TIDMACP

RNS Number : 3418M

Armadale Capital PLC

23 May 2022

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

23 May 2022

Armadale Capital Plc

('Armadale' or 'the Company')

Final Results and Notice of AGM

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

announce its final results for the year ended 31 December 2021

('Final Results' or 'Annual Report'). The Company also announces

that its Annual General Meeting ('AGM') will be held at Suite 2, 23

Railway Road. Subiaco, Western Australia 2016 on 20 June 2022 at

17.00 AWST (10:00 BST) . A notice of AGM, together with printed

copies of the Company's full Annual Report for the year ended 31

December 2021, will be posted to shareholders. Copies will also be

available to view on the Company's website:

www.armadalecapitalplc.com .

Strategic Report

For the year ended 31 December 2021

Operational and Corporate Highlights for Period Ending 31

December 2021

Significant progress made in delivering key accretive milestones

in advancing the Mahenge Liandu Graphite Project in Tanzania

1. In January 2021, the Company reported on the CSIRO

(Australia's Commonwealth Scientific and Industrial Research

Organisation) test work which confirmed natural flake graphite from

Mahenge graphite project as a premium quality product with the

exceptionally high purity and characteristics required for use in

lithium-ion batteries.

2. In March 2021, the Environmental and Social Impact Assessment

('ESIA') was formally granted by National Environment Management

Council ('NEMC') of Tanzania.

3. In September 2021, the Company announced the formal

confirmation and receipt of the Mining Licence (ML/007744/2020) for

the Mahenge Graphite Project from the Tanzanian Ministry of Energy

and Minerals. The Mining Licence provides the Company with

exclusive development and mining rights over the graphite resources

within the 8.54km(2) Mining Licence and is a major de-risking

milestone for investors. The mining licence was granted for an

initial 10-year term which can be extended. Should it be extended,

it would cover the initial 15-year mine life utilising only 25% of

the estimated Resource.

4. 1st phase of Front-End Engineering Design Studies undertaken

by Chinese EPCM Xinhai Mineral EPC completed with positive results

received confirming a premium quality high purity graphite

concentrate, also suitable for the battery anode market and can be

produced from Mahenge using conventional plant as outlined in the

Company's existing Definitive Feasibility Study. This included

metallurgical a test work programme which further confirmed the

efficacy of the Company's intended process flow sheet and helped

ratify project economics.

5. The main focus going forward is gaining project development

finance and binding off take agreements to bring the project to

production.

6. In December 2021, the Company appointed Mr. Greg Entwhistle

as Project Director. Over the past five years, Mr Entwistle has

specialised in the emerging graphite sector in East Africa

consulting to several groups that are advancing projects towards

production. Mr. Entwhistle brings considerable skills and

experience to expedite progress of the Group's Mahenge Graphite

project towards commissioning production .

Post Period End

1. In February 2022 the Company applied for three incremental

exploration licences which are prospective for graphite

mineralisation and materially enhance the Mahenge Liandu Project's

exploration potential.

2. Ongoing review of quoted portfolio, where the Directors

believe there are opportunities for capital gains.

3. Continue to actively review other exciting investment opportunities.

During the year under review, Armadale continued to operate as a

diversified investing group focused on natural resource projects in

Africa. To this end, its portfolio is divided into two groups:

-- actively managed investments where the Company has majority ownership of the investment; and

-- passively managed investments where the Company has a

minority investment, typically in a quoted company, and does not

have management control.

Currently, the Company's key actively managed investment is the

Mahenge Liandu Graphite Project in Tanzania. At present, the

Company is actively marketing the Project to potential industry

partners and end users (offtakers) of graphite products. The

Company is also pursuing a range of potential options relating to

development finance for the project.

PASSIVELY MANAGED INVESTMENTS

Mine Restoration Investments Limited ('MRI'), South Africa

The shares in MRI are being carried at Nil market value (2020:

Nil) as MRI shares were suspended from trading on the Johannesburg

Stock Exchange. The MRI shares continued to be suspended throughout

the year.

Quoted Portfolio

The Company has a small portfolio of quoted investments, valued

at GBP150,000 on 16 May 2022, principally in resource companies

where the Directors believe there are opportunities for capital

gain. The Company continues to keep its portfolio under review. The

Company's strategy with its quoted portfolio is to gain exposure in

projects that have the potential to create short to medium term

returns for the Company as well as diversify the Company's exposure

to a broader range of commodities while being able to enter and

exit the position with minimal cost and time.

SUSTAINABLE DEVELOPMENT

The Company is committed to sustainable development and

conducting its business ethically. Given that the Company invests

in the mining industry, one of its key focuses is on maintaining a

high level of health and safety, environmental responsibility, and

support for the communities close to its investments.

CORPORATE INFORMATION

Principal Risks and Uncertainties

There are known risks associated with the mineral industry,

especially in Africa. The Board regularly reviews the risks to

which the Group is exposed and endeavours to minimise them as far

as possible. The following summary, which is not exhaustive,

outlines some of the risks and uncertainties currently facing the

Group:

-- Although reducing throughout the year under review, the

COVID-19 pandemic continues to have risks for the Group in terms of

its ability to travel to and from its projects and ability for key

personnel to access its projects. As previously reported, the

impact of the COVID- 19

pandemic on the project is so far minimal as the Company's site

activities were substantially completed in 2019.

-- Through the Mahenge Liandu Graphite Project the Group is very

exposed to graphite. Graphite is a relatively new commodity whose

market is being driven by demand in renewable energy. The Company

believes it is thus vulnerable to changing global energy

policies.

-- The impact of Brexit on companies operating in the UK is

still being monitored. Thus far Brexit has not impacted the Group's

ability to raise funds.

-- The exploration for and development of mineral resources

involves technical risks, infrastructure risks and logistical

challenges, which even a combination of careful evaluation and

knowledge may not eliminate.

-- There can be no assurance that the Group's project will be

fully developed in accordance with current plans.

-- Future development work and subsequent financial returns

arising may be adversely affected by factors outside the control of

the Group.

-- The availability and access to future funding within the global economic environment.

-- The Group operates in multiple national jurisdictions and is

therefore vulnerable to changes in government policies which are

outside its control. The mining regulation changes in Tanzania are

still being evaluated, however they seem to have minimal impact on

investment in graphite mining. The Group continues to monitor the

implementation of the changes to evaluate and mitigate sovereign

risks.

-- The Group is exposed to gold as the holder of a royalty on

gold production from its previously held gold project. The Group's

potential future royalty stream will be affected by fluctuations in

the prevailing market price of gold and to variations of the US

dollar in which gold sales will be denominated.

Some of the mitigation strategies the Group applies in its

present stage of development include, among others:

-- Proactive management to reducing fixed costs.

-- Rationalisation of all capital expenditures.

-- Maintaining strong relationships with government (employing

local staff and partial government ownership), which improves the

Group's position as a preferred small mining partner.

-- Engagement with local communities to ensure our activities

provide value to the communities where we operate.

-- Alternative and continued funding activities with a number of

options to secure future funding to continue as a going

concern.

The Directors regularly monitor such risks and will take actions

as appropriate to mitigate them. The Group manages its risks by

seeking to ensure that it complies with the terms of its

agreements, and through the application of appropriate policies and

procedures, and via the recruitment and retention of a team of

skilled and experienced professionals.

Key Performance Indicators

The Group's current key performance indicators ('KPIs') are the

performance of its underlying investments, measured in terms of the

development of the specific projects they relate to, the increase

in capital value since investment and the earnings generated for

the Group from the investment. The Directors consider that it is

still too early in the investment cycle of any of the investments

held, for meaningful KPIs to be given.

Success is also measured through the identification and

investment in suitable additional opportunities that fit the

Group's investment objectives.

Section 172 Statement

Section 172(1): A director of a company must act in the way he

considers, in good faith, would be most likely to promote the

success of the company for the benefit of its members as a whole,

and in doing so have regard (amongst other matters) to -

Section 172(1) (b) the interests of the company's employees,

Company's Comment: While the Company is largely staffed by

contractor employees (rather than direct employees of the Company),

the directors consider that continuing active work on the Mahenge

Liandu Graphite Project to be in the best interest of such staff to

utilise their skills and develop their local communities. The board

seeks regular feedback from its key stakeholders (including staff

and advisers) to ensure that the corporate culture of the Company

remains highly ethical in terms of our Company's values and

behaviours.

Section 172(1) (c) the need to foster the company's business

relationships with suppliers, customers and others,

Company's Comment: The directors ensure that suppliers are

available and meeting commitments and there is good communication

with staff as a key requirement for high levels of engagement. This

is done by periodic and ad-hoc briefings and discussions.

Reasons to engage shareholders are to meet regulatory

requirements and understand shareholder sentiments on the business,

its prospects and performance of management.

This is done by regulatory news releases, keeping the investor

relations section of the website up to date, annual and half-year

reports and presentations and AGM.

Section 172(1) (d) the impact of the company's operations on the

community and the environment,

Company's Comment: The Company's activities impact communities

in the places where we operate and elsewhere. The Company engages

communities with employment / business development arrangements

within guidelines. Through preparation and compliance with

environmental and social management plans, which include the

regulatory requirements for the Company on its Mahenge Liandu

Graphite Project, the directors ensure that wherever possible its

activities have a positive impact on the community and avoid

adverse environmental impacts.

The Company has engaged the services of a local manager in

Liandu who provides information to the community about our intended

project activities and is responsible for managing local affairs

and feedback to the Company.

Section 172(1) (e) the desirability of the company maintaining a

reputation for high standards of business conduct, and

Company's Comment: The directors consider standards of business

conduct in all dealings of the Company. The members of the board

have a collective responsibility and obligation to promote the

interests of the Company and are collectively responsible for

defining standards of business conduct which includes corporate

governance arrangements. The board provides strategic leadership

for the Company and operates within the scope of our corporate

governance framework and sets the strategic goals for the

Company.

Section 172(1) (f) the need to act fairly as between members of

the company.

Company's Comment: The board takes feedback from a wide range of

shareholders (large and small) and endeavours at every opportunity

to pro-actively engage with all shareholders (via regular news

reporting-RNS) and engage with any specific shareholders in

response to particular queries they may have from time to time. The

board considers that its key decisions during the year have

impacted equally on all members of the Company.

Board

In March 2021, Ms Amne Suedi and Mr Steve Mahede resigned from

the Board as non-executive Directors and the Company wishes them

well in the future. The Board is actively considering potential

replacements for former Board members with a focus on a potential

appointment of a UK based Board member.

Financial Results

For the year ended 31 December 2021 the Group did not earn any

revenues as its business related solely to the making of

investments in non-revenue producing resource projects and

companies.

The Group made a loss after tax of GBP0.333 million (2020:

GBP0.196 million) for the year ended 31 December 2021. Expenditure

on the Mahenge Liandu project during the year amounted to GBP0.272

million (2020: GBP0.662 million), which was capitalised as

additional exploration and evaluation assets.

Funds raised during the year amounted in total to GBP1,279,000

of which GBP850,000 came from a placing of shares and GBP429,000

came from the exercise of warrants and options. Other share issues

during the year were in respect of loan note conversions.

At 31 December 2021, the Group had cash of GBP886,000 (2020:

GBP252,000 ) and no debt finance (2020: loan notes of GBP577,000 ).

At 16 May 2022, following the exercise of further warrants, the

Group had cash of GBP1,942,000.

Outlook

The year under review shows that Mahenge Liandu continues to

represent an exciting opportunity for the Group. As identified in

the going concern note to the Directors' Report, the Company's

ability to achieve its strategy with respect to the project is

dependent on the further fundraising. The Directors continue to

keep other investment opportunities, in line with the Group's

investment objectives, under review, which the board believe could

deliver significant value to shareholders.

Nicholas Johansen

Director

20 May 2022

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2021

2021 2020

GBP'000 GBP'000

--------------------------------------- -------- --------

Administrative expenses (330) (378)

-------- --------

Share based payment charges - -

-------- --------

Change in fair value of derivative - 37

-------- --------

Change in fair value of investments 8 176

-------- --------

Operating loss (322) (165)

-------- --------

Finance costs (11) (31)

-------- --------

Loss before taxation (333) (196)

-------- --------

Taxation - -

-------- --------

Loss after taxation (333) (196)

-------- --------

Other comprehensive income

======== ========

Items that may be reclassified to

profit or loss:

---------------------------------------- ======== ========

Exchange differences on translating

foreign entities (61) 39

---------------------------------------- -------- --------

Total comprehensive loss attributable

to the equity holders of the parent

company (394) (157)

======== ========

Loss per share attributable to the Pence Pence

equity holders of the parent company

-------- --------

Basic and diluted loss per share (0.07) (0.04)

======== ========

Consolidated Statement of Financial Position

At 31 December 2021

2021 2020

GBP'000 GBP'000

Assets

Non-current assets

--------- ---------

Exploration and evaluation assets 4,727 4,417

--------- ---------

Investments 138 282

--------- ---------

4,865 4,699

----------------------------------- --------- ---------

Current assets

--------- ---------

Trade and other receivables 150 121

--------- ---------

Cash and cash equivalents 886 252

--------- ---------

1,036 373

----------------------------------- --------- ---------

Total assets 5,901 5,072

========= =========

Equity and liabilities

--------- ---------

Equity

--------- ---------

Share capital 3,275 3,207

--------- ---------

Share premium 23,906 22,348

--------- ---------

Shares to be issued 286 286

--------- ---------

Share option and warrant reserve 925 762

--------- ---------

Foreign exchange reserve 66 127

--------- ---------

Retained earnings (22,636) (22,406)

--------- ---------

Total equity 5,822 4,325

--------- ---------

Current liabilities

--------- ---------

Trade and other payables 79 170

--------- ---------

Loans - 577

--------- ---------

Total Liabilities 79 747

--------- ---------

Total equity and liabilities 5,901 5,072

========= =========

Consolidated Statement of Changes in Equity

For the year ended 31 December 2021

Share Share Shares Share Foreign Retained Total

Capital Premium to be Option Exchange Earnings

issued and Warrant Reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- -------- ------------- ---------- ---------- ----------

At 1 January 2020 3,140 21,037 286 661 88 (22,400) 2,812

--------- --------- -------- ------------- ---------- ---------- --------

Loss for the period - - - - - (196) (196)

--------- --------- -------- ------------- ---------- ---------- --------

Other comprehensive

loss - - - - 39 - 39

--------- --------- -------- ------------- ---------- ---------- --------

Total comprehensive

loss for the year - - - - 39 (196) (157)

--------- --------- -------- ------------- ---------- ---------- --------

Issue of shares

and warrants 68 1,311 - 240 - - 1,619

--------- --------- -------- ------------- ---------- ---------- --------

Release on conversion

of loan notes - - - - - 51 51

--------- --------- -------- ------------- ---------- ---------- --------

Transfer on exercise

of warrants - - - (139) - 139 0

--------- --------- -------- ------------- ---------- ---------- --------

Total other movements 68 1,311 - 101 - 190 1,670

--------- --------- -------- ------------- ---------- ---------- --------

At 31 December

2020 3,208 22,348 286 762 127 (22,406) 4,325

========= ========= ======== ============= ========== ========== ========

Loss for the period - - - - - (333) (333)

========= ========= ======== ============= ========== ========== ========

Other comprehensive

loss - - - - (61) - (61)

--------- --------- -------- ------------- ---------- ---------- --------

Total comprehensive

loss for the year (61) (333) (394)

--------- --------- -------- ------------- ---------- ---------- --------

Issue of shares

and warrants 67 1,558 - 266 - - 1,891

========= ========= ======== ============= ========== ========== ========

Transfer on exercise

of warrants - - - (103) - 103 -

--------- --------- -------- ------------- ---------- ---------- --------

Total other movements 67 1,558 - 163 - 103 1,891

--------- --------- -------- ------------- ---------- ---------- --------

At 31 December

2021 3,275 23,906 286 925 66 (22,636) 5,822

--------- --------- -------- ------------- ---------- ---------- --------

Consolidated Statement of Cash Flows

For the year ended 31 December 2021

2021 2020

GBP'000 GBP'000

------------------------------------------- -------- --------

Cash flows from operating activities

-------- --------

Loss before taxation (333) (196)

-------- --------

Adjustment for:

-------- --------

Change in fair value of derivative - (37)

-------- --------

Change in fair value of investments (8) (176)

-------- --------

Finance costs 11 31

-------- --------

(330) (378)

------------------------------------------- -------- --------

Changes in working capital

Receivables 1 11

-------- --------

Payables (39) (7)

-------- --------

Net cash used in operating activities (368) (374)

======== ========

Cash flows from investing activities

-------- --------

Expenditure on exploration and evaluation

assets (399) (689)

-------- --------

Sale of listed investments 152 -

-------- --------

Net cash used in investing activities (247) (689)

======== ========

Cash flows from financing activities

-------- --------

Proceeds from share issues 1,249 1,246

-------- --------

Proceeds from loan (Note 15) - 50

-------- --------

Loan repayment - (50)

-------- --------

Interest paid - (27)

-------- --------

Net cash from financing activities 1,249 1,219

======== ========

Net increase in cash and cash equivalents 634 156

-------- --------

Cash and cash equivalents at 1 January 252 96

-------- --------

Cash and cash equivalents at 31

December 886 252

======== ========

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

**S**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and Broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UROWRUUUVUAR

(END) Dow Jones Newswires

May 23, 2022 02:00 ET (06:00 GMT)

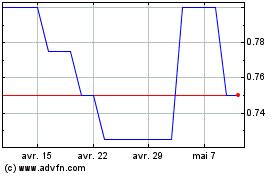

Armadale Capital (LSE:ACP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Armadale Capital (LSE:ACP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024