TIDMKITW

RNS Number : 9458C

Kitwave Group PLC

28 February 2022

28 February 2022

Kitwave Group plc

("Kitwave", the "Group" or the "Company")

Final Results for the twelve months ended 31 October 2021

Kitwave Group plc (AIM: KITW), the delivered wholesale business,

is pleased to announce its final results for the twelve months

ended 31 October 2021.

During the twelve months being reported, the Group traded in

line with the Board's expectations. The results were impacted by

COVID-19 lockdown restrictions and closures within the leisure and

hospitality sectors. Since April 2021, trading has returned close

to pre-pandemic levels and the Directors are pleased to confirm the

Group is currently trading slightly ahead of market

expectations.

Investors should note that the below comparative prior period

was for the 18 months to 31 October 2020.

Financial summary

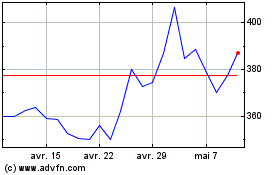

-- Revenues of GBP380.7 million (FP20: GBP592.02 million)

-- Gross profit margin maintained at 18% during the year (FP20: 18%)

-- Adjusted operating profit of GBP7.1 million (FP20: GBP16.5 million)

-- Profit before tax increased by 63% to GBP2.1 million (FP20: GBP1.3 million)

-- GBP7.9 million net cash generated from operations (FP20: GBP35.9 million)*

-- Pre-tax operational cash conversion of 85% (FP20: 151%)*

* For more information on alternative performance measures

please see the glossary at the end of the announcement.

The Board has declared that it is recommending a final dividend

of 4.5 pence per ordinary share, subject to approval at the Annual

General Meeting to be held on 25 March 2022, which will, if

approved, result in a total dividend for the year of 6.75 pence per

ordinary share.

Admission to AIM

-- Significantly over-subscribed Placing and Admission to AIM on

24 May 2021, raising gross proceeds of GBP64.0 million for the

Company and GBP17.6 million for the Selling Shareholders.

-- Gross proceeds for the Company to be used to support the

Group's successful buy-and-build strategy, enhance the profile of

the Group and its brands, improve Kitwave's position with key

suppliers, strengthen the Group's balance sheet, and provide the

Group with greater ability to incentivise and retain key employees

going forward.

-- On Admission, Stephen ("Steve") Smith, Independent

Non-Executive Chairman, and Gerard Murray, Independent

Non-Executive Director, were appointed to the Board.

Operational highlights

-- The Group opened a new 70,000 sq. ft distribution centre in

Luton as a replacement for the previous site at Luton airport. The

centre was delivered on time and on budget and specifically

commissioned to cater for Frozen & Chilled product operations.

The ability to store in excess of 5,000 pallets in highly efficient

cold store conditions will ensure that the Group is well placed to

meet future growth expectations and peak summer demands of

Kitwave's independent customers. This upgraded facility replaced

the previous Luton distribution centre.

-- Work is progressing on a new foodservice warehouse in

Wakefield, expected to be opened in March 2022. This will replace

the existing inherited site in Wakefield that is no longer fit for

purpose.

Post-period end

-- Appointment of Ben Maxted, Group Operations Director and Head

of the Frozen & Chilled division, to the Board as Chief

Operating Officer.

-- Acquisition of the entire issued share capital of M.J. Baker

Foodservice Limited, the South West's leading independent

foodservice supplier, for a gross consideration of GBP24.5 million

paid in cash, funded from the existing banking facilities available

to the Group.

Paul Young, Chief Executive Officer of Kitwave, commented:

" It gives me great pleasure reporting on the first 12-month

period since the Company's listing on AIM in May 2021.

"While this year has been particularly challenging for our

independent customers, who have been forced to close or operate in

a reduced capacity for sustained periods of time as a result of

COVID-19 restrictions, it is clear that we are nearing a return to

some form of normality. The majority of our customers have

successfully guided themselves through the perils that the pandemic

brought upon us and, as a result, trading, which was heavily

impacted in the first six months of the year, has returned to

pre-pandemic levels over recent months.

"The division least impacted by COVID-19 restrictions was our

Frozen & Chilled division which remained extremely resilient

and operated close to pre-pandemic levels throughout the period.

Each of the Group's Ambient, Frozen & Chilled and Foodservice

divisions, however, experienced some degree of disruption during

the period.

" I would like to take this opportunity to thank all our

colleagues, as it is due to their exceptional commitment and

dedication that we have been able to continue operating and

providing a service to our customers throughout the year.

"In line with our buy-and-build strategy, we were delighted to

announce the acquisition of M.J. Baker post-period end. The Board

believes that the acquisition represents an excellent opportunity

to further develop the Group's reach into South West England and

Kitwave's foodservice offering.

"With the worst of the adverse effects brought about by COVID-19

now behind us, and barring any further lockdowns, the outlook for

Kitwave is a positive one. The Board continues to focus on

capitalising upon the UK's fragmented grocery and foodservice

wholesale market and generating value for the Group and its

shareholders through operational efficiencies, organic growth and

further acquisitions. The current year has started well and we look

forward to providing further updates on our progress in due

course."

- Ends -

For further information please contact:

Kitwave Group plc Tel: +44 (0) 191 259 2277

Paul Young, Chief Executive Officer

David Brind, Chief Financial Officer

www.kitwave.co.uk

Canaccord Genuity Limited Tel: +44 (0) 20 7523 8150

(Nominated Adviser and Sole Broker)

Bobbie Hilliam / Georgina McCooke

Alex Aylen - Sales

Yellow Jersey PR Tel: +44 (0) 20 3004 9512

(Financial media and PR)

Sarah Hollins / Henry Wilkinson /

James Lingfield

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

Company Overview

Founded in 1987, following the acquisition of a single-site

confectionery wholesale business based in North Shields, United

Kingdom, Kitwave is a delivered wholesale business, specialising in

selling and delivering impulse products, frozen and chilled foods,

alcohol, groceries and tobacco to approximately 39,000, mainly

independent, customers.

With a network of 27 depots, Kitwave is able to support delivery

throughout the UK to a diverse customer base, which includes

independent convenience retailers, leisure outlets, vending machine

operators, foodservice providers and other wholesalers, as well as

leading national retailers.

The Group's growth to date has been achieved both organically

and through a strategy of acquiring smaller, predominantly

family-owned, complementary businesses in the fragmented UK grocery

and foodservice wholesale market.

Kitwave Group plc (AIM: KITW) was admitted to trading on AIM of

the London Stock Exchange on 24 May 2021.

For further information, please visit www.kitwave.co.uk .

Chairman's statement

Overview

In this maiden Annual Report since the Company's Admission to

AIM in May 2021, it is a pleasure to welcome all our new

shareholders and to report on an excellent performance for Kitwave.

While the year brought a number of challenges as a result of

restrictions put in place by the Government in response to the

COVID-19 pandemic, these have been navigated successfully and we

remain well positioned to capitalise on any growth opportunities

that may arise.

Results summary

The business has demonstrated great resilience in both revenue

and operating profit during the year, with revenue of GBP380.7

million and adjusted operating profit of GBP7.1 million, compared

to GBP592.0 million and GBP16.5 million respectively in FP20 (an

18-month period).

Each of our divisions was disrupted to some degree by the

pandemic with many of our independent customers, particularly in

the hospitality and leisure sectors, forced either to close or to

operate at a reduced capacity. In contrast, our Frozen &

Chilled division was less impacted and operated close to

pre-COVID-19 levels throughout the year.

Since Kitwave was founded in 1987, the convenience and

foodservice customers that we serve have demonstrated their

resilience in the face of adversity. While many felt the effects of

the pandemic, most continue to show that they are capable of

getting through this difficult period and returning to normal

trading levels. This should only help to improve our future

trading.

Dividend

We intend to implement a progressive dividend policy to reflect

the cash flow and earnings potential of the business. Assuming

sufficient distributable reserves are available, and subject to

executing on our growth strategy, the intention is to divide the

total annual dividend between the interim and final dividends in

the approximate proportions one third and two third, respectively.

As a result, we declared an interim dividend of 2.25 pence per

ordinary share, paid on 27 August 2021 to shareholders on the

register at the close of business on 6 August 2021.

We are recommending a final dividend of 4.5 pence per ordinary

share, subject to approval at the AGM.

Admission

Kitwave's Admission to AIM on 24 May 2021 represented a

momentous landmark for the Company and its stakeholders.

Through a significantly over-subscribed Placing, supported by

high quality institutional investors, gross proceeds of GBP64.0

million were raised for the Company and GBP17.6 million for the

Selling Shareholders, giving the Company a market capitalisation of

approximately GBP105.0 million at Admission.

The gross proceeds received by the Company were used to reduce

existing debt and to pay expenses in connection with the

Placing.

We believe that our status as a publicly-traded entity will

support our successful buy-and-build strategy, enhance our profile

and our brands, improve our position with key suppliers, improve

our financial strength, and provide us with greater ability to

incentivise and retain key colleagues going forward.

Environmental, Social and Governance (ESG)

We are committed to ensuring the highest standards of ESG

practices across our business and recognise that we have social and

environmental responsibilities arising from our operations. We

continue to develop this framework and the associated measures that

will need to be considered.

Board

Central to our success has been the highly skilled and committed

management team. The team has a great understanding of the sectors

and customers we serve as well as the energy and leadership to

continue to grow the business.

On Admission of the Company to AIM the Board was strengthened

with the appointment of Gerard Murray as a Non-Executive Director.

On 25 November 2021 Ben Maxted was appointed to the Board as Chief

Operating Officer. We look forward to their continued contribution

in the years ahead.

Our people

I would like to take this opportunity to thank all our

colleagues at this time, as they have responded to these

unprecedented challenges with exceptional commitment. It is due to

their dedication that we have been able to continue operating and

providing a service to our customers throughout the year.

Outlook

Since I joined Kitwave as Chairman in 2016, the Group has

delivered exceptional growth both organically and by acquisition

with turnover increasing by over 40% in the three financial years

prior to the pandemic. While the impact of COVID-19 in the last 18

months has temporarily halted this development, we are well

positioned to recommence our strategy for growth with a strong

balance sheet and a capable management team.

In this regard, we continue to review opportunities for

acquisition that fit with our criteria. Post year end the Group

completed the acquisition of the entire issued share capital of

M.J. Baker Foodservice Limited. The acquisition is in line with

that criteria and will be an excellent addition to our Foodservice

division, expanding the Group's nationwide reach into the South

West. M.J. Baker is renowned for providing a quality delivered

solution to its customers, a key part of the Kitwave Group

ethos.

FY22 has started positively and, subject to no further major

disruptions to the sectors we serve, trading is expected to return

to pre-pandemic levels. Combined with the initiatives implemented

to drive organic growth, this should deliver value to our

shareholders.

Steve Smith

Chairman

25 February 2022

Chief Executive Officer's review

Overview

Having founded Kitwave in 1987, it gives me great pleasure in

reporting on the first period since the Company's listing on AIM in

May 2021. The Group was founded following the acquisition of a

single-site confectionery wholesale business based in North Shields

and has grown to become a leading delivered wholesaler operating

across the UK. From a team of 20 in 1987, we now have over 1,150

employees, 27 depots and a fleet of 430 vehicles servicing

approximately 39,000 customers.

While this year has been particularly challenging for our

independent customers, who have been forced to close or to operate

in a reduced capacity for sustained periods of time, it appears

that we are nearing a return to some form of normality and the

majority of our customers have successfully guided themselves

through the perils that the pandemic brought upon us.

With significant corporate and wholesale expertise and

experience across the Board and senior management team, the Group

is now looking to capitalise upon the fragmented grocery and

foodservice wholesale market in the UK, to drive growth and provide

value to its shareholders.

Divisional summary

Many of the Group's independent retailers and foodservice

provider customers were closed from November 2020 to March 2021 as

a result of COVID-19 lockdown restrictions. As such, the Group's

Ambient, Frozen & Chilled and Foodservices divisions all

experienced some degree of disruption. The least impacted was our

Frozen & Chilled division which was extremely resilient and

operated close to pre-pandemic levels throughout the period.

Ambient division

COVID-19 impacted revenue normally generated through the sale of

impulse products to vending machines so, as expected, trading for

the Ambient business was down versus the comparable period, but in

line with expectations.

FY21 FP20

GBP000 (12 months) (18 months)

Revenue 155,712 249,080

Gross profit 19,280 30,374

Gross margin

% 12% 12%

Frozen & Chilled division

The Frozen & Chilled division has now successfully

integrated the acquisition of Central Supplies, acquired in 2019,

and the division traded well throughout the period, despite some

customers being affected by COVID-19 and the restrictions on

footfall in the main leisure sites across the country. The division

maintains its strong presence in the market and looks set to

capitalise upon further opportunities, both through acquisitions

and growing its customer base, due to its strong nationwide

infrastructure and capabilities.

FY21 FP20

GBP000 (12 months) (18 months)

Revenue 163,895 230,546

Gross profit 34,923 52,468

Gross margin

% 21% 23%

Foodservice division

The biggest impact from COVID-19 was experienced in our

Foodservice division, particularly during the Christmas 2020

period, which is usually our busiest season. The prior year

comparable numbers include trading from December 2019; a pre-COVID

trading period. To mitigate this lost revenue, the division's

distribution expenses were reduced by 44% to GBP4.1 million after

accounting for the benefit of Coronavirus Job Retention Scheme

(CJRS) furlough grants presented as other income.

FY21 FP20

GBP000 (12 months) (18 months)

Revenue 61,087 112,390

Gross profit 14,382 24,332

Gross margin

% 24% 22%

Facilities

In February 2021, the Group was pleased to open its new 70,000

sq. ft distribution centre in Luton. The centre was delivered on

time and on budget and was commissioned to cater for Frozen &

Chilled product operations. With the ability to store over 5,000

pallets in highly efficient cold store conditions, the facility

ensures that the Group is well placed to meet future growth

expectations and peak summer demands of independent customers. This

upgraded facility replaced the previous Luton distribution

centre.

Work is continuing on the Group's new Foodservice warehouse in

Wakefield which is due to open in March 2022. This facility

replaces our current site in Wakefield and allows for the

integration of the Leeds depot.

Utilising the Group's own in-house established fleet of delivery

vehicles and drivers ensures we are not reliant on third party

logistics providers.

Strategy

The Group's strategy remains focused on capitalising upon the

fragmented UK grocery and foodservice wholesale market both through

the acquisition of smaller regional players and by driving organic

growth. This strategy has proven highly successful, with 11

wholesale distributors acquired and integrated into the Group since

2011.

The Board strongly believes that the Group's Admission to AIM

will support this strategy, as well as enhancing the Kitwave brand

in order to remain one of the leading delivered wholesale providers

in the UK.

Having operated for over three decades, the Group has a strong

brand presence and the platform from which to grow. With in excess

of 100 years of combined industry knowledge and expertise, we

believe that the Board and senior management team is more than

capable of delivering this strategy and generating value for the

Group and its shareholders.

Colleagues

We would like to take this opportunity to thank all our

colleagues for their hard work over this challenging period, which

has undoubtedly put the Group in the strong position it finds

itself in today. Similarly, we would like to thank all our new

shareholders for their support.

The Board holds its work colleagues in the highest regard. Their

dedication and loyalty have enabled us to weather the storm of

COVID-19. In return, the Group has, where possible, introduced

apprentice schemes and training courses which have enabled

colleagues to enhance their skills and qualifications. The Board

firmly believes that an investment in people is paramount to its

future success.

Summary and outlook

Having overcome what is expected to be the worst of the COVID-19

pandemic, the outlook for the Group's customer base is much more

positive. As we have seen time and time again, our independent

customers have proven their resilience through adapting their

business models where necessary and are now looking to return

trading back to pre-pandemic levels.

Following a strong second half of the year, as is usual for our

business, we look to 2022 with optimism. Barring any further

lockdown restrictions, we expect the Group to operate in the

current year at efficiency and volume levels similar to those prior

to the pandemic. The Group has at its disposal a pipeline of

exciting opportunities and is well placed to accelerate both

organic revenue and profit growth through its buy-and-build

strategy. We look forward to capitalising upon these opportunities

in the year ahead.

In line with this strategy post year end the Group completed the

acquisition of the entire ordinary share capital of M.J. Baker

Foodservice Limited. The acquisition of M.J. Baker is an excellent

addition to our Foodservice division and expands the Group's

nationwide reach into the South West. M.J. Baker is renowned for

providing a quality delivered solution to its customers, a key part

of the Kitwave Group ethos.

Paul Young

Chief Executive Officer

25 February 2022

Chief Financial Officer's review

Overview

Group revenue was GBP380.7 million, compared to GBP592.0 million

in the 18-month period to October 2021. The Group's Ambient, Frozen

& Chilled and Foodservice divisions have all experienced some

level of impact from the COVID-19 restrictions and as a result the

year covers two contrasting periods of trading.

The main adverse impact of COVID-19 restrictions was seen in the

first six months of the year with revenue levels across the

business returning to close to pre pandemic levels during the last

few months of the year. This compared to the prior 18-month period

with normal trading in the first 12 months being followed by

significant reductions in trade from the start of the pandemic in

April 2020 through to October 2020.

Gross profit margin has been maintained at 18% during the year.

Divisional margins are generally in line with expectations,

although the lockdown restrictions impacted the higher margin

Foodservice division more than the other divisions.

In total the Group received GBP2.3 million (FP20: GBP3.0

million) of Government support which has been shown as other income

and relates to CJRS claims made during the period.

In the 12 months ended October 2021 profit before tax increased

by 63% to GBP2.1 million (FP20: GBP1.3 million) despite the

challenges faced due to the COVID-19 restrictions in the first six

months of the year, demonstrating the resilience of the business

model.

Net finance costs of GBP4.3 million relate mainly to the costs

associated with the debt structure in place prior to the IPO and

the unwind of these facilities. Also included within finance costs

is interest relating to IFRS16 accounting of GBP1.1 million.

The statutory basic and diluted earnings per share for FY21 is

GBP0.02.

The Board is recommending a final dividend of 4.5 pence per

ordinary share, subject to approval at the AGM, which, if approved,

will result in a total dividend for the year of 6.75 pence per

share.

The Board intends to continue its progressive dividend policy

with the interim dividend generally being payable in August and the

final dividend normally being paid in April, in the approximate

proportions of one third and two thirds respectively. This

intention is subject to sufficient distributable reserves being

available and the Group being in a position to continue to execute

its growth plans.

Capital expenditure

The Group has continued to invest in its operations over the

financial period with GBP2.9 million invested in new assets and

GBP10.9 million of right-of-use assets. There was an investment of

GBP2.0 million in the new warehouse facility at Butterfield, Luton

that was funded from the proceeds received from the CPO on the

previous Luton site.

Investment in the vehicle fleet also continued with GBP0.3

million of new vehicles acquired and GBP1.2 million invested

through right-of-use vehicle replacement.

New leases were signed for the Butterfield site and three other

leases that created an additional GBP9.4 million of right-of-use

leasehold assets.

Cashflow

The net cashflow inflow from operating activities for the year

was GBP7.9 million after net investment in working capital of

GBP2.4 million. Payments of GBP2.9 million were made in the year to

acquire a further 20.5% shareholding in Central Supplies (Brierley

Hill) Ltd. The Group now owns 95.5% of the ordinary shares in this

company. After tax payments of GBP2.4 million this resulted in

operating cash conversion of 50%. Over the financial periods FP20

and FY21 pre-tax operational cash conversion* is 126%.

As a result of the IPO in May 2021, GBP61.9 million was raised

net of GBP2.1 million of costs. This was utilised to repay GBP51.3

million of debt and accrued interest and a further GBP1.0 million

of costs associated with the IPO. The balance of GBP9.6 million was

brought into the Group to reduce drawings on the existing working

capital facilities.

The Group paid an interim dividend in August 2021 of 2.25 pence

per ordinary share.

The net cash increase in the year was GBP4.6 million.

Financial position

At 31 October 2021, cash and cash equivalents totalled GBP5.0

million (FP20: GBP0.3 million).

The Group had GBP39.2 million of interest-bearing debt

facilities including GBP21.6 million of IFRS 16 lease

liabilities.

The Group renewed its CID facility in May 2021 at the time of

the IPO for a further two years to April 2023. The facility has one

covenant requiring net debt not to exceed three times EBITDA. As at

31 October 2022 this covenant was met.

There were undrawn facilities available to the Group of GBP28.4

million at the year end.

Taxation

The tax charge for the period was GBP1.0 million (FP20: GBP1.8

million) at an effective rate of 48% (FP20: 138%). The effective

rate is higher than the standard UK rate of corporation tax of 19%

(FP20: 19%) mainly due the non-deductible element of interest

charges and fair value adjustments to debt instruments under the

pre Admission debt structure. A full reconciliation of the tax

charge is shown in note 9 of the financial statements.

Share based payments

In the period there was an expense of GBP0.2 million (FP20:

GBPnil) for share-based payments.

This relates to a new Management Incentive Plan (MIP) that

commenced in July 2021 post the completion of the IPO in May 2021.

Under the MIP, which intends to retain and incentivise key

management personnel, the Company has issued Growth Shares in its

subsidiary, Kitwave Limited, to David Brind (Chief Financial

Officer) and Ben Maxted (Chief Operating Officer).

David Brind

Chief Financial Officer

25 February 2022

Consolidated statement of profit and loss and other

comprehensive income

Note Year ended 18 months

31 October ended 31

2021 October

2020

GBP000 GBP000

Revenue 3 380,694 592,016

Cost of sales (312,109) (484,842)

Gross profit 68,585 107,174

Other operating income 4 4,771 3,020

Distribution expenses (31,203) (44,014)

Administrative expenses (35,755) (54,156)

Operating profit 6,398 12,024

Analysed as:

Adjusted EBITDA 15,053 27,634

Amortisation of intangible

assets 11 (150) (144)

Depreciation 12,13 (7,817) (11,013)

CPO income 4 2,255 -

Restructuring costs 5 (1,257) (1,467)

Acquisition expenses 5 (181) (628)

Compensation for post combination

services 5 (1,278) (2,358)

Share based payment expense 5 (227) -

Total operating profit 6,398 12,024

Finance expenses 8 (4,274) (10,719)

Analysed as:

Interest payable on bank loans

and bank facilities 8 (1,327) (2,805)

Interest and finance charges

payable on loan notes and

debenture loans 8 (7,078) (7,788)

Finance charges on leases 8 (1,239) (1,579)

Fair value movement on financial

liabilities 8 5,410 1,453

Other interest 8 (40) -

Financial expenses (4,274) (10,719)

Profit before tax 2,124 1,305

Tax on profit on ordinary activities 9 (1,028) (1,805)

Profit/(loss) for the financial

period 1,096 (500)

Other comprehensive income - -

Total comprehensive income

/ (loss) for the period 1,096 (500)

Basic earnings per share 10 0.02 (0.02)

Diluted earnings per share 10 0.02 (0.02)

Non-GAAP measures

------------------------------------- ----- ----------- ---------

Basic underlying earnings per

share 10 0.08 0.37

Diluted underlying earnings

per share 10 0.08 0.37

Consolidated balance sheet as at 31 October

Note 2021 2020

GBP000 GBP000

Non-current assets

Goodwill 11 31,249 31,249

Intangible assets 11 431 412

Tangible assets 12 10,104 9,310

Right-of-use assets 13 23,188 20,600

Investments 14 20 20

Investment property 15 - 175

64,992 61,766

Current assets

Inventories 17 26,043 23,198

Trade and other receivables 18 52,814 44,558

Cash and cash equivalents 19 4,968 342

83,825 68,098

Total assets 148,817 129,864

Current liabilities

Other interest bearing loans

and borrowings 21 (14,620) (17,681)

Lease liabilities 21 (4,719) (5,202)

Trade and other payables 20 (47,332) (40,307)

Tax payable (370) (1,984)

(67,041) (65,174)

Non-current liabilities

Other interest bearing loans

and borrowings 21 - (43,079)

Lease liabilities 21 (19,917) (16,200)

Other financial liabilities 16 - (5,410)

Deferred tax liabilities 22 (275) (54)

(20,192) (64,743)

Total liabilities (87,233) (129,917)

Net assets/(liabilities) 61,584 (53)

Equity attributable to equity

holders of the

Parent Company

Called up share capital 25 700 1

Share premium account 25 64,183 12,993

Consolidation reserve 25 (33,098) (33,098)

Share based payment reserve 24 227 -

Retained earnings 29,572 20,051

Equity/(accumulated deficit) 61,584 (53)

Company balance sheet as at 31 October

Note 2021 2020

GBP000 GBP000

Non-current assets

Investments 14 12,993 12,993

12,993 12,993

Current assets

Trade and other receivables 18 63,081 7,752

Cash and cash equivalents 19 3,371 -

66,452 7,752

Total assets 79,445 20,745

Current liabilities

Trade and other payables 20 (227) (590)

(227) (590)

Non-current liabilities

Other financial liabilities 16 - (5,410)

Deferred tax assets 22 57 -

57 (5,410)

Total liabilities (170) (6,000)

Net assets 79,275 14,745

Equity attributable to equity

holders of the

Parent Company

Called up share capital 25 700 1

Share premium account 25 64,183 12,993

Share based payment reserve 24 227 -

Retained earnings* 14,165 1,751

Equity 79,275 14,745

*The Company's profit for the year was GBP3,989,000 (FP20:

GBP622,000)

Consolidated statement of change in equity

Called Share Share based Profit

up premium Consolidation payment and loss Total

share account reserve reserve account equity

capital

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May 2019 1 12,993 (33,098) - 20,551 447

Total comprehensive income

for the period

Loss - - - - (500) (500)

Other comprehensive - - - - - -

income

Total comprehensive

loss for

the period - - - - (500) (500)

Balance at 31 October

2020 1 12,993 (33,098) - 20,051 (53)

Total comprehensive income

for the year

Profit - - - - 1,096 1,096

Other comprehensive - - - - - -

income

Total comprehensive

income for

the year - - - - 1,096 1,096

Transaction with owners, recorded

directly in equity

Share capital reduction - (10,000) - - 10,000 -

New share issuance 699 63,300 - - - 63,999

Costs directly attributable

to new share issuance - (2,110) - - - (2,110)

Transaction with owners

recorded directly in

equity dividends - - - - (1,575) (1,575)

Share based payment

expense - - - 227 - 227

Total contribution

by and transactions 60,541

with the owners 699 51,190 - 227 8,425

Balance at 31 October

2021 700 64,183 (33,098) 227 29,572 61,584

Company statement of change in equity

Called Share Share based Profit

up premium payment and loss Total

share account reserve account equity

capital

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May 2019 1 12,993 - 1,129 14,123

Total comprehensive income for the

period

Profit - - - 622 622

Other comprehensive - - - - -

income

Total comprehensive

income for

the period - - - 622 622

Balance at 31 October

2020 1 12,993 - 1,751 14,745

Total comprehensive income for the

year

Profit - - - 3,989 3,989

Other comprehensive - - - - -

income

Total comprehensive

income for

the year - - - 3,989 3,989

Transaction with owners, recorded directly

in equity

Share capital reduction - (10,000) - 10,000 -

New share issuance 699 63,300 - - 63,999

Costs directly attributable

to new share issuance - (2,110) - - (2,110)

Transaction with owners

recorded directly in

equity - dividends - - - (1,575) (1,575)

Share based payment

expense - - 227 - 227

Total contribution

by and transactions

with the owners 699 51,190 227 8,425 60,541

Balance at 31 October

2021 700 64,183 227 14,165 79,275

Consolidated cash flow statement

Note Year ended 18 months

31 October ended 31

2021 October

2020

GBP000 GBP000

Cash flow from operating activities

Profit/(loss) for the period 1,096 (500)

Adjustments for:

Depreciation and amortisation 11,12,13 7,967 11,157

Financial expense 8 4,274 10,719

Profit on sale of property,

plant and equipment 4 (55) (5)

Net gain on remeasurement of

right-of-use assets and lease

liabilities 4 (124) -

Compensation for post combination

services 5 1,278 2,358

Equity settled share based

payment expense 5 227 -

Taxation 9 1,028 1,805

15,691 25,534

(Increase)/decrease in trade

and other receivables (8,244) 19,425

(Increase)/decrease in inventories (2,845) 11,456

Increase/(decrease) in trade

and other payables 8,671 (17,867)

13,273 38,548

Payments in respect of compensation

for post combination services 2 (2,925) -

Tax paid (2,432) (2,693)

Net cash inflow from operating

activities 7,916 35,855

Cash flows from investing activities

Acquisition of property, plant

and equipment (2,961) (3,125)

Proceeds from sale of property,

plant and equipment 248 358

Acquisition of subsidiary undertakings

(including

overdrafts and cash acquired) 2 - (13,535)

Net cash outflow from investing

activities (2,713) (16,302)

Cash flows from financing activities

IPO fund raise (net of expenses) 61,889 -

Proceeds from new loan 21 5,500 5,000

Net movement in invoice discounting 21 4,559 (6,941)

Interest paid 8,21 (5,093) (5,969)

Net movement in bank trade

loans 21 (4,750) (2,270)

Repayment of bank term loans 21 (21,863) (3,063)

Repayment of investor loans 21 (34,176) -

Payment of lease liabilities 21 (5,068) (7,173)

Dividends paid (1,575) -

Net cash outflow from financing

activities (577) (20,416)

Net increase/(decrease) in

cash and cash equivalents 4,626 (863)

Opening cash and cash equivalents 342 1,205

Cash and cash equivalents at

period end 19 4,968 342

Notes

1 Accounting policies

Kitwave Group plc (the "Company") is a public company limited by

shares and incorporated, domiciled and registered in England in the

UK. The registered number is 9892174 and the registered address is

Unit S3, Narvik Way, Tyne Tunnel Trading Estate, North Shields,

Tyne and Wear, NE29 7XJ.

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the "Group"). The

parent Company financial statements present information about the

Company as a separate entity.

The Group financial statements have been prepared and approved

by the Directors in accordance with International Financial

Reporting Standards ("IFRS") in conformity with the requirements of

the Companies Act 2006.

The Company financial statements were prepared in accordance

with the Companies Act 2006 as applicable to companies using

Financial Reporting Standard 101 'Reduced Disclosure Framework'

("FRS 101"). The Company applies the recognition, measurement and

disclosure requirements of IFRS, but makes amendments where

necessary in order to comply with Companies Act 2006.

The financial information set out above does not constitute the

Group or the Company's statutory accounts for the year ended 31

October 2021 or the financial period ended 31 October 2020.

Statutory accounts for the period ended 31 October 2020 have been

delivered to the registrar of companies, and those for the year

ended 31 October 2021 will be delivered in due course. The auditor

has reported on those accounts; their reports were (i) unqualified,

(ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under s498 (2) or (3)

of the Companies Act 2006.

In publishing the Company financial statements together with the

Group financial statements, the Company is taking advantage of the

exemption in s408 of the Companies Act 2006 not to present its

individual statement of profit and loss and related notes that form

a part of these approved financial statements.

The Company has applied the following exemptions in the

preparation of its financial statements:

-- A cash flow statement and related notes have not been presented;

-- Disclosures in respect of new standards and interpretations

that have been issued but which are not yet effective have not been

provided;

-- Disclosures in respect of transactions with wholly-owned

subsidiaries have not been made; and

-- Certain disclosures required by IFRS 13 Fair Value

Measurement and the disclosures required by IFRS 7 Financial

Instruments have not been provided.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to both periods presented in

these consolidated financial statements.

The consolidated financial statements include the results of all

subsidiaries owned by the Company per note 14. Certain of these

subsidiaries have taken exemption from an audit for the year ended

31 October 2021 by virtue of s479A Companies Act 2006. To allow

these subsidiaries to take the audit exemption, the Company has

given a statutory guarantee of all the outstanding liabilities as

at 31 October 2021. The subsidiaries which have taken this

exemption from audit are:

-- Alpine Fine Foods Limited;

-- TG Foods Limited;

-- Anderson (Wholesale) Limited;

-- Angelbell Limited;

-- Phoenix Fine Foods Limited; and

-- Supplytech Limited

1.1 Critical accounting estimates and judgements

The preparation of financial statements requires the Directors

to make judgements, estimates and assumptions concerning the future

performance and activities of the Group. There are no significant

judgements applied in the preparation of these financial

statements. Estimates and assumptions are based on the historical

experience and acquired knowledge of the Directors, the result of

which forms the basis of the judgements made about the carrying

value of assets and liabilities that are not clear from external

sources. In concluding that there are no significant risks of

material adjustment from accounting estimates and judgements, the

Directors have reviewed the following:

Impairment of goodwill

In accordance with IAS 36 "Impairment of Assets", the Board

identifies appropriate Cash-Generating Units ("CGU's") and the

allocation of goodwill to these units. Where an indication of

impairment is identified the assessment of recoverable value

requires estimation of the recoverable value of the cash generating

units (CGUs). This requires estimation of the future cash flows

from the CGUs and also the selection of appropriate discount rates

in order to calculate the net present value of those cash flows.

There has been no impairment in the period.

Each of the CGU's has significant headroom under the annual

impairment review and the Directors believe that no reasonable

change in any of the above key assumptions would cause the carrying

value of the unit to materially exceed its recoverable amount.

Impairment of trade receivables

IFRS 9, Financial Instruments, requires that provisioning for

financial assets needs to be made on a forward-looking expected

credit loss model. This requires management to consider historic,

current and forward-looking information to determine the level of

provisioning required.

Management has assessed the ageing of the trade receivables,

their knowledge of the Group's customer base, and other economic

factors as indicators of potential impairment. Further information

is considered in note 27 of these financial statements.

Following review of the above accounting estimates and

judgements the Directors have concluded that there is no

significant risk of material adjustment to the carrying amount of

assets and liabilities within the next financial year.

1.2 Measurement convention

The financial statements are prepared on the historical cost

basis except that the following assets and liabilities are stated

at their fair value: financial instruments classified at fair value

through the statement of profit and loss, unlisted investments and

investment property.

1.3 Going concern

The financial information has been prepared on a going concern

basis which the Directors consider to be appropriate for the

following reasons.

As part of the food supply industry, the Group continued to be

affected by COVID-19 due to the lockdown restrictions that impacted

the Group's customer base during the first six months of the

financial year. Revenue amongst foodservice and vending customers

was adversely impacted by continued Government led lockdowns in the

'out of home' sector covering cafes, restaurants, bars and

hotels.

During the period, the Group continued to make use of the

Coronavirus Job Retention Scheme in divisions affected by lockdown

restrictions. Overall the Group's financial performance has been

robust and its position in the market has enabled a prompt return

to pre COVID-19 trading levels following the easing of trading

restrictions in April 2021.

The Group is cash generative and generated GBP13,273,000 of cash

from operating activities (before tax payments) in FY21,

illustrating the strong underlying operating model of the

Group.

On 24 May 2021, the Company announced a significantly

over-subscribed Placing and its admission to the AIM, raising gross

proceeds of GBP64,000,000 and achieving a market capitalisation of

GBP105,000,000. The Group has used the gross proceeds to de-gear

the balance sheet, fully repaying the investors subordinated loan

notes, investors mezzanine loan notes, the Bank Senior A and Bank

Senior B tranche and reducing the Group's advance under its invoice

discounting facility.

The de-gearing of the Group's balance sheet has significantly

reduced the interest liability to be serviced annually and has

provided a material improvement in the headroom on its remaining

working capital facilities.

Post year end, Kitwave Limited completed the acquisition of the

entire share capital of M.J. Baker Foodservice Limited ("M.J.

Baker"). The acquisition was funded through the Group's existing

facilities. and the acquisition will be incorporated into the

Group's existing Foodservice division.

The Group has prepared financial forecasts and projections for a

period of 12 months from the date of approval of this financial

information (the "going concern assessment period"), which take

into account the acquired balance sheet and trading forecast of

M.J.Baker, possible downsides including any further impact of

COVID-19 on the operations.

These forecasts show that the Group will have sufficient levels

of financial resources available both to meet its liabilities as

they fall due for that period and comply with remaining covenant

requirements on its working capital facilities.

Consequently, the Directors are confident that the Group and

Company will have sufficient funds to continue to meet its

liabilities as they fall due for at least 12 months from the date

of approval of this financial information and therefore have

prepared the financial statements on a going concern basis.

1.4 Basis of consolidation

The consolidated financial statements include the financial

statements of the Company and its subsidiary undertakings made up

to 31 October 2021. A subsidiary undertaking is an entity that is

controlled by the Company. The results of subsidiary undertakings

are included in the consolidated statement of profit and loss

account from the date that control commences until the date that

control ceases. Control is established when the Company is exposed

to, or has rights to, variable returns from its involvement with an

entity and has the ability to affect those returns through its

power over the entity. In assessing control, the Group takes into

consideration potential voting rights that are currently

exercisable.

In respect of the legal acquisition of Kitwave One Limited by

the Company in the year ended 30 April 2017, the principles of

reverse acquisition have been applied under IFRS 3. The Company,

via its 100% owned subsidiary Kitwave Investments Limited, is the

legal acquirer of Kitwave One Limited but Kitwave One Limited was

identified as the accounting acquirer of the Company. The assets

and liabilities of the Company and the assets and liabilities of

Kitwave One Limited continued to be measured at book value. By

applying the principles of reverse acquisition accounting the Group

is presented as if the Company has always owned Kitwave One

Limited. The comparative consolidated reserves of the Group were

adjusted to reflect the statutory share capital and share premium

of the Company as if it had always existed, adjusted for movements

in the underlying Kitwave One Limited's share capital and reserves

until the date of the acquisition. A consolidation reserve was

created which reflects the difference between the capital structure

of the Company and Kitwave One Limited at the date of acquisition

less any cash and deferred cash consideration for the

transaction.

1.5 Foreign Currency

Transactions in foreign currencies are translated to the Group

companies' functional currency at the foreign exchange rate ruling

at the date of the transaction. Monetary assets and liabilities

denominated in foreign currencies at the balance sheet date are

retranslated to the functional currency at the foreign exchange

rate ruling at that date. Non-monetary assets and liabilities that

are measured in terms of historical cost in a foreign currency are

translated using the exchange rate at the date of the transaction.

Non-monetary assets and liabilities denominated in foreign

currencies that are stated at fair value are retranslated to the

functional currency at foreign exchange rates ruling at the dates

the fair value was determined. Foreign exchange differences arising

on translation are recognised in the statement of profit and

loss.

1.6 Classification of financial instruments

Financial assets

Financial assets are classified at initial recognition, and

subsequently measured at amortised cost, Fair Value through Other

Comprehensive Income ("FVOCI") or Fair Value through the statement

of Profit and Loss ("FVTPL"). The classification of financial

assets under IFRS 9 is based on two criteria:

-- the Group's business model for managing the assets; and

-- whether the instruments' contractual cash flows represent

'Solely Payments of Principal and Interest' on the principal amount

outstanding (the "SPPI criterion").

A summary of the Group's financial assets is as follows:

Trade and other receivables* Amortised cost - hold to collect

business model and SPPI met

Cash and short-term deposits Amortised cost

Financial liabilities

Financial instruments issued by the Group are treated as equity

only to the extent that they meet the following two conditions:

(a) they include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

(b) where the instrument will or may be settled in the Company's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Company's own

equity instruments or is a derivative that will be settled by the

Company's exchanging a fixed amount of cash or other financial

assets for a fixed number of its own equity instruments.

To the extent that this definition is not met, the proceeds of

issue are classified as a financial liability. Where the instrument

so classified takes the legal form of the Company's own shares, the

amounts presented in these financial statements for called up share

capital and share premium account exclude amounts in relation to

those shares.

A summary of the Group's financial liabilities is as

follows:

Compensation for post combination services Fair value through

the statement of profit and loss

Bank loans and overdrafts Amortised cost

Trade and other payables* Amortised cost

*Prepayments, other receivables, other taxation and social

security payables and other payables do not meet the definition of

financial instruments.

Further information is included in note 27.

1.7 Non derivative financial instruments

Trade and other receivables

Trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition they are measured at

amortised cost using the effective interest method, less any

impairment losses.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition they are measured at amortised

cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits. Bank overdrafts that are repayable on demand and form an

integral part of the Group's cash management are included as a

component of cash and cash equivalents for the purpose only of the

cash flow statement.

Interest-bearing borrowings

Interest-bearing borrowings are recognised initially at fair

value less attributable transaction costs. Subsequent to initial

recognition, interest-bearing borrowings are stated at amortised

cost using the effective interest method.

Invoice discounting

The Group is party to an invoice discounting arrangement which

provides additional working capital up to the value of a set

proportion of its trade receivables balances. The advances are

secured against trade receivables (note 18). These are repayable

within 90 days of the invoice and carry interest at a margin of

2.25%. This is a committed facility expires in 2023. The net

movement of the balance is disclosed in the cash flow

statement.

Equity investments

Equity investments are instruments that meet the definition of

equity from the issuer's perspective: that is they do not contain

an obligation to pay and provide a residual interest in the assets

of the issuer. Equity investments are held at fair value through

the statement of profit and loss.

Investment property

Investment properties are properties which are held either to

earn rental income or for capital appreciation or for both.

Investment properties are stated at fair value. Any gain or loss

arising from a change in fair value is recognised in the statement

of profit and loss.

1.8 Other financial instruments

Derivative financial instruments

Derivative financial instruments are recognised at fair value.

The gain or loss on remeasurement to fair value is recognised

immediately in the statement of profit and loss. No hedge

accounting has been applied.

1.9 Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses.

Where parts of an item of property, plant and equipment have

different useful lives, they are accounted for as separate items of

property, plant and equipment.

Depreciation is charged to the statement of profit and loss on a

straight-line basis over the estimated useful lives of each part of

an item of property, plant and equipment. Land is not depreciated.

The estimated useful lives are as follows:

-- Leasehold improvements straight line over the term of the lease

-- Freehold property 2% straight line

-- Plant and machinery 10-25% reducing balance and straight line

-- Fixtures and fittings 15-20% reducing balance and straight line

-- Motor vehicles 15-25% reducing balance and straight line

Depreciation methods, useful lives and residual values are

reviewed at each balance sheet date.

1.10 Business combinations

Business combinations are accounted for by applying the

acquisition method. Business combinations are accounted for using

the acquisition method as at the acquisition date, which is the

date on which control is transferred to the Group.

At the acquisition date, the Group measures goodwill at the

acquisition date as:

-- the fair value of the consideration (excluding contingent consideration) transferred; plus

-- estimated amount of the contingent consideration (see below): plus

-- the fair value of the existing equity interest in the acquiree; less

-- the net recognised amount (generally fair value) of the

identifiable assets acquired and liabilities and contingent

liabilities assumed.

When the excess is negative, a bargain purchase gain is

recognised immediately in the statement of profit and loss.

Any contingent consideration payable is recognised at fair value

at the acquisition date. Subsequent changes to the fair value of

the contingent consideration are recognised in the statement of

profit and loss.

Acquisitions prior to the date of transition to IFRSs

IFRS 1 grants certain exemptions from the full requirements of

Adopted IFRSs in the transition period. The Group and Company

elected not to restate business combinations that took place prior

to transition date of 1 May 2015. In respect of acquisitions prior

to 30 April 2015, goodwill is included at transition date on the

basis of its deemed cost, which represents the amount recorded

under UK GAAP which was broadly comparable save that goodwill was

amortised. On transition, amortisation of goodwill ceased as

required by IFRS 1.

1.11 Intangible assets and goodwill

Goodwill

Goodwill is stated at cost less any accumulated impairment

losses. Goodwill is allocated to cash-generating units ("CGUs") and

is not amortised but is tested annually for impairment.

Intangible assets

Intangible assets are stated at costs less accumulated

amortisation. They relate to capitalised software and development

costs and are being amortised on a straight line basis over 4-5

years.

1.12 Inventories

Inventories are stated at the lower of cost and net realisable

value. Cost is based on the weighted average principle.

The Group participates in rebate schemes with their suppliers.

Rebates are principally earned from suppliers on purchase of

inventory and are recognised at point of delivery to the Group.

Where the rebate earned relates to inventories which are held by

the Group at the period end, the rebates are deducted from the cost

of those inventories. Any rebates based on a volume of purchases

over a period are only recognised when the volume target has been

achieved.

1.13 Impairment excluding inventories and deferred tax assets

Non derivative financial assets - trade receivables

The Group recognises loss allowance for Expected Credit Losses

("ECLs") on trade receivables measured at amortised cost.

The Group measures loss allowances at an amount equal to

lifetime ECLs as the term of the asset is considered short.

When determining whether the credit risk of a financial asset

has increased significantly since initial recognition and when

estimating ECLs, the Group considers reasonable and supportable

information that is relevant and available without undue cost or

effort. This includes both quantitative and qualitative information

and analysis, based on the Group's historical experience and

informed credit assessment including forward looking

information.

The Group utilises the practical expediency for short term

receivables by adopting the simplified 'matrix' approach to

calculate expected credit losses. The provision matrix is based on

an entity's historical default rates over the expected life of the

trade receivables as adjusted for forward looking estimates.

The Group assumes that the credit risk on a financial asset has

increased if it is aged more than 90 days since delivery. This is

not relevant in all cases and management use its historical

experience and knowledge of the customer base to assess whether

this is an indicator of increased risk on a customer by customer

basis.

The Group considers the financial asset to be in default when

the borrower is unlikely to pay its obligations or has entered a

formal insolvency process or other financial reorganisation.

Loss allowances for financial assets measured at amortised costs

are deducted from the gross carrying amount of the assets.

Non-financial assets

The carrying amounts of the Group's non-financial assets, other

than inventories and deferred tax assets, are reviewed at each

reporting date to determine whether there is any indication of

impairment. If any such indication exists, then the asset's

recoverable amount is estimated. For goodwill, and intangible

assets that have indefinite useful lives or that are not yet

available for use, the recoverable amount is estimated each year at

the same time.

The recoverable amount of an asset or CGU is the greater of its

value in use and its fair value less costs to sell. In assessing

value in use, the estimated future cash flows are discounted to

their present value using a pre-tax discount rate that reflects

current market assessments of the time value of money and the risks

specific to the asset. For the purpose of impairment testing,

assets that cannot be tested individually are grouped together into

the smallest group of assets that generates cash inflows from

continuing use that are largely independent of the cash inflows of

other assets or groups of assets (the "cash-generating unit" or

"CGU"). The goodwill acquired in a business combination, for the

purpose of impairment testing, is allocated to CGUs. Subject to an

operating segment ceiling test, for the purposes of goodwill

impairment testing, CGUs to which goodwill has been allocated are

aggregated so that the level at which impairment is tested reflects

the lowest level at which goodwill is monitored for internal

reporting purposes. Goodwill acquired in a business combination is

allocated to groups of CGUs that are expected to benefit from the

synergies of the combination.

An impairment loss is recognised if the carrying amount of an

asset or its CGU exceeds its estimated recoverable amount.

Impairment losses are recognised in the statement of profit and

loss. Impairment losses recognised in respect of CGUs are allocated

first to reduce the carrying amount of any goodwill allocated to

the units, and then to reduce the carrying amounts of the other

assets in the unit (group of units) on a pro rata basis.

An impairment loss in respect of goodwill is not reversed. In

respect of other assets, impairment losses recognised in prior

periods are assessed at each reporting date for any indications

that the loss has decreased or no longer exists. An impairment loss

is reversed if there has been a change in the estimates used to

determine the recoverable amount. An impairment loss is reversed

only to the extent that the asset's carrying amount does not exceed

the carrying amount that would have been determined, net of

depreciation or amortisation, if no impairment loss had been

recognised.

1.14 Employee benefits

Defined contribution plans and other long term employee

benefits

A defined contribution plan is a post-employment benefit plan

under which the Group pays fixed contributions into a separate

entity and will have no legal or constructive obligation to pay

further amounts. Obligations for contributions to defined

contribution pension plans are recognised as an expense in the

statement of profit and loss in the periods during which services

are rendered by employees.

Share-based payment transactions

Share-based payment arrangements in which the Company receives

goods or services as consideration for its own equity instruments

are accounted for as equity-settled share-based payment

transactions, regardless of how the equity instruments are obtained

by the Company.

The Group operates a Management Incentive Plan for certain

employees that incorporates a put option on the Company's ordinary

shares. The fair value at the grant date of the options is

recognised as an employee expense with a corresponding increase in

equity, over the period in which the employee becomes

unconditionally entitled to the awards.

The fair value of the awards granted is measured using an option

valuation model, taking into account the terms and conditions upon

which the awards were granted. The Monte Carlo option valuation

model was adopted for share based payment arrangements entered into

in the period ended 31 October 2021.

The amount recognised as an expense is adjusted to reflect the

actual number of awards for which the related service and

non-market vesting conditions are expected to be met, such that the

amount ultimately recognised as an expense is based on the number

of awards that do meet the related service and non-market

performance conditions at the vesting date. For share-based payment

awards with non-vesting conditions, the grant date fair value of

the share-based payment is measured to reflect such conditions and

there is no true-up for differences between expected and actual

outcomes.

Under IFRS 3 the contingent payment which has been agreed for

the remaining 5% of the share in Central Supplies (Brierley Hill)

Ltd is classified as remuneration for post-combination services, as

consideration for the shares is linked to an employment

condition.

1.15 Provisions

A provision is recognised in the balance sheet when the Group

has a present legal or constructive obligation as a result of a

past event, that can be reliably measured, and it is probable that

an outflow of economic benefits will be required to settle the

obligation. Provisions are determined by discounting the expected

future cash flows at a pre-tax rate that reflects risks specific to

the liability.

1.16 Revenue

IFRS 15 "revenue from contracts with customers" has been

adopted. The standard establishes a principles-based approach for

revenue recognition and is based on the concept of recognising

revenue for performance obligations only where they are satisfied,

and the control of goods or service is transferred. In doing so,

the standard applies a five-step approach to the timing of revenue

recognition and applies to all contracts with customers, except

those in the scope of other standards. It replaces the separate

models for goods, services and construction contracts under the

previous accounting standards. Following an assessment of the

impact of IFRS 15 and based on the straight forward nature of the

Group's revenue streams with the recognition of revenue at the

point of sale and the absence of significant judgement required in

determining the timing of transfer of control, the adoption of IFRS

15 has not had a material impact on the timing or nature of the

Group's revenue recognition.

The principal performance obligation is discharged on

delivery/collection of the products by the customer at which point

control of the goods has transferred. Customer discounts and

rebates comprise variable consideration and are accounted for as a

reduction in the transaction price, based on the most likely

outcome basis.

The most likely outcome model is used due to the simple nature

of rebate agreements and the limited number of possible outcomes -

principally whether or not the customer achieved the required level

of purchases.

1.17 Financing income and expenses

Financing expenses comprise interest payable, finance charges on

put option liabilities and finance leases recognised in the

statement of profit and loss using the effective interest method,

unwinding of the discount on provisions, and net foreign exchange

losses that are recognised in the statement of profit and loss (see

foreign currency accounting policy). Borrowing costs that are

directly attributable to the acquisition, construction or

production of an asset that takes a substantial time to be prepared

for use, are capitalised as part of the cost of that asset.

Financing income comprise interest receivable on funds invested,

finance income on the put option liability, and net foreign

exchange gains.

Interest income and interest payable is recognised in the

statement of profit and loss as it accrues, using the effective

interest method. Dividend income is recognised in the statement of

profit and loss on the date the entity's right to receive payments

is established. Foreign currency gains and losses are reported on a

net basis.

1.18 Taxation

Tax on the profit or loss for the year comprises current and

deferred tax. Tax is recognised in the statement of profit and loss

except to the extent that it relates to items recognised directly

in equity, in which case it is recognised in equity.

Current tax is the expected tax payable or receivable on the

taxable income or loss for the year, using tax rates enacted or

substantively enacted at the balance sheet date, and any adjustment

to tax payable in respect of previous years.

Deferred tax is provided on temporary differences between the

carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes. The following

temporary differences are not provided for: the initial recognition

of goodwill; the initial recognition of assets or liabilities that

affect neither accounting nor taxable profit other than in a

business combination, and differences relating to investments in

subsidiaries to the extent that they will probably not reverse in

the foreseeable future. The amount of deferred tax provided is

based on the expected manner of realisation or settlement of the

carrying amount of assets and liabilities, using tax rates enacted

or substantively enacted at the balance sheet date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the temporary difference can be utilised.

1.19 Leases

IFRS 16, Leases, became effective in the period ended 31 October

2020. The Group adopts the requirements of IFRS 16 as follows:

The Group has lease arrangements in place for properties,

vehicles, fork lift trucks and other equipment including plant and

machinery. At the inception of the lease agreement, the Group

assesses whether the contract conveys the right to control the use

of an identified assets for a certain period of time and whether it

obtains substantially all of the economic benefits from the use of

that assets in exchange for consideration. The Group recognises a

lease liability and a corresponding right-of-use asset with respect

to all such lease arrangements.

A right-of-use asset is capitalised on the balance sheet at

cost, which comprises the present value of the future lease

payments at inception of the lease. For those leases commencing

prior to adoption of IFRS 16, the modified retrospective approach

has been adopted on transition to value the right-of-use asset and

lease liability.

Right-of-use assets are depreciated using a straight line method

over the shorter of the life of the asset or the lease term and are

assessed in accordance with IAS 36 'Impairment of Assets' to

determine whether the asset is impaired.

The lease liability is initially measured at the present value

of the lease payments as outlined above for the right-of-use asset

and is increased by the interest cost on the lease liability,

subsequently reduced by the lease payments made. Lease liabilities

are classified between current and non-current on the balance

sheet.

The key estimate applied by the Directors relates to the

assessment of the incremental borrowing rate adopted by the Group

to discount the future lease rentals to present value in order to

measure the lease liabilities. A rate has been applied to each

asset class supported by quotes from manufacturers for financing

and the Group's weighted average cost of capital.

The Group has relied upon the exemption under IFRS 16 to exclude

the impact of low-value leases and leases that are short-term in

nature (defined as leases with a term of 12 months or less). Costs

on these leases are recognised on a straight-line basis as an

operating expense within the statement of profit and loss. All

other leases are accounted for in accordance with this policy as

determined by IFRS 16.

1.20 Government Grants

The Group has elected to present grants related to income

separately under the heading "Other income" within the statement of

profit and loss. This income represents the funding provided by the

Government in relation to the Coronavirus Job Retention Scheme.

This funding is applicable on furlough of employees subject to

Government criteria which has been met in each operating entity.

The Directors do not consider there to be a material risk that any

funding received will be repayable.

1.21 Exceptional items

Exceptional items are defined as income or expenses that arise

from events or transactions that are clearly distinct from the

normal activities of the Group and therefore are not expected to

recur frequently or regularly.

Such items have been separately presented to enable a better

understanding of the Group's operating performance. Details of

exceptional income relating to the CPO is presented in note 4,

exceptional expenses are presented in note 5.

1.22 Investments

Investments in subsidiaries are carried at cost less impairment

in the parent Company financial statements.

2 Acquisitions

Acquisitions in the 18 month period ended 31 October 2020

Central Supplies (Brierley Hill) Ltd

On 5 August 2019, the Group acquired 75% of the share capital of

Central Supplies (Brierley Hill) Ltd for a total consideration of

GBP6,558,000. The remaining share capital is subject to an

agreement to acquire it within 4 years of the acquisition, further

details are given below. The resulting goodwill of GBP1,248,000 was

capitalised and is subject to annual impairment testing under IAS

36.

The acquisition had the following effect on the Group's assets

and liabilities:

Fair value

GBP000

Non-current assets

Tangible assets 2,970

Investment property 175

Right-of-use assets 2,155

Current assets

Inventories 1,407

Trade and other receivables 7,131

Other receivables 3,135

Total assets 16,973

Current liabilities

Interest bearing loans and borrowings (3,487)

Lease liabilities (512)

Trade and other payables (5,495)

Corporation tax (437)

Non-current liabilities

Lease liabilities (1,643)

Deferred tax (89)

Total liabilities (11,663)

Net identifiable assets and liabilities 5,310

Goodwill 1,248

Purchase consideration and costs of acquisition paid

in period 6,558

The business was acquired as part of the Group's growth

strategy. Significant control was obtained through the acquisition

of 75% of the share capital.

No material intangible assets were identified. Goodwill

represents buying and other operating synergies.

The acquired undertaking made a profit of GBP780,000 from the

beginning of its financial year to the date of acquisition. In its

previous financial year the profit was GBP818,000 before

revaluations.

Following acquisition, the business contributed revenue of

GBP80,493,000 and operating profit of GBP2,644,000 to the Group for

the period ended 31 October 2020.

If the business had been acquired at the start of the Group's

financial period, being 1 May 2019, it would have added

GBP96,635,000 to Group revenue and GBP3,185,000 to Group operating

profit for the period ended 31 October 2020

A contingent payment, based on a fixed formula, has been agreed

for the remaining 25% of the share in Central Supplies (Brierley

Hill) Ltd. The payment is based on an employment condition under

IFRS 3 and is therefore classed as compensation for

post-combination services. Consequently, no non-controlling

interest is recognised, and goodwill is measured as the difference

between the initial consideration and 100% of the acquired

company's net assets. Further detail on the calculation of this

liability is detailed within note 27.

In the year ended 31 October 2021 an additional payment of