TIDMFSF

RNS Number : 5112I

Foresight Sustain. Forestry Co PLC

05 December 2022

5 December 2022

Foresight Sustainable Forestry Company Plc

("the Company")

FSF becomes the first company to receive LSE Voluntary Carbon

Market designation

Foresight Sustainable Forestry Company Plc, an investment

company that invests in UK forestry and afforestation assets, is

pleased to announce that the Company has today become the first

company to officially receive the London Stock Exchange's Voluntary

Carbon Market ("VCM") designation.

Your browser does not support HTML5 video.

The VCM was launched by the London Stock Exchange on 10 October

2022 and has been created to facilitate financing at scale into

projects that mitigate climate change. The VCM designation will be

applied to funds or operating companies that are admitted to the

London Stock Exchange's Main Market or AIM and which are intent on

investing into climate change mitigation projects that are expected

to yield voluntary carbon credits. The VCM aims to leverage the

power of capital markets to channel capital from corporates and

institutions with net zero pledges, into listed companies that are

creating high integrity voluntary carbon credits. A video

explaining the VCM can be found here:

Your browser does not support HTML5 video.

Richard Davidson, Chairman of Foresight Sustainable Forestry

Company, commented:

"To be the first ever company to receive LSE Voluntary Carbon

Market designation is a hugely proud and significant moment for

Foresight Sustainable Forestry. By connecting investors with net

zero ambitions to entities such as FSF that generate voluntary

carbon credits, the launch of the VCM is a major milestone in the

UK's fight against climate change. VCM designation means that the

ever-growing number of climate-minded investors can easily and

confidently identify sustainable solutions - investors know that,

through FSF, they are investing in climate mitigation projects that

make a real difference. We have a strong UK afforestation pipeline

and the potential of our current capital base alone is expected to

create up to 5 million carbon credits by 2050, equivalent to

offsetting the entire annual carbon footprint of Glasgow."

Julia Hoggett, CEO, the London Stock Exchange plc, said:

"We congratulate Foresight Sustainable Forestry on becoming the

first London-listed issuer to obtain our new Voluntary Carbon

Market designation. The public markets are uniquely positioned to

help scale the voluntary carbon market, whilst driving greater

transparency and providing access to a wider range of investors. We

continue to see a strong pipeline and hope to see more new issuers

receiving the VCM designation and raising new capital for

investment in climate mitigation projects in 2023."

Eligible issuers, such as the Company, will be seeking to

finance projects directly or indirectly and may issue carbon

credits as a distribution "in kind", retire or sell the carbon

credits. This will provide a new solution for corporate investors

seeking access to a long-term supply of carbon credits to augment

their decarbonisation strategies.

The overall objective of the Company in obtaining VCM

designation is to attract new investment from a large and growing

pool of companies which have made net zero pledges. For these

companies, the Company's "in-kind" carbon credit distribution

investment proposition will enable them to:

-- secure a supply of voluntary carbon credits for their

net zero commitments (to be used for their unabatable

emissions) and/or trading purposes;

-- hedge against rapidly rising voluntary carbon credit

prices; and

-- generate an attractive risk adjusted return from

otherwise uninvested balance sheet cash, with

flexibility to adjust carbon credit yield

requirements in a daily traded manner.

The Company's current portfolio consists of approximately 9,700

hectares of UK standing forestry and afforestation assets. The

carbon sequestered by the Company's 27 afforestation sites is

expected to equate to approximately 800,000 voluntary carbon

credits accredited by the Woodland Carbon Code. Once FSF's current

total available capital is deployed, it is anticipated that the

Company will create approximately 1,000,000 voluntary carbon

credits in its first wave of afforestation deployment. The

Company's strategy with afforestation assets is to successfully

develop afforestation assets, exit these young established forests

and recycle the capital into new waves of afforestation

development. By 2050, the Company and Foresight Group LLP (as the

Company's investment manager) estimate that the current capital

base will have been recycled five times with the anticipation that

this will yield, in aggregate, 5,000,000 voluntary carbon credits,

and they acknowledge that this is a long-term ambition and is

subject to ongoing market conditions and factors outside of the

Company's control.

Carbon credits created in relation to the Company's

afforestation projects will mature over time, turning from Pending

Issuance Units ("PIUs") into verified Woodland Carbon Units

("WCUs") that can be retired for offsetting purposes. The majority

of the 1,000,000 PIUs that are expected to be created from the

Company's first wave of afforestation deployment, are expected to

mature into WCUs between 2030 and 2050, enabling shareholders to

pursue their net zero ambitions. It is not currently the intention

to commence the sale or distribution of any voluntary carbon

credits in advance of 2030. It is expected that all voluntary

carbon credits created from FSF's first wave of afforestation

deployment will be sold or distributed "in kind" by 2050.

Save where the sale of carbon credits is required to meet the

working capital needs of the group, the Company intends to realise

the value of carbon credits for the direct benefit of shareholders.

Generally, the Company intends, when appropriate, to sell carbon

credits and make aperiodic distributions to shareholders of the net

proceeds of such sales. As an alternative to receiving a cash

distribution, the Company intends, where practicable, to offer

shareholders the option to elect to receive distributions "in kind"

of carbon credits. The method and process for the distribution of

any carbon credits "in kind" will be determined by the Board from

time to time.

The VCM designation requires issuers to produce additional

disclosures relating to the projects they are directly or

indirectly financing, including but not limited to; the qualifying

bodies whose standards will be applied to the projects, project

types, expected carbon credit yield and the extent to which they

are expecting to meet the United Nations Sustainable Development

Goals ("UN SDGs"). The Designation Circular produced by the

Company, which sets out these additional mandatory disclosures in

compliance with the VCM requirements is available for inspection on

the Company's website at fsfc.foresightgroup.eu .

To ensure that funds or operating companies are having a net

positive impact on the environment, the VCM eligibility

requirements require that all other activity and investments must

be mapped to FTSE Russell's Green Revenues Classification System

(Tier 1 and Tier 2 sectors), which recognises the sectors

contributing to the green economy.

The London Stock Exchange has granted the VCM designation to the

Company on the basis that it will make changes to its existing

investment policy to ensure the Company complies with the

eligibility requirements of the VCM, specifically; to confirm (i)

that the group will operate with a view to generating carbon

credits where commercially available; (ii) what will be done with

carbon credits generated by the Company's assets in particular

clarifying that there will be an ability to receive distributions

"in kind" of carbon credits; and, (iii) that the Company will

invest its cash and cash equivalents in a manner that is compatible

with the principle of climate change mitigation.

The Company announces that it will today publish and post (or

otherwise make available) to shareholders a Notice of General

Meeting with related explanatory circular (together the "GM Notice

and Circular") and form of proxy. The GM Notice and Circular

contains resolutions to: (i) amend the Company's existing

investment policy to implement the changes required for the

purposes of the VCM designation (as summarised above), and (ii)

make certain technical amendments to the Company's existing

articles of association to facilitate the process for the future

distribution of carbon credits "in kind" to electing

shareholders.

Copies of the proposed new articles of association and the

proposed amended investment policy (the "Amended Investment

Policy") are available on the Company's website,

www.fsfc.foresightgroup.eu, and will be made available for

inspection at the Company's registered office, The Shard, 32 London

Bridge Street, London SE1 9SG during normal business hours until

the conclusion of the General Meeting.

The General Meeting will be held at the offices of Foresight

Group, The Shard, 32 London Bridge Street, London, SE1 9SG at 12.30

p.m. on 21 December 2022. Please refer to the GM Notice and

Circular for details on how to vote by proxy.

The Directors consider the resolutions to be proposed at the

General Meeting to be in the best interests of the Company and the

shareholders as a whole. Consequently, the Directors unanimously

recommend that shareholders vote in favour of the resolutions, as

they intend to do in respect of their own beneficial interests

amounting, in aggregate, to 168,000 Ordinary Shares representing

0.10 per cent. of the Ordinary Shares.

In accordance with Listing Rule 9.6.1, a copy of the GM Notice

and Circular has been submitted to the National Storage Mechanism

and will shortly be available to view at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on the

Company's website at fsfc.foresightgroup.eu .

In the event that the Amended Investment Policy is not approved

by shareholders, the Company's continued eligibility for the VCM

designation will be subject to review by the London Stock Exchange

and, in such circumstance, there can be no assurance that such

designation will not be revoked.

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5%, the Company provides investors

with the opportunity for real returns and capital appreciation

driven by the prevailing global imbalance between supply and demand

for timber; the inflation-protection qualities of UK land

freeholds; and biological tree growth of 3% to 4% not correlated to

financial markets. It also offers outstanding sustainability and

ESG attributes and access to carbon units related to carbon

sequestration from new afforestation planting. The Company targets

value creation as the afforestation projects successfully achieve

development milestones in the process of converting open ground

into established commercial forest and woodland areas. The Company

is seeking to make a direct contribution in the fight against

climate change through forestry and afforestation carbon

sequestration initiatives and to preserve and proactively enhance

natural capital and biodiversity across its portfolio. It is

managed by Foresight Group LLP, the leading listed infrastructure

and private equity investment manager listed on the Main Market of

the London Stock Exchange (www.fsg-investors.com)

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

Email: fsfc@foresightgroup.eu +44 20 3667 8100

Website: https://fsfc.foresightgroup.eu/

Jefferies International Limited

Neil Winward

Will Soutar +44 20 7029 8000

Citigate Dewe Rogerson

Toby Moore ( toby.moore@citigatedewerogerson.com

)

Michael Mpofu (michael.mpofu@citigatedewerogerson.com) +44 7768 981763

Important Information

This announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for any share in the

Company or to engage in investment activity (as defined by the

Financial Services and Markets Act 2000) in any jurisdiction nor

shall it, or any part of it, or the fact of its distribution form

the basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction. This

announcement does not constitute a recommendation regarding any

securities.

The information and opinions contained in this announcement are

provided as at the date of this announcement and are subject to

change and no representation or warranty, express or implied, is or

will be made in relation to the accuracy or completeness of the

information contained herein and no responsibility, obligation or

liability or duty (whether direct or indirect, in contract, tort or

otherwise) is or will be accepted by the Company, Foresight Group

LLP or any of their affiliates or by any of their respective

officers, employees or agents in relation to it. No reliance may be

placed for any purpose whatsoever on the information or opinions

contained in this announcement or on its completeness, accuracy or

fairness.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur.

No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views contained herein

are based on financial, economic, market and other conditions

prevailing as at the date of this announcement. The information

contained in this announcement will not be updated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPGMGPUPPGRP

(END) Dow Jones Newswires

December 05, 2022 03:30 ET (08:30 GMT)

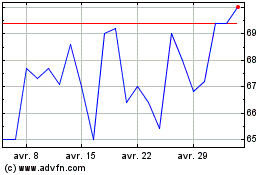

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Foresight Sustainable Fo... (LSE:FSF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024