Canadian Dollar Weakens Amid Falling Oil Prices

18 Novembre 2022 - 11:57AM

RTTF2

The Canadian dollar fell against its major counterparts in the

European session on Friday, as oil prices dropped on concerns about

the U.S. Federal Reserve's tightening path and a slowdown in the

economic growth.

Crude for January delivery dropped $3.59 to 86.19 per

barrel.

St Louis Fed President James Bullard said that the central bank

will be required to continue raising interest rates by at least

another full percentage point as the impact of tightening is having

a limited effect so far.

Minneapolis Fed President Neel Kashkari said that the U.S.

central bank shouldn't pause on monetary tightening before there is

a clear indication that inflation has peaked.

Hawkish comments from Fed officials fuelled expectations for

further interest rate rises that could derail the economic

growth.

The loonie dropped to 0.8978 against the aussie and 1.3399

against the greenback, from its early highs of 0.8893 and 1.3300,

respectively. The next possible support for the loonie is seen

around the 0.90 against the aussie and 1.35 against the

greenback.

The loonie was down at a 2-day low of 1.3865 against the euro.

The loonie is poised to challenge support around the 1.40 mark.

The loonie slipped to 104.36 against the yen, from a 2-day high

of 105.42 seen at 7:05 pm ET. The currency is likely to challenge

support around the 103.00 region.

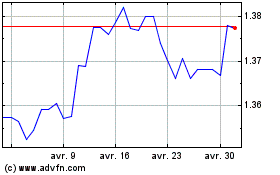

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024