U.S. Dollar Drops Amid Weak Services PMI

05 Juin 2023 - 1:59PM

RTTF2

Reversing direction, the U.S. dollar fell against its major

counterparts in the New York session on Monday, after a data showed

that nation's service sector growth slowed more than expected in

May.

Survey data from the Institute for Supply Management showed that

services PMI fell to 50.3 in May from 51.9 in April. Economists had

expected the index to edge down to 51.5.

The currency was higher in the European session as strong jobs

data increased the likelihood of the Federal Reserve keeping rates

higher for longer.

The Fed is due to announce its latest monetary policy decision

next week, with the central bank widely expected to hold the rate

at 5.00 percent - 5.25 percent.

The greenback fell to 1.0722 against the euro and 139.25 against

the yen, from an early 4-day high of 1.0674 and a 6-day high of

140.45, respectively. The next likely support for the currency is

seen around 1.09 against the euro and 137.00 against the yen.

The greenback eased to 0.9056 against the franc and 1.2432

against the pound, off its early 5-day highs of 0.9119 and 1.2368,

respectively. The greenback is likely to find support around 0.89

against the franc and 1.26 against the pound.

The greenback dropped to 0.6637 against the aussie and 0.6085

against the kiwi, reversing from an early high of 0.6579 and a

4-day high of 0.6041, respectively. The greenback is seen finding

support around 0.68 against the aussie and 0.62 against the

kiwi.

In contrast, the greenback moved up against the loonie, touching

a 4-day high of 1.3461. The greenback may find resistance around

the 1.36 level.

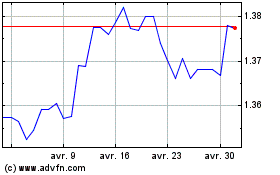

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024