Sales: €271m (up 6.0% as reported) Essentials sales:

€154m (up 9.8% as reported) EBIT before depreciation of

acquired assets: €52m (19.0% of sales) Net income - Group

share: €21m (7.9% of sales) EBITDA: €62m (22.9% of

sales)

Regulatory News:

Matthieu Frechin, CEO of Vetoquinol (Paris:VETO), said:

"In an uncertain environment (Russian-Ukrainian conflict, rising

inflation and a slowdown in the global animal health market), our

laboratory continues to grow, driven by the momentum of our

Essential products. Our new strategic plan "Ambition 2026"

continues and reinforces the changes made over the last 10 years.

It is based on 3 pillars: accentuating our focus (species, segments

and markets), reinforcing our customer orientation in all decisions

and initiatives taken internally, and enhancing our cultural

difference as a family-owned, international animal health

laboratory."

At its meeting on September 13th, 2022, the Vetoquinol S.A.

Board of Directors reviewed the Group results and approved the 2022

Half Year financial statements.

Over the first half of the year, Vetoquinol recorded sales of

€271m, up 6.0% on a reported basis and 2.0% on a like-for-like

basis. The laboratory recorded a positive currency impact of

€11m (+4.1%), mainly due to the appreciation of the US dollar

against the euro.

At 30 June 2022, all strategic territories grew on a reported

basis, +0.9% in Europe, +12.9% in the Americas and +9.3% in

Asia/Pacific, and on a like-for-like basis, +0.4% in Europe, +2.7%

in the Americas and +5.4% in Asia/Pacific.

The performance of the first six months of 2022 is the result

of the continued growth of Essential products, the driving force of

the laboratory's strategy, which grew by 9.8% on a reported

basis and 6.8% on a like-for-like basis. They represent 56.8% of

the laboratory's sales in the first half of 2022, compared with

54.9% in the first half of 2021.

Sales of companion animal products (€183m) accounted for 67.5%

of total sales, up 9.8% on a reported basis and 5.7% on a

like-for-like basis. Sales to farm animals amounted to € 88

million, down 0.8% on a reported basis and down 5.1% on a

like-for-like basis, in line with the dynamics observed in each of

these market segments (source: Vetoquinol).

Gross margin was 72.1%, stable compared to the first half

of 2021 (72.0%) and slightly up by 0.8 point compared to the year

2021 (71.3%). It benefited from an improvement in the product mix

and more particularly from the growth of Essential products.

Stockpiled production rose sharply by €5.7 million (H1 2022 vs H1

2021), reflecting our commitment to continuous customer service in

a volatile environment and the anticipation of a phase of

modernisation work on the main injectable production line at the

Lure site.

Other purchases and external expenses increased by €11.3 million

in the first half of the year, mainly due to an increase in

marketing and advertising costs related to the launch of new

Essential products, including Felpreva®, and an increase in travel

and entertainment expenses following two years of restrictions

related to Covid-19.

Personnel costs increased by 8.0%, due to the scope effect

(full-year integration of the reinforcement of the teams in

connection with the Drontal® and Profender® activities) and the

increase in salaries.

EBIT before depreciation of acquired intangible assets

amounted to €51.5 million (19.0% of sales), down on the same period

last year. Amortisation of assets from acquisitions amounted to

-€7.1m compared to -€6.5m at the end of June 2021.

Group EBIT was €44.4m (16.4% of sales), compared with

€50.4m for the first half of the financial year 2021.

In a contracted and uncertain economic environment in Brazil, a

goodwill impairment charge of €9.3m was recognised. This

non-recurring and non-cash charge does not call into question the

Group's confidence in its ability to align the performance of its

Brazilian subsidiary with that of the laboratory over the long

term.

The apparent tax rate is 38.0% (vs 28.3% at the end of June

2021). Adjusted for the impairment of goodwill in Brazil, it was

30.0%.

The laboratory's EBITDA at 30 June 2022 was €62.0m (22.9%

of sales).

Vetoquinol's Net income was €21.4m compared to €36.2m for

the first 6 months of 2021.

At the end of June 2022, Vetoquinol had a positive net cash

position of €23.7m (after taking into account IFRS 16) compared to

€53.6m at 31 December 2021. This decrease in cash position is the

result of a sharp increase in the first half of 2022 in working

capital due to the impacts of the main items (inventories,

customers and suppliers).

Russian-Ukrainian conflict and health situation

Vetoquinol is not directly present in Ukraine and Russia, but

remains exposed to the consequences of the economic tensions of

this conflict and in particular to the sharp increases in the cost

of certain raw materials, energy and logistics.

The laboratory also remains attentive and vigilant to the

evolution of the health crisis in the countries where it sells its

products and purchases goods and services. It continues to do its

utmost to guarantee the health and safety of its employees, while

respecting its commitments to its customers and stakeholders.

Next update: Q3 2022 sales, October 12th, 2022 after

market close

ABOUT VETOQUINOL

Vetoquinol is a leading global animal health company that

supplies drugs and non-medicinal products for the farm animals

(cattle and pigs) and pet (dogs and cats) markets. As an

independent pure player, Vetoquinol designs, develops and sells

veterinary drugs and non-medicinal products in Europe, the Americas

and the Asia Pacific region. Since its foundation in 1933,

Vetoquinol has pursued a strategy combining innovation with

geographical diversification. The Group’s hybrid growth is driven

by the reinforcement of its product portfolio coupled with

acquisitions in high potential growth markets. Vetoquinol employed

2,621 people as of June 30th, 2022.

Vetoquinol has been listed on Euronext Paris since 2006 (symbol:

VETO).

The Vetoquinol share is eligible for the French PEA and PEA-PME

personal equity plans.

ANNEX

SALES

€m

2022

2021

Change (reported data)

Change (constant exchange

rates)

Q1 Sales

135

128

+5.5%

+2.2%

Q2 Sales

136

127

+6.7%

+1.8%

First semester Sales

271

255

+6.0%

+2.0%

SUMMARY INCOME STATEMENT

€m

06/30/2022

06/30/2021

Change

Total sales

of which Essentials

270.8

153.9

255.3

140.2

+6.0%

+9.8%

EBIT before depreciation of acquired

assets

% of total sales

51.5

19.0

56.9

22.3

-5.3%

Net income Group share

% of total sales

21.4

7.9

36.2

14.2

-14.8%

EBITDA

% of total sales

62.0

22.9

67.5

26.4

-5.5%

CALCULATION OF EBITDA

€m

06/30/2022

06/30/2021

Net income before equity method

21.4

36.2

Income tax expense

13.1

14.4

Net financial income/expense

0.6

(0.3)

Provisions recorded under non-recurring

operating income and expenses

9.1

0.1

Provisions and write-backs

1.8

0.7

Depreciation and amortization

13.2

13.9

Depreciation and amortization – IFRS

16

2.7

2.6

EBITDA

62.0

67.5

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators,

which are not defined by IFRS, provide additional information that

is relevant for shareholders seeking to analyze underlying trends

and Group performance and financial position. They are used by

management for performance analysis.

Essentials products: The products referred to as

“Essentials” comprise veterinary drugs and non-medical products

sold by the Vetoquinol Group. They are existing or potential

market-leading products designed to meet the daily requirements of

vets in the companion animal or livestock sector. They are intended

for sale worldwide and their scale effect improves their economic

performance.

Constant exchange rates: Application of the previous

period’s exchange rates to the current financial year, all other

things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in

terms of volume and/or price at constant consolidation scope and

exchange rates.

EBIT before amortization of acquired assets: This KPI

isolates the non-cash impact of depreciation charges on intangible

assets arising from mergers and acquisitions.

Net cash: Cash and cash equivalents less bank overdrafts

and borrowings, including impact of IFRS 16 compliance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220915005764/en/

FOR MORE INFORMATION, CONTACT:

VETOQUINOL

Investor Relations Fanny Toillon Tel.: +33 (0)3 84

62 59 88 relations.investisseurs@vetoquinol.com

KEIMA COMMUNICATION

Investor & Media Relations Emmanuel Dovergne

Tel.: +33 (0)1 56 43 44 63 emmanuel.dovergne@keima.fr

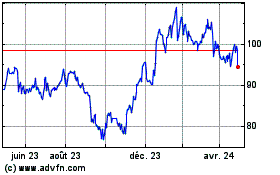

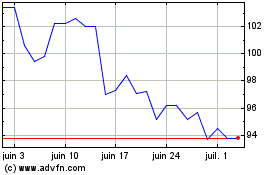

Vetoquinol (EU:VETO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Vetoquinol (EU:VETO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024