Japanese Yen Climbs In Cautious Trade

20 Mars 2023 - 8:29AM

RTTF2

The Japanese yen strengthened against its major counterparts in

the European session on Monday, as a takeover of Credit Suisse by

UBS and the combined efforts of major central banks to avert a

liquidity crisis failed to cheer investors.

The U.S. Federal Reserve announced that it would increase the

frequency of dollar swap line operations with the European Central

Bank, the Bank of Japan, the Bank of England, the Bank of Canada

and the Swiss National Bank to shore up liquidity conditions.

Investors digested the merger agreement between UBS and Credit

Suisse in an attempt to secure financial stability.

Traders also looked ahead to Wednesday's US Federal Reserve's

monetary policy announcement, expecting the Fed to raise interest

rate by 25 basis points.

CME Group's FedWatch tool currently indicates a 43.2 percent

chance the Fed will leave rates unchanged and a 56.8 percent chance

of a 25 basis point rate hike.

The yen appreciated to near a 6-week high of 130.53 against the

greenback and a 2-month high of 140.22 against the franc, from its

early lows of 132.65 and 143.17, respectively. The yen may find

resistance around 127.00 against the greenback and 137.00 against

the franc.

The yen firmed to near 2-month highs of 138.82 against the euro

and 95.02 against the loonie, off its early lows of 141.74 and

96.87, respectively. The currency is seen finding resistance around

135.5 against the euro and 92.00 against the loonie.

The yen climbed to a 3-month high of 87.12 against the aussie

and a 4-day high of 81.47 against the kiwi, up from its prior lows

of 89.23 and 83.27, respectively. Next immediate resistance for the

currency is seen around 85.00 against the aussie and 80.00 against

the kiwi.

The yen was up against the pound, at a 4-day high of 158.95. On

the upside, 157.00 is likely seen as its next resistance level.

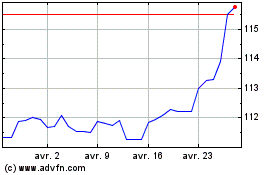

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024