Japanese Yen Climbs In Cautious Trade

08 Novembre 2022 - 8:24AM

RTTF2

The Japanese yen advanced against its major counterparts in the

European session on Tuesday amid safe-haven status, as rising

coronavirus cases in China fuelled concerns about the growth

outlook.

Guangzhou and other major Chinese cities reported a spike in

infections, dashing hopes for an easing of zero COVID policy.

Investors focus on U.S. midterm elections that will decide the

fate of Congress.

The Republican party is expected to get a majority in both

Houses, paving the way for a political instability.

Preliminary figures from the Cabinet Office showed that Japan's

leading index weakened to the lowest since December 2020.

The leading index, which measures future economic activity,

decreased to 97.4 in September from 101.3 in August. The expected

score was 97.5.

The yen climbed to 146.14 against the greenback and 167.53

against the pound, from its early lows of 146.94 and 169.08,

respectively. The next possible resistance for the yen is seen

around 122.00 against the greenback and 160.00 against the

pound.

The yen moved up to 147.77 against the franc, after falling to a

1-week low of 148.41 in the Asian session. If the yen extends rise,

124.00 is possibly seen as its next resistance level.

The yen edged up to 146.12 against the euro and 108.27 against

the loonie, off its early lows of 146.99 and 108.73, respectively.

The yen is likely to find resistance around 141.00 against the euro

and 101.00 against the loonie.

The yen reversed from an early low of 95.03 against the aussie

and near a 2-month low of 87.23 against the kiwi, rising to 94.59

and 86.60, respectively. The yen is poised to test resistance

around 92.00 against the aussie and 84.00 against the kiwi.

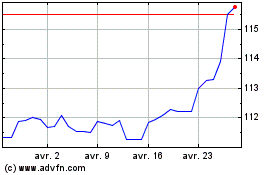

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024