NZ Dollar Slides On Weak GDP Data

16 Mars 2023 - 3:11AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Thursday, after data showed the nation's

gross domestic product contracted in the fourth quarter of

2022.

Statistics New Zealand showed that New Zealand's gross domestic

product contracted a seasonally adjusted 0.6 percent on quarter in

the fourth quarter of 2022. That missed forecasts for a decline of

0.2 percent following the downwardly revised 1.7 percent increase

in the three months prior.

On an annualized basis, GDP climbed 2.2 percent, that missed a

forecast of 3.3 percent following the 6.4 percent increase in the

third quarter.

Asian Markets traded lower, following a fresh sell-off in the

banking sector amid concerns about the debt woes of Swiss lender

Credit Suisse, and the collapse of Silicon Valley Bank and

Signature Bank in the U.S. last week. This raised concerns the

global economy could see a significant slowdown in the near to

medium term.

Credit Suisse shares fell nearly 25 percent in the Swiss market

after Saudi National Bank, the bank's largest investor, reportedly

said it would not provide any more funding to the Swiss lender.

Wednesday, the NZ dollar was retreating from early highs against

its major counterparts.

In the Asian session today, the NZ dollar fell to a 2-month low

of 81.67 against the yen from yesterday's closing value of 82.57.

The kiwi may find support around the 80.00 area.

Against the U.S. dollar, the kiwi dropped to a 3-day low of

0.6139 from yesterday's closing quote of 0.6188. If the kiwi

extends its downtrend, it is likely to find support around the 0.60

area.

The kiwi slipped to a 3-day low of 1.0776 against the Australian

dollar from yesterday's closing value of 1.0687. The AUD/NZD pair

is likely to find their support around the 1.09 level.

In economic news, the unemployment rate in Australia came in at

a seasonally adjusted 3.5 percent in February, the Australian

Bureau of Statistics said on Thursday. That was beneath

expectations for 3.6 percent and was down from 3.7 percent in

January. The participation rate was 66.6 percent, in line with

expectations and up from 66.5 percent a month earlier.

Against the euro, the kiwi edged down to 1.7232 from yesterday's

closing value of 1.7087. The next support level for the kiwi is

seen around the 1.74 area.

Looking ahead, Canada final wholesale sales data for January.

U.S. building permits, housing starts, export and import prices,

all for February, and U.S. weekly jobless claims data are due to be

released in the New York session.

At 8:15 am ET, European Central Bank's Monetary policy decision

is due. The central bank has signaled for another 50-basis point

increase on today's meeting.

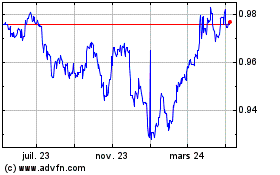

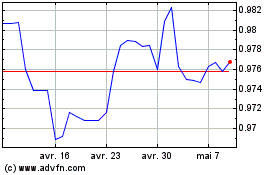

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024