Armadale Capital PLC Result of AGM (4614P)

20 Juin 2022 - 11:45AM

UK Regulatory

TIDMACP

RNS Number : 4614P

Armadale Capital PLC

20 June 2022

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

20 June 2022

Armadale Capital Plc

('Armadale' or 'the Company')

Result of AGM

Armadale Capital plc (LON: ACP) the AIM quoted investment

company focused on natural resource projects in Africa, held its

annual general meeting today and all resolutions were duly

passed.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Chairman

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Seamus Fricker / Teddy Whiley +44 (0) 20 7220 0500

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is located in a highly prospective

region, with a high-grade JORC compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt @ 10.5% Measured 32.Mt

Indicted at 9.6% and 15.9Mt at 9.8% TGC, making it one of the largest high-grade resources

in Tanzania.

The work to date has demonstrated the Project's potential as a commercially viable deposit,

with significant tonnage, high-grade coarse flake and near surface mineralisation (implying

a low strip ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020) confirmed Mahenge as a long-life

low-cost graphite project with a US$430m NPV and IRR of 91% based on a two-stage expansion

strategy comprising:

* Stage One - processing plant and infrastructure at a

nominal design basis rate of 0.4-0.5 Mt/pa to produce

a nominal 60,000t/pa graphite concentrate in the

first three years of production

* Stage Two - a second 0.5 Mt/y plant and associated

additional infrastructure doubling throughput to 1

Mt/y from Year 5 of operation

The DFS shows that Armadale can be a significant low-cost supplier to the graphite industry

with the potential to generate pre-tax cashflows of US$985m over an initial 15 year mine-life

and scope for further improvement as this utilises just 25% of the current resource, which

remains open in multiple directions.

Projected timeline to first production is expected to be approximately 10-12 months from the

start of construction and the capital cost estimate for Stage 1 is US$39.7m, which includes

a contingency of U$S4.1m or 15% of total direct capital cost, with a 1.6 year payback for

Stage 1 (after tax) based on an average sales price of US$1,112/t. Stage 2 expansion is expected

to be funded from cashflow.

More information can be found on the website www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGSESSUSEESEDM

(END) Dow Jones Newswires

June 20, 2022 05:45 ET (09:45 GMT)

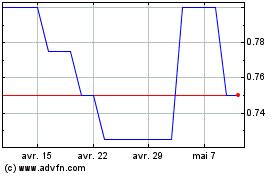

Armadale Capital (LSE:ACP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Armadale Capital (LSE:ACP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024