Canadian Dollar Climbs Against Most Majors

14 Mars 2023 - 6:18AM

RTTF2

The Canadian dollar advanced against its most major counterparts

in the European session on Tuesday, as investors await key U.S.

consumer price inflation data later in the day for clues on the

path for interest rates.

The consumer price index is expected to have risen by 6 percent

year-over-year in February compared to 6.4 percent in January.

Traders shifted back to betting Fed rate cuts amid the fallout

from SVB and lingering worries about contagion.

Some economists now expect no rate increase at all when the

Federal Reserve delivers its interest-rate decision later this

month.

The loonie climbed to 1.3702 against the greenback and 97.82

against the yen, from its prior lows of 1.3748 and 96.83,

respectively.

The loonie up against the euro, at a 4-day high of 1.4641.

Next near term resistance for the currency is likely seen around

1.36 against the greenback, 99.00 against the yen and 1.46 against

the euro.

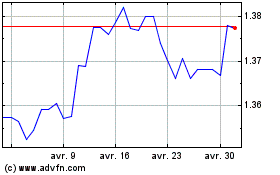

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024