Turkish Central Bank Holds Rates Unchanged, Erdogan Raises Minimum Wage By 55%

22 Décembre 2022 - 8:47AM

RTTF2

Turkey's central bank left its key interest rates unchanged on

Thursday after lowering them sharply over the past four meetings as

President Recep Tayyip Erdogan in Ankara raised the monthly minimum

wage by nearly 55 percent to support households reeling under the

pressure of rising cost of living and sky-rocketing inflation.

The Monetary Policy Committee of the Central Bank of the

Republic of Turkey decided to hold the policy rate at 9.00 percent,

as widely expected. The bank has lowered the policy rate by a

cumulative 500 basis points since August despite inflation rising

persistently. In November, consumer price inflation remained near

85 percent.

"Considering the increasing risks regarding global demand, the

Committee evaluated that the current policy rate is adequate," the

bank said in the statement.

The MPC said it expects disinflation process to start on the

back of measures taken and decisively implemented for strengthening

sustainable price and financial stability along with the resolution

of the ongoing regional conflict.

Conditions need to be maintained for preserving the growth

momentum in industrial production as well as the positive trend in

employment in a period of increasing uncertainties surrounding

global growth as well as further escalation of geopolitical

risks.

Earlier on Thursday, President Erdogan announced a 54.5 percent

hike in the monthly minimum wage, during a televised statement, in

a bid to help people cope with soaring inflation. The government

has raised the wage three times in the past year.

With political pressure driving central bank decision making and

President Erdogan recently suggesting that rates should remain in

single-digits with the 2023 elections approaching, the central bank

will not deliver the hikes that are desperately needed to control

inflation and regain credibility anytime soon, Capital Economics

economist Nicholas Farr said.

Even if interest rates are not lowered further, the central

bank's deeply negative real policy stance and precarious external

position means that the lira is highly vulnerable to a large

adjustment, the economist noted.

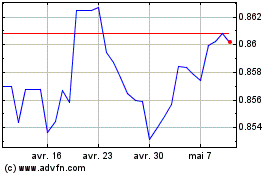

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

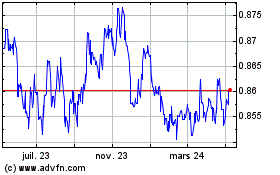

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024