TIDMBHP

RNS Number : 3322D

BHP Group Limited

19 October 2022

Release Time IMMEDIATE

Date 19 October 2022

Release Number 35/22

BHP OPERATIONAL REVIEW

FOR THE QUARTERED 30 SEPTEMBER 2022

-- We continued to deliver safe and reliable operational performance during the quarter.

-- All production and unit cost guidance(1) remains unchanged for the 2023 financial year.

-- Jansen Stage 1 is tracking to plan, with civil and mechanical

construction activities progressing at the Jansen site and at the

port. We are targeting Jansen Stage 1 first production in the 2026

calendar year and have accelerated the Jansen Stage 2 study.

-- BHP announced the signing of a large-scale renewable Power

Purchase Agreement (PPA) with Alinta Energy, which is expected to

halve greenhouse gas (GHG) emissions from the electricity used in

our Western Australian Iron Ore (WAIO) port facilities by the end

of the 2024 calendar year.

BHP Chief Executive Officer, Mike Henry:

"We have started the new financial year strongly, achieving safe

and reliable operating performance. The first quarter included

significant planned major maintenance in Western Australia Iron Ore

(WAIO), BHP Mitsubishi Alliance (BMA), and Olympic Dam.

Copper production was up nine per cent on the same quarter last

year, with strong concentrator throughput at Escondida and record

quarterly anode production at Olympic Dam. WAIO continued to

perform strongly, with production up by 3% relative to the same

period last year, and we managed through substantial rainfall and

labour constraints in our coal assets with production only down

marginally year on year. Our full year production and unit cost

guidance is unchanged.

The South Flank iron ore ramp-up and the Jansen potash project

are tracking well, with work ongoing to bring forward first

production from Jansen Stage 1 and accelerate Jansen Stage 2.

During the quarter, BHP struck a new agreement to supply our

WAIO port facilities with renewable electricity, which is expected

to halve GHG emissions from the electricity used , signed an MoU

with India's Tata Steel to collaborate on lower GHG emission

steelmaking and announced a partnership with Pan Pacific Copper to

reduce GHG emissions from maritime transportation, as we take

further action to reduce GHG emissions from our operations and

support decarbonisation of our suppliers and customers.

We expect global macro-economic uncertainty in the short term to

continue to affect supply chains, energy costs, labour markets and

equipment and materials availability. BHP remains well positioned,

with a portfolio and balance sheet to withstand external challenges

and a strategy positioned to benefit from the global mega-trends of

decarbonisation and electrification."

1

Sep Q22 Sep Q22

Production (vs Sep Q21) (vs Jun Q22) Sep Q22 vs Jun Q22 commentary

----------------------- ------------- ------------- --------------------------------------------------------------------------------------------------

Copper (kt) 410.1 410.1 Lower volumes at Escondida due to lower concentrator feed grade, lower ore stacked in prior

months at Pampa Norte reducing cathode production, and lower volumes at Olympic Dam as a result

of planned refinery maintenance.

9% (11%)

Iron ore (Mt) 65.1 65.1 Strong operational performance at WAIO, partially offset by planned car dumper maintenance

in the quarter.

3% 1%

Metallurgical coal (Mt) 6.7 6.7 Lower volumes due to significant wet weather in the quarter, mining higher strip ratio areas,

a planned longwall move at Broadmeadow and planned wash plant maintenance at Blackwater, Goonyella

and Saraji.

(1%) (19%)

Energy coal (Mt) 2.6 2.6 Lower volumes due to significant wet weather in the quarter and ongoing labour shortages impacting

stripping and mine productivity.

(38%) (33%)

Nickel (kt) 20.7 20.7 Higher volumes due to unplanned downtime at the smelter in the prior period.

16% 10%

2

Summary

Operational performance

Production and guidance are summarised below.

Sep Q22 Sep Q22 Current

Sep vs vs FY23

Production Q22 Sep Q21 Jun Q22 guidance

-------------------------------------------- ------ -------- -------- ------------- ---------

Copper (kt) 410.1 9% (11%) 1,635 - 1,825

Escondida (kt) 252.7 4% (13%) 1,080 - 1,180 Unchanged

Pampa Norte (kt) 70.6 5% (9%) 240 - 290 Unchanged

Olympic Dam (kt) 49.7 68% (11%) 195 - 215 Unchanged

Antamina (kt) 37.1 4% (6%) 120 - 140 Unchanged

Iron ore (Mt) 65.1 3% 1% 249 - 260

WAIO (Mt) 63.9 3% 1% 246 - 256 Unchanged

WAIO (100% basis) (Mt) 72.1 2% 1% 278 - 290 Unchanged

Samarco (Mt) 1.1 10% 15% 3 - 4 Unchanged

Metallurgical coal - BMA (Mt) 6.7 (1%) (19%) 29 - 32

Metallurgical coal - BMA (100% basis) (Mt) 13.3 (1%) (19%) 58 - 64 Unchanged

Energy coal - NSWEC (Mt) 2.6 (38%) (33%) 13 - 15 Unchanged

Nickel (kt) 20.7 16% 10% 80 - 90 Unchanged

Corporate update

Decarbonisation

Throughout the September 2022 quarter we've continued to make

progress towards our decarbonisation targets and goals and

supported efforts to reduce GHG emissions in our value chain.

-- BHP entered into a large-scale renewable Power Purchase

Agreement (PPA) with Alinta Energy, which is expected to halve

emissions from the electricity used in our WAIO port facilities by

the end of 2024 based on current forecast demand and compared with

FY2020 reported emissions. In addition, BHP and Alinta Energy have

entered a Memorandum of Understanding (MoU) in relation to the

development of the Shay Gap Wind Farm, currently planned to be 45MW

capacity with a targeted first-generation date of 2027.

-- BHP signed an MoU with India's Tata Steel to jointly study

and develop lower carbon iron and steelmaking technology. The

technologies to be explored in this partnership seek to reduce GHG

emission intensity of integrated steel mills by up to 30 per cent.

The announcement of this partnership takes BHP to a total of five

decarbonisation partnerships with steelmakers whose combined output

accounts for over 13 per cent of reported global steel

production.

-- BHP announced a partnership with Pan Pacific Copper (PPC)

which aims to reduce GHG emissions from maritime transportation

between BHP's mines in Chile and PPC's smelters in Japan through a

retrofit installation of a push-button wind-assisted propulsion

system on board the M/V Koryu vessel estimated to be around 10

times more efficient than a conventional sail and expected to make

the M/V Koryu the lowest GHG emission intensity vessel in its

category.

3

Copper

Production

Sep Q22 Sep Q22

vs vs

Sep Q22 Sep Q21 Jun Q22

------- -------- --------

Copper (kt) 410.1 9% (11%)

Zinc (t) 32,685 (2%) 19%

Uranium (t) 817 54% 5%

Copper - Total copper production increased by nine per cent to

410 kt. Guidance for the 2023 financial year remains unchanged at

between 1,635 and 1,825 kt.

Escondida copper production increased by four per cent to 253 kt

primarily due to higher concentrator feed grade of 0.83 per cent

compared to 0.73 per cent in the September 2021 quarter. Guidance

for the 2023 financial year remains unchanged at between 1,080 and

1,180 kt, with production weighted toward the second half of the

year. Medium term guidance of 1.2 Mtpa of copper production on

average over the next five years remains unchanged.

Pampa Norte copper production increased by five per cent to 71

kt reflecting the continued ramp up of the Spence Growth Option

(SGO). Guidance for the 2023 financial year remains unchanged at

between 240 and 290 kt. This reflects plant design modification

shutdowns at SGO and the continued transition towards the planned

closure of Cerro Colorado at the end of the 2023 calendar year. The

SGO plant modifications started in August 2022 and are planned to

finish in the 2023 calendar year, with further studies ongoing for

additional capacity uplift.

At Spence, we continue to closely monitor previously identified

Tailings Storage Facility (TSF) anomalies. We have reduced the

volume of water in the tailings facility and continue to work with

the local regulatory agencies, including the implementation of a

remediation plan for the TSF. The SGO concentrator continues to

operate with no impact to production or market guidance. Spence is

expected to reach an average of approximately 270 ktpa of

production for four years (including cathodes) following the

completion of the SGO plant modifications and remediation of TSF

anomalies.

Olympic Dam copper production increased by 68 per cent to 50 kt

primarily as a result of the September 2021 quarter having included

the SCM21 major smelter maintenance campaign. Strong smelter

performance resulted in record gross anode(2) production in the

September 2022 quarter, however copper cathode production was

constrained by planned annual refinery maintenance. Near record

gold production was also achieved in the quarter as a result of

debottlenecking initiatives implemented in the prior year.

Production guidance for the 2023 financial year remains unchanged

at between 195 and 215 kt.

Antamina copper production increased by four per cent to 37 kt,

reflecting higher concentrator throughput. Zinc production

decreased by two per cent to 33 kt reflecting lower zinc head

grades. Guidance remains unchanged for the 2023 financial year,

with copper production of between 120 and 140 kt, and zinc

production of between 115 and 135 kt.

4

Iron Ore

Production

Sep Q22 Sep Q22

vs vs

Sep Q22 Sep Q21 Jun Q22

Iron ore production (kt) 65,073 3% 1%

Iron ore - Total iron ore production increased by three per cent

to 65 Mt. Guidance for the 2023 financial year remains unchanged at

between 249 and 260 Mt.

WAIO production increased by three per cent to 64 Mt (72 Mt on a

100 per cent basis), reflecting continued strong supply chain

performance and lower COVID-19 related impacts than the prior

period, partially offset by wet weather impacts. South Flank ramp

up to full production capacity of 80 Mtpa (100 per cent basis)

remains on track. Natural variability in the ore grade is expected

as the mine progresses through the close to surface material,

however this is expected to stabilise as we move deeper into the

ore body and achieve full ramp up.

WAIO production guidance for the 2023 financial year remains

unchanged at between 246 and 256 Mt (278 and 290 Mt on a 100 per

cent basis) and reflects the tie-in of the port debottlenecking

project (PDP1) as well as the continued ramp up of South Flank

throughout the year.

Samarco production of 1.1 Mt (BHP share) reflected continued

production of one concentrator, following the recommencement of

iron ore pellet production in December 2020. Guidance for the 2023

financial year is unchanged at between 3 and 4 Mt (BHP share).

Coal

Production

Sep Q22 Sep Q22

vs vs

Sep Q22 Sep Q21 Jun Q22

Metallurgical coal (kt) 6,662 (1%) (19%)

Energy coal (kt) 2,622 (38%) (33%)

Metallurgical coal - BMA production was marginally lower than

the prior period at 7 Mt (13 Mt on a 100 per cent basis) despite

record wet weather during the September 2022 quarter(3) and ongoing

labour shortages. These impacts have been largely offset by an

inventory drawdown, and the continued ramp up of autonomous haul

truck fleets at Goonyella. Maintenance activities completed in the

quarter included a planned longwall move at Broadmeadow, planned

wash plant maintenance at both Saraji and Blackwater, and the

commencement of wash plant maintenance at Goonyella in

September.

The near tripling of top end royalties by the Queensland

Government remains a serious concern and threat to investment and

jobs in that state. We see strong long-term demand from global

steelmakers for Queensland's high-quality metallurgical coal. In

the absence of fiscal terms that are both competitive and

predictable, we are unable to make significant new investments in

Queensland.

Guidance for the 2023 financial year remains unchanged at

between 29 and 32 Mt (58 and 64 Mt on a 100 per cent basis).

Energy coal - New South Wales Energy Coal (NSWEC) production

decreased by 38 per cent to 3 Mt, reflecting the ongoing impacts of

significant wet weather with more than three times the amount of

rainfall than the prior year, (4) continued labour shortages

impacting stripping performance and mine productivity, and an

increased proportion of washed coal. Higher quality coals made up

approximately 85 per cent of sales compared to approximately 70 per

cent in the September 2021 quarter. Guidance for the 2023 financial

year remains unchanged at between 13 and 15 Mt.'

5

Other

Nickel production

Sep Q22 Sep Q22

vs vs

Sep Q22 Sep Q21 Jun Q22

------- -------- --------

Nickel (kt) 20.7 16% 10%

Nickel - Nickel West production increased by 16 per cent to 21

kt, reflecting the completion of planned maintenance across the

supply chain in the prior period. Guidance for the 2023 financial

year remains unchanged at between 80 and 90 kt, weighted to the

second half of the year due to planned smelter maintenance in the

December 2022 quarter.

Potash - Our major potash project under development is tracking

to plan. For the 2023 financial year, we will continue to focus on

civil and mechanical construction on the surface and underground,

as well as equipment procurement and port construction.

Projects

Capital Initial

expenditure production

Project and US$M target

ownership date Capacity Progress

------------ ------------ ----------- ------------------------------- ------------------

Jansen Stage 5,723 End-CY26 Design, engineering and Approved in August

1 construction of an underground 2021, project is

potash mine and surface 11% complete

infrastructure, with capacity

to produce 4.35 Mtpa.

(Canada)

100%

Minerals exploration

Minerals exploration expenditure for the September 2022 quarter

was US$73 million, of which US$58 million was expensed.

Following our agreement with Midland Exploration in April 2022

to fund a new nickel exploration program in Nunavik, Quebec, on 21

July 2022 we extended our strategic alliance for one year until

August 2023, including agreement to provide additional funding for

the program.

At Oak Dam in South Australia, BHP is continuing next stage

resource definition drilling with six drill rigs.

6

Variance analysis relates to the relative performance of BHP

and/or its operations during the three months ended September 2022

compared with the three months ended September 2021, unless

otherwise noted. Production volumes, sales volumes and capital and

exploration expenditure from subsidiaries are reported on a 100 per

cent basis; production and sales volumes from equity accounted

investments and other operations are reported on a proportionate

consolidation basis. Numbers presented may not add up precisely to

the totals provided due to rounding.

The following footnotes apply to this Operational Review:

1 2023 financial year unit cost guidance: Escondida

US$1.25-1.45/lb, WAIO US$18-19/t, and BMA of US$90-100/t; based on

exchange rates of AUD/USD 0.72 and USD/CLP 830.

2 Anode is the product from the smelting process at Olympic Dam.

Anode is converted to copper cathode through the refining

process.

3 BMA experienced the wettest September quarter in 10 years with

212mm of rainfall recorded at Moranbah in the September 2022

quarter compared to 123mm in the September 2021 quarter.

4 R ainfall of 297mm was recorded at Muswellbrook in the

September 2022 quarter, compared to 96mm in the September 2021

quarter.

The following abbreviations may have been used throughout this

report: cost and freight (CFR); cost, insurance and freight (CIF);

dry metric tonne unit (dmtu); free on board (FOB); grams per tonne

(g/t); kilograms per tonne (kg/t); kilometre (km); megawatt (MW);

metre (m); million tonnes (Mt); million tonnes per annum (Mtpa);

ounces (oz); pounds (lb); thousand ounces (koz); thousand tonnes

(kt); thousand tonnes per annum (ktpa); thousand tonnes per day

(ktpd); tonnes (t); and wet metric tonnes (wmt).

In this release, the terms 'BHP', the 'Group', 'BHP Group',

'we', 'us', 'our' and 'ourselves' are used to refer to BHP Group

Limited and, except where the context otherwise requires, our

subsidiaries. Refer to note 28 'Subsidiaries' of the Financial

Statements in BHP's 30 June 2022 Appendix 4E for a list of our

significant subsidiaries. Those terms do not include non-operated

assets. Notwithstanding that this release may include production,

financial and other information from non-operated assets,

non-operated assets are not included in the BHP Group and, as a

result, statements regarding our operations, assets and values

apply only to our operated assets unless stated otherwise. Our

non-operated assets include Antamina and Samarco. BHP Group

cautions against undue reliance on any forward-looking statement or

guidance in this release, particularly in light of the current

economic climate and significant volatility, uncertainty and

disruption arising in connection with COVID-19. These

forward-looking statements are based on information available as at

the date of this release and are not guarantees or predictions of

future performance and involve known and unknown risks,

uncertainties and other factors, many of

which are beyond our control and which may cause actual results

to differ materially from those expressed in the statements

contained in this release.

7

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Dinesh Bishop

Tel: +61 3 9609 3830 Mobile: Mobile: +61 407 033 909

+61 411 071 715

Europe, Middle East and Africa

Europe, Middle East and Africa

James Bell

Neil Burrows Tel: +44 20 7802 7144 Mobile:

Tel: +44 20 7802 7484 Mobile: +44 7961 636 432

+44 7786 661 683

Americas

Americas

Monica Nettleton

Renata Fernandez Mobile: +1 416 518-6293

Mobile: +56 9 8229 5357

BHP Group Limited ABN 49 004

028 077

LEI WZE1WSENV6JSZFK0JC28

Registered in Australia

Registered Office: Level 18,

171 Collins Street

Melbourne Victoria 3000 Australia

Tel +61 1300 55 4757 Fax +61

3 9609 3015

BHP Group is headquartered in Australia

Follow us on social media

8

NEWS RELEASE

19 October 2022

BHP OPERATIONAL REVIEW

FOR THE QUARTERED 30 SEPTEMBER 2022

Production and sales summary (Excel version)

www.bhp.com

9

Production summary

Year to

Quarter ended date

------------------------------------------- ----------------

BHP Sep Dec Mar Jun Sep Sep Sep

interest 2021 2021 2022 2022 2022 2022 2021

---------- ------- ------- ------- ------- ------- ------- -------

Copper (1)

Copper

Payable metal in concentrate

(kt)

Escondida (2) 57.5% 194.7 196.2 178.2 233.5 203.1 203.1 194.7

Pampa Norte (3) 100.0% 26.4 24.2 32.4 28.2 28.6 28.6 26.4

Antamina 33.8% 35.8 38.4 36.1 39.6 37.1 37.1 35.8

Total 256.9 258.8 246.7 301.3 268.8 268.8 256.9

Cathode (kt)

Escondida (2) 57.5% 49.0 48.4 48.2 55.8 49.6 49.6 49.0

Pampa Norte (3) 100% 41.1 44.1 35.8 49.0 42.0 42.0 41.1

Olympic Dam 100% 29.5 14.2 39.0 55.7 49.7 49.7 29.5

Total 119.6 106.7 123.0 160.5 141.3 141.3 119.6

Total copper (kt) 376.5 365.5 369.7 461.8 410.1 410.1 376.5

Lead

Payable metal in concentrate

(t)

Antamina 33.8% 378 277 282 181 228 228 378

Total 378 277 282 181 228 228 378

Zinc

Payable metal in concentrate

(t)

Antamina 33.8% 33,289 29,603 32,732 27,576 32,685 32,685 33,289

Total 33,289 29,603 32,732 27,576 32,685 32,685 33,289

Gold

Payable metal in concentrate

(troy oz)

Escondida (2) 57.5% 41,962 42,937 36,303 45,770 38,236 38,236 41,962

Pampa Norte (3) 100% 6,967 5,776 7,929 8,198 5,521 5,521 6,967

Olympic Dam (refined

gold) 100% 26,277 37,805 29,355 26,080 47,184 47,184 26,277

Total 75,206 86,518 73,587 80,048 90,941 90,941 75,206

Silver

Payable metal in concentrate

(troy koz)

Escondida (2) 57.5% 1,291 1,462 1,270 1,311 1,210 1,210 1,291

Pampa Norte (3) 100% 273 215 261 262 252 252 273

Antamina 33.8% 1,367 1,308 1,191 1,212 1,190 1,190 1,367

Olympic Dam (refined

silver) 100% 191 258 149 145 295 295 191

Total 3,122 3,243 2,871 2,930 2,947 2,947 3,122

10

Production summary

Year to

Quarter ended date

------------------------------------------- ----------------

BHP Sep Dec Mar Jun Sep Sep Sep

interest 2021 2021 2022 2022 2022 2022 2021

---------- ------- ------- ------- ------- ------- ------- -------

Uranium

Payable metal in concentrate

(t)

Olympic Dam 100% 531 287 781 776 817 817 531

Total 531 287 781 776 817 817 531

------- ------- ------- ------- ------- ------- -------

Molybdenum

Payable metal in concentrate

(t)

Pampa Norte (3) 100% - - - 71 34 34 -

Antamina 33.8% 142 217 190 249 262 262 142

Total 142 217 190 320 296 296 142

Iron Ore

Iron Ore

Production (kt) (4)

Newman 85% 16,461 14,577 11,940 14,063 14,053 14,053 16,461

Area C Joint Venture 85% 18,947 22,911 24,888 27,685 26,971 26,971 18,947

Yandi Joint Venture 85% 11,834 12,261 8,418 6,409 5,497 5,497 11,834

Jimblebar (5) 85% 15,009 15,324 13,444 15,005 17,404 17,404 15,009

Samarco 50% 1,048 1,029 994 1,000 1,148 1,148 1,048

Total 63,299 66,102 59,684 64,162 65,073 65,073 63,299

Coal

Metallurgical coal

Production (kt) (6)

BHP Mitsubishi Alliance

(BMA) 50% 6,715 6,300 7,944 8,183 6,662 6,662 6,715

Total 6,715 6,300 7,944 8,183 6,662 6,662 6,715

Energy coal

Production (kt)

NSW Energy Coal 100% 4,238 2,967 2,577 3,919 2,622 2,622 4,238

Total 4,238 2,967 2,577 3,919 2,622 2,622 4,238

Other

Nickel

Saleable production

(kt)

Nickel West 100% 17.8 21.5 18.7 18.8 20.7 20.7 17.8

Total 17.8 21.5 18.7 18.8 20.7 20.7 17.8

Cobalt

Saleable production

(t)

Nickel West 100% 177 220 125 110 238 238 177

Total 177 220 125 110 238 238 177

------- ------- ------- ------- ------- ------- -------

1 Metal production is reported on the basis of payable metal.

2 Shown on a 100% basis. BHP interest in saleable production is 57.5%.

3 Includes Cerro Colorado and Spence.

4 Iron ore production is reported on a wet tonnes basis.

5 Shown on a 100% basis. BHP interest in saleable production is 85%.

6 Metallurgical coal production is reported on the basis of

saleable product. Production figures may include some thermal

coal.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

11

Production and sales report

Quarter ended Year to date

-------------------------------------- ------------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

-------- -------- -------- -------- -------- -------- --------

Copper

Metals production is payable metal unless otherwise stated.

Escondida, Chile

(1)

Material mined (kt) 113,874 117,284 107,676 115,409 110,248 110,248 113,874

Concentrator throughput (kt) 33,528 35,787 30,235 34,318 32,894 32,894 33,528

Average copper grade

- concentrator (%) 0.73% 0.71% 0.80% 0.88% 0.83% 0.83% 0.73%

Production ex mill (kt) 201.2 203.6 191.5 239.5 214.6 214.6 201.2

Production

Payable copper (kt) 194.7 196.2 178.2 233.5 203.1 203.1 194.7

Copper cathode (EW) (kt) 49.0 48.4 48.2 55.8 49.6 49.6 49.0

- Oxide leach (kt) 14.8 13.1 12.2 17.5 15.2 15.2 14.8

- Sulphide leach (kt) 34.2 35.3 36.0 38.3 34.4 34.4 34.2

Total copper (kt) 243.7 244.6 226.4 289.3 252.7 252.7 243.7

(troy

Payable gold concentrate oz) 41,962 42,937 36,303 45,770 38,236 38,236 41,962

(troy

Payable silver concentrate koz) 1,291 1,462 1,270 1,311 1,210 1,210 1,291

Sales

Payable copper (kt) 190.5 200.2 177.0 230.4 196.7 196.7 190.5

Copper cathode (EW) (kt) 46.7 49.7 47.2 58.9 45.9 45.9 46.7

(troy

Payable gold concentrate oz) 41,962 42,937 36,303 45,770 38,236 38,236 41,962

(troy

Payable silver concentrate koz) 1,291 1,462 1,270 1,311 1,210 1,210 1,291

1 Shown on a 100% basis. BHP interest in saleable production is 57.5%.

12

Production and sales report

Quarter ended Year to date

---------------------------------- ----------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

------- ------- ------- ------- ------- ------- -------

Pampa Norte, Chile

Cerro Colorado

Material mined (kt) 5,378 4,782 3,516 3,604 3,179 3,179 5,378

Ore stacked (kt) 3,566 4,029 3,181 4,259 4,373 4,373 3,566

Average copper grade

- stacked (%) 0.60% 0.62% 0.53% 0.55% 0.54% 0.54% 0.60%

Production

Copper cathode (EW) (kt) 13.4 15.3 11.6 14.7 12.8 12.8 13.4

Sales

Copper cathode (EW) (kt) 12.1 16.0 10.5 16.2 13.3 13.3 12.1

Spence

Material mined (kt) 21,154 24,025 24,040 26,749 26,956 26,956 21,154

Ore stacked (kt) 5,258 5,071 5,055 5,099 5,577 5,577 5,258

Average copper grade

- stacked (%) 0.64% 0.66% 0.67% 0.66% 0.70% 0.70% 0.64%

Concentrator throughput (kt) 5,786 6,234 6,512 6,311 6,433 6,433 5,786

Average copper grade

- concentrator (%) 0.65% 0.60% 0.65% 0.66% 0.63% 0.63% 0.65%

Production

Payable copper (kt) 26.4 24.2 32.4 28.2 28.6 28.6 26.4

Copper cathode (EW) (kt) 27.7 28.8 24.2 34.3 29.2 29.2 27.7

Total copper (kt) 54.1 53.0 56.6 62.5 57.8 57.8 54.1

(troy

Payable gold concentrate oz) 6,967 5,776 7,929 8,198 5,521 5,521 6,967

(troy

Payable silver concentrate koz) 273 215 261 262 252 252 273

Payable molybdenum (t) - - - 71 34 34 -

Sales

Payable copper (kt) 28.4 24.9 28.1 28.1 26.0 26.0 28.4

Copper cathode (EW) (kt) 27.7 31.2 20.2 35.4 29.1 29.1 27.7

(troy

Payable gold concentrate oz) 6,967 5,776 7,929 8,198 5,521 5,521 6,967

(troy

Payable silver concentrate koz) 273 215 261 262 252 252 273

Payable molybdenum (t) - - - 25 25 25 -

13

Production and sales report

Quarter ended Year to date

---------------------------------- ----------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

------- ------- ------- ------- ------- ------- -------

Copper (continued)

Metals production is payable metal unless otherwise stated.

Antamina, Peru

Material mined (100%) (kt) 66,581 58,179 58,118 64,026 63,865 63,865 66,581

Concentrator throughput

(100%) (kt) 13,219 13,011 13,135 13,131 13,858 13,858 13,219

Average head grades

- Copper (%) 0.97% 1.00% 0.94% 1.02% 0.93% 0.93% 0.97%

- Zinc (%) 1.16% 1.11% 1.13% 1.05% 1.09% 1.09% 1.16%

Production

Payable copper (kt) 35.8 38.4 36.1 39.6 37.1 37.1 35.8

Payable zinc (t) 33,289 29,603 32,732 27,576 32,685 32,685 33,289

(troy

Payable silver koz) 1,367 1,308 1,191 1,212 1,190 1,190 1,367

Payable lead (t) 378 277 282 181 228 228 378

Payable molybdenum (t) 142 217 190 249 262 262 142

Sales

Payable copper (kt) 32.7 41.9 32.9 40.7 37.6 37.6 32.7

Payable zinc (t) 32,635 32,513 29,920 30,847 33,820 33,820 32,635

(troy

Payable silver koz) 1,103 1,405 1,078 1,230 1,015 1,015 1,103

Payable lead (t) 232 344 269 363 130 130 232

Payable molybdenum (t) 86 170 199 205 250 250 86

Olympic Dam, Australia

Material mined (1) (kt) 1,935 1,998 2,424 2,477 2,412 2,412 1,935

Ore milled (kt) 2,024 1,105 2,122 2,436 2,570 2,570 2,024

Average copper grade (%) 2.03% 2.17% 2.21% 2.15% 2.13% 2.13% 2.03%

Average uranium grade (kg/t) 0.55 0.55 0.62 0.56 0.58 0.58 0.55

Production

Copper cathode (ER

and EW) (kt) 29.5 14.2 39.0 55.7 49.7 49.7 29.5

Payable uranium (t) 531 287 781 776 817 817 531

(troy

Refined gold oz) 26,277 37,805 29,355 26,080 47,184 47,184 26,277

(troy

Refined silver koz) 191 258 149 145 295 295 191

Sales

Copper cathode (ER

and EW) (kt) 29.1 17.9 36.3 55.8 45.9 45.9 29.1

Payable uranium (t) 536 541 236 1,031 272 272 536

(troy

Refined gold oz) 24,654 38,768 30,935 24,622 49,542 49,542 24,654

(troy

Refined silver koz) 126 290 182 87 320 320 126

1 Material mined refers to underground ore mined, subsequently hoisted or trucked to surface.

14

Production and sales report

Quarter ended Year to date

---------------------------------- ----------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

------- ------- ------- ------- ------- ------- -------

Iron Ore

Iron ore production and sales are reported

on a wet tonnes basis.

Western Australia Iron

Ore, Australia

Production

Newman (kt) 16,461 14,577 11,940 14,063 14,053 14,053 16,461

Area C Joint Venture (kt) 18,947 22,911 24,888 27,685 26,971 26,971 18,947

Yandi Joint Venture (kt) 11,834 12,261 8,418 6,409 5,497 5,497 11,834

Jimblebar (1) (kt) 15,009 15,324 13,444 15,005 17,404 17,404 15,009

Total production (kt) 62,251 65,073 58,690 63,162 63,925 63,925 62,251

Total production

(100%) (kt) 70,587 73,852 66,674 71,660 72,135 72,135 70,587

Sales

Lump (kt) 17,546 17,827 16,966 20,006 19,561 19,561 17,546

Fines (kt) 45,039 46,809 42,187 44,308 42,696 42,696 45,039

Total (kt) 62,585 64,636 59,153 64,314 62,257 62,257 62,585

Total sales (100%) (kt) 70,815 73,222 67,110 72,796 70,276 70,276 70,815

1 Shown on a 100% basis. BHP interest in saleable production is 85%.

Samarco, Brazil

Production (kt) 1,048 1,029 994 1,000 1,148 1,148 1,048

Sales (kt) 1,111 950 943 991 1,146 1,146 1,111

15

Production and sales report

Quarter ended Year to date

------------------------- -------------------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

------- ------- ------- ------- ------- ------- -------

Coal

Coal production is reported on the

basis of saleable product.

BHP Mitsubishi Alliance

(BMA), Australia

Production (1)

Blackwater (kt) 1,403 1,202 1,478 1,751 1,283 1,283 1,403

Goonyella (kt) 1,798 1,797 2,336 2,429 1,780 1,780 1,798

Peak Downs (kt) 1,223 960 1,395 1,366 1,325 1,325 1,223

Saraji (kt) 999 1,081 1,366 1,168 1,020 1,020 999

Daunia (kt) 377 304 338 472 324 324 377

Caval Ridge (kt) 915 956 1,031 997 930 930 915

Total production (kt) 6,715 6,300 7,944 8,183 6,662 6,662 6,715

Total production (100%) (kt) 13,430 12,600 15,888 16,366 13,324 13,324 13,430

Sales

Coking coal (kt) 5,415 4,875 6,334 6,734 5,615 5,615 5,415

Weak coking coal (kt) 734 754 805 1,118 600 600 734

Thermal coal (kt) 576 455 484 765 267 267 576

Total sales (kt) 6,725 6,084 7,623 8,617 6,482 6,482 6,725

Total sales (100%) (kt) 13,450 12,168 15,246 17,234 12,964 12,964 13,450

1 Production figures include some thermal coal.

16

Production and sales report

Quarter ended Year to date

---------------------------------------------------------------- ------------------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

----------- ----------- ----------- ----------- ------------ ----------- -----------

NSW Energy Coal,

Australia

Production (kt) 4,238 2,967 2,577 3,919 2,622 2,622 4,238

Sales (kt) 3,780 3,718 2,703 3,923 2,441 2,441 3,780

Quarter ended Year to date

-------------------------------------- ---------------

Sep Dec Mar Jun Sep Sep Sep

2021 2021 2022 2022 2022 2022 2021

------ ------ ------ ------ ------ ------- ------

Other

Nickel production is reported on

the basis of saleable product

Nickel West, Australia

Mt Keith

Nickel concentrate (kt) 53.7 47.0 47.1 48.0 42.6 42.6 53.7

Average nickel grade (%) 14.6 13.2 14.4 16.1 17.0 17.0 14.6

Leinster

Nickel concentrate (kt) 73.8 77.4 78.0 76.0 66.8 66.8 73.8

Average nickel grade (%) 8.9 9.1 8.9 10.3 9.9 9.9 8.9

Saleable production

Refined nickel (1) (kt) 14.4 18.2 13.3 11.7 17.5 17.5 14.4

Nickel sulphate (2) (kt) - 0.4 0.7 0.5 1.2 1.2 -

Intermediates and nickel

by-products (3) (kt) 3.4 2.9 4.7 6.6 2.0 2.0 3.4

Total nickel (kt) 17.8 21.5 18.7 18.8 20.7 20.7 17.8

Cobalt by-products (t) 177 220 125 110 238 238 177

Sales

Refined nickel (1) (kt) 13.8 16.9 15.3 11.7 18.1 18.1 13.8

Nickel sulphate (2) (kt) - 0.1 0.7 0.5 0.8 0.8 -

Intermediates and nickel

by-products (3) (kt) 3.9 3.1 2.7 6.4 1.8 1.8 3.9

Total nickel (kt) 17.7 20.1 18.7 18.6 20.7 20.7 17.7

Cobalt by-products (t) 177 220 125 110 238 238 177

1 High quality refined nickel metal, including briquettes and powder.

2 Nickel sulphate crystals produced from nickel powder.

3 Nickel contained in matte and by-product streams.

17

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUWUARUSURAUA

(END) Dow Jones Newswires

October 19, 2022 02:00 ET (06:00 GMT)

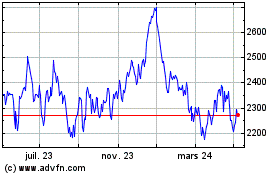

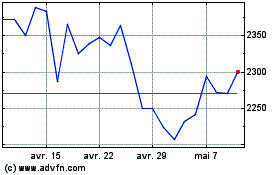

Bhp (LSE:BHP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bhp (LSE:BHP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024