By Jaime Llinares Taboada

BP PLC on Tuesday reported a significant net loss for the first

quarter, but its underlying earnings improved on the back of

exceptional trading profits, higher oil prices and refining

margins. Here's what the British energy giant had to say:

On 1Q performance:

"Reported loss for the quarter was $20.4 billion, compared with

a profit of $2.3 billion for the fourth quarter 2021. The reported

result includes adjusting items before tax of $30.8 billion."

"Underlying replacement cost profit was $6.2 billion, compared

with $4.1 billion for the previous quarter. This was driven by

exceptional oil and gas trading, higher oil realizations and a

stronger refining result, partly offset by the absence of Rosneft

from the first quarter underlying result."

On gas & low carbon energy:

"After excluding adjusting items, the underlying replacement

cost profit before interest and tax for the first quarter was

$3,595 million, compared with $2,270 million for the same period in

2021."

"The underlying replacement cost profit for the first quarter,

compared with the same period in 2021, reflects higher

realizations, offset by a higher depreciation, depletion and

amortization charge, and an exceptional gas marketing and trading

result, albeit lower than in 2021."

"Reported production for the quarter was 966mboe/d, 6.2% higher

than the same period in 2021, mainly due to major project start-ups

during 2021, partially offset by base decline and the partial

divestment in Oman at the end of the first quarter 2021."

"The renewables pipeline increased by 1.8GW during the quarter,

primarily as a result of bp and its partner EnBW being awarded a

lease option off the east coast of Scotland to develop an offshore

wind project with a total generating capacity of around 2.9GW

(1.45GW bp net)."

On oil production & operations:

"After excluding adjusting items, the underlying replacement

cost profit before interest and tax for the first quarter was

$4,683 million, compared with $1,565 million for the same period in

2021."

"The higher underlying replacement cost profit for the first

quarter, compared with the same period in 2021, primarily reflects

higher liquids and gas realizations."

"Reported production for the quarter was 1,286mboe/d, 1.7% lower

than the first quarter of 2021. Underlying production* for the

quarter was flat compared with the first quarter of 2021."

On customers & products:

"After excluding adjusting items, the underlying replacement

cost profit before interest and tax for the first quarter was

$2,156 million, compared with $656 million for the same period in

2021."

"The customers & products result for the first quarter

reflects a significantly stronger performance compared with the

same period in 2021, with higher results in both refining and oil

trading."

On 2Q guidance:

"bp expects an ongoing elevated risk of oil price volatility.

This reflects uncertainties around the level of disruption to

Russian supply, the capacity for increased OPEC+ supply, the

ongoing impact of COVID-19 on demand and the impact of the conflict

in Ukraine on economic growth."

"bp expects the short-term outlook for gas prices to remain

heavily dependent on Russian pipeline flows to Europe."

"In the second quarter of 2022, bp expects industry refining

margins to remain elevated due to ongoing supply disruptions,

particularly in Russia and Europe."

"Looking ahead, we expect second-quarter 2022 underlying

upstream production to be lower than first-quarter 2022, primarily

in gas & low carbon energy, reflecting base decline and

seasonal maintenance. On a reported basis, second-quarter

production will reflect additional impacts from the absence of

production from our Russia incorporated joint ventures."

"In our customers & products business, there is an elevated

level of uncertainty due to the developing impacts from the

conflict in Ukraine and ongoing COVID-19 restrictions. In addition,

in Castrol, additive supplies are expected to remain under

pressure. In refining, we expect higher industry refining margins,

although the increase in realized margins may differ due to market

dislocations. In addition, energy prices are expected to remain

elevated and turnaround costs to be higher."

On 2022 guidance:

"For full year 2022 we continue to expect reported upstream

production to be broadly flat compared with 2021 despite the

absence of production from our Russia incorporated joint ventures.

On an underlying basis, we expect production from oil production

& operations to be slightly higher and production from gas

& low carbon energy to be broadly flat."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

May 03, 2022 03:10 ET (07:10 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

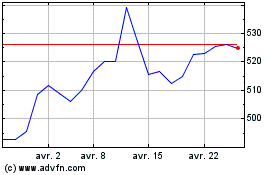

Bp (LSE:BP.)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bp (LSE:BP.)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024