TIDMFSF

RNS Number : 7734O

Foresight Sustain. Forestry Co PLC

14 June 2022

14 June 2022

Foresight Sustainable Forestry Company Plc

Interim Results to 31 March 2022

Foresight Sustainable Forestry Company Plc ("FSF" or "the

Company"), an investment company that invests in UK forestry and

afforestation assets, is pleased to announce the publication of its

(unaudited) inaugural interim results (the "Interim Results"),

covering the seven month period from FSF's incorporation on 31

August 2021 to 31 March 2022.

H1 2022 Performance Highlights

- Since the Company's IPO raised GBP130m of gross proceeds in November

2021, the Company's Net Asset Value has increased to GBP135.5 million.

- NAV per Share over the period increased to 104.2 pence, a total NAV

return of 4.2%. The key driver of the uplift has been the 18% upwards

revaluation of FSF's afforestation sites, driven by rising land prices,

granting of planting permission, and completion of planting.

- As at 31 March 2022, 91% of IPO proceeds (GBP117.7 million) had been

utilised to acquire 29 forestry and afforestation assets made up of

38 properties, making the Company substantially invested.

- The Company's acquired portfolio comprised 8,473 hectares of land,

of which 36% (by value) are afforestation properties (FSF expects

this to rise to over 40% in the near future).

- Planting of approximately 250,000 trees was completed during the period.

- FSF plans to harvest 100,000 tonnes of timber during 2022.

Key Metrics

As at 31 March 2022

Net Asset Value ("NAV") GBP135.5 million

--------------------

NAV per Share 104.2 pence

--------------------

Total NAV return 4.2%

--------------------

Profit/(loss) for the period GBP7.9 million

--------------------

Recent Developments

-

- Since the Company's IPO in November 2021, FSF has acquired a total

of 40 individual properties (38 properties prior to the period end,

including the seed assets deal, and 2 additional properties since

31 March 2022).

- The total size of the Company's portfolio is 8,658 hectares, of which

37% by value are afforestation properties. The properties (by value)

are located in Scotland (80%), Wales (12%) and England (8%).

Results presentation

The Company is holding a webcast presentation for analysts at

8.30 a.m. today. Analysts wishing to attend should contact Citigate

Dewe Rogerson by email at fsfc@citigatedewerogerson.com . A results

presentation will also be uploaded to the FSF website.

Commenting on the Company's results, Richard Davidson, Chair of

Foresight Sustainable Forestry Company Plc, said:

"Foresight Sustainable Forestry has achieved a huge amount over

the past few months - a successful IPO as we became the first

natural capital investment company to list on the LSE, the delivery

of our initial objectives once listed, the acquisition of new

sites, community engagement programmes, and the planting of new

forests. Sustainable forestry and afforestation has a vital role in

the ongoing battles against climate change and biodiversity loss

and I am delighted that the Company is increasingly playing its

part.

"An attractive, diversified portfolio has been successfully

constructed with strong upside potential from afforestation sites

in particular. The GBP6.9 million increase in the valuation of our

afforestation properties highlight that when development milestones

are met, value can immediately be unlocked. Sustainable UK timber

supply is a crucial part of the Company's strategy and the

long-term timber supply deficit provides us with a significant

opportunity."

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

fsfc@foresightgroup.eu +44 20 3667 8100

Jefferies International Limited

Neil Winward

Will Soutar

Harry Randall +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore ( toby.moore@citigatedewerogerson.com

)

Jos Bieneman ( jos.bieneman@citigatedewerogerson.com +44 7768 981763

) +44 7834 336650

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5%, the Company provides investors

with the opportunity for real returns and capital appreciation

driven by the prevailing global imbalance between supply and demand

for timber; the inflation-protection qualities of UK land

freeholds; and biological tree growth of 3% to 4% not correlated to

financial markets. It also offers outstanding sustainability and

ESG attributes and access to carbon units related to carbon

sequestration from new afforestation planting. The Company targets

value creation as the afforestation projects successfully achieve

development milestones in the process of converting open ground

into established commercial forest and woodland areas. The Company

is seeking to make a direct contribution in the fight against

climate change through forestry and afforestation carbon

sequestration initiatives and to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

managed by Foresight Group LLP. https://fsfc.foresightgroup.eu/

This announcement does not constitute, and may not be construed

as, an offer to sell or an invitation to purchase investments of

any description, or the provision of investment advice by any

party. No information set out in this announcement is intended to

form the basis of any contract of sale, investment decision or any

decision to purchase securities in the Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will", "targeting" or

"should" or, in each case, their negative or other variations or

comparable terminology. All statements other than statements of

historical facts included in this announcement, including, without

limitation, those regarding the Company's financial position,

strategy, plans, proposed acquisitions and objectives, are

forward-looking statements.

INVESTMENT OBJECTIVES

-- Real returns and capital appreciation driven from

supply/demand dynamics for UK timber and land

-- Value creation through new afforestation opportunities

-- Direct contribution to the fight against climate change

-- Access to voluntary carbon units related to carbon

sequestration from new afforestation planting

HIGHLIGHTS

As at 31 March 2022

GBP135.5m

NET ASSET VALUE ("NAV")

104.2p

NAV PER SHARE

8,473

HECTARES IN THE PORTFOLIO

3,340 hectares

LAND NEWLY PLANTED OR IN AFFORESTATION DEVELOPMENT

4.2%

TOTAL NAV RETURN SINCE IPO

91.0%

IPO PROCEEDS UTILISED

100,000 tonnes

TIMBER IN 2022 HARVESTING PROGRAMME

CHAIR'S STATEMENT

On behalf of the Board, I am pleased to present the very first

Unaudited Interim Report and Financial Statements for Foresight

Sustainable Forestry Company Plc (the "FSF", "Company" or the

"Fund") for the period to 31 March 2022.

Richard Davidson

Chair

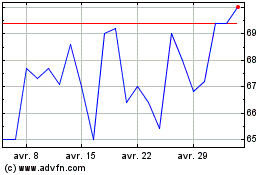

On 24 November 2021, we were delighted to complete the listing

of the Company. In doing so, FSF became the only listed forestry

vehicle on the main market of the LSE with a primary focus on UK

forestry investment. The Company raised GBP130 million at a share

price of 100.0 pence in the fundraising process. After an initial

dip to close to 90.0 pence in post-IPO trading, our shares have

followed a steady upwards trend to recent highs of 116.0 pence (at

the time of writing, 13 June 2022). Also, pleasingly, for almost

the entire period since mid-April 2022, our shares have traded at a

premium to NAV.

I'd like to put on record my sincere congratulations and thanks

to the Fund Managers, advisors, new Shareholders and other members

of the Board for contributing to the early successes we are

reporting. We are very proud of both the listing and the investment

strategy which offers investors asset class diversification and

resilience to market conditions (such as inflation) whilst offering

strong sustainability, biodiversity and ESG credentials.

FSF offers both retail and institutional investors an

opportunity to invest in UK forestry. The Company's investment

strategy focuses on the UK's need for sustainable timber production

and is targeting a diversified portfolio of both forestry and

afforestation (forest creation) sites.

We believe that having the correct tree species mix and forest

designs will allow the Company to successfully deliver a blend of

cash flows from the sale of timber whilst sequestering carbon,

increasing biodiversity and creating natural habitats. As at 31

March 2022, afforestation assets by value make up 36% of the

portfolio and, as outlined in the Prospectus, the ambition is to

increase the allocation to over 40% in the near future. Suitable

afforestation also allows access to grant schemes and the ability

to create voluntary carbon credits.

During the period, FSF took ownership of 38 individual

properties across 29 assets spanning an area a little under 8,500

hectares. Pleasingly, two new forests were also planted, the first

of multiple afforestation schemes. With over 91% of IPO proceeds

deployed, the Board looks forward to continuing the positive

trajectory for the remainder of the financial year.

Key financials

In the period to 31 March 2022, the NAV per Ordinary Share

increased to 104.2 pence (24 November 2021: 98.1 pence). The key

driver of this gain was an 18% upwards revaluation of our

afforestation sites, driven by rising land prices, granting of

planting permission and completion of planting.

Acquisitions

The Company made three acquisitions during the period. The first

was the portfolio of seed assets from the Foresight Inheritance Tax

Fund for GBP113.4 million which was a critical part of the

early-stage business plan. FSF continues to actively seek further

opportunities in the market, is in exclusivity to acquire several

afforestation sites and has a healthy pipeline. Now that the IPO

proceeds are significantly deployed, our stated intention is to

grow the Company with additional fundraising at the appropriate

time.

Forest operations

During the period, the Investment Manager has been working hard

at all stages of the forestry lifecycle. A particular highlight of

the period was the planting of over a quarter of a million trees at

Banc Farm in Wales. In addition, plans for significant harvesting

and subsequent re-stocking in 2022/23 have been finalised. The

Investment Manager has led successful grant funding

applications.

Sustainability

We are proud that FSF was awarded the Green Economy Mark at IPO.

This recognises companies that derive 50% or more of their revenues

from environmental solutions.

The Company also aims to achieve both the Forest Stewardship

Council ("FSC") and Programme for the Endorsement of Forest

Certification ("PEFC") accreditation for each property within 12

months of acquisition and is currently on track to achieve this.

FSC and PEFC are the two main global certification schemes and

exist to promote sustainable forest management and a system for

product assurance. The schemes allow consumers to identify,

purchase and use timber and wood products produced from

well-managed forests.

Market outlook

Prices in the forest property market remain underpinned as the

asset class continues to attract interest from new private and

institutional sources. This has been driven by many of forestry's

traditional long-term attributes such as inflation protection,

environmental impact and attractive cash flows from growing

timber.

The planting land market has seen particularly strong demand in

recent years. Forestry interest is now a key driver in the market

for marginal land types. The recent strong rise in ESG investing

has widened this from land purely suitable for growing commercial

timber, to a range of land types suitable for commercial forestry,

native woodland planting for CO2 sequestration and various other

holistic environmental projects such as rewilding or habitat

restoration.

Timber prices have shown some volatility in recent months after

an exceptionally strong two-year performance. The UK economy

appears to be slowing and winter storms have increased supply. In

contrast, the pound has weakened (which is important due to the

level of UK imports of timber) and the conflict in Ukraine has led

to timber import bans from both Russia and Belarus, reducing

supply. In addition to this, the FSC and PEFC have defined Russian

and Belarusian timber as "conflict timber" and as such will not

qualify for any accreditations whilst the conflict is ongoing.

The Investment Manager and the Board remain of the view that the

longer-term timber supply deficit provides a significant

opportunity beyond any current uncertainty.

Summary

The first seven months of FSF's life has been filled with many

successful events: the IPO, property acquisitions, new Shareholders

and the planting of new forests. As a Board, we are proud of what

has been achieved so far and are optimistic for the future. FSF

aims to be a success for our Shareholders but also to make a

difference to the planet.

Richard Davidson

Chair

14 June 2022

INVESTMENT MANAGER'S REPORT

Robert Guest

Investment Director, Co-lead Manager of FSF

Richard Kelly

Investment Director, Co-lead Manager of FSF

Executive summary

We are very fortunate to have a Board of Non-Executive Directors

with a deep and broad range of experience, a progressive mindset

and who share our passion for sustainability, biodiversity and a

home-grown renewable supply of UK timber. We thank each of them for

their support and guidance in the run-up to the IPO and during this

first period in the life of the Company as a listed entity.

The seed assets transaction means that the Company has been able

to get off to a flying start in terms of deployment. We were then

pleased to complete two further afforestation acquisitions during

the period. Beyond that, we have primarily focused our efforts on

continuing the origination of a strong pipeline of afforestation

deals using our network of contacts and our proactive

market-mapping and deal procurement approach.

Afforestation is the development of land that is suitable for

the planting of both commercial conifer and native broadleaf trees,

and results in new forest and woodland creation. Such planting

projects initiate additional carbon sequestration, serve to

increase the supply of sustainable UK timber for the next

generation, as well as enhance biodiversity levels, provide natural

capital services and offer other societal educational, recreational

and health benefits.

We are pleased by the prospect of generating incremental value

uplifts as these projects successfully achieve their development

milestones. The development programme is progressing very well,

with much of the design work, environmental surveys,

forward-ordering for the supply of saplings, and applications for

permissions and grant funding ready for submission to the relevant

authorities for approvals now well-advanced.

To see the first trees planted on two sites during the period

was particularly satisfying and with multiple assets poised to

progress through various next key development stages, the team are

keen to see more results from all the hard work done to date.

The other major aspect of the Company's portfolio is mature

established forests. From the commercially productive areas within

these forests we supply, each year, a stream of sustainable

home-grown timber to the UK market by thinning and harvesting on a

rotational basis, re-stocking as we go. From what is harvested, the

sawlog (supplied to the construction industry) is the main product

and has the additional benefit of locking up carbon in buildings

(embodied carbon) over the long term.

The by-products of FSF's sawlog-focused commercial forestry -

small and medium-sized Roundwood - are utilised following

waste-hierarchy principles and these ultimately become pallet wood,

fencing wood and wood chips that are used in pulp, paper, panel

board, chipboard mills and for biomass heat and electrical energy

generation.

Despite some recent headwinds and related pricing volatility,

overall levels of demand for timber has remained robust following a

period of strong price growth during the COVID-19 pandemic and we

have a significant harvesting programme lined up for the calendar

year 2022.

As well as the afforestation development, harvesting and ongoing

management of the land during the period, there are several new

initiatives underway which target positive sustainability and ESG

impacts and/or generate value upside. Details of the highlights of

these are covered in this section, the Investment Manager's Report

and the Sustainability and ESG section.

The Investment Manager is looking forward to building on this

strong initial first period as we now work towards the year end.

The medium term goal is to grow the Company to in excess of GBP500

million Gross Asset Value ("GAV") within four to five years of

listing, whilst delivering a combination of strong financial

returns and environmental and social impacts for the

Shareholders.

Portfolio allocation

As at 31 March 2022, the Company's portfolio comprised 29 assets

across 38 properties with total area of 8,473 hectares. All of

these assets were acquired during the period across three

transactions.

The allocation is currently weighted towards Scotland, which is

the most forested of the UK countries and the closest to achieving

its annual planting targets. Wales is the next most prominent

country in the portfolio and government targets for afforestation

in Wales are significant. The Investment Manager is also seeking

opportunities in Northern England to increase allocation there,

noting that this is a relatively more challenging market

environment and with England yet to come anywhere close to

fulfilling its annual planting targets.

The Company has made strong progress during the period towards

achieving its afforestation target of greater than 40% (by

value).

The Company has made strong progress during the period in terms

of its allocation to afforestation towards the target of greater

than 40% (by value).

UK timber market

2022 timber market

--

- Storm Arwen in November 2021 came in from the North East and caused

a large amount of damage to forests in the North East of England and

North and East of Scotland. Circa 30% of the annual national cut now

needs to be cleared and brought to market during 2022. This has impacted

short-term Roundwood prices in particular and had some effect on sawlog

prices. However, larger commercially managed forests were generally

less impacted, with smaller policy woodland and shelter belts on farms

and estates experiencing the most severe effects. Further, for larger

players able to push back harvesting of wind-blown compartments to

later in the year, timber prices, in particular for sawlog, have remained

resilient, underpinned by continued overall shortage of supply and

sustained demand.

- Construction for 2022 remains on schedule, but for 2023/24 there is

market sentiment that the spike in commodity prices (pushing up the

capex costs of construction) may force some projects to go "on standby".

However, the Investment Manager's view is that the global shortage

of timber and shortage of housing with a rising population means that

the fundamentals for sustained increases in timber prices remain strong.

Further, as a net importer of timber, UK forest owners are likely to

remain relatively well insulated from these effects.

- GBP has weakened against EUR and USD during the period. This has a

positive effect on prices for UK timber growers.

- As the Chair has outlined in his statement, the effect of the tragic

war in Ukraine on timber supply is likely to put upward pressure on

global timber prices, including UK timber prices. Russia supplied c.20%

of global timber and c.3.5% of UK timber prior to the conflict.

- The maturity levels of UK commercial forests are such that reducing

supply levels over the medium term are a certainty. It is the view

of the Investment Manager that, once the storm damage has been cleaned

up, the impact of Storm Arwen will only intensify the supply shortage

- as a reasonable portion of the storm-damaged trees will not have

achieved optimal size and bulk at the point they were wind blown. We

are therefore of the view that the overall outlook for UK timber prices

remains good.

Harvesting plan

The harvesting programme for 2022 involves eight assets with an

estimated timber yield of 100,000 tonnes. The first FSF forests are

planned to begin harvesting in summer 2022 and the process of

tendering and agreeing prices is well underway. The 2022 harvesting

programme will include the small number of assets affected by Storm

Arwen where wind blow has occurred. During the seed asset

transaction, FSF negotiated an equitable commercial solution to

deal with the harvesting and revenue generated from the windblown

timber. This meant that despite the storm, FSF was not impacted

financially. Since acquiring, the Company has insured the portfolio

assets to cover future storm events.

Voluntary carbon market

The EU Emissions Trading Scheme (EU ETS) is a regulated

cap-and-trade market for carbon in Europe which operates separately

to the voluntary carbon market. However, the Investment Manager is

of the view that it is a useful proxy market for voluntary carbon.

In theory, the gap between voluntary carbon market pricing and

regulated carbon market pricing may narrow/converge over time as

the trust in the voluntary carbon markets and the related systems

and controls increases.

The most notable development in the EU ETS pricing during the

period was a material (c.30%) decrease in March 2022 from highs of

approximately EUR95 per tonne to below EUR60 per tonne. Market

commentators suggested at the time that the drivers for this were

threefold: (i) fear of regulatory amendments where the EU

Commission could reduce the trigger point for market intervention

where the current market price exceeds the average price of the

preceding 6 month period from 3.0x to 2.0x, (ii) market speculation

about whether the Russian war in Ukraine could accelerate net zero

ambitions of countries such as Germany thereby reducing demand for

carbon and (iii) traders liquidating carbon to offset losses

elsewhere as a result of equity market volatility/corrections.

From a voluntary carbon market perspective, the Investment

Manager has, anecdotally, observed higher pricing for high quality

UK Woodland Carbon Code ("WCC") Pending Issuance Units of between

GBP12 per tonne and GBP15 per tonne during the period, increased

from an observed/ anecdotal range of GBP5 per tonne to GBP8 per

tonne 12 months ago. The Investment Manager remains optimistic

about the prospects for pricing growth in the WCC units that the

portfolio expects to generate over time, providing that the Company

can demonstrate that its units are of the highest quality in the

future. Please see the Sustainability and ESG section of this

interim report, on pages 14 to 18 for the Investment Manager's view

of why data collection and management will be key to the integrity

and value of voluntary units in the future.

Voluntary biodiversity market update

There is a material opportunity within FSF's forest, woodland

and afforestation areas to enhance connected ecosystems and natural

habitats that generate a significant uplift in biodiversity. There

are also large areas of open ground within the portfolio which

contain upland montane habitats and wetland/ peatland habitats

which are not suitable for tree planting but which can be enhanced

ecologically by alleviating the impacts of over-grazing by

livestock and/or deer.

The goal of the Company is to combine a wide range of

sustainable income streams and positive natural capital service

outcomes including timber, eco-tourism, renewable energy, carbon

sequestration, flood protection, water quality and

societal/community benefits. Alongside those elements, the market

for biodiversity net gain is gathering momentum at a rapid

pace.

The Taskforce for Nature-related Financial Disclosures ("TNFD"),

a group of 34 international taskforce members backed by 350

institutional supporters, has published its first beta version

framework for how companies and funds should report on the impact

they are having on the natural world. The UK Green Finance

Institute has estimated that there is a funding gap of between

EUR44 billion and EUR97 billion over the next 10 years if the UK is

to meet its targeted levels of nature related sustainability and

environmental outcomes.

The Natural History Museum has carried out a global Biodiversity

Intactness Survey and scored the UK at 53% intactness, putting it

in the bottom 10% of the World's countries. The governments of

England, Scotland and Wales now recognise the importance of

nature-recovery, and this is being reflected in policy, regulation

and incentives.

Foresight advocates in favour of nature and biodiversity

recovery and has joined the Natural Capital Investment Alliance

(NCIA) which was created by the Prince of Wales in recognition of

the need to mobilise investment in nature-based economic

opportunities. As part of the Foresight Sustainable Forest

Management approach for FSF the Investment Manager is therefore

carrying out baseline biodiversity surveys and looking to deploy

strategies to improve from that baseline, including exploring the

potential to integrate livestock amongst some of the Company's

forest and woodland areas (i.e., agroforestry/rewilding).

In some instances, we are collecting data to test against

DEFRA's biodiversity metric 3.0. In other scenarios this involves a

more intensive level of data collection, sampling and testing,

including potentially environmental DNA (eDNA) testing. There are

already examples of over-the-counter sales and purchases of

voluntary biodiversity uplift units and biodiversity net gain units

and this could represent a substantial revenue stream for the

Company in the future. Often the verifiers of such biodiversity

units require identification of positive social impacts alongside

the biodiversity impacts before they will approve and verify

units.

This is a nascent area and many of the initiatives are at

pilot/feasibility stage. However, Foresight is taking steps to make

sure that the Company is well placed to participate strongly in

this emerging sector as the market develops.

Data management

The Investment Manager is of the view that efficient data

collection and management will be critical for validation and

verification of voluntary carbon units, voluntary biodiversity

units and other such credits in the future and is therefore running

a pilot with a data management Software as a Service ("SaaS")

partner with a view to this facilitating efficient data capture

which can then be used for multiple other purposes, including

general management and reporting functions.

Health and safety ("H&S")

H&S management of the assets is a key focus and there are a

number of activities in place to ensure that the correct

information is provided at regular intervals to Foresight so that

appropriate action can be taken where necessary. There were no

H&S incidents (near misses or RIDDORs) during the period across

the portfolio.

Afforestation asset development progress

There are 14 afforestation assets in the portfolio, located in

both Scotland and Wales. The status(1) of each of the afforestation

assets for the period is as follows:

Property name Forest design Permits Planting Initial Trees fully

completed and grants completed WCC validation established

secured, completed

admitted

to WCC register

----------------- -------------- ----------------- ----------- ---------------- -------------

Banc Farm -- -- -- - -

Mountmill Burn -- -- - - -

Upper Barr -- - - - -

Auchensoul -- - - - -

Cwmban Fawr Farm -- - - - -

Frongoch -- - - - -

Brynglas -- - - - -

Esgair Hir -- - - - -

Pistyll South -- - - - -

Ellenber Farm -- - - - -

Fordie -- - - - -

Rory Hill -- - - - -

Lamb Craigs -- - - - -

Maescastell -- - - - -

(1) Status as at 31 March 2022

As described in the executive summary, the Investment Manager

attaches high importance to reaching development milestones in

terms of the financial return value and positive sustainable and

ESG impacts that this will deliver.

Pipeline and deal procurement

Foresight sources deals and acquisition opportunities via

selling agents, on-market bids, bilateral deals, direct origination

and direct approaches.

Approximately 4,500 specific properties (c.900,000 hectares)

which are highly suitable for afforestation have been identified by

the Investment Manager, which is able to secure transaction

opportunities through its direct origination system. The Company

has priority over these and other Foresight forestry opportunities

that are within the Company's mandate.

At the time of writing, FSF holds exclusivity over approximately

GBP77 million worth of afforestation and forestry pipeline.

Community engagement

The Foresight Sustainable Forest Management approach is applied

across the Company's afforestation projects as well as its

established forest and woodland assets. Some examples are provided

below of where this approach has been pro-actively pursued during

the period, with a particular focus on community engagement and our

drive to unlock positive natural capital service and societal

benefits:

-- Consultation and engagement with local communities has been carried

out, at the appropriate moment, as part of the design and application

stage of each of the Company's in-progress afforestation schemes.

-- A forestry skills training programme has been launched that sponsors

interested members of the local community to receive the training,

qualifications/ certifications, mentoring and equipment to enable

jobs and careers in the forestry industry, with a view to expanding

the scale and geographic reach of the programme in due course if

the initial phase is successful.

-- Opportunities to enhance connectivity between local communities and

the Company's forests and woodlands (e.g., signposts, walking paths,

mountain bike trails, carparks, gates/styles, donations of land)

have been initiated as part of the design process on the Company's

afforestation schemes.

-- The Company has sold and/or leased land that is not suitable for

afforestation to local farmers.

-- Potential for utilisation of various bothies and cottages within

the portfolio as centres for education and recreation relating to

sustainable forest management and wildlife & ecosystem enhancement

is being explored.

-- The Company is promoting local tourism and job creation by working

with a luxury glamping pod business to establish plans to install

pods across several forests and afforestation sites.

-- Foresight is exploring several opportunities to co-locate renewable

energy generation (e.g., wind, hydro) with forest sites to supply

sustainable electricity into the local grid system and is carrying

out an enhancement project at an existing run-of-hill-stream hydro

scheme at one of the Company's properties.

-- Foresight has made a pro-active decision, upon acquisition of a landscape-scale

estate, to manage the houses, buildings and employees closely alongside

the land, forest and woodland. The estate staff are deeply involved

in the forestry/afforestation/ peatland/rewilding project that is

in progress, with the letting of a number of the estate houses to

local families and with the establishment of an eco-tourism business.

-- A business case has been successfully demonstrated where one of the

forests in the Company's portfolio has carried out thinning, engaged

a local contractor to drag the trees by horse to a work-area (a low

impact method), subsequently sawn and processed the timber on-site

and then sold the resultant highly specialist timber product to local

buyers.

Please see the Sustainability and ESG section on pages 14 to 18

of this report for more details of the Foresight Sustainable

Forestry Management ethos and approach

Upside opportunities

A number of upside opportunities have been identified across the

portfolio with key themes emerging, including wind farm development

on existing or proposed wind farm sites, eco-tourism (holiday lets

and glamping pods) and repurposing or renovating buildings that

have been included as part of the acquisition. Each upside

opportunity will be reviewed on its merits and taken forward on a

case-by-case basis.

We also have a significant focus on biodiversity and are

actively exploring the potential verification routes which are

available.

The value of these upside opportunities is not currently

included in the valuations of the Company's properties. On

successful implementation and completion of such projects the

Investment Manager will notify the RICs Red Book valuer in order

that the additional value created is reflected in the Company's

NAV.

AFFORESTATION CASE STUDY

BANC FARM

Carmarthenshire, Wales

Investment overview

Company Foresight Sustainable Forestry Company

Plc

-------------------- ---------------------------------------

Property location Carmarthenshire, Wales

-------------------- ---------------------------------------

Asset type Afforestation

-------------------- ---------------------------------------

Project size 150 hectares

-------------------- ---------------------------------------

Operational date April 2022

-------------------- ---------------------------------------

Investment amount GBP1.48 million, including deal costs,

but excluding all afforestation costs

-------------------- ---------------------------------------

Banc Farm is a 150 hectare afforestation property in

Carmarthenshire in Central Wales. This property is marginal

farmland, located in a highly afforested part of Wales and

surrounded by mature forests owned by Natural Resources Wales

("NRW"). NRW offer grants for afforestation under the Glastir

Woodland Creation Scheme. To qualify for these grants, scheme

designs must include at least 25% native broadleaves and a maximum

of 50% of a single species.

The UK is well below its afforestation targets; as such, FSF

targets a 40-50% allocation to afforestation projects. In 2021,

only 300 hectares of afforestation was undertaken across all of

Wales. At 150 hectares, Banc Farm represents one of the largest

afforestation schemes undertaken in Wales in recent years.

The Foresight Forestry team has worked with third parties EJDF

(Forestry Advisors) and Tilhill (Forest Managers) to develop a

scheme design that is expected to generate good returns for

investors and benefits for the community.

Accordingly, the scheme design incorporates both commercial and

broadleaf species, including: Sitka Spruce; Douglas Fir; Norway

Spruce; Silver Birch; Sycamore; Oak; Black Poplar; and Juniper.

Black Poplar and Juniper are both recognised as "rare and

endangered" by the Forestry Commission. The property will also

incorporate community benefits such as the extension of mountain

bike trails and the creation of a car park.

Once the scheme design was agreed and approved by NRW, the

planting process began and has now been completed.

FSF is committed to using low-impact, sustainable planting

methods; as such, continuous mounding is used in place of ploughing

to prepare the ground for planting. Trees are then planted by hand;

a single individual will plant in the region of 2,000 trees per

day.

Approximately 250,000 commercial trees have been planted in the

period to 31 March 2022. Once established, the property is expected

to yield an estimated 48,000 tonnes of sustainable timber for each

rotation. In addition to the timber yield, this project has been

registered with the WCC and will seek approval and verification

from the WCC. The project is expected to sequester 21,000 tonnes of

CO2e and generate the carbon units associated with this

sequestration.

On 2 March 2022, a group of children from Talley Primary School

attended a community planting day at Banc Farm. The children learnt

about biodiversity conservation and new silviculture skills

including how to establish, grow and maintain healthy forests and

woodlands and the importance of doing so for society and the

planet. They each planted a tree at Banc Farm and hammered in an

orange peg with their name engraved on it so they can follow their

tree's progress. The children also took home a sapling to practise

their new planting skills. Nick Gale, a teacher present on the day

stated, "the children of Talley Primary School thoroughly enjoyed

planting trees at Banc Farm. They learnt about the environment,

climate change and the value of planting trees for our future. The

experience was a very beneficial one for the pupils. Thank you for

the opportunity."

Sustainability and ESG

Our core Sustainability and ESG objectives

1. To deliver and increase the supply of home-grown UK timber to reduce

the country's reliance on imports;

2. To do so in a way that combines sustainable financial returns with

carbon sequestration, biodiversity gain and other positive environmental

and social impacts; and

3. To be a sustainability leader in the UK forestry industry whilst delivering

both traditional commercial timber products and innovative natural

capital services.

Our Sustainable business model

We blend:

-- tangible commercial products (e.g., timber, renewable energy, eco-tourism)

with

-- natural capital service outputs (e.g., carbon sequestration, biodiversity

gain, flood protection, social contributions, water quality) with an

ethical approach to governance and management decision making to deliver

sustainable financial returns.

Our holistic approach to Sustainability and ESG

FORESIGHT SUSTAINABLE FOREST MANAGEMENT

SUSTAINABLE FINANCIAL RETURNS

--

Environmental

-- Increase home-supply of UK timber

-- Sawlog-focused timber production

-- Substitution of carbon intensive materials

-- Substitution of wasteful materials

-- Increase standing forest carbon sinks

-- Embodied carbon locked up in buildings

-- Additional carbon sequestration

-- Biodiversity gain & ecosystem services

-- Flood protection

-- Water quality

Social

-- Job creation

-- Renewable products GDP contribution

-- Recreation

-- Education

-- Physical health

-- Mental health

-- Society/community engagement

-- Communication and consultation

-- Community/donations

Governance

-- Manager with sustainability ethos and expertise

-- Experienced independent board with S & ESG committee

-- Supply chain counterparties comply with ethos

-- Transparency, data and reporting

-- Member of the AIC

-- Company code

Foresight Sustainable Forest Management - generating 'natural

capital alpha'

We create natural capital alpha through our proprietary

sustainable forestry management practices. We balance UK timber

production, carbon sequestration, biodiversity and positive social

impacts, amongst other considerations, for each of our

afforestation sites. As well as commercial trees, this will include

the planting of significant hectarage of native broadleaf trees and

re-instating wetlands and reducing grazing levels on large areas of

open ground, which increases positive carbon impacts and creates

additional biodiverse ecosystems. We have multiple schemes where

the proportion of native broadleaf trees relative to commercial

conifer trees is significant (even in excess of 50% on some

projects).

Our sustainable approach tackles some of the key challenges and

opportunities in UK Forestry

The importance of timber as a sustainable product

On average, around two-thirds of the commercial trees grown by

FSF produce sawlog (the best sites can produce >80% sawlog)

which is used in building construction, locking up carbon for up to

100 years or more. Waste hierarchy principles are generally applied

to the non-sawlog parts of the commercial trees (i.e., the residual

resource is not wasted) and these by-products have a broad range of

sustainable applications.

Timber products are renewable and have a low/negative carbon

profile when compared with the alternatives. Concrete, steel,

plastics and synthetics have highly negative carbon and/or waste

impacts which means displacing these with home-grown timber

products is a highly sustainable endeavour.

The Importance of reducing the UK's level of reliance on timber

imports

The UK is increasingly reliant on imports to meet its own demand

for timber, with current annual import levels of c.80%. Because

only c.30% of world demand for timber is currently met by

commercial plantations, higher levels of UK imports ultimately put

increased pressure on natural and semi-natural forests in the

global timber supply chain. So, FSF's contribution towards

increased home-grown UK timber supply from our afforestation

schemes has positive local impacts as well as far-reaching global

impact

Climate change, biodiversity loss, positive social impacts -

Data is key to integrity

The urgent requirement to reduce the rate of global warming and

the dramatic decreases in the UK's baseline biodiversity levels are

well documented. The FSF Management approach ensures that the

impact our projects is having in these key areas (and other of the

core S & ESG areas) will be carefully monitored over time

through meticulous data collection and management.

Foresight is partnering with natural-capital focussed Software

as a Service ("SaaS") experts, piloting a LIDAR methodology for

measuring biomass levels and related carbon sequestration rates,

exploring a range of biodiversity monitoring techniques and

investigating methodologies for quantifying 'natural capital

premium' in order to ensure that FSF remains in the vanguard of the

drive for accountability, verification, transparency and

credibility. This will ensure that any voluntary carbon,

biodiversity or social units generated by FSF meet high standards

of integrity and consequently hold high financial natural capital

values.

Afforestation as part of UK land use change - Communicating a

sustainable transition

The UK government's tree planting target of 900,000 hectares in

total by 2050, whilst ambitious, represents only 3.7% of total UK

land area. This is part of a much larger national adjustment as the

UK seeks to re-invent its approach to agriculture and general land

use and will see an increase in UK forest cover from c.13% to

c.17%, compared to the European average of 34%.

With the UK's current high reliance on timber imports, the

urgent need to reach net zero carbon and low levels of biodiversity

baseline, FSF considers that an allocation of a reasonable

proportion of UK land towards the creation of new forest and

woodland is a sensible objective, provided it is carried out in the

right way. To date, the UK is yet to achieve its annual planting

target. However, the Scottish government remains supportive of

additional planting and the Welsh and English governments are

taking additional steps to further encourage planting. The Company

will materially contribute towards the UK's afforestation

targets.

For FSF, the key is communication with communities about the

design and development process on our afforestation sites,

demonstrating what the FSF Management approach can bring in terms

of positive contribution towards local industry, local society and

the local environment.

Contribution to the United Nations Sustainable Development Goals

("SDGs")

The following diagram highlights the 5 most relevant SDGS that

the Company has contributed to during the period.

The annual report to the period 30 September 2022 will report

more specifically, and quantitively, on the Company's contributions

to UN SDGs during its first year.

FSF's commitment to other leading Sustainability and ESG

standards

The Investment Manager confirms its view that at the half year

point the Company meets or exceeds the following voluntary

compliance standards.

EU Article 9 SFDR

-- The Sustainable Finance Disclosure Regulation ("SFDR") is a framework

designed to increase transparency on sustainability reporting with a view

to facilitating sustainable investment practices and to aid the understanding

of sustainability credentials as published by funds and/or companies.

-- Article 6 - Funds without any consideration of sustainability

-- Article 8 - Funds that promote a social or environmental characteristic

(light green)

-- Article 9 - Funds that sustainable investment as their objective alongside

a robust framework for reporting sustainable impact

EU Green Taxonomy

-- Under SFDR, Article 9 funds must report on their level of alignment to

the EU Taxonomy for Sustainable Activities ('EU Taxonomy')

-- The EU taxonomy is a classification system, establishing a list of sustainable

economic activities under six environmental objectives as outlined below:

o Climate change mitigation

o Climate change adaptation

o Sustainable use and protection of water and marine resources

o Transition to a circular economy

o Pollution prevention and control

o Protection and restoration of biodiversity and ecosystems

-- The aim of the EU Taxonomy is to create security for investors, protect

private investors from greenwashing, help companies to become more climate-friendly,

mitigate market fragmentation and help shift capital to where it is most

needed.

-- The Company has set the objective of having all of its assets be compliant

with the EU Taxonomy's pre-determined screening criteria

-- The intention to have all assets aligned to an internationally recognised

sustainable forest management standard (such as FSC or PEFC) is a fundamental

component of achieving EU Taxonomy compliance.

UK Green Taxonomy and UK Sustainable Disclosure Requirements

("SDR")

-- The goals of the UK Green Taxonomy and SDR are broadly similar to EU Green

Taxonomy and SFDR.

-- As a UK managed fund, FSF will ultimately come under the UK's Green Taxonomy

and its SDR regime, both of which are currently in the consultation phase

and do not yet have a set date for implementation

-- The Investment Manager will continue to monitor developments so that the

Company is compliant with the emerging requirements.

The LSE Green Economy Mark

-- This standard recognises London-listed companies and funds that derive

more than 50% of their revenues from products and services that are contributing

to environmental objectives such as climate change mitigation and adaptation,

waste and pollution reduction and the circular economy. The Company meets

these qualification requirements and holds the LSE Green Economy Mark.

Objectives set - Working towards the year-end Sustainability

& ESG update

Having outlined the Company's Sustainability and ESG objectives

in this set of Interims, we will publish KPIs and data sets that

align with our mission statement and goals in the forthcoming

year-end annual report.

PORTFOLIO VALUATION

Methodology

Savills Advisory Services Limited ("Savills") is engaged by the

Company to provide a fair value valuation of the portfolio in

accordance with the Royal Institution of Chartered Surveyors

("RICS") Valuation - Global Standards July 2017 (the "Red

Book").

The Red Book valuation falls within the International Financial

Reporting Standards ("IFRS"), as part of the International

Valuation Standards which requires investment properties to be

considered on the basis of fair value at the balance sheet date.

IFRS 13 outlines the principles for fair value measurement which

Savills valuation is consistent with. The Red Book valuations are

undertaken on an asset-by-asset basis and will be completed

semi-annually.

The fair value assessment of the assets has been completed by

Savills on a comparable basis by looking at transactions of similar

assets. Afforestation land comparables include the rights to

voluntary carbon unit creation. However, the Red Book valuation

approach is largely backwards looking and thus the Investment

Manager is of the view that the valuations are likely to be

conservative in relation to the potential future value of the

voluntary carbon units that could be generated.

In addition to the fair value, the Red Book methodology

considers a number of additional factors impacting the valuation. A

reasonable view of the potential for afforestation sites' value

uplift over time is considered rather than valuing the land in its

current state. Savills also consider the stage of each site within

the forestry grant application process and may make reassessments

as to the value of a site when a new developmental milestone

occurs. Additionally, as the assets under ownership are located

across the UK (Scotland, North England and Wales), the external

valuer accounts for the potential differences in market interest

and demand at the different locations. On a case-by-case basis

Savills will also assess the extent of damage suffered by sites due

to any extreme windblow incidents. Where damage is extensive,

Savills will make prudent adjustments to the value of the site, if

it is evident that some of the affected timber may be challenging

to recover.

Portfolio valuation

Following the successful IPO, the Company acquired a seed asset

portfolio for EUR110.9 million (pre-tax and transaction costs) and

two further assets (EUR5.2 million) that were valued using the Red

Book methodology at 30 September 2021 (EUR116.3 million). Following

the revaluation at 31 March 2022, forestry asset valuations

increased by EUR2.3 million and afforestation asset valuations

increased by EUR6.9 million.

For forestry, there were a relatively low number of comparable

transactions over the period, partly due to market seasonality and

Storm Arwen which saw a reluctance of buyers to acquire

storm-affected properties. The valuation period also covers the

winter months, when trees are dormant and not adding biological

growth to the portfolio.

The increase in valuation of the afforestation portfolio was

driven by a combination of factors: the rapidly appreciating market

for properties with strong afforestation and carbon credit

potential, and several properties achieving material development

milestones - mainly the completion of planting at Banc Farm and the

commencement of planting at Mountmill Burn.

RISK AND RISK MANAGEMENT

The Directors consider the following as the principal risks and

uncertainties to the Company at this time:

-- The Company being unable to access sufficient funding to complete its

growth expectations

-- A reduction in demand from the users of timber that negatively impacts

profitability

-- Resistance to change of land use from the public generating negative PR

and impacting the Company's ability to obtain planning consent

-- Changes in the economic, technological, political or regulatory environment,

including inflation

Risk and risk management

The Company is exposed to a number of risks that have the

potential to materially affect the Company's valuation, reputation

and financial or operational performance. The nature and levels of

risk are identified according to the Company's investment

objectives and existing policies, with the levels of risk tolerance

ultimately defined by the Board.

Financing capital

As a newly listed entity, the Company is focused on growing its

portfolio. In order to achieve our growth ambitions and to ensure

the Company is able to take full advantage of the opportunities in

its pipeline, additional financing will be required in the short to

medium term.

The Company's borrowing policy enables the Directors to use

gearing for liquidity and working capital purposes or to finance

acquisition of investments subject to following a prudent approach

and maintaining a conservative level of aggregate borrowings that

will not exceed 30% of Gross Asset Value, calculated at the time of

drawdown. The equity levels of the Company are closely monitored by

the Board and the Investment Manager on a regular basis.

The Company continues to work closely with its broker, Jefferies

International Limited, and the Investment Manager's in-house Retail

Sales team, will conduct market research ahead of any future

funding rounds to gauge demand from existing and new investors.

Timber market volatility

Timber prices can be volatile periodically. However, demand over

the medium to long term has historically created real-term pricing

growth. In the context of global under-supply and increasing

demand, this reduces market risk for the sale of the Company's key

products and revenue streams.

Should timber prices be less attractive at the point of felling,

the Investment Manager also has the option to delay felling,

allowing trees to grow on and provide time for a recovery from

short-term pricing volatility.

Community engagement

The development of afforestation assets in rural areas is

sensitive for local residents and, if managed poorly, could result

in poor relationships developing between the Company and local

communities. This in turn could impact both the Company's

reputation, ability to obtain the necessary planning consent for

planting to commence and potentially the share price.

During the due diligence phase of afforestation investments, the

Investment Manager commissions an independent community risk

assessment to ensure that afforestation only takes place in areas

where tree planting is less likely to be a contentious issue. A

separate planning risk assessment is also undertaken ahead of all

potential land acquisitions where afforestation is intended and the

Investment Manager only pursues opportunities where the risk of not

obtaining planning consent, including for reasons relating to

objections raised by the local community, is assessed to be

low.

Once afforestation properties are acquired, the Investment

Manager runs a co-ordinated programme of community engagement and

seeks to respond and, wherever possible, adapt the scheme design to

concerns raised by community members.

In addition, in the event that planting was unable to go ahead,

the acquired land would still have agricultural value. Therefore,

whilst the revenue generated from this would be lower, an income

stream would still be available to the Company.

The Company is also working closely with industry bodies such as

Confor and Timber Development UK to promote the merits of increased

sustainable UK timber supply. The Investment Manager is in the

process of developing a forestry skills training programme that

will enable members of rural farming communities to adapt to

afforestation-related land use change by providing them with the

required skills, training, qualifications and safety equipment.

Changes in the macroeconomic environment

The UK economy has seen significant fluctuations in growth over

the last 2 years, predominantly due to the COVID-19 pandemic and

Russia's invasion of Ukraine. Rising inflation is also impacting

the price of goods and materials used in planting and felling.

However, the Company is in a relatively strong position to

withstand changes in the macro-economic environment as it is

invested in real assets, principally freeholds of UK land and

forest stock. The forest stock is experiencing biological growth

regardless of occurrences in financial markets. UK freeholds, real

assets and the value of commodities, such as timber, have a strong

track record of good performance during periods of inflation and

instability of equity markets. In the view of the Investment

Manager, the continued global supply and demand imbalance in timber

markets, which is accentuated in the UK as a net timber importer

and during a period where GBP is weak versus EUR and USD, leaves

the Company well positioned to deliver real terms value growth for

shareholders. Moreover, FSF is in a position to mitigate the impact

of any intra-quarter or intra-year falls in timber prices by

postponing parts of its harvesting programme and allowing the trees

to continue to grow until the underlying imbalance between supply

and demand

begins to flow through to market prices again.

FINANCIAL REVIEW

Analysis of financial results

The financial statements of the Company for the period from

incorporation on 31 August 2021 to 31 March 2022 are set

out on pages 35 to 46.

The Company prepared the condensed unaudited financial

statements from the date of incorporation to 31 March 2022 in

accordance with IAS 34 as adopted by the UK and issued by the

International Accounting Standards Board. The Company applies IFRS

10 and Investment Entities: Amendments to IFRS 10, IFRS 12 and

measures all their subsidiaries that are themselves investment

entities at fair value. The Company accounts for its interest in

its wholly owned direct subsidiary FSFC Holdings Limited as an

investment at fair value through profit or loss in accordance with

IFRS 13 Fair Value Measurement.

The primary impact of this application, in comparison to

consolidating subsidiaries, is that the cash balances, the working

capital balances and borrowings in the intermediate holding

companies are presented as part of the Company's fair value of

investments.

The Company's intermediate holding companies provide services

that relate to the Company's investment activities on behalf of the

parent which are incidental to the management of the portfolio.

The Company, its subsidiaries FSFC Holdings Limited and FSFC

Holdings 2 Limited (together the "Group"), hold investments in 29

portfolio assets which intend to make distributions in the form of

interest on loans and dividends on equity as well as loan

repayments and equity redemptions.

Net assets

The Net Asset Value at 31 March 2022 is GBP135.5 million and

comprises GBP125.2 million portfolio value of forestry and

afforestation assets, cash balances of GBP10.4 million (GBP8.6

million in the Company and GBP1.8 million in the project

companies), offset by GBP0.1 million of other net liabilities

(GBP0.5 million of other assets in the Company and GBP0.6 million

of other liabilities in the project companies).

Analysis of the Group's net assets at 31 March 2022

As at

All amounts presented in GBPmillion (except as noted) 31 March

2022

----------------------------------------------------------------- ------------

Portfolio value (Red Book valuation) 125.2

Project companies' cash 1.8

Project companies' other net liabilities (0.6)

Fair value of the Company's investment in FSFC Holdings Limited 126.4

Company's cash 8.6

Company's other net assets 0.5

Net Asset Value 135.5

Number of shares 130,000,001

Net Asset Value per share (pence) 104.2

----------------------------------------------------------------- ------------

(1) Classified as the gross fair value of the underlying assets in the portfolio

Net Asset Value bridge

With the net proceeds of GBP127.6 million from the successful

IPO (GBP130.0 million gross proceeds less IPO costs of GBP2.4

million), capital was deployed to acquire the portfolio of assets.

The GBP8.9 million fair value increase of the afforestation and

forestry assets held by the Group, offset by fund operating costs

of GBP1.0 million, resulted in a Net Asset Value of GBP135.5

million at 31 March 2022.

Company performance

Profit and loss

The Company's profit before tax for the period from

incorporation on 31 August 2021 to 31 March 2022 is GBP7.9

million

(6 pence per share).

For the same period to 31 March 2022, the total return on

investments was GBP8.9 million, which comprised GBP0.1 million of

interest on the FSFC Holdings loan notes and GBP8.8 million net

gains on investments at fair value. The interest income is from

Company's Shareholder loan to FSFC Holding Limited. The net gain on

investment is generated by the net fair value movement on the

Company's investment in FSFC Holding Limited.

Operating expenses included in the income statement for the

period were GBP1.0 million, in line with expectations. These

comprise investment management fees of GBP0.4 million and GBP0.6

million of operating expenses. The details on how the investment

management fees are charged are set out in note 4 to the financial

statements

Period from

incorporation

on

31 August

2021

All amounts presented in GBPmillion (except as noted) to 31 March

2022

------------------------------------------------------- --------------

Interest received on FSFC Holdings loan notes 0.1

Net gain on investments at fair value 8.8

Total return on investment 8.9

Operating expenses (1.0)

Profit before tax 7.9

Earnings per share (pence) 6.0

------------------------------------------------------- --------------

Cash flow

The Company held cash balances at 31 March 2022 of EUR8.6

million. This amount excludes cash held in subsidiaries.

The breakdown of the movements in cash during the period is

shown below.

Cash flows of the company for the period from incorporation on

31 August 2021

to 31 March 2022 (GBPmillion)

Period from

31 August

2021

to 31 March

2022

------------------------------------------------------------ ------------

Gross proceeds from IPO 130.0

IPO issuance costs (2.4)

Investment in FSFC Holdings Limted (equity and loan notes) (117.7)

Assets acquisition cost paid on behalf of subsidiaries (1.0)

Directors' fees and expenses (0.1)

Investment management fees (0.1)

Administrative expenses (0.1)

Company's cash balance at 31 March 2022 8.6

------------------------------------------------------------ ------------

Cash flows of the group for the period to 31 March 2022

(GBPmillion)

The Group is defined as the Company and its two intermediate

holding companies. The cash flows for the Group of

EUR8.6 million are the same as the cash flows for the

Company.

CORPORATE SUMMARY

Corporate summary

Foresight Sustainable Forestry Company Plc is a closed-ended

investment company incorporated in England and Wales on 31 August

2021 with registration number 13594181. The Company has been

granted Investment Trust status as defined in Chapter 4 of Part 24

of the Corporate Tax Act 2010.

The Company's IPO on 24 November 2021 raised EUR130 million in

seed funding.

Following three significant acquisitions since launch, the

Company has a Net Asset Value of EUR135.5 million as at 31 March

2022. It is the only UK-listed investment trust dedicated to

forestry and afforestation.

As at 31 March 2022, the Company has 130,000,001 Ordinary Shares

in issue which are listed on the Premium Segment of the Official

List and traded on the LSE's Main Market. The Company subscribes to

the AIC Code of Corporate Governance (2019).

Operating structure and business model

As an investment company, the Company has no direct employees

and outsources all operations to a number of key service

providers.

The Company makes its investments through intermediate holding

companies and underlying special purpose vehicles ("SPVs").

Significant shareholders

The Company's Shareholders include a mix of institutional and

retail investors.

Shareholders in the Company with more than a 5% holding as at 31

March 2022 are as follows:

% shareholding

Investor in the

Company

------------------- ---------------

Blackmead

Infrastructure 29.92

Friends

Life Stewardship

Equity

Fund 8.46

Cantor

Fitzgerald

Ireland 8.12

East Riding

of Yorkshire

PF 7.69

West Yorkshire

PF 6.15

------------------- ---------------

Total 60.34

------------------- ---------------

Investment objective

The Company seeks to generate an attractive net total return for

Shareholders over the longer term, comprising capital growth and

aperiodic dividends, targeting sustainable impact through

investment predominantly in sustainably managed Forestry Assets,

including Standing Forests and Afforestation assets). The Company

seeks to make a direct contribution in the fight against climate

change through forestry and afforestation carbon sequestration

initiatives. The Company seeks to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

expected that the Company will achieve, and aim to exceed, the

requirements of compliance with the EU Green Taxonomy and Article 9

of the Sustainable Finance Disclosure Regulation ("SFDR").

Investment policy

The Company achieves its investment objective by investing in a

diversified portfolio of sustainable Forestry Assets, predominantly

located in the UK.

The Company acquires a mixture of cash flow generating

sustainable Forestry Assets representing a mixture of Standing

Forests (of varying age classes) together with land suitable for

Afforestation projects (representing both Commercial Forestry

projects and Non-Commercial Forestry projects) to achieve a

balanced portfolio with an optimal harvesting and capital growth

profile.

Diversification within the Company's portfolio is achieved

by:

a) investing in a range of individual underlying Forestry Assets, each of

which will be capable of separate disposal;

b) investing in different types of Forestry Assets (both Standing Forests

and Afforestation projects) with a range of age classes and harvesting

profiles;

c) where possible, seeking diversification in tree species and a blend of

Commercial Forestry and Non-Commercial Forestry (including native woodland

and open ground) across the overall portfolio;

d) engaging with a range of different off-takers for the Company's harvested

timber; and

e) achieving a geographic spread across the underlying Forestry Assets.

The Company's revenues are primarily generated by the sale of

harvested timber and, in due course, the sale of Carbon Credits.

Where appropriate the Company will also seek to generate ancillary

non-core revenue streams from its Forestry Assets. This includes,

but is not limited to, the leasing or licensing of land to third

parties for agricultural, sporting and tourism activities, the

leasing of land to third parties for renewable energy and/or energy

storage and/or telecommunications development projects (such as the

erection of wind turbines or mobile telecommunication towers) and,

if a future market develops, the sale of biodiversity credits.

The Company gains exposure to Forestry Assets indirectly through

its holding of equity interests in underlying asset holding

companies. The Company invests via equity or debt interests in such

asset holding companies. The asset holding companies will use the

funds received by the Company to acquire Forestry Assets directly

or indirectly through intermediate holding companies.

The Company may acquire freehold or leasehold interests in

Forestry Assets or may acquire the shares in corporate entities

holding such Forestry Assets.

Returns generated by the asset holding companies will either be

reinvested, paid to the Company in the form of dividend

distributions or the payment of interest on intra-group debt.

Investments in Forestry Assets will typically entail 100%

ownership by the Company. The Company may, however, enter into

joint venture arrangements alongside one or more co-investors where

the Investment Manager, in consultation with the Board, believes it

is in the Company's best interests to do so (such as where an

investment opportunity is too large for the resources of the

Company on its own, to share risk or where a joint venture

arrangement will optimise returns for the Company). In the case of

such co--investments, the Company will target retaining a control

position, where this is possible, or, where this is not possible,

will have strong minority investor protections and governance

rights.

In addition, as part of a transaction to acquire Forestry

Assets, the Company may end up owning ancillary

non-forestry-related assets, including, but not limited to,

residential land and buildings, vehicles, equipment, agricultural

outbuildings and small-scale renewable energy assets (together

"Non-Core Assets"). Where appropriate and beneficial to the overall

strategy, the Company will look to realise the value of any

Non--Core Assets over time for the benefit of the Shareholders.

The Investment Manager has overall responsibility for asset

managing the Company's Forestry Assets (including any ancillary

non-core revenue streams) and Non-Core Assets. The Company has

appointed appropriate specialist third-party forestry management

companies which are responsible for the day-to-day physical

management of the Company's Forestry Assets, including harvesting

and planting activity.

Investment restrictions

The Company invests and manages its assets with the objective of

spreading risk and, in doing so, will maintain the following

investment restrictions:

-- no single Forestry Asset will represent more than 15% of Gross Asset Value

(with two or more Forestry Assets which are directly adjacent being treated

as a single asset), the Board may approve the increase of this limit up

to 25% of Gross Asset Value on an exceptional basis where considered appropriate

to cater for a larger scale strategic Forestry Asset investment;

-- at least 90% of Gross Asset Value shall be invested in Forestry Assets

located in the United Kingdom;

-- no more than 10% of Gross Asset Value may be invested in Forestry Assets

located in EEA countries;

-- the maximum exposure to Afforestation projects will not exceed, in aggregate,

50% of Gross Asset Value;

-- the maximum exposure to Non--Core Assets will not exceed, in aggregate,

10% of Gross Asset Value; and

-- the Company will not invest in other listed investment companies.

In accordance with the requirements of the Listing Rules, the

Company will not undertake any trading activity which is material

in the context of the Company as a whole.

Compliance with the above investment limits is measured at the

time of investment and non--compliance resulting from changes in

the price or value of assets following investment will not be

considered as a breach of the investment limits.

Investment manager

The Company's Investment Manager, Foresight Group LLP, is

responsible for the acquisition and management of the Company's

assets, including the sourcing and structuring of new acquisitions

and advising on the Company's borrowing strategy. Foresight Group

is authorised and regulated by the Financial Conduct Authority.

Foresight Group was founded in 1984 and is a leading listed

infrastructure and private equity investment manager. With a

long-established focus on ESG and sustainability-led strategies, it

aims to provide attractive returns to its institutional and private

investors from hard-to-access private markets. Foresight manages

over 300 infrastructure assets with a focus on solar and onshore

wind assets, bioenergy and waste, as well as renewable energy

enabling projects, energy efficiency management solutions, social

and core infrastructure projects and sustainable forestry assets.

Its private equity team manages eight regionally focused investment

funds across the UK and an SME impact fund supporting Irish SMEs.

This team reviews close to 2,500 business plans each year and

currently supports more than 130 SMEs. Foresight Capital Management

manages four strategies across six investment vehicles with an AUM

of over EUR1.6 billion.

Foresight operates from 12 offices across six countries in

Europe and Australia with AUM of EUR8.7 billion as at 31 March

2022. Foresight Group Holdings Limited listed on the Main Market of

the LSE in February 2021

Foresight consisted of 249 full-time employees as at 30

September 2021. The team is comprised of:

1. An investment management team of professionals responsible for originating,

assessing and pricing assets, managing due diligence and executing

transactions.

A portfolio management team with expertise across electrical and civil

engineering, finance and legal disciplines.

2. The Foresight Group infrastructure team has substantial experience