TIDMHZM

RNS Number : 8464X

Horizonte Minerals PLC

27 December 2023

NEWS RELEASE

27 December 2023

HORIZONTE SIGNS INTERIM US$20 MILLION FUNDING PACKAGE

HIGHLIGHTS:

-- Horizonte agrees a US$20 million interim funding package

provided by Orion, Glencore and La Mancha

-- The funding package is expected to provide liquidity while a

full funding solution is progressed

-- Agreement with existing Senior Lenders to defer interest payments due 31 December 2023

-- The Company continues to review the outstanding Project

capital expenditure and schedule re-estimate, necessary to

implement a full funding solution

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company") the nickel development company, announces that it has

agreed a US$20 million interim funding package (the "Funding

Package") which comprises a US$15 million Senior Secured Loan

Facility (the "Facility"), and the release of US$5 million by OMF

Fund III (Cr) Ltd. previously secured at Vermelho, that will allow

for critical construction streams to advance at its flagship

Araguaia Nickel Project ("Araguaia" or "the Project") and for

general working capital purposes.

Interim CEO Karim Nasr commented, "We are pleased to see the

continued support from our cornerstone shareholders through this

US$20 million funding package. This funding package is a

demonstration from the Company's largest shareholders on their

commitment towards finding a solution to complete the Araguaia

Nickel Project construction. We are actively engaging with our

cornerstone shareholders and senior lenders with the goal of

unlocking a funding solution in Q2 2024. We wish to thank our

cornerstones, local stakeholders and employees for their continued

commitment and support."

The Facility has been provided by OMF Fund III (F) Ltd. ("Orion

Mine Finance"), La Mancha Investments S.à r.l. ("La Mancha") and

Glencore International AG ("Glencore") (together the "New Money

Lenders"), who have each committed US$5 million to the Facility.

The New Money Lenders will rank pari passu with the Senior Lenders

and will benefit from the same security package. The Facility will

have a maturity date falling 102 months from 7 December 2022 and

will bear interest at 15.00% per annum.

Furthermore, the existing Senior Lenders have agreed to waivers

that include deferral of interest due at 31(st) December 2023 to

the end of February 2024 in addition to any breaches or Events of

Default under the Senior Debt Facilities.

The Funding Package constitutes a related party transaction

under Rule 13 of the AIM Rules for Companies. As such, the

Company's independent directors (excluding those connected to La

Mancha and their nominees) consider, having consulted with its

nominated adviser Peel Hunt LLP, that the terms of the Funding

Package are fair and reasonable insofar as its shareholders are

concerned.

Further to the above, OMF Fund III (Cr) Ltd. has demonstrated

its further support to the Project through the release of an

additional US$5 million currently secured at Vermelho, Horizonte's

second 100% owned project in Brazil. Following the closing of the

funding package, US$11 million will remain segregated for the

development of Vermelho, where on-going studies continue to

advance.

The Funding Package provides the Company with liquidity to

advance the required re-estimation work at Araguaia, necessary to

implement a full funding solution. It will also allow two critical

workstreams to be completed, the Water Storage Reservoir and the

230kV powerline, while maintaining a strong focus on safety.

As previously announced, the Company's cornerstone shareholders

and senior lenders are continuing to undertake their respective due

diligence as part of a full funding solution, which includes

working with the Company and consultants who are undertaking a

review of the outstanding Project capital expenditure and schedule.

It is expected that this due diligence process and review will be

finalised in Q1 2024, with a full funding solution targeted for Q2

2024.

While the Funding Package will allow near term work at Araguaia

to progress, completion of construction activities at Araguaia will

be subject to successful completion of a full financing solution in

2024. There can be no certainty at this stage that the full

financing solution will be achieved.

Figure 1 - An overview of the Araguaia processing site as at the

beginning of December 2023.

Figure 2 - A view from above the Homogenisation building looking

towards the primary and secondary crushers, the ROM pad and

stockpiles.

Figure 3 - A view of the steel erection of the Electrostatic

Precipitator, the Rotary Kiln, the Electric Arc Furnace and the

Refinery.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as retained in the UK

pursuant to the European Union (Withdrawal) Act 2018.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Patrick Chambers (Head of IR) +44 (0) 203 356 2901

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

Richard Crichton

David McKeown

Bhavesh Patel +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Jos Simson

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable. Araguaia is under construction and

when fully ramped up with both Line 1 and Line 2, is forecast to

produce 29,000 tonnes of nickel per year. Vermelho is at

feasibility study stage. Horizonte's combined production profile of

over 60,000 tonnes of nickel per year positions the Company as a

globally significant nickel producer. Horizonte's top three

shareholders are La Mancha Investments S.à r.l., Glencore Plc and

Orion Mine Finance.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future payment obligations; potential disputes with

respect to the Company's title to, and the area of, its mining

concessions; the Company's dependence on its ability to obtain

sufficient financing in the future; the Company's dependence on its

relationships with third parties; the Company's joint ventures; the

potential of currency fluctuations and political

or economic instability in countries in which the Company

operates; currency exchange fluctuations; the Company's ability to

manage its growth effectively; the trading market for the ordinary

shares of the Company; uncertainty with respect to the Company's

plans to continue to develop its operations and new projects; the

Company's dependence on key personnel; possible conflicts of

interest of directors and officers of the Company, and various

risks associated with the legal and regulatory framework within

which the Company operates, together with the risks identified and

disclosed in the Company's disclosure record available on the

Company's profile on SEDAR at www.sedar.com, including without

limitation, the annual information form of the Company for the year

ended December 31, 2022, and the Araguaia and Vermelho Technical

Reports available on the Company's website

https://horizonteminerals.com/. Although management of the Company

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZQLFLXLLXFBX

(END) Dow Jones Newswires

December 27, 2023 02:00 ET (07:00 GMT)

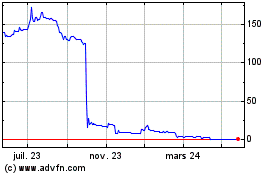

Horizonte Minerals (LSE:HZM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

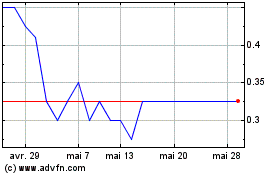

Horizonte Minerals (LSE:HZM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024