Intermediate declaration by the

Board of Directors

Regulatory News: (Paris:XFAB)

Highlights Q3 2021:

› Revenue was USD 169.1 million, at the upper

end of the guided USD 162-170 million, up 76% year-on-year (YoY)

and up 5% quarter-on-quarter (QoQ)

› New quarterly records achieved for

industrial revenues with USD 38.3 million, medical revenues with

USD 14.3 million and prototyping revenues with USD 25.6 million

› Bookings came in at USD 199.0 million,

remaining at a high level, up 78% YoY and down 5% QoQ

› EBITDA margin of 23.9%, clearly above the

18-22% guidance

› EBITDA was USD 40.4 million, up USD 35.7

million YoY and down USD 2.9 million QoQ

› EBIT was USD 21.4 million, up USD 35.3

million YoY and down USD 3.2 million QoQ

Outlook:

› Q4 2021 revenue is expected in the range of

USD 170-180 million with an EBITDA margin in the range of

19‑23%.

› Full-year revenue guidance has been

increased to USD 655-665 million (previously USD 640-660) with an

EBITDA margin in the range of 23-24%.

› The guidance is based on an average

exchange rate of 1.18 USD/Euro.

Revenue breakdown per quarter:

in millions of USD

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q3 y-o-y growth

Automotive

56.7

68.3

61.6

40.8

65.4

83.5

82.8

81.5

100%

Industrial

20.1

22.1

23.9

23.9

27.3

32.4

35.2

38.3

61%

Medical

6.3

6.5

7.3

7.7

12.0

8.7

10.4

14.3

86%

Subtotal core business

83.2

96.9

92.7

72.3

104.7

124.6

128.4

134.1

85%

73.3%

76.4%

78.1%

75.2%

77.1%

80.1%

79.8%

79.3%

CCC1

30.1

29.7

25.9

23.7

30.9

30.6

32.4

34.7

46%

Others

0.1

0.3

0.2

0.1

0.3

0.3

0.1

0.3

Total revenues

113.4

126.9

118.8

96.1

135.9

155.4

161.0

169.1

76%

- Consumer, Communications & Computer

in millions of USD

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q3 y-o-y growth

CMOS

98.1

112.8

103.4

81.1

115.0

135.9

137.5

141.8

75%

MEMS

9.9

9.6

10.4

9.8

14.6

14.4

16.2

17.4

78%

Silicon carbide

5.5

4.5

5.0

5.2

6.3

6.1

7.2

9.9

80%

Total revenues

113.4

126.9

118.8

96.1

135.9

155.4

161.0

169.1

76%

Business development

In the third quarter, X-FAB continued to see strong demand.

Quarterly revenues came in at USD 169.1 million, at the upper end

of the guided USD 162-170 million, up 76% year-on-year and 5%

quarter-on-quarter.

X-FAB recorded strong quarterly growth across all end markets.

Revenues in the core markets – automotive, industrial and medical –

amounted to USD 134.1 million, which is an increase of 85%

year-on-year and 4% quarter-on-quarter. Both revenues in industrial

and medical set a new quarterly record with USD 38.3 million and

USD 14.3 million respectively. The growth of the industrial

business was mainly driven by the accelerated demand for X-FAB’s

silicon carbide (SiC) technologies. In medical, the main growth

drivers were lab-on-a-chip and ultrasound applications. X-FAB’s CCC

business (Consumer, Communications & Computer) recorded

quarterly revenues of USD 34.7 million benefiting from the

increasing deployment of 5G supported by X-FAB’s RF SOI

technology.

Demand remained at a high level with third quarter bookings

amounting to USD 199.0 million, up 78% year-on-year and down 5%

compared to the previous quarter. Based on this and with factories

running at high utilization levels, allocation of capacity to

customers had to be continued throughout the third quarter. X-FAB

is therefore in close contact with its customers to manage the

tight supply responsibly. It is of utmost importance for X-FAB to

ensure customers receive the minimum quantities required to avoid

disruptions in their supply chain. X-FAB’s French site, where spare

capacity is available, in particular for X-FAB’s much sought after

0.18µm automotive technology, plays a key role for this purpose. As

a result of the ongoing efforts to move business to X-FAB France,

the share of the site’s revenues based on X-FAB-owned technologies

significantly increased from 20% in the previous quarter to 34% in

the third quarter.

In addition to ongoing volume recovery following weak demand

linked to COVID-19 in 2020, growth is also driven by strong

interest in X-FAB’s specialty technologies that enable multiple

solutions to address today’s megatrends, from the ongoing

electrification in response to climate change to fast and reliable

point-of-care diagnostics for aging societies as well as the

transition to 5G in an increasingly connected world. This also

translated into significant growth in prototyping activities where

third quarter revenues reached an all-time high of USD 25.6

million, an increase of 60% year-on-year and 26%

quarter-on-quarter.

Prototyping and production revenue per quarter and end

market:

in millions

of USD

Revenue

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Q3 2021

Q2 y-o-y growth

Automotive

Prototyping

2.6

3.6

3.2

3.0

3.5

35%

Production

38.2

61.8

80.4

79.8

78.0

104%

Industrial

Prototyping

7.2

8.2

9.0

10.3

12.9

79%

Production

16.6

19.0

23.3

24.9

25.4

52%

Medical

Prototyping

3.4

6.9

2.2

2.9

4.1

20%

Production

4.2

5.1

6.4

7.5

10.2

140%

CCC

Prototyping

2.6

3.2

4.3

4.1

4.8

81%

Production

21.0

27.7

26.3

28.3

29.9

42%

Operations update

Due to the consistently strong demand, X-FAB’s factories

continued to run at high utilization rates. Execution excellence

and further productivity gains have therefore been a key focus for

all activities throughout the third quarter. This includes the

elimination of production bottlenecks, the hire of additional staff

and strict compliance with the safety measures in place to prevent

any COVID-19-related disruptions. X-FAB is also closely monitoring

developments relating to tight raw materials and is taking

necessary measures to secure sufficient supply going forward.

The high level of utilization led to higher maintenance efforts

across all sites. Even though this has an adverse impact on

short-term production output, it is essential to ensure the

stability of manufacturing in the long term. In September, X-FAB

was also affected by a power outage at its site in Dresden,

Germany. The resulting delivery delays will impact fourth quarter

revenue, which is already included in the guidance.

Demand for X-FAB’s silicon carbide (SiC) technologies continued

to accelerate. In the third quarter, SiC bookings recorded a 76%

increase year-on-year. Quarterly SiC revenues came in at USD 9.9

million, a growth of 90% year-on-year and 38% quarter-on-quarter.

X-FAB is working to further streamline and shorten the process from

onboarding to volume production ramp up, which will contribute to

faster time-to-market. X-FAB’s in-house SiC epitaxy is also in high

demand. While some customers already started production on X-FAB’s

SiC epitaxy line, others are in process of qualification, which

keeps progressing well. As more customers move into production,

X-FAB will look into further expanding its SiC epitaxy capacity in

line with the strong increase in demand.

Capital expenditures in the third quarter amounted to USD 21.9

million, mainly reflecting prepayments made for new equipment,

which were ordered as part of the capacity expansion projects

ongoing across all sites. Total capex launched by X-FAB as at the

end of September amounts to approx. USD 150 million, most of which

will not start to have an impact until next year considering the

lead times for new equipment. Most of the capex payment will be due

next year, namely at the time of equipment delivery and

installation.

Financial update

Third quarter EBITDA was USD 40.4 million with an EBITDA margin

of 23.9%, clearly exceeding the guidance of 18-22%. The positive

earnings development was driven by strong revenue growth but also

by the significant increase of unfinished and finished goods

inventory, which amounted to USD 7.4 million in the third quarter

and is mainly composed of work in progress supporting future

growth.

Quarter-on-quarter, the EBITDA margin went down three percentage

points, which is due to the past quarter’s one-off effect relating

to a loan of USD 6.5 million, which X-FAB Texas had received in the

context of a COVID-19 government support scheme (cf. Q2 results

release for more details).

Cash and cash equivalents at the end of the third quarter were

at USD 226.0 million, up 10% from the end of the previous

quarter.

In the third quarter, X-FAB

has achieved its objective of bringing the share of

Euro-denominated sales to 40%, in line with the level of costs

incurred in Euro. This natural hedging of the business makes

X-FAB’s profitability development largely independent of exchange

rate fluctuations.

The actual US-Dollar/Euro

exchange rate for the third quarter of 2021 was 1.18 leading to an

EBITDA margin of 23.9%. At a constant exchange rate of 1.17, as in

the third quarter of last year, the EBITDA margin would have been

the same.

Management comments & outlook

Rudi De Winter, CEO of X-FAB Group, said: “Strong business

development and high activity levels continued throughout the third

quarter, which was marked by X-FAB achieving several sales records.

Revenues in the industrial and medical market were at an all-time

high as were the revenues for prototyping and SiC. I am thrilled

about the many exciting applications we support serving fast

growing end markets. The rapid electrification of cars, for

example, provides us with strong opportunities in the automotive

market as it dramatically increases the average number of chips per

car, and the sale of electric vehicles is accelerating. Thanks to

our expertise in SiC and high-voltage applications, we are

perfectly placed to benefit from this turning point in automotive

history. Right now our key focus is to secure reliable supply to

our customers despite the challenges created by this unprecedented

demand. I am confident that X-FAB is well on track to build a

sustainable profitable business.”

X-FAB Quarterly Conference Call

X-FAB’s third quarter results will be discussed in a live

conference call on Thursday, October 28, 2021, at 6.30 p.m. CET.

The conference call will be in English. Please register in advance

of the conference using the following link:

http://emea.directeventreg.com/registration/5162989.

Upon registering, you will be provided with participant dial-in

numbers, Direct Event passcode and a unique registrant ID. In the

10 minutes prior to the call, you will need to use the conference

access information provided in the email received at the point of

registering.

The conference call will be available for replay from October

28, 2021, 11.30 p.m. CET until November 4, 2021, 11.30 p.m. CET.

The replay number will be +44 (0) 3333009785, conference ID

5162989.

The fourth quarter 2021 results will be communicated on February

10, 2022.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 to 0.13 µm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs about 4,000 people worldwide.

For more information, please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended 30 Sep 2021

unaudited

Quarter

ended 30 Sep 2020

unaudited

Quarter

ended 30 Jun 2021

unaudited

Nine months

ended 30 Sep 2021

unaudited

Nine months

ended 30 Sep 2020

unaudited

Revenue

169,097

96,085

160,955

485,471

341,735

Revenues in USD in %

60

65

66

64

68

Revenues in EUR in %

40

35

33

35

32

Cost of sales

-129,773

-97,233

-119,230

-369,422

-317,594

Gross Profit

39,323

-1,148

41,725

116,049

24,141

Gross Profit margin in %

23.3

-1.2

25.9

23.9

7.1

Research and development expenses

-7,751

-5,462

-8,692

-24,925

-17,253

Selling expenses

-1,969

-1,798

-2,008

-6,095

-5,928

General and administrative expenses

-8,320

-6,897

-7,649

-24,120

-21,544

Rental income and expenses from investment

properties

422

765

668

1,717

988

Other income and other expenses

-340

583

559

374

1,359

Operating profit

21,366

-13,957

24,602

63,000

-18,238

Finance income

5,166

4,262

3,470

12,920

11,171

Finance costs

-6,027

-3,240

-3,104

-16,299

-16,935

Net financial result

-861

1,022

366

-3,379

-5,764

Profit before tax

20,505

-12,935

24,968

59,621

-24,002

Income tax

1,296

5

1,769

1,691

-1,540

Profit for the period

21,801

-12,930

26,737

61,313

-25,541

Operating profit (EBIT)

21,366

-13,957

24,602

63,000

-18,238

Depreciation

19,076

18,700

18,718

56,345

56,188

EBITDA

40,442

4,743

43,320

119,345

37,950

EBITDA margin in %

23.9

4.9

26.9

24.6

11.1

Earnings per share at the end of

period

0.17

-0.10

0.20

0.47

-0.20

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.17954

1.16732

1.20429

1.19661

1.12418

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Quarter ended 30 Sep 2021

unaudited

Quarter ended

30 Sep 2020

unaudited

Year ended

31 Dec 2020

audited

ASSETS

Non-current assets

Property, plant, and equipment

330,295

337,130

336,848

Investment properties

8,120

8,701

8,556

Intangible assets

3,996

4,747

4,726

Other non-current assets

38

4,712

68

Deferred tax assets

36,097

33,103

30,392

Total non-current assets

378,546

388,393

380,590

Current assets

Inventories

172,560

160,088

153,711

Trade and other receivables

66,530

51,274

54,576

Other assets

38,784

35,285

38,054

Cash and cash equivalents

226,013

179,662

205,867

Total current assets

503,886

426,309

452,208

TOTAL ASSETS

882,432

814,702

832,798

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

-58,671

-159,743

-120,603

Cumulative translation adjustment

-587

-715

-747

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

721,426

620,225

659,334

Non-controlling interests

348

356

344

Total equity

721,774

620,581

659,677

Non-current liabilities

Non-current loans and borrowings

32,251

76,860

44,413

Other non-current liabilities and

provisions

4,153

7,409

4,371

Total non-current liabilities

36,404

84,269

48,784

Current liabilities

Trade payables

31,204

20,376

27,882

Current loans and borrowings

17,647

29,381

31,796

Other current liabilities and

provisions

75,404

60,094

64,658

Total current liabilities

124,255

109,852

124,336

TOTAL EQUITY AND LIABILITIES

882,432

814,702

832,798

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended 30 Sep 2021

unaudited

Quarter

ended 30 Sep 2020

unaudited

Quarter

ended 30 Jun 2021

unaudited

Nine months

ended 30 Sep 2021

unaudited

Nine months

ended 30 Sep 2020

unaudited

Income before taxes

20,505

-12,935

24,968

59,621

-24,002

Reconciliation of net income to cash

flow arising from operating activities:

18,131

9,974

12,079

51,801

54,623

Depreciation and amortization, before

effect of grants and subsidies

19,076

18,700

18,718

56,345

56,188

Recognized investment grants and subsidies

netted with depreciation and amortization

-850

-852

-848

-2,539

-2,603

Interest income and expenses (net)

-139

348

-117

-379

1,980

Loss/(gain) on the sale of plant,

property, and equipment (net)

80

-270

-280

-312

-584

Loss/(gain) on the change in fair value of

derivatives (net) and financial assets (net)

0

0

0

0

-420

Other non-cash transactions (net)

-36

-7,953

-5,393

-1,313

63

Changes in working capital:

15,565

1,148

-12,864

-17,494

12,180

Decrease/(increase) of trade

receivables

1,439

-2,663

-943

-10,796

3,954

Decrease/(increase) of other receivables

& prepaid expenses

10,743

4,800

-6,055

-811

20,077

Decrease/(increase) of inventories

-10,324

5,178

-6,055

-18,848

-5,441

(Decrease)/increase of trade payables

4,446

-7,082

-126

4,845

-15,581

(Decrease)/increase of other

liabilities

9,261

914

316

8,117

9,172

Income taxes (paid)/received

-220

-113

-14

-1,967

-833

Cash Flow from operating

activities

53,981

-1,926

24,169

91,962

41,969

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-21,932

-6,756

-14,216

-45,849

-23,849

Proceeds from sale of financial assets

0

0

0

0

1,156

Payments for loan investments to related

parties

-72

-34

-38

-201

-172

Proceeds from loan investments related

parties

42

40

45

166

154

Proceeds from sale of property, plant, and

equipment

47

1,208

285

449

1,526

Interest received

451

436

468

1,390

1,406

Cash Flow used in investing

activities

-21,464

-5,105

-13,456

-44,046

-19,780

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended 30 Sep 2021

unaudited

Quarter

ended 30 Sep 2020

unaudited

Quarter

ended 30 Jun 2021

unaudited

Nine months

ended 30 Sep 2021

unaudited

Nine months

ended 30 Sep 2020

unaudited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

310

-266

4,479

4,789

8,547

Repayment of loans and borrowings

-8,561

-7,781

-4,231

-20,411

-20,718

Payments of lease installments

-1,335

-1,390

-1,529

-4,037

-4,201

Receipt of government grants and

subsidies

0

0

0

0

696

Interest paid

-312

-185

-350

-1,010

-627

Distribution to non-controlling

interests

0

0

0

-12

-12

Cash Flow from (used in) financing

activities

-9,898

-9,622

-1,630

-20,681

-16,315

Effect of changes in foreign currency

exchange rates on cash

-1,715

4,679

217

-7,089

577

Increase/(decrease) of cash and cash

equivalents

22,619

-16,654

9,083

27,235

5,874

Cash and cash equivalents at the beginning

of the period

205,109

191,636

195,810

205,867

173,211

Cash and cash equivalents at the end

of

the period

226,013

179,662

205,109

226,013

179,662

###

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211028005881/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

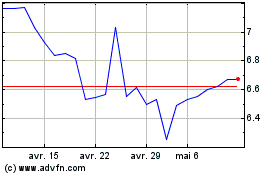

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

X-FAB Silicon Foundries (EU:XFAB)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024