VGP NV: Allianz and VGP expand relationship with new European

logistics joint venture

Regulated Information

Paris |

Munich | Antwerp

| 04 January

2022 | 08.30am

CET

Allianz Real Estate, acting on behalf of several

Allianz group companies, and VGP, a European provider of

high-quality logistics and semi-industrial real estate, have agreed

to form a new 50/50 joint venture. The vehicle, the fourth such

venture between Allianz Real Estate and VGP since 2016, will

develop a portfolio of prime logistics assets in Germany, the Czech

Republic, Hungary and Slovakia.

Allianz Real Estate and VGP are targeting to

grow the joint venture to a gross asset value of EUR2.8 billion

within five years by exclusively acquiring prime assets developed

by VGP.

Within these countries, VGP has a pipeline of

over 90 assets in around 25 strategic locations, including near

capital cities such as Bratislava, Berlin and Budapest, with a

total forecast GLA of over 2.5 million sqm. The entire land bank

has been already secured and a number of assets already

delivered.

VGP is a leading developer, manager and owner of

logistics and semi-industrial real estate. The firm has a

development land bank of 10.49 million sqm of own or committed

land1 and currently owns and operates assets in 12 European

countries. It will again act as the JV manager, asset manager and

property manager for the venture with Allianz Real Estate.

The logistics sector accounts for 13% of global

Allianz Real Estate’s AUM, or EUR 10.3 billion, with the largest

allocation in Europe at EUR 4.9 billion as at the end of September.

2021 has seen some of the firm’s most significant transactions,

including the largest single logistics asset in terms of value in

the U.S. to date. It’s Italian Logistics Fund alone accounts for

over EUR 400 million across 16 facilities

The environmental profile of each facility will

be a priority, aiming to encompass Carbon Risk Real Estate Monitor

and EU Taxonomy compliance, the use of Sustainable Certification

including high BREEAM or DGNB ratings, and EPC criteria, among

others. As such, the JV will help Allianz Real Estate meet its

target to reduce carbon emissions across its portfolio by 25% by

2025 and be carbon net-zero by 2050.

“We are acutely aware of the impact that e-commerce has

generated in terms of the opportunities available in the market,

where onshoring and inventory management on the building networks

are essential. Having a dedicated logistics team working alongside

prime partners such as VGP, has enabled us to remain ahead of the

curve and continue to add significant capital allocation to our

global logistics portfolio, an area that represents a key strategic

focus for Allianz Real Estate,” said Kari Pitkin, Head of

Business Development Europe,

Allianz Real Estate.

Jan Van Geet, Chief Executive Officer

at VGP, said “We are delighted to

be expanding our partnership with Allianz Real Estate as this new

joint venture will give VGP greater optionality to refinance whilst

continuing to expand the Group’s asset base and development

pipeline. Having a partner who shares our commitment to sustainable

and responsible building and investment practices, we are very

pleased we have been able to agree to an ESG framework for this new

joint venture which appreciates and is aligned with our long-term

commitments. With a portfolio of prime and certified warehouses

under construction and an enviable land bank, the new joint venture

benefits from our significant Grade A pipeline in these four

markets.”

In June last year, VGP and Allianz Real Estate

announced the successful eighth and final closing of their first

50/50 joint venture, VGP European Logistics. The transaction

comprised of four logistic buildings, including two buildings in a

new VGP park and another two newly completed logistic buildings

which were developed in parks previously transferred to the joint

venture. Following this transaction this joint venture reached its

expanded investment target and is fully invested2

- End -

Allianz

enquiries:

Allianz Real EstatePaula

Eirich +49

89 3800 68318 / +49 160 9576

7391 paula.eirich@allianz.com

Citigate Dewe Rogerson

(UK)Hugh Fasken / Camilla Wyatt / Patrick

EvansAllCDRUKAllianzRealEstate@citigatedewerogerson.com

About Allianz Real Estate and PIMCOAllianz Real

Estate is a PIMCO Company, comprising Allianz Real Estate GmbH and

Allianz Real Estate of America and their subsidiaries and

affiliates. It is one of the world’s largest real estate investment

managers, developing and executing tailored portfolio and

investment strategies globally on behalf of a range of global

liability driven investors, creating long-term value for clients

through direct as well as indirect investments and real estate

financing. The operational management of investments and assets is

performed out of 18 offices in key gateway cities across 4 regions

(West Europe, North & Central Europe, USA and Asia Pacific).

For more information, please visit: www.allianz-realestate.com.

PIMCO is one of the world’s premier fixed income investment

managers. With its launch in 1971 in Newport Beach, California,

PIMCO introduced investors to a total return approach to fixed

income investing. In the nearly 50 years since, the firm continued

to bring innovation and expertise to our partnership with clients

seeking the best investment solutions. PIMCO has offices around the

world and 3,000+ professionals committed to delivering superior

investment returns, solutions and service to its clients. PIMCO is

owned by Allianz SE, a leading global diversified financial

services provider.

Source: Allianz Real Estate, data as at 30th September 2021.

These assessments are, as always, subject to the disclaimer

provided below.

Important Information Some of the statements in

this press release may be forward-looking statements or statements

of future expectations based on currently available information.

Such statements are naturally subject to risks and uncertainties.

Factors such as the development of general economic conditions,

future market conditions, unusual catastrophic loss events, changes

in the capital markets and other circumstances may cause the actual

events or results to be materially different from those anticipated

by such statements. Allianz Real Estate does not make any

representation or warranty, express or implied, as to the accuracy,

completeness or updated status of such statements. Therefore, in no

case whatsoever will Allianz Real Estate be liable to anyone for

any decision made or action taken in conjunction with the

information and/or statements in this press release or for any

related damages. Any views expressed were held at the time of

preparation and are subject to change without notice. While any

forecast, projection or target where provided is indicative only

and not guaranteed in any way. Allianz Real Estate accepts no

liability for any failure to meet such forecast, projection or

target. This document is not intended for distribution to or use by

any person or entity in any jurisdiction or country where such

distribution or use would be contrary to law or regulation. This

document is not and should not be construed as an offer to sell or

the solicitation of an offer to purchase or subscribe to any

investment. This document is not intended as investment advice, or

an offer or solicitation for the purchase or sale of any financial

instrument, or an offer or recommendation related to Allianz Real

Estate and/or its products. None of the information or analyses

presented herein are intended to form the basis for any investment

decision, and no specific recommendations are intended. PIMCO is a

trademark of Allianz Asset Management of America L.P. in the United

States and throughout the world. ©2021, PIMCO.

VGP

enquiries:

VGPKaren Huybrechts (media)+32 3 289

1432Karen.huybrechts@vgpparks.eu

Martijn Vlutters (investors)+32 3 289

1433martijn.vlutters@vgpparks.eu

Brunswick GroupAnette Nachbar+49 152 288

10363

About VGPVGP

N.V. is a pan-European developer, manager and owner of high-quality

logistics and semi-industrial real estate. VGP operates a fully

integrated business model with capabilities and longstanding

expertise across the value chain. The company has a development

land bank (owned or committed) of 10.49 million m² (as at 31

Oct-21) and the strategic focus is on the development of business

parks. Founded in 1998 as a Belgian family-owned real estate

developer in the Czech Republic, VGP with a staff of circa 350

employees owns and operates assets in 12 European countries

directly and through several 50:50 joint ventures. As of June 2021,

the Gross Asset Value of VGP, including the joint ventures at 100%,

amounted to € 4.48 billion and the company had a Net Asset Value

(EPRA NTA) of € 1.51 billion. VGP is listed on Euronext Brussels

(ISIN: BE0003878957). For more information, please visit:

http://www.vgpparks.eu

Forward-looking statements This press release

may contain forward-looking statements. Such statements reflect the

current views of management regarding future events, and involve

known and unknown risks, uncertainties and other factors that may

cause actual results to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. VGP is providing the information in

this press release as of this date and does not undertake any

obligation to update any forward-looking statements contained in

this press release in light of new information, future events or

otherwise. The information in this announcement does not constitute

an offer to sell or an invitation to buy securities in VGP or an

invitation or inducement to engage in any other investment

activities. VGP disclaims any liability for statements made or

published by third parties and does not undertake any obligation to

correct inaccurate data, information, conclusions or opinions

published by third parties in relation to this or any other press

release issued by VGP.

1 As of 31st of October 20212 Barring any top-ups related to

assets being completed in parks already owned by the joint

venture

- Allianz Real Estate_VGP JV EN 220104

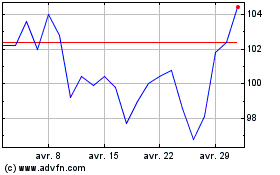

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024