss) |

75 |

(495) |

+€570m |

|

(147) |

(196) |

-€49m |

Net interest expense |

(21) |

(48) |

-€27m |

|

(89) |

(30) |

+€59m |

Other financial income and expenses |

(4) |

0 |

+€4m |

|

(236) |

(227) |

4.0% |

Financial income/(loss) |

(25) |

(48) |

-47.9% |

|

138 |

(1,229) |

+€1,367m |

Pre-tax income (loss) |

50 |

(543) |

+€593m |

|

(101) |

(96) |

5.2% |

Income tax |

40 |

(45) |

na |

|

(5) |

(3) |

na |

Share in net income/(loss) of equity affiliates |

(1) |

(1) |

na |

|

32 |

(1,328) |

+€1,360m |

Net income |

89 |

(589) |

+€678m |

|

(8) |

(122) |

na |

Attributable to non-controlling interests |

- |

(19) |

na |

|

40 |

(1,206) |

+€1,246m |

Net income, Group share |

89 |

(570) |

+€659m |

|

0.3 |

(105.4) |

na |

Net earnings per share (in €) * |

0.4 |

(49.8) |

na |

na = not applicable* FY and Q4 2020 figures adjusted for new

number of shares following reverse stock split effective on May 25

2020

Summary consolidated balance sheet

| In €

million |

|

|

|

|

|

|

Assets |

12/31/2021 |

12/31/2020 |

Liabilities |

12/31/2021 |

12/31/2020 |

|

|

|

|

Equity - Group share * |

1,763 |

(187) |

| |

|

|

Non-controlling interests |

45 |

321 |

|

Net intangible assets |

45 |

50 |

Total equity |

1,808 |

134 |

|

Goodwill |

38 |

25 |

Shareholder loan |

- |

9 |

|

Net property, plant and equipment |

1,666 |

1,718 |

Bank loans and other borrowings (A) |

1,387 |

1,751 |

|

Biological assets |

38 |

30 |

Lease debt (D) |

33 |

84 |

|

Equity affiliates |

35 |

42 |

Employee benefit commitments |

14 |

203 |

|

Other non-current assets |

162 |

128 |

Deferred taxes |

29 |

20 |

|

Deferred taxes |

239 |

187 |

Provisions and other long-term liabilities |

140 |

142 |

|

Total non-current assets |

2,223 |

2,180 |

Total non-current liabilities |

1,603 |

2,200 |

|

Inventories |

856 |

664 |

Provisions |

40 |

104 |

|

Trade and other receivables |

541 |

468 |

Overdraft and other short-term borrowings (B) |

190 |

1,853 |

|

Derivatives - assets |

4 |

37 |

Lease debt (E) |

15 |

24 |

|

Other current assets |

133 |

203 |

Trade payables |

457 |

426 |

|

Cash and cash equivalents (C) |

619 |

1,390 |

Derivatives - liabilities |

19 |

21 |

|

Other current liabilities |

242 |

241 |

|

Total current assets |

2,153 |

2,762 |

Total current liabilities |

963 |

2,669 |

|

Assets held for sale and discontinued operations |

372 |

107 |

Liabilities held for sale and discontinued operations |

374 |

37 |

|

Total assets |

4,748 |

5,049 |

Total equity and liabilities |

4,748 |

5,049 |

|

|

|

|

|

|

|

|

* Net income (loss), Group share |

40 |

(1,206) |

|

|

|

|

|

|

|

|

|

|

|

Net debt (A+B-C) |

958 |

2,214 |

|

|

|

|

|

|

|

|

|

|

|

Lease debt (D+E) |

48 |

108 |

|

|

|

Free cash flow

|

Full year 2021 |

Full year 2020 |

Change |

In € million |

Q4 2021 |

Q4 2020 |

Change |

|

26 |

(146) |

+€172m |

Cash flow from operating activities (A) |

10 |

(18) |

+€28m |

|

(172) |

173 |

-€345m |

Change in operating WCR [+ decrease, (increase)] (B) |

61 |

178 |

-€117m |

|

(138) |

(138) |

na |

Gross capital expenditure (C) |

(54) |

(48) |

-€6m |

|

(284) |

(111) |

-€173m |

Free cash flow (A)+(B)+(C) |

17 |

112 |

-€95m |

Cash flow statement

|

Full year 2021 |

Full year 2020 |

In € million |

Q4 2021 |

Q4 2020 |

|

26 |

(146) |

Cash flow from operating activities |

10 |

(18) |

|

(172) |

173 |

Change in operating WCR [+ decrease, (increase)] |

61 |

178 |

|

(146) |

27 |

Net cash flow from operating activities |

71 |

160 |

|

(138) |

(138) |

Gross capital expenditure |

(54) |

(48) |

|

1,540 |

(72) |

Asset disposals & other items |

19 |

3 |

|

1,256 |

(183) |

Change in net debt [+ decrease, (increase)] |

36 |

115 |

|

958 |

2,214 |

Financial net debt (end of period) |

958 |

2,214 |

Definitions of non-GAAP financial data

Data at constant exchange

rates: the data presented « at constant exchange

rates » is calculated by eliminating the translation effect

into euros for the revenue of the Group’s entities whose functional

currency is not the euro. The translation effect is eliminated by

applying Year N-1 exchange rates to Year N revenue of the

contemplated entities.

Free cash flow: Free cash-flow

(FCF) is defined as cash flow from operating activities minus gross

capital expenditure and plus/minus change in operating working

capital requirement.

Gross capital expenditure:

gross capital expenditure is defined as the sum of cash outflows

for acquisitions of property, plant and equipment and intangible

assets and cash outflows for acquisitions of biological assets.

Industrial margin: the

industrial margin is defined as the difference between revenue and

cost of sales (i.e. after allocation of industrial variable costs

and industrial fixed costs), before depreciation.

Lease debt: defined as the

present value of unavoidable future lease payments

Net debt: consolidated net debt

is defined as Bank loans and other borrowings plus Overdrafts and

other short-term borrowings minus Cash and cash equivalents. Net

debt excludes lease debt.

Net working capital

requirement: defined as working capital requirement net of

provisions for inventories and trade receivables; net working

capital requirement days are computed on an annualized quarterly

sales basis.

Operating working capital

requirement: includes working capital requirement as well

as other receivables and payables.

Working capital requirement:

defined as trade receivables plus inventories minus trade payables

(excluding provisions).

1 Capital IQ: $110/MT 2 Capital IQ Consensus

3 The impact of a variation in the iron ore price of 10 USD/t on

average over the year, based on an annual normalized production of

approximately 8.7Mt, would be approximately $40 million on the

mine's EBITDA

- Vallourec-press-release-Q4 FY 2021 results

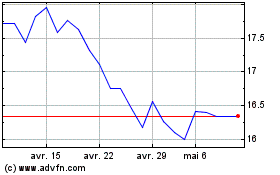

Vallourec (EU:VK)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Vallourec (EU:VK)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024