Pound Climbs As U.K. Retail Sales Rise Unexpectedly

20 Mai 2022 - 9:15AM

RTTF2

The pound appreciated against its most major counterparts in the

European session on Friday, as the nation's retail sales grew

unexpectedly in April despite consumer confidence sliding to a

record low as soaring inflation boosted the cost of living

further.

Data from the Office for National Statistics showed that retail

sales expanded 1.4 percent monthly, reversing a revised 1.2 percent

decline in March.

Sales were forecast to drop 0.2 percent in April.

China's reduction in the borrowing rate to boost the virus-hit

economy lifted European shares, further underpinning the

currency.

The People's Bank of China cut the five-year loan prime rate by

15 basis points to 4.45 percent from 4.60 percent to revive the

property sector. This was the second reduction this year.

The pound reversed from its early lows of 1.2080 against the

franc and 1.2437 against the greenback, rising to 1.2163 and

1.2497, respectively. The pound is seen finding resistance around

1.24 against the franc and 1.28 against the greenback.

The pound advanced to a 2-day high of 160.20 against the yen,

from a low of 158.73 set at 11:50 pm ET. If the pound rises

further, 162.00 is possibly seen as its next resistance level.

The pound reached as high as 0.8464 against the euro, but it has

since eased to 0.8491. At yesterday's close, the pair was worth

0.8485.

Looking ahead, Eurozone flash consumer sentiment index for May

will be published at 10:00 am ET.

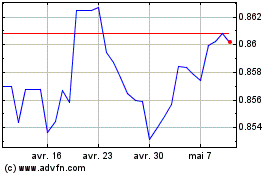

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

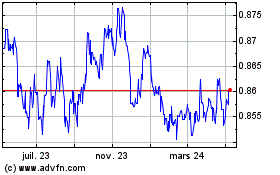

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024