Yen Rises As Strong Tokyo CPI Spurs BoJ Rate Hike Bets

29 Novembre 2024 - 4:25AM

RTTF2

The Japanese yen strengthened against other major currencies in

the Asian session on Friday, after data showed that Tokyo's

faster-than-expected inflation bolstered speculation that the Bank

of Japan might raise interest rates next month.

Data from the Ministry of Internal Affairs and Communications

that the Tokyo consumer price inflation advanced to 2.6 percent in

November from 1.8 percent in October. Core inflation that excludes

fresh food climbed to 2.2 percent from 1.8 percent.

The Ministry of Economy, Trade and Industry reported that

industrial production expanded at a faster pace of 3.0 percent in

October and marked the second consecutive increase. However, the

rate was weaker than the expected growth of 3.8 percent. Output was

up 1.6 percent in September.

In October, retail sales grew 1.6 percent from a year ago, which

was more than double the 0.7 percent growth posted in September,

the METI said in a separate report. Still, this was slower than the

2.1 percent forecast.

Elsewhere, the Ministry of Internal Affairs and Communications

reported that the jobless rate rose marginally to a seasonally

adjusted 2.5 percent in October from 2.4 percent in September.

The number of unemployed decreased 50,000 from the previous year

to 1.7 million.

Another report showed that the decline in housing starts

worsened more than expected in October. Housing starts were down

2.9 percent on year after falling 0.6 percent in September, the

Ministry of Land, Infrastructure, Transport, and Tourism said.

Economists had forecast a 2.0 percent annual fall.

Construction orders received by 50 big contractors surged 44.6

percent annually, in contrast to the 21.3 percent decrease in

September.

Asian stock markets traded lower, as traders react to a slew of

economic data from Japan and manufacturing data from South Korea.

The developments in the Middle East are also hurting market

sentiment.

In the Asian trading today, the yen rose to near 2-month highs

of 158.24 against the euro, 190.33 against the pound and 170.01

against the Swiss franc, from yesterday's closing quotes of 159.92,

192.26 and 171.56, respectively. If the yen extends its uptrend, it

is likely to find resistance around 154.00 against the euro, 184.00

against the pound and 167.00 against the franc.

Against the U.S. and the Canadian dollars, the yen advanced to

nearly a 1-1/2-month high of 149.76 and nearly a 2-month high of

107.04 from Thursday's closing quotes of 151.54 and 108.13,

respectively. The yen may test resistance around 144.00 against the

greenback and 104.00 against the loonie.

Against the Australia and the New Zealand dollars, the yen

climbed to more than 2-month highs of 97.53 and 88.47 from

yesterday's closing quotes of 98.49 and 89.23, respectively. On the

upside, 96.00 against the aussie and 87.00 against the kiwi are

seen as the next resistance levels for the yen.

Looking ahead, Germany's unemployment data for November, U.K.

mortgage approvals for October and Eurozone inflation data for

November are slated for release in the European session.

In the New York session, Canada GDP data for September, Canada

budget balance for September and U.S. Federal Reserve's monthly

balance sheet are set to be released.

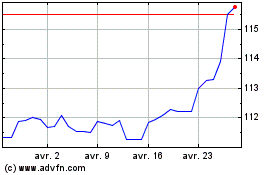

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Nov 2024 à Déc 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Déc 2023 à Déc 2024