Bank Indonesia Slows Rate Hikes As Inflation Remains High

22 Décembre 2022 - 10:22AM

RTTF2

Indonesia's central bank decided to raise its key interest rate

for the fifth policy session at its December meeting, though at a

slower pace than in the previous months, as inflation came off

slightly from highs due to a modest easing in energy prices and the

pace of economic growth is forecast to slow next year in the

backdrop of a global slowdown.

The Board of Governors, headed by Perry Warjiyo, hiked the BI

7-day reverse repo rate to 5.50 percent from 5.25 percent following

its two-day rate-setting session, the Bank Indonesia said on

Thursday.

In November, the central bank had raised interest rates by 50

basis points.

The deposit facility rate was also raised by a quarter-point to

4.75 percent and the lending facility rate to 6.25 percent.

By raising interest rates in a measured manner, the bank aims to

ensure a continued decline in inflation and inflation expectations

so that core inflation is maintained within the range of 3.0

percent to 1.0 percent.

Recent data showed that Indonesia's headline inflation eased to

a three-month low of 5.42 percent from 5.71 percent. Nonetheless,

the inflation was well above the target corridor of 3 plus or minus

one percent.

Meanwhile, the core inflation declined further to 3.30 percent

due to the continued impact of the limited fuel price adjustment on

core inflation and mild inflationary pressure from demand.

The bank also said it remains focused on the Rupiah exchange

rate stabilization policy, which continues to be strengthened in

order to control imported inflation and mitigate the spillover

effects of a strong US dollar and high market uncertainty.

Bank Indonesia observed that Indonesia's domestic economy

remains strong due to resilient domestic demand created by

households' purchasing power and strong confidence indicators.

Along with hopes of better exports and domestic demand, economic

growth in 2022 is predicted to remain biased upwards within the

range of Bank Indonesia's projection of 4.5 percent to 5.3 percent

in 2023.

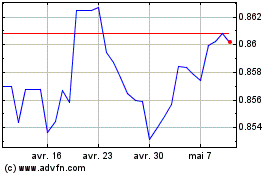

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

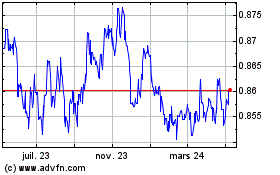

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024