Keller Group PLC Director/PDMR Shareholding

17 Mars 2022 - 2:59PM

UK Regulatory

TIDMKLR

Keller Group plc (the "Company")

Notification and public disclosure of transactions by Persons Discharging

Managerial Responsibilities ("PDMRs")

Awards made under the Company's Long-Term Incentive Plan ("LTIP")

On 15 March 2022 the Company granted:

* Deferred bonus share awards totalling 61,840 ordinary shares of 10p each in

the Company ("Ordinary Shares"); and

* Performance share awards totalling 394,163 Ordinary Shares

The grant to the PDMRs listed in the tables below was approved by the

Remuneration Committee under the terms of the LTIP and the Company was notified

by the PDMRs on 17 March 2022. The transactions took place in the United

Kingdom.

Deferred Bonus Share Award - in respect of the year ended 31 December 2021

Executive Directors are subject to a deferral of 25% of any annual bonus

payment into Ordinary Shares for a period of two years. The deferred bonus

share award retains eligibility for dividend equivalents from the date of grant

until the vesting date. Malus and clawback apply.

Name Position No. of Total

Ordinary Deferred

Shares Bonus Awards

awarded1/3 outstanding3

Michael Speakman Chief Executive Officer 24,684 48,214

David Burke Chief Financial Officer 16,206 19,728

Other PDMRs are subject to a deferral into Ordinary Shares of any annual bonus

payment in excess of 100% of salary. The deferral is also for a period of two

years, with the deferred bonus share award retaining eligibility for dividend

equivalents from the date of grant until the vesting date. Malus and clawback

apply.

Name Position No. of Total

Ordinary Deferred

Shares Bonus Awards

awarded1/3 outstanding3

Jim De Waele President, Europe 1,921 1,921

Eric Drooff President, North America 5,647 9,365

Venu Raju Engineering and Operations Director 13,382 27,440

Performance Share Award - for the period 2022/24

Name Position No. of Total

Ordinary Performance

Shares Share Awards

awarded 1 outstanding3

/2/3

Michael Speakman Chief Executive Officer 112,990 325,361

David Burke Chief Financial Officer 61,820 118,093

Graeme Cook Group People Director 26,111 74,156

Jim De Waele President, Europe 29,674 78,707

Eric Drooff President, North America 35,669 105,407

Kerry Porritt Group Company Secretary and Legal 22,760 63,651

Advisor

John Raine Group HSEQ Director 21,623 63,694

Venu Raju Engineering and Operations Director 29,535 102,016

Katrina Roche Chief Information Officer 24,234 46,293

Peter Wyton President, AMEA 29,747 84,8774

The measures selected by the Remuneration Committee together with the

associated targets are shown on the table below. The weightings are all set at

25% in order to provide balance between measures and materiality to each of

them individually.

Measure Weighting Vesting Schedule

% of award that will vest

0% 25% 100%

Operating Profit Margin 25% Below 5.5% 5.5% 6.5%

Cumulative EPS 25% Below 330p 330p 400p

ROCE 25% Below 12% 12% 18%

Relative TSR 25% Below Median Upper

median quartile

The Performance Share Award performance conditions are measured over a three

year period ending on 31 December 2024, except for the Operating Profit Margin

which is measured in year three. The Performance Share Award performance

conditions are expected to vest in March 2025. Executive Directors are subject

to a further two year holding period. Malus and clawback apply.

Enquiries:

Keller Group plc

Silvana Glibota-Vigo, Group Head of Secretariat

Tel: 020 7616 7575

1 The price used to calculate the maximum number of Ordinary Shares under the

Deferred Bonus Share Award and Performance Share Award was 781p, being the

average closing price on 9, 10 and 11 March 2022 of the Company's shares on the

main market of the London Stock Exchange.

2 The amounts shown above represent the maximum possible number of Ordinary

Shares that may be granted to the above named participants under the 2022

Performance Share Award.

3 The awards above exclude notional dividends.

4 55,130 of these Performance Share Awards are rights to receive cash linked to

share value and will, to the extent vested following the end of the performance

period, be settled in cash.

LEI number: 549300QO4MBL43UHSN10

Classification: 2.2 Inside information

END

(END) Dow Jones Newswires

March 17, 2022 09:59 ET (13:59 GMT)

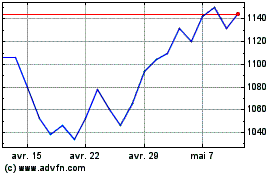

Keller (LSE:KLR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Keller (LSE:KLR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024