Affinity Water Finance (2004) Plc Affinity Water - Substitution of Cayman Issuer (7843N)

22 Janvier 2019 - 1:00PM

UK Regulatory

TIDM72YE TIDM19LP

RNS Number : 7843N

Affinity Water Finance (2004) Plc

22 January 2019

AFFINITY WATER FINANCE PLC (the "Substitute Programme

Issuer")

GBP14.2 million of 3.625 per cent. Sterling Denominated Fixed

Rate Bonds due 2022

GBP60 million of 2.699 per cent. Sterling Denominated Fixed Rate

Bonds due 2033

GBP10 million of 1.024 per cent. Sterling Denominated Retail

Price Index Linked Bonds due 2033

GBP250 million of 4.5 per cent. Sterling Denominated Fixed Rate

Bonds due 2036

GBP85 million of 3.278 per cent. Sterling Denominated Fixed Rate

Bonds due 2042

GBP60 million of 0.23 per cent. Sterling Denominated Consumer

Price Index Linked Bonds due 2042

GBP190 million of 1.548 per cent. Sterling Denominated Retail

Price Index Linked Bonds due 2045

(the "Programme Issuer Bonds")

issued by the Substitute Programme Issuer and guaranteed by

Affinity Water Limited, Affinity Water Holdings Limited and

Affinity Water Finance (2004) plc

AFFINITY WATER FINANCE (2004) PLC (the "Existing Issuer")

GBP250 million of 5.875 per cent. Guaranteed Notes due 2026 (the

"Existing Issuer Bonds" and, together with the Programme Issuer

Bonds, the "Bonds")

issued by the Existing Issuer and guaranteed by Affinity Water

Limited, Affinity Water Holdings Limited and the Substitute

Programme Issuer

AFFINITY WATER LIMITED ANNOUNCES THE SUBSTITUTION OF ITS CAYMAN

ISSUER

22 January 2019

Further to the announcement made by Affinity Water Limited (the

"Company") dated 7 December 2018, and further to amendments

described in a proposal dated 15 November 2018 (the "STID

Proposal"), the Company announces today that the following

conditions have been satisfied:

(a) the approval of the STID Proposal and the announcement by the Company of such approval;

(b) the due execution by the relevant parties of the Master Implementation Deed;

(c) opinions from Hogan Lovells International LLP as to (i)

matters of capacity and the enforceability of the Master

Implementation Deed and (ii) certain taxation matters in relation

to the proposed substitution;

(d) confirmation from each of the rating agencies that the

Substitution will not result in a downgrading of the then current

credit ratings of such rating agency applicable to the Bonds (or

where a rating agency is not willing to provide such confirmation

due to its prevailing policy, a certificate from the Company

certifying that, in its opinion, having consulted with such rating

agency, the Substitution would not result in a downgrading of the

then current credit ratings of such rating agency applicable to the

Bonds); and

(e) the other conditions set out in paragraph 7 of the STID Proposal,

(the "Amendment Conditions").

Following satisfaction of the Amendment Conditions, Affinity

Water Programme Finance Limited (the "Previous Programme Issuer")

has been substituted with the Substitute Programme Issuer, a public

limited company incorporated in England and Wales, as the issuer of

the Bonds and as a guarantor for the Existing Issuer Bonds.

Additionally, the Substitute Programme Issuer has replaced the

Previous Programme Issuer as the issuer of its privately placed

notes and for all other purposes as Programme Issuer under the

Transaction Documents. Accordingly, the Previous Programme Issuer

has been removed from the Financing Group.

Capitalised terms used in this announcement and not defined

herein have the meanings ascribed to them in the solicitation

memorandum dated 15 November 2018.

For further information, please contact:

Affinity Water Limited

Tamblin Way

Hatfield

Hertfordshire

AL10 9EZ

Telephone: +44 1707 679 340

Email: nilesh.patel@affinitywater.co.uk

Attention: Nilesh Patel, Treasurer

This notice is given by:

Affinity Water Limited

22 January 2019

This announcement is released by Affinity Water Limited and

contains inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) 596/2014 ("MAR"), encompassing

information relating to the Substitution described above. For the

purposes of MAR and Article 2 of Commission Implementing Regulation

(EU) 2016/1055, this announcement is made by Tim Monod at Affinity

Water Limited.

ISINs:

XS0883690090

XS1722862080

XS1360548215

XS0883686650

XS1480879540

XS1722861439

XS0883688516

XS0195751523

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBBGDBSUDBGCD

(END) Dow Jones Newswires

January 22, 2019 07:00 ET (12:00 GMT)

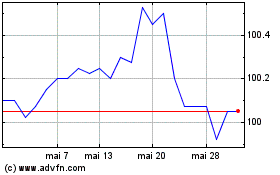

Affinity 5 7/8% (LSE:72YE)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Affinity 5 7/8% (LSE:72YE)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025