TIDMFSF

RNS Number : 0471Q

Foresight Sustain. Forestry Co PLC

24 June 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO, THE UNITED STATES, AUSTRALIA,

CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY EEA STATE

(OTHER THAN ANY MEMBER STATE OF THE EEA WHERE THE COMPANY'S

SECURITIES MAY BE LEGALLY MARKETED) OR IN ANY OTHER JURISDICTION IN

WHICH THE SAME WOULD BE UNLAWFUL.

The information communicated in this announcement is deemed to

constitute inside information as stipulated under the UK version of

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018, as amended ("EUWA"), as further amended by UK legislation

from time to time ("UK MAR"). Upon the publication of this

announcement, this information is considered to be in the public

domain.

24 June 2022

Foresight Sustainable Forestry Company Plc

("FSF" or the "Company")

Results of Placing, Offer for Subscription and Total Voting

Rights

Further to its announcement of 14 June 2022, the Board of

Directors of FSF is pleased to announce the results of the placing

(the "Placing") of new ordinary shares pursuant to the Placing

Programme and the offer for subscription (the "Offer for

Subscription") (together the "Issue").

38,002,022 new ordinary shares (the " New Ordinary Shares ")

will be issued pursuant to the Placing, and 4,054,052 New Ordinary

Shares will be issued pursuant to the Offer for Subscription, at

107 pence per New Ordinary Share, raising combined gross proceeds

of GBP45 million. The net proceeds of the Issue will be used to

acquire further assets within the Company's Imminent Pipeline of

opportunities.

Richard Davidson, Chair of FSF, said:

"This fundraising represents another significant milestone for

Foresight Sustainable Forestry. It has been a busy first eight

months for the Company, having fully deployed the proceeds of the

Company's IPO and now undertaken a further issuance of new shares.

The net proceeds of the Issue, along with the proceeds of a

Revolving Credit Facility that is nearing completion, will be used

to acquire our imminent pipeline of forestry and afforestation

assets and to further enhance the growing reach and impact of FSF.

We would like to thank our existing Shareholders for their

continued support and to welcome all new Shareholders."

Robert Guest and Richard Kelly, FSF Co-Fund Managers,

commented:

" We are delighted by the positive reception from both existing

and new investors, despite the current challenging broader equity

market conditions. We are also highly encouraged by the level of

interest we have received from investors in FSF and its future

prospects. We are focused on continuing to execute our strategy on

behalf of our growing and high calibre investor base. We are

excited to deploy the proceeds of the issue into our pipeline of

mostly afforestation opportunities, that offer attractive capital

appreciation potential whilst further extending the direct

contribution FSF makes to the twin fights against climate change

and biodiversity loss. "

Application for Admission

Application has been made for 42,056,074 New Ordinary Shares to

be admitted to the premium listing segment of the O cial List of

the FCA and to trading on the Main Market of the London Stock

Exchange. It is expected that admission ( "Admission") will become

e ective and dealings in the New Ordinary Shares will commence on

the London Stock Exchange at 8.00 a.m. on 28 June 2022.

Total Voting Rights

On Admission, the Company's issued share capital will consist of

172,056,075 ordinary shares with voting rights. This figure may be

used by Shareholders in determining the denominator for the

calculation by which they will establish if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

The New Ordinary Shares issued in connection with the Issue will

be fully paid and will rank pari passu in all respects with each

other and with the existing ordinary shares of the Company.

Jefferies International Limited ("Jefferies") acted as sole

bookrunner and sole global coordinator in respect of the Issue.

Capitalised terms will have the meanings given to them in the

Company's announcement dated 14 June 2022 unless otherwise defined

in this announcement.

For further information:

Foresight Sustainable Forestry Company

Plc

Robert Guest

Richard Kelly

fsfc@foresightgroup.eu +44 20 3667 8100

Jefferies International Limited

Neil Winward

Will Soutar

Harry Randall +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore ( toby.moore@citigatedewerogerson.com

)

Jos Bieneman ( jos.bieneman@citigatedewerogerson.com +44 7768 981 763

) +44 7834 336 650

About the Company

Foresight Sustainable Forestry Company Plc ( " the Company " )

is an externally managed investment company investing in a

diversified portfolio of UK forestry and afforestation assets.

Targeting a net total return of more than CPI +5% p.a., the Company

provides investors with the opportunity for real returns and

capital appreciation driven by the prevailing global imbalance

between supply and demand for timber; the inflation-protection

qualities of UK land freeholds; and biological tree growth of 3% to

4% not correlated to financial markets. It also offers outstanding

sustainability and ESG attributes and access to carbon units

related to carbon sequestration from new afforestation planting.

The Company targets value creation as the afforestation projects

successfully achieve development milestones in the process of

converting open ground into established commercial forest and

woodland areas. The Company is seeking to make a direct

contribution in the fight against climate change through forestry

and afforestation carbon sequestration initiatives and to preserve

and proactively enhance natural capital and biodiversity across its

portfolio. It is managed by Foresight Group LLP.

https://fsfc.foresightgroup.eu/

Important Notice

Jefferies, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting exclusively

for the Company in connection with the Issue and will not regard

any other person (whether or not a recipient of this announcement)

as its client in relation to the Issue and will not be responsible

to anyone other than the Company for providing the protections

afforded to its clients or for providing advice to any such person

in connection with the Issue, the contents of this announcement or

any other matter referred to in this announcement. Nothing in this

paragraph shall serve to exclude or limit any responsibilities

which Jefferies may have under the Financial Services and Markets

Act 2000, as amended, or the regulatory regime established

thereunder.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States (as defined

below). This announcement is not an offer of securities for sale

into the United States. The New Ordinary Shares have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended (the "U.S. Securities Act"), or with any securities

regulatory authority of any State or other jurisdiction of the

United States (as defined below) and accordingly may not be

offered, sold or transferred within the United States of America,

its territories or possessions, any State of the United States or

the District of Columbia (the "United States") except pursuant to

an exemption from, or in a transaction not subject to, registration

under the U.S. Securities Act and in compliance with the securities

laws of any State or other jurisdiction of the United States. No

public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the

U.S. Investment Company Act of 1940, as amended (the " U.S.

Investment Company Act " ) and investors will not be entitled to

the benefits of the U.S. Investment Company Act.

The distribution of this announcement, and/or the issue of New

Ordinary Shares in certain jurisdictions may be restricted by law

and/or regulation. No action has been taken by the Company,

Jefferies or any of their respective affiliates as defined in Rule

501(b) under the U.S. Securities Act (as applicable in the context

used, "Affiliates") that would permit an offer of the New Ordinary

Shares or possession or distribution of this announcement or any

other publicity material relating to the New Ordinary Shares in any

jurisdiction where action for that purpose is required (other than

the United Kingdom, the Republic of Ireland and the Netherlands).

Persons receiving this announcement are required to inform

themselves about and to observe any such restrictions. Any failure

to comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

Information to distributors

Solely for the purposes of the product governance requirements

contained within PROD 3 of the FCA's Product Intervention and

Product Governance Sourcebook (the " Product Governance

Requirements " ), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any " manufacturer "

(for the purposes of the Product Governance Requirements) may

otherwise have with respect thereto, the New Ordinary Shares have

been subject to a product approval process, which has determined

that the New Ordinary Shares to be issued pursuant to the Issue

are: (i) compatible with an end target market of retail investors

and investors who meet the criteria of professional clients and

eligible counterparties, each as defined in COBS 3.5 and 3.6 of the

FCA's Conduct of Business Sourcebook, respectively; and (ii)

eligible for distribution through all distribution channels as are

permitted by the Product Governance Requirements (the " Target

Market Assessment " ).

Notwithstanding the Target Market Assessment, distributors

should note that: (a) the price of the New Ordinary Shares may

decline and investors could lose all or part of their investment;

the New Ordinary Shares offer no guaranteed income and no capital

protection; (b) an investment in the New Ordinary Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Issue. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, Jefferies will

only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of the FCA's Conduct of Business Sourcebook; or

(b) a recommendation to any investor or group of investors to

invest in, or purchase, or take any other action whatsoever with

respect to the New Ordinary Shares.

Each distributor is responsible for undertaking its own Target

Market Assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROISEWEEDEESESM

(END) Dow Jones Newswires

June 24, 2022 02:00 ET (06:00 GMT)

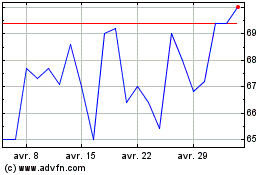

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024