NZ Dollar Appreciates Amid China Reopening Signals

05 Décembre 2022 - 4:36AM

RTTF2

The NZ dollar climbed against its major counterparts in the

Asian session on Monday, as investors bet on a gradual reopening of

Chinese economy following a relaxation of travel restrictions in

more cities.

China's financial hub Shanghai removed testing requirements for

public transportation and entry to public venues effective

today.

Zhengzhou city, which home to the world's largest iPhone

factory, also ended testing requirements to use public

transportation and enter other public venues.

Oil prices climbed OPEC+ nations reaffirmed their output

targets.

An EU embargo on seaborne Russian oil will likely take effect

today after the Group of Seven clinched a last-minute deal to cap

the price of Russian crude at $60 per barrel.

The kiwi approached 0.6443 against the greenback, its highest

level since August 15. Next key resistance for the kiwi is seen

around the 0.66 level.

The kiwi rose to 86.69 against the yen, setting a 4-day high.

The currency is seen finding resistance around the 87.5 level.

The kiwi rebounded to 1.0612 against the aussie, from a low of

1.0648 hit at 10:05 pm ET. The kiwi may test resistance around the

1.05 level, if it rises again.

Against the euro, the kiwi reached as high as 1.6422. If the

kiwi extends rise, 1.62 is possibly seen as its next resistance

level.

Looking ahead, PMI reports from major European economies and

Eurozone retail sales for October are due in the European

session.

U.S. factory orders for October and ISM non-manufacturing PMI

for November, as well as Canada building permits for October will

be released in the New York session.

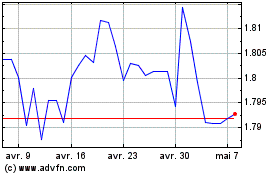

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024