Canadian Dollar Lower Amid Falling Oil Prices

09 Mai 2022 - 1:00PM

RTTF2

The Canadian dollar fell against its most major counterparts in

the European session on Monday amid a drop in oil prices, as

China's two biggest cities tightened restrictions, sparking worries

about economic growth in the world's second largest economy.

Crude for July delivery fell $2.80 to 109.59 per barrel.

Authorities in Shanghai issued notices in several districts,

ordering residents to remain at home and prevented from receiving

nonessential deliveries at least until Wednesday.

China's export growth slowed to the weakest in almost two years

and imports were barely changed in April, adding to concerns over

the economic outlook.

Saudi Aramco, the world's largest oil producer, reduced its

official selling prices for Asian and European customers amid

subdued demand.

The G7 countries pledged to phase out or ban the import of

Russian oil to ramp up pressure on President Vladimir Putin over

the attacks on Ukraine.

The loonie touched 1.2954 against the greenback, its lowest

level since December 2021. If the loonie slides further, it may

find support around the 1.32 mark.

The loonie was down against the euro, at nearly a 2-week low of

1.3664. The loonie is likely to challenge support around the 1.38

level.

The loonie pulled back against the yen to hit a 5-day low of

100.92. The next key support for the loonie is seen around the 98.5

mark.

In contrast, the loonie rallied to 0.9042 against the aussie,

marking a new 3-month high. The loonie is poised to find resistance

around the 0.88 area.

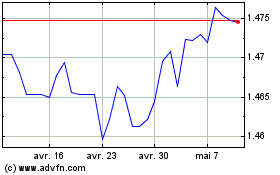

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024