Valneva Reports Nine-Month 2022 Results and Provides Corporate

Updates

Total nine-month

revenues of €249.9

million, a ~

3.5-fold increase

compared to 2021

- Product sales of €74.4 million (vs

€45.5 million in the first nine months of 2021) driven by a

continued recovery of travel vaccine sales and by COVID-19 vaccine

sales in Europe. Product sales outside of COVID-19 grew by double

digits (11.2%) vs. prior period

- €175.5 million of other

revenues (vs €24.4 million in the first nine months of 2021) mainly

driven by revenue recognition related to previous COVID-19 vaccine

supply agreements

Cash and cash equivalents of €261.0 million at the end

of September 2022

- Excludes €102.9 million of gross

proceeds received in October 2022 from an upsized global

offering1

- Includes drawing the final tranche ($20 million) from Deerfield

& Orbimed loan agreement2

Continued

progression

of late-stage

clinical programs as guided

Lyme Disease Vaccine Candidate

VLA15

- Phase 3 study recruitment ongoing;

enrollment completion expected in the second quarter of 2023

Single-Shot Chikungunya Vaccine

Candidate VLA1553

- Ongoing rolling submission for Biologics License Application

(BLA) with the U.S. Food and Drug Administration (FDA); submission

completion expected by end of 2022

Progression of pre-clinical assets and

focus on strengthening the Company’s

clinical pipeline

- VLA1554 (human metapneumovirus) and

VLA2112 (Epstein-Barr virus) currently prioritized

Updated FY

2022

Financial

Guidance

- Valneva reiterates expected total

revenues of €340 million to €360 million, noting continued recovery

of travel vaccine sales, further revenue recognition linked to

payments received under the Advance Purchase Agreement (APA) with

each of the European Commission (EC) and United Kingdom (UK) and

the expected sales from the revised EC APA.

- Product sales of the Company’s

travel vaccines are still expected to reach €70 million to €80

million despite supply challenges and COVID-19 product sales are

expected to reach €30 million to €40 million.

- Other Revenues are expected to

reach approximately €240 million. They will be mainly related to

COVID-19 revenue recognition in relation to the UK and EC APAs and

will have no impact on cash. Other Revenues not related to COVID-19

will be negative in 2022 due to the increased refund liability

resulting from the amendment of the VLA15 collaboration and license

agreement with Pfizer.

- Given phasing of clinical trial

expenses and accelerated wind-down of VLA2001 related activities,

Valneva now expects lower R&D expenses of €95 million to €110

million compared to the €120 million to €135 million previously

communicated. The Company remains committed to advancing its

late-stage vaccine candidates and to further expanding its R&D

pipeline, including, but not limited to, through the advancement of

some of the Company’s pre-clinical candidates towards clinical

entry.

- As part of the communicated reshape

strategy, Valneva is in the process of re-sizing its operations

which is expected to result in a reduction of approximately 20% to

25% of its existing workforce. Post restructuring, the Company’s

total workforce is expected to be approximately 25% above pre-COVID

levels enabling the Company to retain key talents and additional

expertise to successfully execute on its strategy. This re-sizing

and re-focusing is expected to result in annualized savings of

approximately €12 million.

Financial Information(unaudited

results, consolidated per IFRS)

|

€ in million |

Nine months ending

September 30 |

|

|

2022 |

2021 |

|

Total revenues |

249.9 |

69.8 |

|

Product sales |

74.4 |

45.5 |

|

Net loss |

(99.1) |

(245.9) |

|

Adjusted EBITDA loss |

(38.0) |

(227.6) |

|

Cash (at end of period) |

261.0 |

247.9 |

Saint-Herblain

(France),

November

10, 2022 –

Valneva SE (Nasdaq: VALN; Euronext Paris: VLA), a specialty vaccine

company, today reported consolidated financial results for the

first nine months of the year, ended September 30, 2022. The

condensed consolidated interim financial results are available on

the Company’s website (Financial Reports – Valneva).

Valneva will provide a live webcast of its nine months financial

results conference call beginning at 3 p.m. CET/9 a.m. EST today.

This webcast will also be available on the Company’s website.

Please refer to this link:

https://edge.media-server.com/mmc/p/cay4shas

Thomas

Lingelbach, Valneva’s Chief

Executive Officer, commented,

“Valneva is continuing to successfully execute on its key

activities. Raising over €100 million in the current economic

environment, attracting new investors, and maintaining support of

our existing shareholders clearly underlines the value of the

Company’s fundamentals, its R&D pipeline and our strategic

ambitions. We will continue to fully pursue the Company’s strategic

priorities, including advancing our chikungunya vaccine candidate

towards marketing approval and launch, completing the Phase 3 trial

of our Lyme disease vaccine candidate, progressing pre-clinical

assets, and focusing on strengthening our clinical pipeline. The

re-sizing of our operations will allow us to increase efficiency

and focus on achieving our operational and strategic business

objectives.”

Clinical Stage Vaccine

Candidates

LYME DISEASE VACCINE

CANDIDATE – VLA15 Phase 3 study

initiated

Valneva and Pfizer are developing VLA15, a Lyme

disease vaccine candidate that targets the outer surface protein A

(OspA) of Borrelia burgdorferi, the bacteria that cause Lyme

disease. The vaccine candidate covers the six OspA serotypes

expressed by Borrelia burgdorferi sensu lato species that are

prevalent in North America and Europe.

Recruitment of approximately 6,000 participants

five years of age and older for the Phase 3 clinical study “VALOR”

(Vaccine Against Lyme for Outdoor Recreationists) is currently

ongoing in highly endemic regions in the United States and Europe3.

Enrollment for the study, which investigates the efficacy, safety,

and immunogenicity of VLA15, is expected to be completed in the

second quarter of 2023. As per the terms of the collaboration

agreement between the two companies, Valneva received a $25 million

milestone payment from Pfizer in October following initiation of

the Phase 3 study.

Pending successful Phase 3 completion, Pfizer

could potentially submit a Biologics License Application (BLA) to

the U.S. FDA and a Marketing Authorization Application (MAA) to the

European Medicines Agency (EMA) in 2025.

Valneva and Pfizer entered into a collaboration

agreement in April 2020 to co-develop VLA154. In June 2022, the

terms of this collaboration were updated, and Pfizer invested €90.5

($95) million in Valneva as part of an Equity Subscription

Agreement5.Valneva will continue to pay its 40% contribution to the

Phase 3 activities over 2022 and 2023.

If approved, Pfizer will commercialize VLA15 and

Valneva will be eligible to receive substantial milestone and

royalty payments.

CHIKUNGUNYA VACCINE CANDIDATE –

VLA1553BLA rolling submission

with U.S. FDA

initiated

VLA1553 is a live-attenuated, single-dose

vaccine candidate against the chikungunya virus (CHIKV), a

mosquito-borne virus that has spread to more than 120 countries

with the potential to rapidly expand further. There are currently

no preventive vaccines or effective treatments for the chikungunya

virus available, and VLA1553 is currently the only chikungunya

vaccine candidate that successfully completed pivotal Phase 3

studies6,7 and the first chikungunya vaccine candidate for which a

regulatory filing process has been initiated with the U.S. FDA.

Valneva initiated BLA rolling submission with

the FDA for approval of VLA1553 in persons aged 18 years and above

in August 20228. This BLA submission is part of the accelerated

approval pathway agreed with the FDA in 20209 and follows final

pivotal Phase 3 data in March 202210 and final lot-to-lot

consistency results in May 202211.

Valneva expects to complete its BLA submission

by the end of 2022. Once completed, and if the FDA accepts the

filing, the FDA will determine priority review eligibility along

with the action due date upon which it will complete its

evaluation. The program received FDA Fast Track and Breakthrough

Therapy designations in 2018 and 2021, respectively. VLA1553 was

also granted PRIority MEdicine (PRIME) designation by the EMA in

2020. Valneva currently plans to make additional regulatory

submissions for VLA1553 in the first half of 2023.

Valneva has presented and will continue to

present clinical data for VLA1553 at high-profile medical and

scientific congresses12. Recently, the Company highlighted

additional immunological results from an expanded panel of

serological samples from adults over 65 years of age who received

VLA1553 at the American Society for Tropical Medicine and Hygiene

(ASTMH) Annual Meeting. Similar to the pivotal data presented

previously, the results from the expanded cohort continue to show

that older adults generated similarly high seroresponse rates

compared to younger adults in the pivotal Phase 3 study13. The

Company is also expecting to report twelve-month antibody

persistence data in late 2022.

At the recent meeting of the Centers for Disease

Control and Prevention’s Advisory Committee on Immunization

Practices (ACIP), Valneva presented an overview of VLA1553 safety

and immunogenicity results and the chikungunya working group

provided a preliminary review and timeline towards ACIP’s

recommendation decision. Ahead of the anticipated February 2024

ACIP vote, the working group plans to present further on CHIKV

traveler epidemiology and disease burden, a more comprehensive

review of immunogenicity and safety data as part of its Grading of

Recommendations, Assessment, Development and Evaluation (GRADE)

assessment, and longer-term additional data in younger age

groups.

A clinical trial of VLA1553 in adolescents is

also ongoing in Brazil14 for which topline results are expected in

the first half of 2023. This trial may support future regulatory

submissions and label extensions following a potential initial

regulatory approval in adults in the U.S. This ongoing clinical

trial conducted by Instituto Butantan and funded by the Coalition

for Epidemic Preparedness Innovations (CEPI) is also expected to

support licensure of the vaccine in Brazil, which would be the

first potential approval for use in an endemic region.

Pre-Clinical Vaccine

Candidates

The Company continues to progress select

pre-clinical assets and focus on strengthening its future clinical

pipeline. The Company is currently focused on two pre-clinical

assets, VLA1554 and VLA2112. The hMPV candidate, VLA1554, is a

pre-fusion recombinant protein subunit vaccine targeting the human

metapneumovirus (hMPV), which is a major worldwide respiratory

pathogen that causes acute upper and lower respiratory tract

infection in children and is a common cause of morbidity and

mortality in immunocompromised patients and in older adults.

VLA1554 is currently in pre-clinical proof of concept studies.

VLA2112 is a vaccine candidate targeting the Epstein-Barr virus

(EBV), which is one of the most common human viruses and can cause

infectious mononucleosis and other illnesses. VLA2112 is currently

in a late-stage evaluation phase.

Commercial

Vaccines

JAPANESE ENCEPHALITIS VACCINE

(IXIARO®/JESPECT®)

IXIARO® is the only Japanese encephalitis vaccine licensed and

available in the U.S., Canada and Europe.

In the first nine months of 2022,

IXIARO®/JESPECT® sales were €22.9 million compared to

€33.7 million in the first nine months of 2021, as a result of

the planned delivery schedule to the U.S. Department of Defense.

This decrease was partly offset by the private travel markets,

which showed significant recovery with IXIARO®/JESPECT® private

sales reaching €19.4 million in the first nine months of 2022

compared to €4.6 million in the first nine months of 2021.

CHOLERA /

ETEC15-DIARRHEA VACCINE

(DUKORAL®)

DUKORAL® is an oral vaccine for

the prevention of diarrhea caused by Vibrio cholerae and/or

heat-labile toxin producing ETEC16, the leading cause of travelers’

diarrhea. DUKORAL® is authorized for use in the

European Union and Australia to protect against cholera, and in

Canada, Switzerland, New Zealand and Thailand to protect against

cholera and ETEC.

In the first nine months of 2022, DUKORAL® sales

increased to €9.2 million compared to €0.5 million in the

first nine months of 2021, also benefitting from the significant

recovery in the private travel markets.

SARS-CoV-2 INACTIVATED

WHOLE-VIRUS VACCINE

Valneva’s COVID-19 vaccine, VLA2001, is the only

inactivated whole-virus COVID-19 vaccine approved in Europe17 and

was the first COVID-19 vaccine to receive a full marketing

authorization from the European Medicines Agency (EMA). It is

produced using Valneva’s established Vero-cell platform, leveraging

the manufacturing technology for the Company’s commercial Japanese

encephalitis vaccine, IXIARO®.

In addition to its marketing approval in Europe,

Valneva’s COVID-19 vaccine received conditional marketing

authorization in the United Kingdom18 and emergency use

authorization in the United Arab Emirates19 and Kingdom of

Bahrain20. During the third quarter of 2022, the World Health

Organization (WHO) also issued recommendations for use of the

vaccine, including for a booster dose of VLA2001 four to six months

after completion of the primary series. The vaccine generated sales

of €23.9 million during the first nine months of 2022.

Following a revised purchase agreement with the

EC in July 2022, which included VLA2001 orders of 1.25 million21,

Valneva has been delivering doses to participating EU Member States

(Germany, Austria, Denmark, Finland, and Bulgaria). Valneva has

retained inventory for potential additional supply to these EU

Member States should demand increase and, in parallel, is

continuing discussions on potential additional supply and financing

agreements with various other governments around the world to

deploy remaining inventory. VLA2001’s shelf life is expected to be

extended to up to 24 months, compared to 15 months currently.

Valneva reported first positive heterologous

booster results for VLA2001 in August 202222 and expects additional

heterologous booster data following primary vaccination with an

mRNA vaccine or natural COVID-19 infection in the fourth quarter of

2022.

Subject to regulatory assessments, heterologous

booster results may support label extensions for VLA2001,

additional product approvals and/or additional scientific

recommendations.

In light of the reduced order volume from EU

Member States, Valneva suspended internal and terminated external

manufacturing of VLA2001. Valneva is executing its “reshape”

strategy including re-sizing which will allow the Company to

increase efficiency and focus on its operational and strategic

business objectives.

THIRD-PARTY DISTRIBUTION

Valneva distributes certain third-party vaccines in countries where

it operates its own marketing and sales infrastructure. In June

2020, the Company entered into a distribution agreement with

Bavarian Nordic, pursuant to which it agreed to commercialize

Bavarian Nordic’s marketed vaccines for rabies (Rabipur®/RabAvert®)

and tick-borne encephalitis, leveraging its commercial

infrastructure in Canada, the United Kingdom, France and Austria.

In September 2022, Valneva also announced a partnership with VBI

Vaccines for the marketing and distribution of the only 3-antigen

Hepatitis B vaccine, PreHevbri®, in select European markets23.

Valneva and VBI expect PreHevbri to be available in these countries

in early 2023.

In the first nine months of 2022, third party

product sales increased by 64.6% to €18.4 million from

€11.2 million in the first nine months of 2021.

Nine-Month

2022 Financial Review (Unaudited,

consolidated under IFRS)

Revenues

Valneva’s total revenues were

€249.9 million in the first nine months of 2022 compared to

€69.8 million in the first nine months of 2021, an increase of

257.8%.

Product sales, including COVID-19 vaccine sales,

increased by 63.7% to €74.4 million in the first nine months of

2022 compared to €45.5 million in the first nine months of

2021. Foreign currency fluctuations contributed positively to

€4.9 million of the change in product sales. Product sales

from commercial products amounted to €50.6 million in the first

nine months of 2022, an increase of 11.2% compared to the first

nine months of 2021. Product sales related to COVID-19 amounted to

€23.9 million.

IXIARO®/JESPECT® sales decreased by 32.1% to

€22.9 million in the first nine months of 2022 compared to €33.7

million in the first nine months of 2021, primarily as a result of

the planned delivery schedule to the DoD during the period. This

decrease was partly offset by the private travel markets, which

showed significant recovery with IXIARO®/JESPECT® sales reaching

€19.4 million in the first nine months of 2022 compared to

€4.6 million in the first nine months of 2021. Foreign

currency fluctuations also contributed positively for

€4.6 million to the change in IXIARO® product sales. DUKORAL®

also benefited from this recovery in the private travel market as

sales increased significantly to €9.2 million in the first

nine months of 2022 compared to €0.5 million in the first nine

months of 2021. COVID-19 vaccine sales amounted to €23.9 million

resulting from shipments to participating EU Member States and

Bahrain. Third Party product sales increased by 64.6% to

€18.4 million in the first nine months of 2022 from

€11.2 million in the first nine months of 2021, driven by

growth related to Valneva’s distribution agreement with Bavarian

Nordic for the sale of Rabipur®/RabAvert® and Encepur®.

Other Revenues, including revenues from

collaborations, licensing and services, amounted to

€175.5 million in the first nine months of 2022 compared to

€24.4 million in the first nine months of 2021. This increase

is attributable to €89.4 million of released refund liability as a

result of the settlement with the UK government as well as a

release of non-refundable advance payments from EU Member States

amounting to €110.8 million. This was partially offset by €36.1

million of negative revenue resulting from an increase in the

refund liability linked to the amendment to the VLA15 collaboration

and license agreement with Pfizer. Valneva’s future contribution to

the VLA15 Phase 3 study will go against the refund liability

included in the balance sheet.

Operating Result and adjusted

EBITDA

Costs of goods and services sold (COGS) were

€202.7 million in the first nine months of 2022. The gross

margin on commercial product sales amounted to 55.4% compared to

37.8% in the first nine months of 2021. COGS of €6.4 million

related to IXIARO® product sales, yielding a product gross margin

of 72.0%. COGS of €3.7 million related to DUKORAL® product sales,

yielding a product gross margin of 60.0%, which was positively

impacted by provision releases resulting from reduced expiry risks

on inventory. Of the remaining COGS in the first nine months of

2022, €12.4 million were related to the Third-Party products

distribution business, €174.0 million to the COVID-19 vaccine

business and €6.2 million to cost of services. COGS of the COVID-19

vaccine program included effects from the significant reduction of

sales volumes to EU Member States. In the first nine months of

2021, overall COGS were €159.6 million, of which

€142.4 million related to cost of goods and €17.2 million

related to cost of services.

Research and development expenses amounted to

€75.4 million in the first nine months of 2022, compared to

€117.2 million in the first nine months of 2021. This decrease

was mainly driven by lower clinical trials costs for Valneva’s

chikungunya vaccine program advancing towards licensure as well as

reduced spend on the COVID-19 program. Marketing and distribution

expenses in the first nine months of 2022 amounted to

€13.1 million compared to €15.0 million in the first nine

months of 2021. Marketing and distribution expenses in the first

nine months of 2022 notably included €4.3 million of expenses

related to the launch preparation costs for Valneva’s chikungunya

vaccine candidate, VLA1553, compared to €2.8 million in the

first nine months of 2021. In the first nine months of 2022,

general and administrative expenses declined to €23.3 million

from €31.7 million in the first nine months of 2021. COGS,

research and development, marketing and distribution as well as

general and administrative expenses benefited from a non-cash

accrual adjustment of €30.6 million related to the positive effect

of the Company’s share price development on the employee

share-based compensation programs. This income compares to a cost

of €13.7 million in the first nine months of 2021.

Other income, net of other expenses, reduced to

€7.5 million in the first nine months of 2022 from

€16.0 million in the first nine months of 2021. This decrease

was mainly driven by reduced R&D tax credits directly resulting

from lower R&D spending and an increase of other expenses

related to the provision for the ongoing Vivalis / Intercell merger

litigation proceedings.

Valneva recorded an operating loss of €57.1

million in the first nine months of 2022 compared to €237.6 million

in the first nine months of 2021, of which the COVID-19 operating

loss represented €14.2 million and €194.4 million in the first nine

months of 2022 and 2021, respectively and the other segments

represented €42.9 million in the first nine months of 2022 compared

to €43.2 million in the first nine months of 2021. Adjusted

EBITDA (as defined below) loss in the first nine months of 2022 was

€38.0 million compared to an adjusted EBITDA loss of

€227.6 million in the first nine months of 2021.

Net Result

In the first nine months of 2022, Valneva

generated a net loss of €99.1 million compared to a net loss

of €245.9 million in the first nine months of 2021.

Finance expense and foreign currency effects in

the first nine months of 2022 resulted in a net finance expense of

€39.8 million, compared to a net finance expense of

€6.6 million in the first nine months of 2021. This was mainly

a result of a foreign exchange loss amounting to €26.5 million

in the first nine months of 2022, primarily driven by non-cash

revaluation results of non-Euro denominated balance sheet

positions, compared to a net foreign exchange gain of €5.3 million

in the first nine months of 2021. Interest expenses net of interest

income were €13.3 million in the first nine months of 2022

compared to €11.9 million in the first nine months of

2021. Cash

Flow and Liquidity

Net cash used in operating activities amounted

to €189.5 million in the first nine months of 2022 compared to

€36.5 million of cash generated by operating activities in the

first nine months of 2021. Cash outflows in the first nine months

of 2022 were mainly related to the operating loss generated in the

period and non-cash revenues (cash received in previous periods),

while during the first nine months of 2021 cash inflows mainly

resulted from pre-payments received related to the vaccine supply

agreement signed with the UK government.

Cash outflows from investing activities amounted

to €22.5 million in the first nine months of 2022 compared to

€69.9 million in the first nine months of 2021, both mainly a

result of COVID-19-related construction activities across

production sites in Scotland and Sweden, as well as equipment

purchases.

Net cash generated from financing activities

amounted to €121.6 million in the first nine months of 2022,

which was mainly a result of proceeds from the equity subscription

agreement with Pfizer as well as a draw-down in September on the

credit facility provided by Deerfield & Orbimed24. Cash inflows

in the first nine months of 2021 amounted to €74.6 million

which was mainly a result of proceeds from issuance of new shares

in the U.S. initial public offering and European private placement

in May of 2021.

Cash and cash equivalents decreased to €261.0

million as of September 30, 2022, compared to €346.7 million as of

December 31, 2021 and consisted of €258.1 million in cash and €3.0

million in restricted cash. The cash decrease mainly resulted from

COVID-19-related investments into fixed assets, R&D and

Manufacturing expenses. Net proceeds from the recent global

offering were received in October and are not included in the cash

position reported per September 30, 2022.

Non-IFRS Financial Measures

Management uses and presents IFRS results, as

well as the non-IFRS measure of Adjusted EBITDA to evaluate and

communicate its performance. While non-IFRS measures should not be

construed as alternatives to IFRS measures, management believes

non-IFRS measures are useful to further understand Valneva’s

current performance, performance trends, and financial

condition.

Adjusted EBITDA is a common supplemental measure

of performance used by investors and financial analysts. Management

believes this measure provides additional analytical tools.

Adjusted EBITDA is defined as earnings (loss) for the period before

income tax, finance income/expense, foreign exchange gain/(loss),

results from investments in associates, amortization, depreciation,

and impairment.

A reconciliation of Adjusted EBITDA to net loss

for the period, which is the most directly comparable IFRS measure,

is set forth below:

|

€ in million |

Nine months ending

September 30 |

|

(unaudited results, consolidated per IFRS) |

2022 |

2021 |

|

Loss for the period |

(99.1) |

(245.9) |

|

Add: |

|

|

|

Income tax expense |

2.2 |

1.6 |

|

Total Finance income |

(0.1) |

(0.2) |

|

Total Finance expense |

13.4 |

12.1 |

|

Foreign exchange gain/(loss) – net |

26.5 |

(5.3) |

|

Result from investments in associates |

- |

0.1 |

|

Amortization |

5.3 |

4.9 |

|

Depreciation |

10.6 |

5.1 |

|

Impairment |

3.3 |

- |

|

Adjusted EBITDA |

(38.0) |

(227.6) |

About Valneva

SE Valneva

is a specialty vaccine company focused on the development and

commercialization of prophylactic vaccines for infectious diseases

with significant unmet medical need. The Company takes a highly

specialized and targeted approach to vaccine development and then

applies its deep understanding of vaccine science to develop

prophylactic vaccines addressing these diseases. Valneva has

leveraged its expertise and capabilities both to successfully

commercialize three vaccines and to rapidly advance a broad range

of vaccine candidates into the clinic, including candidates against

Lyme disease and the chikungunya virus.

|

Valneva Investor and Media ContactsLaetitia

Bachelot-FontaineVP, Global Communications and European Investor

RelationsM +33 (0)6 4516

7099investors@valneva.com |

Joshua Drumm, Ph.D.VP, Global Investor Relations M +001

917 815 4520joshua.drumm@valneva.com |

|

|

Forward-Looking StatementsThis

press release contains certain forward-looking statements relating

to the business of Valneva, including but not limited to statements

regarding expected total revenues and R&D spending for full

fiscal year 2022, product sales, possible regulatory approvals of

product candidates, the re-shaping of the Company’s operations,

initiation and progression of clinical trials, and development of

pre-clinical vaccine candidates. In addition, even if the actual

results or development of Valneva are consistent with the

forward-looking statements contained in this press release, those

results or developments of Valneva may not be indicative of future

results. In some cases, you can identify forward-looking statements

by words such as "could," "should," "may," "expects,"

"anticipates," "believes," "intends," "estimates," "aims,"

"targets," or similar words. These forward-looking statements are

based on the current expectations of Valneva as of the date of this

press release and are subject to a number of known and unknown

risks and uncertainties and other factors that may cause actual

results, performance or achievements to be materially different

from any future results, performance or achievement expressed or

implied by these forward-looking statements. In particular, the

expectations of Valneva could be affected by, among other things,

uncertainties involved in the development and manufacture of

vaccines, unexpected clinical trial results, regulatory actions or

delays, competition in general, currency fluctuations, the impact

of the global and European credit crisis, the ability to obtain or

maintain patent or other proprietary intellectual property

protection, the cancellation of existing contracts, and the impact

of the COVID-19 pandemic, the occurrence of any of which could

substantially harm Valneva’s business, financial condition,

prospects and results of operations. In light of these risks and

uncertainties, there can be no assurance that the forward-looking

statements made during this presentation will in fact be realized.

Valneva is providing the information in this press release as of

the date hereof and disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

1 Valneva Announces Closing of Upsized €102.9 Million Global

Offering - Valneva2 Valneva Announces Upsized Financing Arrangement

with Leading US Healthcare Funds Deerfield and OrbiMed - Valneva3

Pfizer and Valneva Initiate Phase 3 Study of Lyme Disease Vaccine

Candidate VLA15 - Valneva4 Valneva and Pfizer Announce

Collaboration to Co-Develop and Commercialize Lyme Disease Vaccine,

VLA155 Valneva and Pfizer Enter into an Equity Subscription

Agreement and Update Terms of Collaboration Agreement for Lyme

Disease Vaccine Candidate VLA156 Valneva Successfully Completes

Pivotal Phase 3 Trial of Single-Shot Chikungunya Vaccine Candidate

– Valneva7 Valneva Successfully Completes Lot-to-Lot Consistency

Trial for its Single-Shot Chikungunya Vaccine Candidate - Valneva8

Valneva Initiates Rolling Submission of FDA Biologics License

Application for its Single-Shot Chikungunya Vaccine Candidate -

Valneva9 Valneva Reports Positive End-of-Phase 2 Chikungunya

Meeting with the U.S. FDA; Sets Stage for Phase 3 Study10 Valneva

Successfully Completes Pivotal Phase 3 Trial of Single-Shot

Chikungunya Vaccine Candidate – Valneva11 Valneva Successfully

Completes Lot-to-Lot Consistency Trial for its Single-Shot

Chikungunya Vaccine Candidate - Valneva12 Valneva to Present on its

Single-Shot Chikungunya Vaccine Candidate at Leading Scientific

Conferences - Valneva13 Presentation at ASTMH: Chikungunya: Phase 3

Clinical Development of a Single-shot Live-Attenuated Vaccine 14

Valneva Announces Initiation of Adolescent Phase 3 Trial for its

Single-Shot Chikungunya Vaccine Candidate – Valneva15 Indications

differ by country - Please refer to Product / Prescribing

Information (PI) / Medication Guide approved in your respective

countries for complete information, incl. dosing, safety and age

groups in which this vaccine is licensed, ETEC = Enterotoxigenic

Escherichia coli (E. Coli) bacterium.16

Enterotoxigenic Escherichia coli (ETEC) is a type of

Escherichia coli and one of the leading bacterial causes of

diarrhea in the developing world, as well as the most

common cause of travelers’ diarrhea.17 Valneva Receives Marketing

Authorization in Europe for Inactivated Whole-Virus COVID-19

Vaccine VLA200118 Valneva Receives Conditional Marketing

Authorization from UK MHRA for its Inactivated COVID-19 Vaccine –

Valneva19 Valneva Receives Emergency Use Authorization from the

United Arab Emirates for its Inactivated COVID-19 Vaccine20 Valneva

Receives Emergency Use Authorization from Bahrain for its

Inactivated COVID-19 Vaccine VLA2001 – Valneva21 Valneva Confirms

Amendment of Advance Purchase Agreement with European Commission

for Valneva’s Inactivated COVID-19 Vaccine - Valneva22 Valneva

Reports Further Positive Phase 3 Immunogenicity and the First

Heterologous Booster Results for its Inactivated, Adjuvanted

COVID-19 Vaccine VLA2001 - Valneva23 Valneva and VBI Vaccines

Announce European Partnership for Marketing and Distribution of

PreHevbri® - Valneva24 Valneva Announces Upsized Financing

Arrangement with Leading US Healthcare Funds Deerfield and OrbiMed

- Valneva

- 2022_11_10_VLA_Nine-Month_PR_EN_Final

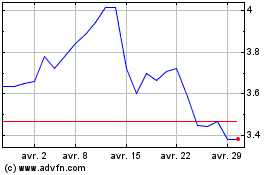

Valneva (EU:VLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Valneva (EU:VLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024