Pound Weakens Despite BoE's Slower Rate Cut Prospects

29 Novembre 2024 - 11:50AM

RTTF2

The pound was lower against its major counterparts in the New

York session on Friday, as the U.S. dollar rebounded after the

Thanksgiving holiday.

U.K. inflation rose sharply in October, official data showed

last week, dampening the prospects of a final interest rate cut

this year.

The BoE cut rates by 25 basis points earlier this month, but

indicated gradual rate cuts in the future.

On the data front, UK mortgage approvals increased to the

highest level in more than two years in October as falling interest

rates boosted housing market activity but consumers became more

cautious about borrowing and saving ahead of the Autumn Budget.

Mortgage approvals for house purchases, an indicator of future

borrowing, increased to 68,303 in October from 66,115 in the prior

month. Approvals were expected to fall to 65,000.

The pound fell to near a 2-month low of 190.15 against the yen

and a 2-day low of 1.1166 against the franc, from an early high of

192.31 and a 4-day high of 1.1220, respectively. The next possible

support for the currency is seen around 185.00 against the yen and

1.10 against the franc.

The pound retreated to 1.2671 against the greenback, from an

early more than 2-week high of 1.2749. If the currency falls

further, it is likely to test support around the 1.24 region.

The pound declined to 0.8331 against the euro in the previous

session and held steady thereafter. This may be compared to an

early 1-week high of 0.8304. The currency is likely to locate

support around the 0.86 level.

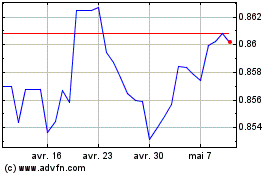

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Oct 2024 à Nov 2024

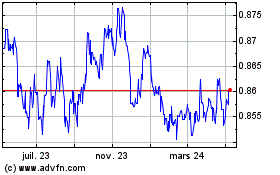

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Nov 2023 à Nov 2024