U.S. Dollar Slumps Amid Lingering Worries About Trump Tariffs

27 Novembre 2024 - 5:25PM

RTTF2

Following the rebound seen during trading on Tuesday, the value

of the U.S. dollar is extending Monday's slump during trading on

Wednesday.

The U.S. dollar index has slid 0.94 points or 0.9 percent to

106.07, pulling back well off last Friday's two-year highs.

The greenback has shown a significant move to the downside

versus the Japanese yen, tumbling to 151.11 compared to the 153.08

yen it fetched at the close of New York trading on Tuesday. Against

the euro, the dollar is trading at $1.0565 compared to yesterday's

$1.0489.

The weakness in the value of the dollar comes amid lingering

concerns about President-elect Donald Trump's to impose increased

sanctions on Mexico, Canada and China and the possibility about a

wider trade war.

Traders were also reacting to the Commerce Department's closely

watched consumer price inflation data that matched

expectations.

The Commerce Department said its personal consumption

expenditures (PCE) price index rose by 0.2 percent in October,

matching the uptick seen in September as well as economist

estimates.

The annual rate of growth by the PCE price index accelerated to

2.3 percent in October from 2.1 percent in September, which was

also in line with expectations.

Excluding food and energy prices, the core PCE price index

climbed by 0.3 percent in October, matching the increase seen in

September as well as economist estimates.

The annual rate of growth by the core PCE price index crept up

to 2.8 percent in October from 2.7 percent in September, which was

also in line with expectations.

"Whilst the CME Fedwatch tool suggests markets still broadly

expect a further rate cut from the Federal Reserve next month,

there is a concern that the pace of cuts is likely to slow as

central bankers respond to the sticky nature of prices in core

areas as well as fears about how Trump's tariffs might impact the

U.S. consumer," said AJ Bell head of financial analysis Danni

Hewson.

The inflation readings, which are preferred by the Federal

Reserve, largely overshadowed a slew of other U.S. economic

data.

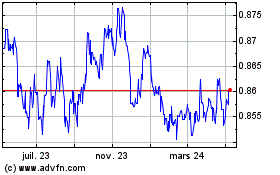

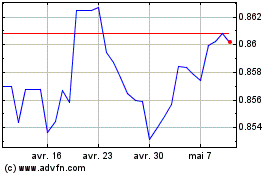

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Oct 2024 à Nov 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Nov 2023 à Nov 2024