TIDMFSF

RNS Number : 3370U

Foresight Sustain. Forestry Co PLC

01 August 2022

Monday 01 August, 2022

Foresight Sustainable Forestry Company Plc

("FSF" or "the Company")

FSF acquires three afforestation sites in Scotland and signs

GBP30 million Revolving Credit Facility

Foresight Sustainable Forestry Company Plc, an investment

company that invests in UK forestry and afforestation assets, today

announces the acquisition of a further three afforestation sites in

Scotland (deploying GBP3.8m, inclusive of tax and other transaction

costs) and the signing of a GBP30m Revolving Credit Facility

agreement.

Acquisitions

On 15 July 2022, FSF completed the acquisition of Droveroad

Wood, a c.50 hectare afforestation property located in Lilliesleaf

in the Scottish Borders, for GBP0.9m (including tax and other

transaction costs). The property contains a mix of existing forest

and woodland and land well suited for the establishment of a

productive woodland creation scheme.

On 18 July 2022, FSF completed the acquisition of Chatto Craigs,

a c.98 hectare afforestation property located near Galashiels in

the Scottish Borders, for GBP1.8 million in aggregate (inclusive of

tax and other transaction costs). A high proportion of the property

is expected to be suitable for a high yielding woodland creation

scheme.

Droveroad Wood and Chatto Craigs are both well located in

relation to sawmills and timber processors and expand FSF's growing

Scottish Borders portfolio.

On 29 July 2022, FSF completed the acquisition of Piltanton

Wood, a c.79 hectare afforestation property located in Dumfries

& Galloway, Scotland, for GBP1.1 million in aggregate

(inclusive of tax and other transaction costs). The property has a

small proportion of existing forestry, including native

broadleaves, and a high proportion of the land area is expected to

be suitable for inclusion in a woodland creation scheme. The

acquisition extends the Company's presence in the region.

Combined, the three transactions increase the total area of

FSF's portfolio to 8,769 hectares and the percentage (by value) of

afforestation sites in the portfolio to 38%, representing continued

progress towards the Company's aim of having 40-50% of its

portfolio by value allocated to afforestation. The Company is

looking to further increase its number of afforestation properties

in the near future and is on track to deliver on this core

strategic objective.

Revolving Credit Facility

FSF is also pleased to announce that it has signed a new three

year agreement providing a committed Revolving Credit Facility

("RCF") of GBP30 million and an uncommitted accordion facility of

up to an additional GBP30 million. The RCF has a 3-year tenor and

two 1-year extension options. The accordion feature allows the

Company to bring debt in line with 30% of Gross Asset Value, as

detailed in FSF's Prospectus.

The RCF gives FSF a committed source of flexible funding outside

equity raisings. Once drawn, the facility is expected to be paid

down periodically by the proceeds of equity issues. This enables

FSF to make new investments with certainty of funding and on a

timely basis, reducing performance drag associated with holding

cash balances.

The interest margin chargeable on the RCF is linked to the

Company's Sustainability and ESG ("S & ESG") performance, with

FSF incurring a premium or discount to its margin based on its

performance against defined targets. These S & ESG targets

are:

- A year-on-year increase in the total number of hectares of

land acquired for carbon sequestering activities (including

afforestation, peatland restoration and voluntary carbon credit

acquisition)

- A year-on-year increase in the total number of people

completing FSF's Forestry Skills Training Programme

Performance against these targets will be measured annually,

with the interest cost of the RCF being amended accordingly in the

following year.

The lender is Virgin Money and the interest margin can vary

between 200bps and 220bps over SONIA ('Sterling Overnight Index

Average'), depending on performance against the Company's S &

ESG targets.

Richard Kelly and Rob Guest, Co-Heads of Foresight Sustainable

Forestry Company, commented:

"We are delighted to have completed this trio of afforestation

acquisitions which commences the deployment of the proceeds from

our recent fundraise. These investments move us closer to achieving

our objective of having 40-50% of the value of the portfolio

allocated to afforestation and our attractive imminent pipeline

makes us confident of achieving that goal".

Richard Davidson, Chairman of Foresight Sustainable Forestry

Company, also commented

"Reaching financial close on the RCF is an important part of the

business plan documented in FSF's IPO Prospectus. The RCF provides

access to flexible capital which will be used to grow the business

through the delivery of our deal pipeline. The Company is very

pleased to be working with Virgin Money and are proud that the

interest margin is aligned to S & ESG targets which form a core

part of FSF's investment strategy".

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5%, the Company provides investors

with the opportunity for real returns and capital appreciation

driven by the prevailing global imbalance between supply and demand

for timber; the inflation-protection qualities of UK land

freeholds; and biological tree growth of 3% to 4% not correlated to

financial markets. It also offers outstanding sustainability and

ESG attributes and access to carbon units related to carbon

sequestration from new afforestation planting. The Company targets

value creation as the afforestation projects successfully achieve

development milestones in the process of converting open ground

into established commercial forest and woodland areas. The Company

is seeking to make a direct contribution in the fight against

climate change through forestry and afforestation carbon

sequestration initiatives and to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

managed by Foresight Group LLP. https://fsfc.foresightgroup.eu/

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

fsfc@foresightgroup.eu +44 20 3667 8100

Jefferies International Limited

Neil Winward

Will Soutar +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore ( toby.moore@citigatedewerogerson.com

)

Jos Bieneman ( jos.bieneman@citigatedewerogerson.com

) +44 7768 981763

This announcement does not constitute, and may not be construed

as, an offer to sell or an invitation to purchase investments of

any description, or the provision of investment advice by any

party. No information set out in this announcement is intended to

form the basis of any contract of sale, investment decision or any

decision to purchase securities in the Company.

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will", "targeting" or

"should" or, in each case, their negative or other variations or

comparable terminology. All statements other than statements of

historical facts included in this announcement, including, without

limitation, those regarding the Company's financial position,

strategy, plans, proposed acquisitions and objectives, are

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPPUCWMUPPGQB

(END) Dow Jones Newswires

August 01, 2022 02:00 ET (06:00 GMT)

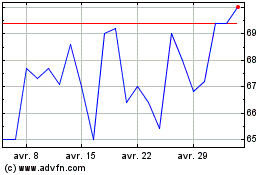

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024